Guidelines for Harmonized System Classification of Goods

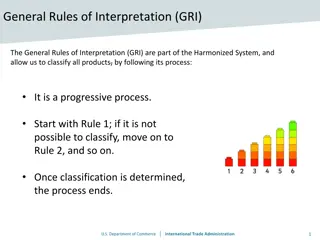

Understand the step-by-step process of classifying goods under the Harmonized System, including referencing section notes and chapter notes, resolving ambiguities in word meanings, identifying essential characteristics of unfinished goods, choosing specific headings over general ones, and classifying goods similar to those not explicitly mentioned. Follow specific rules to ensure accurate classification.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

NACEN, MUMBAI 9/23/2024 1

STRUCTURE OF HARMONIZED SYSTEM Chapters: 77 reserved for future use 21 Sections 99 Chapters 1,244 Headings Chapters 98&99 reserved for National Use 5,224 Subheadings.

A commodity can be classified either by: Notes to Sections, Chapters or Subheadings. General Interpretative Rules Terms of Heading.

CLASSIFICATION STEP BY STEP Read correspondin g Section Notes and Chapter Notes .Refer the heading and sub-heading No confusion or ambiguity Classification final Under RULE 1 Confusion or Ambiguity exist

Meaning of Word is not clear Ist refer to trade Practice 2nd find technical or dictionary meaning Classification Final 3rdRefer to BIS or other standards Rule 1 of GIR Not Resolved

Goods are incomplete or un-finished, But classification of finished product is known, ascertain if unfinished item has essential character of finished goods, RULE 2(a) If finished article is in state of Unassembled or Disassembled condition ,it has to be classified under the same heading as long as they have the essential character of finished article If Goods are mixtures or combination of material or substance.? Reference to material or substance includes reference to mixtures or combination of that material or substances with other material substance. And classify the article accordingly RULE 2(b) Not Resolved Not Resolved

If ambiguity persist, find out which heading is specific and which heading is more general (Prefer Specific Heading) RULE 3(a) If not resolved by 3(a) Find out Which material or component is giving essential character to the goods in question RULE 3(b) RULE 3(c) If both are equally specific, find which comes last in the Tariff and take it Not Resolved Not Resolved

If you are unable to find any entry which matches the goods in question, find goods which are most akin, classify under the same heading as goods similar or virtually identical. RULE 4 If the article in question is containers, specially shaped or fitted to contain a specific article or set of articles, suitable for long-term use and presented with the articles for which they are intended, shall be classified with such articles when of a kind normally sold therewith. RULE 5(a) If the article/s is/are packing materials and packing containers presented with the goods therein shall be classified with the goods if they are of a kind normally used for packing such goods. RULE 5(b) Not resolved

-Must have 4 digit classification using rule 1to5 -Now Classification at subheading level is to determined. -At many subheading levels the description is same but subheading have to read along with their main heading for correct classification. -Further only Sub-Heading at the same level are comparable. - Classification on the subheading shall be determined by the of the subheading and any Subheading Notes. RULE 6

Punctuation Marks Terms of the heading with Semi-colon (;) Some of heading texts include independent items which are divided by semicolon (;). This means that the semicolon(;) has two functions, as a full stop (.) and it separates the terms of heading into parts of different scopes. For example, heading 42.02 reads : 1)Trunks, brief-cases, school satchels, spectacle-cases, binoculars cases, camera cases, gun cases, holsters and similar containers; 2)travelling-bags, insulated food or beverages bags, toilet bags, rucksacks, handbags, shopping bags, wallets, purses, map-cases, cigarettes-cases, tobacco- pouches, tool bags, sports bags, bottle-cases, jewelry boxes, powder boxes, cutlery containers, of leather or of composition leather, of sheeting of plastics, of textile materials, of vulcanized fibre or of paperboard, or wholly or mainly covered with such materials or with paper suit-cases, vanity-cases, executive-cases, cases and similar

Punctuation - Contd The commodities listed before the semi- colon in the terms of the heading (part 1 above)have no limitation regarding their materials content. On the other hand, the latter ones after the semi-colon in the terms of the heading (part 2 above) must be made of leather or of composition leather, of sheeting of plastics, of textile materials, of vulcanized fiber or of paperboard, or wholly or mainly covered with such materials or with paper .

Terms of heading with comma(s)(,) In the Harmonized System, Commas (,) are distributive. This means that in the terms of the heading, a description after the last comma applies to all the goods previously mentioned. For example, heading 69.11 reads: Tableware, kitchenware, other household articles and toilet articles, of porcelain or china This expression implies that the tableware and kitchenware must be of porcelain or china and that other household articles and toilet articles must also be of porcelain or china

One-dash terms of subheading with a colon (:) When a colon (:) appears at the end of one-dash subheading text, it indicates that the one dash subheading is further divided into two-dash subheadings. Example: Heading 01.03 Live swine 0103.10 - Pure bred breeding animals - Other: 0103.91 -- Weighing less than 50kg 0103.92 -- Weighing 50kg or more The one dash subheading text (pure bred breeding animals does not have a colon (:) and therefore not further subdivided. On the other hand, the one dash subheading (Other) has a colon (:) meaning that it is further subdivided into weighing less than 50kgs and weighing 50kgs or more.

Special Provisions Some of the legal Notes have the expression otherwise require . This means that if other legal provisions provide different views to those notes, they are given preference. For example, Note 1 to Chapter 25 reads: Except where the context or Note 4 to this Chapter otherwise requires, the headings of this Chapter cover only products which are in the crude state or washed with chemicals to eliminate impurities without changing the structure of the product, but not products which have been roasted, calcined, obtained by mixing or subjected to processing beyond that mentioned in each heading. On the other hand, the text of heading 25.07 reads Kaolin and other kaolinic clays, whether or not calcined. In this case, the provision of the terms of heading 25.07 is given preference to Note 1 to Chapter 25.

Legal Text The Harmonized System contains Section Notes, Chapter Notes and Terms of the heading as legal texts according to Rule 1 of the Harmonized System. The Subheadings are legal texts at the subheading level according to Rule 6 of the GIR of the Harmonized System. Subheading Notes and terms of the Section or Chapter Notes should be consulted for every classification.

Types of Notes There are three types of Notes; Section Notes, Chapter Notes and Subheading Notes. Section and Chapter Notes clarify the scopes of Section, Chapter and heading (within 4- digit level). Subheading Notes only clarify the scope of subheading for the purpose of classification at the subheading level (within 6-digit).

HS FOR TARIFF CLASSIFICATION The title of Section, chapter and sub chapter Ease of reference only Are only pointers or labels used to divide up the nomenclature. Help in directing you to areas of the nomenclature Have no legal standing. They should not be quoted to support classification. E.g Section XV is entitled base metal and articles of base metal. However, many articles of base metal are classified in other Section

Agricultural Products The first 24 chapter deal with agricultural products (Sec.1-1V) SECTION No. CHAPTER No. Description of articles Sec 1 live animals and animals product. Chap 1 to 5 Chap 6 to 14 vegetable products Sec II chapter (15) animal or vegetable fats and oils. chap 16 to 24 Tobacco. Sec III beverages spirits vinegar and SecIV

Mineral and Chemical Products SECTION V Chap 25,26,27 mineral products. SECTION VI Chap 28 Chemical and Para chemical products(inorganic chemicals, Chap29 Chemical and Para chemical products(organic chemicals.) Chap(30- 38) products of the chemical industries e.g. (pharmaceutical product, paints etc) SECTION VII Chap 39 covers plastics and articles thereof Chap 40 Rubber and articles thereof SECTION VIII Chap41 Hides and Skin Chap 42 Article of Leather or animal gut Chap43 fur skins and artificial fur.

Mineral and Chemical Products Section IX Chap 44 Wood and articles of wood Chap 45 Cork and articles of cork Chap 46 Basket-ware and wicker-wor Section X Chap 47 Pulp Chap 48 Paper and paperboard and articles thereof Chap49 Product of the printing industry

Manufactured Products(Textile) Section No. Chapter No. Description of article SECTION XI Chap 50 Silk Chap 51 Wool and Animal hair Chap52 Cotton Chap53 Other vegetable fiber Chap 54 Man made textile materials (filaments) Chap 55 Staple fibers Chap 56 Floor covering Chap 57 Special woven fabrics Chap 58 Finished articles of woven fabric Chap 59 Impregnated., coated, laminated, articles of industrial use etc. Chap 60 Knitted or crocheted fabrics. Chap 61 Made up articles of chapter 60

Manufactured Products Section no. Chapter No. Description of Articles Section XII Chap 64 footwear Chap 65 Headgear Chap 66 Umbrellas, walking sticks etc Chap 67 Articles flowers and articles of human hair Section XIII Chap 68 Articles of stones ,plaster ,cement ,asbestos, mica or similar materials Chap 69 Ceramic products Chap 70 Glass and glassware Section XIV Chap 71 Pearls and precious stones, precious metals, jewellery and coin.

Base Metals Section No. Chapter No. Description of Article Section XV Chap 72 Ferrous metals Chap73 Other articles thereof Chap 74 Copper Chap75 Nickel Chap76 Aluminum Chap 77 Reserved for future use Chap 78 Lead Chap 79 Zinc Chap 80 Tin Chap 81 Other base metals and cermets Chap 82,83 Tools, implements, cutlery, spoons and forks

Manufactured Products Section No. Chapter No. Description of Articles Section XVI Chap 84 Machinery & Mechanical appliances Chap 85 Electrical machinery and Equipment Section XVII Chap 86 Railway rolling-stock Chap 87 Motor vehicles and other special type vehicles Chap88 Aircraft and spacecraft Chap 89 Ships and floating structures Section XVIII Chap 90 Measuring devices, optical devices, medical etc. Chap 91 Clock and watches Chap 92 Musical instruments Section XIX Chap 93 Arms and ammunition

Other Products Section No Chapter No. Description of Articles Section XX Chap 94 Furniture ,light fittings, Prefabricated bldgs.etc. Chap 95 Toys, Games. Sports requisite etc. Chap 96 Miscellaneous Manufactured Articles Section XXI Chap 97 Work of Art, Collectors Pieces and Antique Chap 98 Reserved for special use by Contracting Parties Cha 99 Reserved for special use by Contracting Parties

MISCELLANEOUS ISSUES OF CLASSIFCATION

Goods in CKD/SKD Condition What if, Goods imported separately and they are not presented as one CKD pack at the time of import. If some non-essential items are not imported, can the CKD pack still become complete article? If some essential items not imported can the CKD pack be considered complete article. Issue arises which is essential and which is non-essential. This is a matter of fact and has to be decided in each case. Simply the essential parts do not make a complete article. Board has issued a circular 30.5.1995 (F. No.528/42/95-Cus.(TU) No.55/95-Cus dated

Rule 2(b) Refers to following situations: Heading reference to a material or substance to include mixture or combinations of that material or substance with other materials or substances Mixture of horsehair (60%) and wool (40%) ?? = 05.03 Horsehair. Mixture of horsehair (50%) and wool (50%) ?? =Rule 3

Blanks Blanks are classified as a finished article when presented with an approximate shape or outline of a finished article. Blank Keys-Classified as finished keys as they have the essential character of finished keys as per Rule 2(a)

RULE 2(b) Reference to goods of a given material or substance to include goods consisting partly of that material or substance Example; Classify a wooden carpenters plane with a screw in steel blade? 44.17? Chapter 44 Note 5 (Explanatory Note 1 to 44.17) Chapter 82 Note 1 (a) Classified under 82.05 (Tool partly of base metal)

Rule 2(b)- contd The last part of GIR 2(b) states that the classification of goods consisting of more than one material or substance shall be classified according to the principles of Rule 3. In addition, there is a similar statement in Explanatory Notes to GIR 2(b) (XIII) which reads as a consequence of Rule 2(b), if goods are prima facie classifiable under two or more headings, classification shall be according to the principles of Rule 3. GIR 2(b) widens the scopes of the headings, it does not conclude the classification. The classification must be considered according to the principles of GIR 3

Rule 3 Order of priority (a)Most description (b)Essential character (c)Heading which occurs last in numerical order Most specific description Description by name better than description by class Electric hair clippers 85.08? 83.09?85.10? -85.10 If goods answer to description which more clearly identifies them. Tufted textile carpet for cars 57.03 ? 87.08 ? 57.03 specific Applies only if the terms of the heading Section/Chapter Notes do not otherwise require. and

Relevance of End-Use/Software Classification End use is generally not relevant for classification It can be relevant in only limited cases like Pipes of refrigerating system can be classified as part of refrigerating system. Classification of Software- Preloaded software to be classified with the Computer/Main machine. Software supplied separately and have separate market is to be classified as software (85.24)

Trade Parlance Theory A word in the statute should be construed in its popular sense with the subject matter with which it is dealing. Legislature does not suppose merchants to be naturalists, geologists etc Examples : Carbon paper is not understood as paper and hence it can not be classified as paper. Glass Mirror can not be classified as glass and glassware in ISI classification Statuary definition overrides trade Parlance meaning HSN and Rules of Interpretation overrides trade parlance Technical and scientific terms must be understood in technical sense End-use is generally irrelevant for classification

Classification- settlement of issues Dictionary meaning:- Dictionary meanings are not always and safe guide because dictionaries give different shades of meaning. Even where the goods were produced before the Supreme Court in evidence of classification, it was held that the goods shall be classified as per trade understanding and not on the basis of dictionary, technical or scientific meaning Purewal Associates Ltd. vs. CCE (1996-87-ELT- 321-SC). Trade meaning is to be preferred, and where such trade meaning is not available, ordinary meaning is to be preferred over scientific or technical meaning CCE vs. Krishna Carbon Paper Co. 1988-37-ELT-480-SC. Trade commerce and customers understanding and not dictionary meanings should govern the classification on goods CCE. Vs. Sun flame Industries (2000- 119-ELT-726-Large Bench-Tri.). Technical Meanings:- Technical Meaning are to be taken only on a selective manner and not to be resorted to be routine.

Mis Classfication-Examples Flanges were classified under CTH 85030010/85030090 of the Customs tariff as parts of wind operated electricity generators and levied basic customs duty at the rate of 7.5 percent . Flanges fall under the category of parts of general use , as per the aforesaid provisions and merit classification under CTH 73072100 leviable to BCD at the rate of 10 percent . misclassified Projectors as articles used in automatic data processing system. Projectors capable of working with an Automatic Data Processing Machine (ADPM) as well as with television and videos are classifiable under CTH 85286900 assessable to BCD at the rate of 10 percent .

CLASSIFICATION OPINIONS- Examples Cartridge for an electronic cigarette, consisting of a plastic mouthpiece and a plastic tube containing an absorbing material saturated with a solution consisting of propylene glycol, glycerol, tobacco volatile oil, vanilla, menthol, linalool,2,5- dimethylpyrazine and cartridge is used in an electronic cigarette which heats and vaporises the solution in the cartridge to produce a vapour mist which is inhaled by the user of the cigarette. "3824.90 Application of GIRs 1, 3 (b) and 6. 2-acetylpyrazine. The

OTHER GUIDES TO CLASSIFICATION BOARD S CIRCULARS CLASSIFICATION GLOSSARY/OPINION OF WCO. WEBSITES OF OTHER COUNTRIES DECISION OF AUTHORITY ON ADVANCE RULINGS- SECTION 28J OF THE ACT DECISIONS OF COMMR(APPEALS), CESTAT, HIGH COURT AND SUPREME COURT

Case Study/ example-I Soya Floor Powder- Chapter 15/ 12- @ 15% BCD imported by Abott Labs Food Supplement- CTH 2106 @ 30% BCD Sold in capsules form Imported in bulk form- packed in capsules 9/23/2024 39

Case Study/ Example-II Parachute Coconut Oil( excise case) Vegetable Oil ( Edible Oil)under Chapter 15 Preparation for use on hair under 3305 Used as Edible Oil only in south Board Circular Packing up to 200 ml is to be classified as cosmetic including hair oil under CTH 3305 and not as Edible Oil 9/23/2024 40