ECC Social Value Reporting and Evaluation Framework

Essex County Council (ECC) has implemented a robust Social Value Reporting and Evaluation framework based on the Local Government Association's National TOMs method. This framework categorizes and assesses social value contributions in two parts - Value Score and Supporting Statement Score - to deri

3 views • 16 slides

Capital Structure

An appropriate capital structure aims to maximize shareholder return, minimize financial risk, provide flexibility, ensure debt capacity is not exceeded, and maintain shareholder control. The optimum capital structure achieves a balance of equity and debt to maximize firm value.

1 views • 5 slides

Buyback of Shares in India under Companies Act & Tax Consideration

Explore the intricacies of share buybacks in India, from regulatory compliance under the Companies Act to tax considerations under the Income-tax Act. Discover how companies navigate legal frameworks to optimize surplus cash, enhance shareholder value, and strengthen promoter holdings through strate

6 views • 4 slides

Financial Impacts of Electric Vehicles on Utility Ratepayers and Shareholders

Analysis funded by the U.S. Department of Energy examines the effects of electric vehicle adoption on utility finances, including ratepayer and shareholder impacts. The study delves into customer EV adoption, utility revenue collection, and investment value. Various charging strategies and utility c

0 views • 21 slides

Understanding Employee Engagement and its Impact on Workplace Performance

Employee engagement is crucial for organizational success as it reflects the emotional connection employees have with their work. It involves high levels of energy, dedication, and absorption at work, leading to enhanced productivity, performance, and a positive work environment. Engaged employees a

2 views • 34 slides

Understanding the Value of Money and Standards

The value of money refers to its purchasing power, which is influenced by the price level of goods and services. Different standards, such as wholesale, retail, and labor, help measure the value of money. Money can have internal and external value, affecting domestic and foreign transactions. The Qu

0 views • 62 slides

Financial Planning and Control in Business

Financial planning involves projecting sales, income, and assets to determine the resources needed to achieve goals. Financial control focuses on implementing plans, receiving feedback, and making adjustments. Growth should not be the sole goal; shareholder value creation is key. The percentage of s

0 views • 27 slides

Features of an Appropriate Capital Structure and Optimum Capital Structure

While developing a suitable capital structure, the financial manager aims to maximize the long-term market price of equity shares. An appropriate capital structure should focus on maximizing returns to shareholders, minimizing financial insolvency risk, maintaining flexibility, ensuring the company

2 views • 5 slides

FPC Annual General Meeting & Shareholder Information Session Summary

The FPC Annual General Meeting featured introductory remarks by Chairman Mr. Michael Gallagher, followed by formal business resolutions and a shareholder information session by Mr. Angus Geddes. Key resolutions included the adoption of the Remuneration Report and the re-election of Director Mr. Mich

0 views • 26 slides

Understanding Dividend Policy and Share Repurchase in Corporate Finance

Firms in corporate finance make decisions on dividend payouts and share repurchases, impacting company value and shareholder returns. Dividends are payments to shareholders, while share repurchases involve buying back company stock. Companies can choose between these methods based on various factors

1 views • 29 slides

Business Doctors: Workshop on Business Growth Strategies

Explore the transformative workshop on business growth strategies by Business Doctors. Learn to work on your business effectively, setting clear goals, strategies, and action plans. Understand the importance of personal drivers, core values, and market knowledge for business success. Elevate your bu

0 views • 45 slides

Understanding Corporate Finance: A Comprehensive Guide

Corporate finance involves managing financial activities within a corporation to maximize shareholder value. It covers areas such as balance sheets, income statements, return on investment, and investor expectations. Investors play a crucial role by investing capital in exchange for potential return

1 views • 28 slides

Enhancing Social Value through Strategic Procurement

STAR Procurement, the shared service for multiple councils, emphasizes the importance of Social Value in procurement practices. The Social Value Portal serves as a management tool to measure and demonstrate the benefits of Social Value commitments. Bidders are required to provide quantitative and qu

0 views • 14 slides

Sustainable Value Chains and Business Strategy Alignment

This content covers the importance of aligning improvements with business strategy, defining company strategy, value proposition, making a business case based on external drivers impact, and building shareholder value through stakeholder management. It emphasizes the significance of adopting sustain

0 views • 14 slides

Integrated Value Creation in Corporate Finance

Explore the concept of integrated value creation in corporate finance, emphasizing the importance of managing for long-term value while incorporating social and environmental goals. Learn about responsible management practices that focus on creating net present value (NPV) through a balance of finan

0 views • 38 slides

Sustainability in Supply Chain Management: Key Considerations and Benefits

Sustainable supply chain management is crucial for meeting sustainability criteria while staying competitive and addressing customer needs. It encompasses activities from raw materials to end-users, impacting aspects like product design, recycling, risk management, and shareholder value. By promotin

0 views • 20 slides

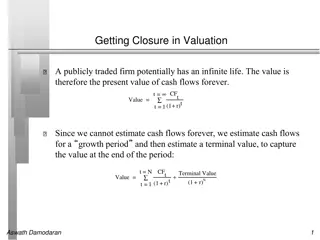

Understanding Terminal Value in Valuation

Valuation of publicly traded firms with potentially infinite lives involves estimating cash flows for a growth period and a terminal value to capture value at the end. The stable growth rate, which cannot exceed the economy's growth rate, plays a crucial role in determining the present value of futu

0 views • 8 slides

Maximizing Customer Value, Satisfaction & Loyalty in Business

Explore the essence of customer value, satisfaction, and loyalty in business success through Dr. Ananda Sabil Hussein's insightful perspective. Learn about customer perceived value, determinants of value, steps in value analysis, loyalty definitions, satisfaction measurements, and the significance o

0 views • 18 slides

Practical Tips for ESG Litigation Strategies: Claimants and Defendants

Learn about constructing effective ESG litigation strategies with practical tips for both claimants and defendants. Explore topics such as what ESG litigation entails, jurisdiction issues, and examples of ESG litigation cases. Understand the formats for group actions and shareholder actions, along w

0 views • 14 slides

Union Stewardship in Shareholder Engagement

Janet Williamson, TUC Senior Policy Officer and Trustee of the TUC Pension Fund, emphasizes the importance of stewardship in public debate and policy. The Stewardship Code principles include public disclosure, conflict management, monitoring investee companies, and collective action. Increased union

0 views • 13 slides

The Value of Knowledge: A Philosophical Exploration

Exploring the value of knowledge through the lens of Plato's Meno Problem, this text delves into why knowledge is considered more valuable than mere true belief. It discusses Plato's solution to the problem, the secondary and tertiary value problems, and constraints on solutions and strategies in un

0 views • 22 slides

How to Calculate Present Value & Future Value Using Microsoft Excel

Learn how to calculate present value and future value using Microsoft Excel functions such as PV and FV. Understand the syntax, arguments, and examples for determining the value of single amounts, annuities, and lump sums. Step-by-step instructions provided for efficient financial calculations.

0 views • 14 slides

Recent Developments in Shareholder Claims and Legal Issues

Explore the latest insights on shareholder claims and legal issues in the banking and financial services sector, including significant litigation cases and key considerations regarding causes of action, reflective loss, procedural routes, and privilege challenges. Stay informed about important judgm

1 views • 86 slides

Exploring Land Value Return and Recycling for Transportation Funding

With transportation investment needs surpassing available resources, investigating the potential of land value return and recycling as a revenue source can benefit public agencies. This involves recovering and reusing a portion of the increased land value generated by public investment in transporta

0 views • 33 slides

Legal Rights and Obligations Regarding Shareholder Meetings

This content discusses the rights and obligations related to shareholder meetings in a legal context. It covers topics such as the chairman's authority to call special meetings, shareholders' voting rights, and the secretary's obligation to provide notice for meetings. The comparison between optiona

0 views • 28 slides

Enhancing Corporate Value Through Insider-Shareholder Collaboration

This study delves into two contrasting models of the corporation - confrontational versus collaborative. It explores how collaboration between insiders and shareholders can lead to increased economic value for the firm, drawing on examples and insights from corporate law, private ordering, and game

0 views • 16 slides

Maximizing Shareholder Value Creation Through Strategic Business Practices

Explore the concept of shareholder value creation, the importance of generating revenues exceeding economic costs, and meeting shareholders' expectations. Learn about Economic Value Added (EVA), key value drivers, aligning strategy with value creation, and essential factors for overall business succ

0 views • 11 slides

Rethinking Firm Governance Through Property Rights and Stakeholder Theory

Challenging the traditional shareholder-centric view, this study explores how property rights theory and stakeholder theory can offer a more comprehensive perspective on firm governance. It delves into the complexities of value creation, contractual relationships, and diverse stakeholder interests,

0 views • 10 slides

Understanding the New Jersey Oppressed Shareholder Statute

The New Jersey Oppressed Shareholder Statute, N.J.S.A. 14A:12-7, outlines the grounds for oppression in a corporation and the process for a buyout. It allows the Superior Court to appoint a custodian, provisional director, order stock sale, or dissolve the company. Key provisions include shareholder

0 views • 12 slides

India Fellowship Seminar on Participating vs. Non-participating Products

The seminar delved into the role of participating and non-participating insurance products in premium growth, risk management, and creating shareholder value in the long term. It discussed market trends, historical data, and key drivers influencing shareholder value in the Indian insurance industry.

0 views • 21 slides

Overview of Redomiciliation Transactions and Section 7874 Implications

Section 7874 imposes restrictions on domestic corporations becoming owned by foreign entities with the same or similar shareholder base. It outlines tests triggering adverse consequences and discusses self-inversion transactions, tax considerations, and cross-border combinations. Notably, substantia

0 views • 8 slides

Understanding Trade in Value-Added (TiVA) and Global Value Chains

Trade in Value-Added (TiVA) offers crucial insights into the complexities of global value chains and economic globalization. By shifting focus from gross trade statistics to value creation along supply chains, TiVA helps in formulating better policies and addressing systemic risks associated with ma

0 views • 22 slides

Understanding Capital Structure and Financial Leverage in Corporate Finance

The capital structure of a firm involves deciding on the mix of debt and equity securities to meet financing needs, impacting market value and shareholder wealth. Financial leverage, or gearing, affects shareholders by altering the firm's value through debt-equity substitutions. The optimal policy m

0 views • 31 slides

Understanding Dividend Policy in Financial Management

Dividend policy plays a critical role in balancing long-term financing and shareholder wealth. It involves determining the distribution of profits among shareholders while retaining earnings for company growth. Approaches like Long Term Financing and Wealth Maximisation influence dividend decisions,

0 views • 24 slides

Economic Foundations of Imperialism: Exploitation and Value Transfer

Imperialism primarily functions as an economic mechanism for exploiting value rather than seeking political dominance. The transfer of value occurs through mechanisms like unequal exchange, global value chain flows, and capital flows, leading to the long-term appropriation of value by imperialist na

0 views • 28 slides

Understanding Capital Restructuring and Financial Leverage in Financial Management

Explore the concepts of capital restructuring and financial leverage in financial management, focusing on how changes in capital structure impact firm value. Learn about the primary goal of financial managers, the role of leverage in achieving goals, and how firms choose their debt-equity ratio to m

0 views • 46 slides

Understanding Absolute Value Equations and Inequalities

In this lesson, students will learn to solve absolute value equations and inequalities both algebraically and graphically. The concept of absolute value, which represents the distance between a number and zero on the number line, is explained through examples and solutions. The importance of using g

0 views • 43 slides

Business Model Reporting for Value Creation

Integrated Reporting (IR) plays a crucial role in forging business partnerships and facilitating sound decision-making. Understanding the organizational business model is essential for long-term sustainability and value creation. The global approach to business model reporting encompasses business s

0 views • 42 slides

India Fellowship Seminar: Product Contributions to Growth, Risk Management, and Shareholder Value

India Fellowship Seminar discussed the contributions of participating and non-participating products to premium growth, risk management, and shareholder value. Key topics included market trends, drivers of shareholder value, PAR vs NPAR attractions, creating shareholder value, and risk management st

0 views • 21 slides

Understanding Corporate Governance: Principles, Objectives, and Duties

Corporate governance is a system of principles and practices used to manage conflicts of interest in corporations. It ensures managers act in the best interest of shareholders. Key aspects include objectives to mitigate conflicts, ensure efficient asset use, and common sources of conflict like manag

0 views • 10 slides