Facilities Improvement Fund (FIF): Tax Implications

Learn how Facilities Improvement Fund (FIF) grants impact taxable income for home-based child care providers in this informative webinar. Find out how to calculate taxable income and make informed financial decisions. Presenter: Margie Cangelosi, E.A.

0 views • 25 slides

Consignment Accounts in Business

Consignment accounts involve the sending of goods by a consignor to a consignee for sale on the consignor's behalf. The consignor remains the owner of the goods until they are sold, and the consignee sells the goods, collects money from customers, and receives commissions. Various types of commissio

9 views • 22 slides

Factors Influencing Economic Growth: Human Capital and Capital Goods

Factors such as investment in human capital, capital goods, natural resources, and entrepreneurship play a crucial role in determining a country's economic growth. Human capital encompasses the skills and abilities of workers, while capital goods are the tools and equipment used to produce goods and

2 views • 28 slides

ABMN 0511 - RURAL MARKETING

Rural marketing in India involves the flow of goods and services from producers to rural consumers, encompassing demand estimation, product planning, distribution, and ensuring consumer satisfaction. Key components of rural markets include the presence of goods for transactions, buyers and sellers,

1 views • 15 slides

Optimizing Transportation Costs for Perishable Goods

In the realm of logistics, the transportation of perishable goods presents a unique challenge. From fresh produce to pharmaceuticals, these time-sensitive commodities require specialized handling and efficient transportation to maintain their quality and integrity. One of the critical aspects of man

2 views • 6 slides

Analysis of GST Provisions in the Banking Industry

The Goods and Services Tax (GST) regime replaced the old service tax regime on July 1, 2017. In the context of the banking industry, the provisions governing GST for services provided by Cooperative Banks and Banking Cooperative Societies are similar to those of the service tax regime. While interes

1 views • 13 slides

Mastering Desktop Receiving in PeopleSoft eProcurement

Explore the functionality of desktop receiving in the PeopleSoft eProcurement module to efficiently manage goods receipt processes in your department. Learn how to receive, review, sort, and reject ePro goods, along with creating desktop receipts for Office Depot Purchase Orders. Understand the step

0 views • 14 slides

Basic Economic Concepts: Needs, Wants, Goods, and Services

Exploring fundamental economic concepts such as needs versus wants, goods, services, and products. Learn about the differences between goods and services, types of goods related to income, types of goods related to price, and types of goods related to consumption ability.

0 views • 11 slides

SAP Goods Receiving Training Overview

SAP Goods Receiving training covers the process of confirming receipt of goods or services within a department. It includes roles, training requirements, process flow, transaction codes, and various functionalities related to Goods Receiving in SAP. The training targets individuals authorized to rec

2 views • 52 slides

Business Environment and Objectives

Business encompasses a wide range of activities related to the production and distribution of goods and services, influenced by various interpretations from consumers, governments, and environmentalists. It involves activities like buying, selling, manufacturing, and service provision, all aimed at

0 views • 61 slides

In-Bond Manufacturing: A Game Changer in Customs Regulations

In-bond manufacturing allows for certain operations to be carried out on warehoused goods without payment of customs duties, benefiting businesses by facilitating cash flow and ease of doing business. The process involves obtaining permission, following specific regulations, and potentially exportin

1 views • 17 slides

Deductions in Taxation

Explore the essentials of tax deductions in Module 5, including how to calculate taxable income, lower taxable income plus income taxes, differentiate between Standard and Itemized Deductions, select the appropriate deduction for a client's return, and identify expenses covered by Itemized Deduction

2 views • 20 slides

Brexit VAT Treatment of Goods and Services Overview

The Brexit VAT treatment of goods and services impacts cross-border supplies to the UK, VAT refunds for goods, separation provisions under the Withdrawal Agreement, and the Ireland/Northern Ireland Protocol. Changes in VAT regulations and protocols are outlined for businesses and traders within the

4 views • 10 slides

Types of Goods and Demand in Economics

Explore the concepts of normal versus inferior goods, the law of demand, and graphing demand curves in economics. Learn how income changes affect consumer behavior with examples of goods and services. Understand how to identify normal and inferior goods based on consumer preferences and income level

0 views • 11 slides

Rwanda Income Taxation and Transfer Mispricing Overview

Explore the taxation framework in Rwanda covering taxable presence, computation of business profits, deductable expenses, and base erosion with profit shifting measures. Understand how residents and non-residents are taxed on their incomes and the criteria for taxable presence in the country. Learn

0 views • 16 slides

The Installment Purchase System

The installment purchase system is similar to credit and hire purchase systems, allowing buyers to make payments in installments over a period of time. The buyer gets possession and ownership of the goods immediately, but if there's a default in payment, the vendor can't repossess the goods. Instead

1 views • 4 slides

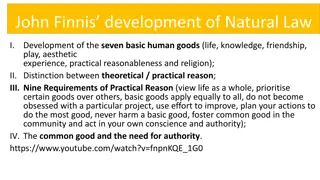

John Finnis' Development of Natural Law and Basic Human Goods

John Finnis' theory of natural law focuses on the development of seven basic human goods, including life, knowledge, friendship, play, aesthetic experience, practical reasonableness, and religion. He emphasizes the distinction between theoretical and practical reason, outlines nine requirements of p

1 views • 14 slides

Residuary Income and Taxable Sources

Residuary income, under section 56(1), includes all income not excluded from total income and subjected to income tax under "Income from other sources." Certain specific incomes listed in section 56(2) are taxable, such as dividends, winnings, employee contributions, interest on securities, and inco

0 views • 9 slides

May Trucking Co. v. ODOT - Ninth Circuit Case Analysis

May Trucking Company, an interstate motor carrier, challenged an assessment by the Oregon Department of Transportation (ODOT) for underpaid fuel taxes. The dispute centered on whether fuel consumed during idling should be taxable under the International Fuel Tax Agreement (IFTA). The Administrative

2 views • 9 slides

Safety and Energy Efficiency Regulations Overview by Mauritius Standards Bureau

Explore the comprehensive overview of safety and energy efficiency regulations presented by the Mauritius Standards Bureau on 1st March 2017. The presentation covers important topics such as the Consumer Protection Act, Controlled Goods, Energy Efficiency Act, verification of Certificates of Conform

1 views • 15 slides

Taxable Scholarships at International Tax Informational Workshop

Explore the essentials of taxable scholarships at an informational workshop for international students and employees. Learn about compensatory payments, Forms W-2 and 1042-S, and how to differentiate between qualified and non-qualified education expenses to manage tax liabilities effectively.

0 views • 22 slides

Moving Expense Information and Eligibility Guidelines

Information on moving expense eligibility for non-taxable treatment, including distance requirements and time considerations. Details on taxable vs. non-taxable moving expenses, helpful hints for new employees, and guidelines for adequate accounting. IRS Publication 521 is referenced for additional

1 views • 6 slides

Public Goods in Higher Education

This text delves into the concept of public goods in higher education, examining the distinctions between public and private forms, the economic and political dimensions, and the normative value of public goods. It discusses the economic definition of public goods, emphasizing their non-rivalrous an

2 views • 18 slides

Goods and Services Tax (GST) Time of Supply

Goods and Services Tax (GST) time of supply, also known as TOS, determines when GST becomes payable on a supply. This includes various elements like agreement to supply, delivery of goods, provision of services, invoice issuance, payment, and recording of payments. The time of supply for goods and s

0 views • 26 slides

Tax Invoices, Debit Notes, and Credit Notes in Goods and Services Tax

This content covers the basic concepts of supply, invoicing obligations, tax invoices under Section 28, removal of goods for supply, and scenarios where removal does not result in a supply. Learn about the different types of taxes and when tax invoices should be issued for taxable goods and services

0 views • 28 slides

Segregation of Dangerous Goods in Transport

This presentation provides valuable information on the segregation of dangerous goods for transport, based on the Six Pillars of Dangerous Goods Transport. It covers topics such as what dangerous goods to segregate, how to segregate them, and includes practical examples. Important examples of incomp

0 views • 12 slides

Risk Analysis Methods Related to Transport of Dangerous Goods at Buda University, Hungary

Explore risk analysis methods in relation to Transport of Dangerous Goods (TDG) at Buda University, Hungary. Discover best practices for teaching staff through funded training programs aimed at modernizing curricula and developing professionals in the Western Balkans. Learn about European recommenda

0 views • 30 slides

Guidelines for Harmonized System Classification of Goods

Understand the step-by-step process of classifying goods under the Harmonized System, including referencing section notes and chapter notes, resolving ambiguities in word meanings, identifying essential characteristics of unfinished goods, choosing specific headings over general ones, and classifyin

0 views • 41 slides

W-2 Discrepancies and Pay Statement Variances

The W-2 form and pay statements may not always match due to differences in taxable wages, deductions, and withholdings. Understanding how to reconcile Box 1 wages, Box 2 federal income tax withheld, and Box 3 Social Security wages can help employees accurately report their income for tax purposes. T

0 views • 14 slides

U.S. Graduate Student Tax Reporting for Fellowships and Assistantships

U.S. Graduate Student Tax Information Session for U.S. students and resident aliens covers tax reporting rules for fellowships and assistantships. It discusses taxable and non-taxable aspects based on expenditure categories. Tips on accessing and utilizing tax-related documents are provided.

0 views • 63 slides

Tax Reporting Guidelines for Graduate Students in the US - March 2020

This document provides tax reporting guidelines for US citizens, permanent residents, and resident aliens who receive fellowship or assistantship payments. It explains the tax implications of these payments, detailing what is considered taxable and non-taxable income. The document also outlines the

0 views • 44 slides

Tax Information for US Resident Students and Scholars

Fellowship stipends for students and postdoctoral fellows, tax responsibilities, qualified expenses exclusion, taxable stipends for services like TA and RA assistantships, and guidelines for reporting taxable amounts on tax forms are discussed in detail in the provided information.

0 views • 17 slides

Challenges and Trends in the Sporting Goods Industry

The sporting goods industry has faced challenges such as store closures, bankruptcies, and shifting consumer preferences. Sales in sporting goods stores remained relatively stable from 2015 to 2016, but a significant decrease was seen in the first seven months of 2017. Participation in physical acti

0 views • 10 slides

Analysis of Key Issues for Transport of Dangerous Goods in Slovenia

This analysis focuses on the legal bases and regulations governing the transportation and inspection of dangerous goods in Slovenia, covering aspects such as international agreements, EU requirements, specific legislation for different modes of transportation, and the Dangerous Goods Transport Act.

0 views • 11 slides

Modernization of Transport of Dangerous Goods in Poland

Analysis of key issues related to the transport of dangerous goods (TDG) in Poland, focusing on tools, methods, standards, and programs involved in the TDG chain, including the relevant legislation such as the Act on the Carriage of Dangerous Goods and the ADR Agreement. The ADR covers general provi

0 views • 11 slides

Public Goods and Common Resources

Exploring concepts like private goods, public goods, common resources, free rider problem, Tragedy of the Commons, and cost-benefit analysis in economics, this content helps differentiate between types of goods and resources, providing insights into the challenges and considerations associated with

0 views • 15 slides

Taxable Scholarships for International Students

Explore the taxation implications of scholarships for international students at UNT System, including what constitutes taxable scholarships, qualified education expenses, and examples illustrating the calculation of taxable scholarship amounts. Gain insights into the importance of understanding thes

0 views • 24 slides

Income Tax Basics

Income tax is a fundamental part of contributing to a civilized society, with various taxes like sales tax, gas tax, and alcohol tax playing a role. This guide explains how income tax works, including taxable income calculations and refund processes. It also covers what amounts are taxable, such as

0 views • 14 slides

Overview of Ohio School District Taxable Property Values

Residential and agricultural properties make up a significant portion of Ohio's total taxable property values. The composition varies by district type, with suburban and urban districts experiencing the fastest growth since 2017. Public utility tangible personal property values have also seen rapid

0 views • 4 slides

The Role of Public Goods in Higher Education

This paper discusses the concept of public goods in higher education, exploring how they are defined, observed, and improved. It analyzes the distinctions between public and private goods based on economic and juridical-political factors, and examines the significance of public goods in advancing so

0 views • 19 slides