MONITORING OF TREASURY OPERATIONS

The state financial control system in Uzbekistan is governed by the Budget Code and involves various bodies such as the Accounts Chamber, Ministry of Economy and Finance, and Treasury Service Committee. It includes methods like full control and selective control, types such as preliminary and ongoin

5 views • 10 slides

Budgeting Overview at Montclair State University

This presentation provides an overview of budget management concepts, departments, systems, and processes at Montclair State University. It covers the definition of a budget, the roles of the Office of Budget and Planning, the Division of Finance and Treasury, and the MSU Foundation in budgeting and

2 views • 21 slides

Treasury Single Account Structure and Management in the Republic Moldova

The document outlines the establishment and management of the Treasury Single Account (TSA) in the Republic of Moldova. It discusses the transition from the previous treasury system to the TSA, the regulatory framework, and the gradual expansion of the TSA. Details include the involvement of various

3 views • 13 slides

Janet Yellen: Achievements of the First Female U.S. Secretary of the Treasury

Janet Yellen, an American economist and civil servant, made history as the first woman to hold the position of United States Secretary of the Treasury. From her education at Brown University and Yale to her early career as a professor and her groundbreaking roles in economic leadership, Yellen's acc

6 views • 11 slides

Overview of Ministry of Finance Treasury Department Functions

The Treasury Department of the Ministry of Finance plays a crucial role in managing government finances. It is responsible for payment of expenditures, collection of non-tax revenues, custody of public monies, setting financial standards, and more. The department is divided into various sections lik

0 views • 12 slides

Understanding U.S. GAAP and Federal Accounting Standards

Explore the relationship between FASAB, OMB, and Treasury in setting accounting standards for federal entities under U.S. GAAP. Learn about the issuance of financial reporting requirements, uniform chart of accounts, and definitions of accounts receivable and payable. Discover the guidance provided

0 views • 6 slides

Kosovo Treasury Response to COVID-19 Pandemic Situation

Kosovo Treasury has efficiently managed its operations during the COVID-19 pandemic, ensuring continuity in financial functions and creating a dedicated bank account for funds related to fighting the pandemic. Despite reduced office staff, the Treasury has remained fully operational, handling revenu

1 views • 6 slides

Modernizing Public Financial Management Systems for Enhanced Efficiency

This content discusses the implementation of an Integrated Financial Management Information System (IFMIS) to improve revenue mobilization, budget execution, and government financial transparency. It covers the objectives of the new IFMIS, including fiscal discipline, improved budget planning, and e

2 views • 14 slides

National Treasury Responses to Public Hearings - Cross-Cutting Issues Update

National Treasury responds to key cross-cutting issues from public hearings, addressing matters such as additional funding for programs, accountability, corruption, single wage regime, and reduction of politicians' and managers' packages. The Treasury outlines its actions and plans for each issue to

3 views • 13 slides

The Historical Significance of the First Islamic State in Medina

The Islamic State in Medina established by Prophet Muhammad marked the beginning of a new era in Islamic history. It was the first welfare state, where divine teachings were implemented under his guidance. This state pioneered the integration of spiritual and temporal authorities, setting the founda

0 views • 60 slides

Understanding Treasury Bills Market and its Significance in Finance

The treasury bills market is where finance is provided against government-issued short-term promissory notes. These bills are considered safe and liquid assets with maturity periods of 91, 182, or 364 days. Major participants include the RBI, commercial banks, and other financial institutions. Treas

0 views • 6 slides

Cash Management Case Study: Republic of Kosovo's Treasury Operations

Explore the cash management practices and treasury operations of Kosovo's State Treasury, highlighting its responsibilities, organizational structure, revenue, expenditures, primary balance, and cash flow forecasting methods. Learn about the budget organization's cash flow preparation process, fund

0 views • 14 slides

Understanding Integrated Acquisition System (IAS) and Treasury's IPP

This presentation provides insights into how the Integrated Acquisition System (IAS) and Treasury's Invoice Processing Platform (IPP) function together to process acquisitions seamlessly. It covers the document flow, interfaces, and reporting aspects, emphasizing the role of the Procurement Systems

0 views • 27 slides

Government Debt Management at the Zero Lower Bound: A Roundtable Discussion

This roundtable discussion in 2014 focused on the conflict between the Federal Reserve and the Treasury in managing government debt, particularly in the era of Quantitative Easing (QE). It explores the historical perspectives, a modern debt management framework, and potential solutions to resolve th

0 views • 19 slides

Legislative Requirements for Independent System Audits in Local Government

National legislation mandates the establishment of a National Treasury to ensure transparency and expenditure control in all government spheres, including local government. This involves adherence to Generally Recognized Accounting Practice (GRAP OAG), uniform expenditure classifications, and treasu

0 views • 12 slides

Modern Treasury Performance Management Framework

Explore the key elements of measuring and monitoring performance in a modern treasury, highlighting the importance of strategic planning, risk assessment, performance frameworks, and client orientation. Learn about performance evaluation, key performance indicators, and the integration of budget and

4 views • 17 slides

Challenges and Engagements in Working with Non-Delegated Municipalities in Gauteng

This report discusses the challenges faced by Gauteng Provincial Treasury in overseeing non-delegated municipalities like City of Johannesburg and City of Tshwane. While there are existing working relationships and engagements with National Treasury for support and monitoring, there are still comple

0 views • 5 slides

Provincial Treasury Process for Dealing with Irregular Expenditures

The Provincial Treasury outlines the process for handling irregular expenditures, including the definition of irregular expenditure, regulations introduced, legal opinions, and duties of Accounting Officers (AOs) and Authorized Officials (AAs) to prevent and address irregularities. Various steps and

0 views • 12 slides

Understanding Financial Instruments and Markets

Explore asset classes like fixed income securities, money market instruments, and capital market instruments. Learn about different financial instruments in various markets including money market, bond market, equity markets, and derivative markets. Dive into money market instruments like Treasury b

0 views • 47 slides

George Washington's Presidency: Establishing Governmental Precedents

George Washington, as the first President of the United States, set important precedents during his two terms in office from 1789 to 1797. He established the federal court system under the Judiciary Act of 1789, appointed the first Supreme Court justices including John Jay, and formed the first Pres

0 views • 16 slides

Insights from FP&A, Treasury, and Partnership Panel Discussion at 2015 Rocky Mountain Summit

Engage with industry experts as Moderator Brian Kalish leads a panel including Stephanie Lambert, Beth Newton, Beth Ongun, and Clare Wilson to discuss the dynamics of FP&A, Treasury, and partnership success. Gain valuable insights and perspectives from seasoned professionals in finance and administr

0 views • 8 slides

Understanding Export Controls and Regulations in the United States

This content provides insights into export controls and regulations, covering topics such as Federal Export Control restrictions, definitions of U.S. Person and Foreign National, Technology Control Plans, Deemed Export discussions, and oversight by Federal agencies like the Department of Commerce, S

0 views • 20 slides

Treasury Fund Overview and Analysis

The Treasury Fund is the central repository for all funds managed by the General Secretariat, consolidating cash and bank accounts while accounting for separate funds. The composition, loans, temporary loan history, and quota balance provide a comprehensive snapshot of the Treasury Fund's financial

0 views • 16 slides

Understanding Export Control Laws and Compliance Concerns

Federal Export Control Laws (ECL) regulate the export of sensitive products, technologies, and software to foreign entities. Non-compliance can lead to severe penalties for researchers and institutions. ECL aims to promote national security, prevent terrorism, and comply with international commitmen

0 views • 25 slides

Transforming the Financial Sector for Better Service: National Treasury Presentation

National Treasury presented insights on transforming the financial sector to serve South Africa better through promoting economic transformation, reducing inequality, and implementing higher standards for transformation. The discussion focused on the challenges, achievements, and lessons learned, em

0 views • 25 slides

Overview of State Debts and the Treasury Offset Program (TOP)

Explore the role of Debt Management Services (DMS) in assisting states with debt collection, including child support obligations and income tax debts. Learn about the Treasury Offset Program (TOP) that intercepts federal and state payments to payees with delinquent debts. Discover how states can add

0 views • 13 slides

Developing State Personal Income Distribution Statistics

This project aims to create a distributional account for State Personal Income, allowing for the analysis of inequality by state and over time. Using various data sources such as BEA aggregates and IRS statistics, the distributional model provides insights into state-level income inequality. Census

0 views • 17 slides

Insurance Lesson for Non-Military Service Personnel

Learn about insurance coverage and responsibilities for individuals in non-military service. Find out how accidents and service-related illnesses are handled, as well as the notification process for filing claims with the State Treasury. Contact details and procedures for seeking compensation are pr

0 views • 7 slides

ARPA Reporting Overview and SLFRF Guidelines in Alaska

This document outlines the reporting overview for the ARPA (American Rescue Plan Act) and specific guidelines for the Coronavirus State and Local Fiscal Recovery Fund (SLFRF) in Alaska. It covers acceptance, use, and reporting of funds, as well as designating staff roles for managing reports. The co

2 views • 22 slides

Finrex Treasury Advisors LLP - Expert Financial Consulting and Treasury Management

Finrex Treasury Advisors LLP is a leading FX consulting and treasury management company with a dedicated team of experienced professionals offering comprehensive treasury services, software solutions, and expert consulting in forex risk management. With decades of combined experience, they cater to

0 views • 27 slides

Guidance on U.S. Treasury Final Rule for ARPA State & Fiscal Recovery Fund

The U.S. Treasury issued the Final Rule for the ARPA State & Fiscal Recovery Fund, effective from April 1, 2022. This rule introduces noteworthy changes including a standard allowance for revenue loss, flexibility in using funds for government services, public health, economic impacts, and more. Rec

0 views • 11 slides

Louisiana's Unclaimed Property Program Overview

Louisiana's Unclaimed Property Program, managed by Kimneye S. Cox, MBA, Accountant Manager in the Unclaimed Property Division of the State Treasury Department, focuses on reuniting residents with unclaimed assets such as funds, wages, and refunds. The program boasts a high return rate, efficient sta

0 views • 28 slides

American Rescue Plan Act - State and Local Fiscal Recovery Funds Allocation Overview

The American Rescue Plan Act provides funding allocations for various municipalities in Alaska, including boroughs, census areas, and cities. Funds are distributed based on proportional and consistent guidelines with mandatory reporting. The allocation process involves state, boroughs, entitlement c

0 views • 34 slides

ARPA Reporting and Compliance Guidelines for Recipients

This content provides important information regarding ARPA reporting and compliance requirements for recipients of government funding. It covers topics such as spam/phishing warnings, recipient tiers, resources for reporting, Treasury's disclaimer on project approval, and guidance on using the Treas

0 views • 21 slides

Understanding Bond Valuation and Types

Explore the world of bond valuation, from the definition of bonds to the different types such as zero-coupon, coupon, self-amortizing, and perpetual bonds. Learn about bond issuers, including the US government and agencies, and delve into the specifics of US government bonds like Treasury Bills, Not

0 views • 39 slides

National Treasury Strategic Initiative on Travel & Accommodation

This strategic initiative by the National Treasury focuses on improving travel and accommodation practices through the implementation of national travel policies, online directories, enhanced compliance measures, modern payment methods, and leveraging technology for better efficiency. The initiative

0 views • 20 slides

UTD Treasury Marketplace Change Request Process

Streamline your request process for Marketplace store updates with the UTD Treasury Change Request Form. Accessible via PeopleSoft, this form allows you to make changes such as adding or removing users, updating cost centers, and managing products efficiently. Improve customer service and enhance co

0 views • 13 slides

Indiana Homeowner Assistance Fund (IHAF) Program Overview

The Indiana Homeowner Assistance Fund (IHAF) was established under the American Rescue Plan Act (ARPA) to provide financial aid to homeowners for housing-related costs. Managed by the US Treasury, IHAF aims to prevent mortgage delinquencies and foreclosures exacerbated by COVID-19. With a total allo

0 views • 22 slides

Office Operations Best Practices for Treasury and Collector Offices

Enhance office operations efficiency and customer service in treasury and collector offices by implementing best practices such as consistency in routines, posting guidelines, cash control, and handling of abatements, exemptions, and refunds. Maintain a positive and helpful attitude towards customer

0 views • 13 slides

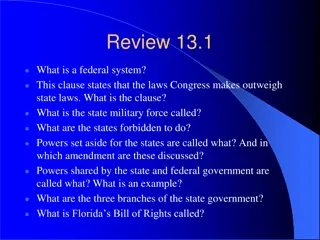

Overview of State Government and State Legislatures in Florida

A federal system is a political framework where power is divided between a central government and individual states. In this system, laws created by Congress take precedence over state laws. The supremacy clause enforces this hierarchy. States are prohibited from actions like declaring war or mintin

0 views • 12 slides