UMass Boston Student Payment Plan Working Group

The student payment plan working group at UMass Boston aims to enhance the billing and collections process to prevent financial troubles for students. By defining and implementing effective payment strategies, the group seeks to ensure that students either pay their bills in full or have a feasible

0 views • 6 slides

Advantages of Having Money: Why Financial Stability Matters

Having sufficient money provides various advantages, including easier life management, ability to afford conveniences and luxuries, and financial stability during uncertain times. Money enables economic freedom, convenience in purchases, homogeneous experiences like vacations, and elasticity in payi

1 views • 5 slides

Understanding the Essential Features of Partnership

Partnership is the relationship between two or more individuals who agree to share profits and losses in a business venture. Essential features include having two or more partners, a mutual agreement, conducting business activities, mutual agency among partners, sharing of profits and losses, and jo

1 views • 5 slides

Garnishment Basics and Process Overview

Understanding garnishment basics and the process involved in handling creditor writs, timelines, proper service requirements, and the role of the Attorney General's Office. Learn about the types of creditor writs, filing requirements, and how the garnishee is named, along with details on different 6

1 views • 34 slides

Financial Sector Reforms in India: An Overview

In the early 1990s, India witnessed significant reforms in its financial sector, addressing issues like lack of transparency, extensive regulation, and financial repression. Key reforms included setting up expert committees, reducing SLR and CRR, implementing prudential norms, and deregulating inter

0 views • 18 slides

Understanding Insolvency Accounts and Laws in India

Insolvency accounts come into play when a debtor is unable to pay debts fully, leading to a legal process supervised by the government for debt resolution. Various scenarios constitute an act of insolvency, such as transferring property to defraud creditors or notifying them of debt payment suspensi

0 views • 38 slides

Export Credit Guarantee Corporation of India Ltd. Overview

ECGC Ltd., wholly owned by the Government of India, promotes exports by providing credit risk insurance services to Indian exporters. It offers various insurance covers, guarantees to financial institutions, overseas investment insurance, and guidance on export-related activities. ECGC aims to enhan

0 views • 13 slides

Liquidation of Companies: Procedures as per IBC 2016

The process of liquidating a company involves collecting and selling its assets to pay off debts, with remaining funds distributed to shareholders. Under the Insolvency and Bankruptcy Code (IBC) 2016, specific procedures must be followed, including initiation by either creditors or debtors within se

0 views • 16 slides

SBA Provides Economic Injury Disaster Loans for Coronavirus-Related Economic Disruptions

The U.S. Small Business Administration (SBA) is offering low-interest federal disaster loans for working capital to small businesses affected by the economic impact of the Coronavirus (COVID-19) pandemic. Eligible businesses include those directly and indirectly affected by the crisis, with loan ter

1 views • 16 slides

Understanding Consignment in Accounting

Consignment in accounting involves sending goods from a consignor to a consignee for sale on commission basis. The consignor retains ownership until the goods are sold. The relationship is that of principal and agent, with the consignee handling sales and remitting net proceeds. Important terms incl

1 views • 7 slides

Understanding Insolvency Accounts and Laws in Financial Accounting

Insolvency in financial accounting refers to the inability to pay debts when they fall due. This article covers the meaning of insolvency, the criteria for being declared insolvent, the Insolvency Act in India, and its applicability to individuals, firms, and Hindu Undivided Families. It distinguish

1 views • 10 slides

Understanding Marshalling of Securities in Mortgage Law

Marshalling of Securities, as per Section 81 of the Transfer of Property Act, addresses the scenario where a property owner mortgages properties to different individuals. This doctrine ensures subsequent mortgagees are entitled to have debts satisfied from properties not mortgaged to them while prot

0 views • 20 slides

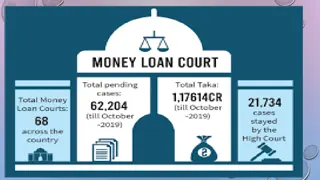

Artha Rin Ain 2003: Special Legislation for Financial Institutions' Debt Recovery

Artha Rin Ain 2003 is a special legislation aimed at enhancing the recovery process of outstanding debts of financial institutions in Bangladesh. The law addresses the shortcomings of previous acts and establishes dedicated courts for the swift resolution of cases involving unpaid claims. It encompa

0 views • 15 slides

Mastering Personal Budgeting: A Guide to Financial Wellness

Take control of your finances through budgeting to understand your spending, pay off debts, and plan for the future. Budgeting promotes good habits, reduces financial anxiety, and helps achieve short and long-term goals at every stage of life. Learn to differentiate needs from wants, manage fixed an

0 views • 14 slides

Managing Account Receivables in Business Operations

Firms commonly offer credit terms to clients, creating trade credit and receivables. High trade receivables signify investment in clients, balancing sales growth with risks of bad debts and credit default. Efficient management of receivables is crucial for optimizing working capital and minimizing c

2 views • 31 slides

Understanding the Insolvency and Bankruptcy Code of 2016 in India

The Insolvency and Bankruptcy Code of 2016 in India replaced various existing laws to streamline the process of corporate restructuring, insolvency, and liquidation. Enacted to resolve bad debts efficiently, attract investors, and strengthen the economy, the code offers benefits like quicker resolut

0 views • 31 slides

Understanding Deferred Taxation in Accounting

Deferred taxation in accounting arises due to differences in financial statement preparation and tax regulations, leading to provisions for future tax obligations. It involves estimating tax liabilities based on future tax legislation and accounting treatments. Provisions, such as for doubtful debts

0 views • 24 slides

City of Houston Charity Care Assistance Program Overview

Houston Fire Department provides Emergency Medical Service (EMS) Ambulance Services in the City under the Houston City Code of Ordinance Chapter 4. The Ambulance Supplement Payment Program (ASPP) offers reimbursement for ambulance services provided to Medicaid and uninsured patients. Changes to Fede

0 views • 8 slides

Understanding the Impact of Debt Collection Laws in South Africa

The content discusses the implications of a proposed amendment to debt collection laws in South Africa, focusing on the financial impact on consumers. It provides background information on debt collection history, the role of the Council for Debt Collectors, and changes in regulations over the years

2 views • 21 slides

Civilian Permanent Change of Station Tax Law Changes Town Hall Session

The presentation covers updates on Tax Cuts and Jobs Act affecting PCS entitlements, tax reporting, debts, and reimbursements. It details the process, deadlines, and responsibilities for civilians moving under DFAS. Information on RITA, vendor payments, amended returns, and IRS compliance is provide

0 views • 24 slides

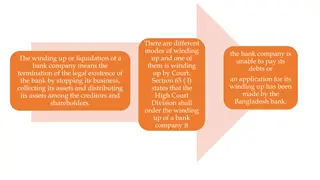

Winding Up of a Bank Company in Bangladesh: Legal Process and Circumstances

The winding up of a bank company in Bangladesh involves terminating its legal existence by ceasing its operations, realizing assets, and distributing them among creditors and shareholders. Section 65(I) of the law empowers the High Court Division to order winding up based on inability to pay debts o

1 views • 8 slides

Liquidating a Small Business in Dubai: Challenges and Solutions

Discover the challenges and solutions involved in company liquidation in Dubai, UAE. Learn how to navigate legal requirements, settle debts, and ensure tax compliance for a smooth business closure.

0 views • 11 slides

Impact of Taxation Laws Amendment on Real People Home Finance

The Taxation Laws Amendment Bill proposes changes affecting non-bank lenders like Real People Home Finance, limiting their doubtful debts allowance to 25% of the IFRS 9 provision. This would result in an inequitable treatment compared to banks, impacting the sustainability of non-bank lending busine

4 views • 8 slides

Understanding Sole Traders in Business Operations

Sole traders play a significant role in various business sectors by owning and running businesses independently. They take on significant risks, responsibilities, and have control over decision-making. Sole traders have unlimited liability for debts, which can impact their personal assets. However,

0 views • 45 slides

Understanding Alexander Hamilton's Economic Problems and Financial Plan

Exploring Alexander Hamilton's approach to addressing economic challenges, financial planning, and interpretation of the Constitution. Delve into his strategies to tackle war debts, promote a strong central government, and foster economic growth. Discover the significance of repaying debts, nurturin

0 views • 13 slides

Understanding Hamilton's Economic Program and Its Impact on Early American Politics

Hamilton's Economic Program, implemented in the late 18th century, set the stage for conflicts between regions in the newly formed United States. The program included measures such as tariffs, debt assumption, creating a national bank, and imposing excise taxes. Hamilton's approach favored the North

0 views • 23 slides

European Political Situation in 1635

In 1635, Europe was embroiled in political turmoil with various regions grappling with debt, overspending, and military conflicts. France experienced a significant increase in revenue but faced challenges due to high military spending. Saxony and the Holy Roman Empire struggled with mounting debts a

2 views • 26 slides

Illegitimate Debts and the Asian Development Bank: The Philippine Case Overview

The Philippine government's debt situation is outlined, highlighting the importance of a historical audit to determine the legitimacy of foreign loans. The General Appropriations Act of 2017 calls for a debt audit on specific projects. The audit aims to ascertain the legitimacy of contracted loans a

0 views • 15 slides

Managing Finances in the United States: Creating a Spending Plan

Explore the importance of creating a spending plan to cover basic living needs, care for family, purchase desired items, and manage financial obligations or debts. Learn about different types of expenses, frequency of occurrence, and how to start creating a personalized spending plan based on your i

0 views • 14 slides

Analysis of Louisiana State Retirement Systems Sustainability

The report by Paul T. Richmond, EA, ASA, MAAA, Actuary for the Legislative Auditor, highlights the sustainable nature of Louisiana state retirement systems despite accumulated debts. It emphasizes the need for contributions to address the Unfunded Accrued Liabilities (UAL) and discusses strategies t

0 views • 26 slides

Empirical Credit Risk Management at FMB Group Credit Union

Empirical Credit-Risk Management (ECM) presentation to FMB Group Credit Union by Financial Analytics Ltd discusses the background, traditional forecasting methods, income and risk recognition, provisioning approaches, and benefits for credit unions. ECM offers expert retail credit risk management th

0 views • 25 slides

Understanding Utility Affordability Challenges for Low-Income Households

Low-income households face significant challenges with utility affordability, especially during COVID-19. The lack of standardized affordability standards and the growing utility debts are exacerbating negative health outcomes and increasing the risk of eviction and homelessness for many families.

0 views • 37 slides

Overview of State Debts and the Treasury Offset Program (TOP)

Explore the role of Debt Management Services (DMS) in assisting states with debt collection, including child support obligations and income tax debts. Learn about the Treasury Offset Program (TOP) that intercepts federal and state payments to payees with delinquent debts. Discover how states can add

0 views • 13 slides

Developing State Personal Income Distribution Statistics

This project aims to create a distributional account for State Personal Income, allowing for the analysis of inequality by state and over time. Using various data sources such as BEA aggregates and IRS statistics, the distributional model provides insights into state-level income inequality. Census

0 views • 17 slides

Understanding Liability of Individuals in Maine Business Entities

Maine business entities, including corporations and LLCs, offer limited liability protections for owners and managers. Shareholders of corporations are not personally liable for the entity's debts, except in specific circumstances. Similarly, members and managers of LLCs are not personally obligated

0 views • 32 slides

Internal Dispute Resolution - Helping Clients Navigate Debt Issues

Explore the process of internal dispute resolution (IDR) to assist clients in resolving problem debts efficiently. Learn how to identify, gather information, determine issues, assess urgency, and negotiate resolutions. Discover the importance of IDR, its benefits, and who offers IDR procedures. Gain

0 views • 71 slides

Jesus' Parable of the Unrighteous Steward in Luke 16:1-13

In the parable of the unrighteous steward, Jesus tells of a steward who wastes his master's goods, leading to his dismissal. However, the steward cleverly resolves his situation by reducing the debts owed to his master. Surprisingly, the master commends him for his shrewdness. Jesus then imparts the

0 views • 13 slides

Hamilton's Economic Program and Its Impact on Early American Politics

Hamilton's economic program, implemented in the late 18th century, set the stage for conflicts between different regions of the United States. His measures favored the Northeast over the South, West, and hinterlands, with income-based policies that did not sit well with Southern planters. The progra

0 views • 23 slides

Discussion on Swapping Debts for Green Projects - 2024 HLPF Side Event

Middle-income and developing countries face a critical debt situation, hindering their development tasks. This virtual side event during the 2024 HLPF aims to discuss swapping debts of poor nations for green projects to address the financing gap and promote climate action. Experts will explore solut

0 views • 16 slides

Overview of State Government and State Legislatures in Florida

A federal system is a political framework where power is divided between a central government and individual states. In this system, laws created by Congress take precedence over state laws. The supremacy clause enforces this hierarchy. States are prohibited from actions like declaring war or mintin

0 views • 12 slides