RBI Directions on Filings of Supervisory Returns

RBI issues new Master Directions on 'Filing of Supervisory Returns,' emphasizing NBFCs. Timelines, revised applicability, and online portals introduced for streamlined filing. Physical submission required for Form A Certificate.

1 views • 5 slides

Maximize Tax Savings and Profitable Returns with Section 12BA Renewable Asset Portfolio

Discover how to preserve your earnings through smart tax savings and harvest profitable returns from solar investments with the innovative Futureneers Energy Team. Learn about the main differences between 12J and 12B tax deductions, investment structures, and the unique approach taken by securing So

0 views • 15 slides

Issuance of notice in Form GST ASMT-10

Form GST ASMT-10 is a scrutiny notice issued to intimate the discrepancies observed by the officer while verifying the GST returns filed by the taxpayer.\n\nUpon scrutiny of GST returns by GST authorities, if any discrepancy is noticed, he may issue a notice in Form GST ASMT-10. In the said notice t

1 views • 6 slides

Maximising Benefits: Tips for NRI Income Tax Returns from India to England

Non-Resident Indians (NRIs) living in England can benefit from \"Maximising Benefits: Tips for NRI Income Tax Returns from India to England\". Practical strategies and expert advice are provided to help NRIs maximise available deductions, credits, and exemptions. From understanding the intricacies o

8 views • 4 slides

Understanding the Concept of Return to Factor in Production Economics

Return to Factor is a key concept in production economics that explains the relationship between variable inputs like labor and total production output. The concept is based on the three stages of production - increasing returns, diminishing returns, and negative returns. By analyzing the behavior o

0 views • 7 slides

Al Masraf Maximizing Your Business Returns with Corporate Call Deposits

Looking for a secure and flexible solution to manage your excess business funds? Al Masraf offers tailor-made options through Corporate Call Deposits, allowing you to earn competitive returns while maintaining easy access to your cash. This blog post

0 views • 6 slides

Understanding the Importance of Filing Income Tax Returns

Filing income tax returns is crucial as it involves declaring total income and tax payable. Deadlines are specified based on the type of assessee, with penalties for late filing. The process allows for claiming refunds, showing financial worth for visas, and ensuring eligibility for tenders. Failing

0 views • 26 slides

Understanding Credit Analysis for Farmers and Fishers

Credit analysis is crucial for farmers and fishers to access the right amount of credit at the right time. Economic feasibility tests such as returns on investment, repayment capacity, and risk-bearing ability are essential factors to evaluate credit worthiness. The 3Rs of credit - returns, repaymen

0 views • 30 slides

Understanding CRSP Useful Variables for Financial Analysis

Explore CRSP useful variables for analyzing financial data, including negative prices, adjusting prices and shares for splits, returns with dividends, delisting returns, and more. Learn about adjusting prices and shares for splits, delisting dates, and daily vs. monthly delisting returns. Gain insig

0 views • 16 slides

Understanding Risk and Return in Corporate Finance

Exploring risk and return in market history is crucial for determining appropriate returns on assets. By analyzing dollar returns, percentage returns, holding period returns, and capital market returns, investors can grasp the risk-return tradeoff. Lessons from capital market return history emphasiz

4 views • 18 slides

ECOA Request for Information Summary - CFPB Advisory Committee Meeting

ECOA Request for Information (RFI) issued seeks comments to address credit discrimination, promote fair access to credit, and develop solutions by extending the comments deadline. RFI topics include Adverse Action Notices, Disparate Impact, Serving Limited English Proficient Consumers, Special Purpo

0 views • 10 slides

Tax Filing, Payment, and Penalties Overview for LRA Practitioners in Monrovia 2021

Comprehensive training module covering income tax, excise tax, goods and services tax filing requirements, due dates for tax returns, and more for taxpayers in Monrovia. Learn about the responsibilities of taxpayers, due dates for filing tax returns, and specific requirements for various types of ta

0 views • 43 slides

Co-operative Annual Returns & XBRL Date: March 2022

This presentation covers the purpose and format related to CIPC processes and functions, including details on payment of annual fees, filing of annual returns, and iXBRL. It introduces the Learn-i-Biz Programme by CIPC aimed at educating SMME company directors on their duties and compliance. Additio

1 views • 18 slides

Understanding Portfolio Theory and CAPM in Corporate Finance

Exploring the Capital Asset Pricing Model (CAPM) and portfolio theory in corporate finance, this chapter covers topics such as expected returns with ex-ante probabilities, portfolio variability measures, asset diversification strategies, and portfolio returns calculation. Through formulas and exampl

0 views • 51 slides

Fundamentals of Portfolio Management and Risk Aversion in Investing

Portfolio theory is based on the principles of maximizing returns for a given risk level, considering all assets owned. Investors typically exhibit risk aversion, preferring lower risk assets for similar returns. Risk is defined as future outcome uncertainty. Markowitz Portfolio Theory highlights th

1 views • 17 slides

Laws of Production in Economics

The content discusses the laws of production in economics, including the law of variable proportion in the short run and the law of returns to scale in the long run. It explains the concepts of total product, average product, and marginal product, along with the stages of production. The law of vari

0 views • 18 slides

Understanding the Production Function and Laws of Production

Production function expresses the relationship between inputs and outputs, showcasing how much can be produced with a given amount of inputs. The laws of production explain ways to increase production levels, including returns to factors, law of variable proportions, and returns to scale. The law of

2 views • 20 slides

Best Tax Returns in East Geelong

Are you looking for the Best Tax Returns in East Geelong? Then contact Certum Advisory. Their dedicated team of certified accountants and experienced business advisors offers a wide range of services, including tax returns, Business planning and str

0 views • 6 slides

Understanding Risk and Return in Financial Markets

This chapter delves into the concepts of risk and return in financial markets, exploring the relationship between expected and unexpected returns, systematic and unsystematic risk, and the Security Market Line. It also discusses the impact of announcements and news on stock returns, distinguishing b

1 views • 73 slides

Managing Customer Returns and Reverse Logistics in Customer Service Operations

This learning block delves into the processes, responsibilities, and metrics associated with managing customer returns and reverse logistics in customer service operations. It covers key aspects of the return process, employee responsibilities, metrics used, and best practices for effective manageme

0 views • 21 slides

A Guide to Making Tax Digital (MTD) for VAT Regulations

The new Making Tax Digital (MTD) for VAT regulations came into effect from April 1, 2019. Businesses with a taxable turnover over £85,000 must keep digital records and file VAT returns using HMRC-approved software. The Government Gateway for VAT returns will be disabled, and businesses need to regi

0 views • 10 slides

Stock Valuation Analysis and Calculations

The given content discusses various stock valuation scenarios involving dividend payments, growth rates, and required returns on investments. It covers calculations for determining current stock prices, future prices, dividend yields, and required returns based on different company scenarios. Exampl

0 views • 7 slides

Federal Fiduciary Income Tax Returns Overview

Form 1041 is an income tax return for trusts or estates reporting income earned by the assets. Understand filing requirements, types of returns, and deadlines for Form 1041, Form 706, and Form 1040. Learn about calendar year vs. fiscal year options for estates and trusts.

0 views • 15 slides

Understanding Portfolio Evaluation, Management, and Risk-Adjusted Performance

Explore the world of portfolio evaluation by Dr. Pravin Agrawal, Ph.D. in Finance. Delve into the intricacies of portfolio management, balancing strengths and weaknesses in debt vs. equity, domestic vs. international investments, and more. Learn about measuring portfolio performance and risk-adjuste

4 views • 32 slides

Understanding GST Returns: Types, Benefits, and Mechanisms

GST returns play a crucial role in the tax system by providing necessary information to the government in a specific format. They include details of outward and inward supplies, ITC availed, tax payable, and more. Filing returns ensures timely transfer of information, aids in tax liability determina

4 views • 38 slides

2020 Custody RFP & RFI Initiatives Summary

The 2020 Custody Request for Proposal (RFP) and Request for Information (RFI) focus on enhancing transparency, engagement, and participation with various pension funds and agencies in Ohio. The Treasurer's Office is committed to improving the custodial RFP process, including initiatives such as fund

0 views • 11 slides

Panel Discussion on Radio Astronomy Issues at RFI2019 in Toulouse

Experts like Federico Di Vruno, Braam Otto, Harvey Liszt, Tasso Tzioumis, and Willem Baan discussed topics such as RFI mitigation costs, WRC-19 outcomes, new strategies for coping with RFI, and managing RFI impact on MeerKAT during SKA1 Mid construction.

0 views • 7 slides

GEAR Center Stakeholder Forum: Insights and Recommendations

Insights and recommendations from the responses to the Request for Information (RFI) for the Government Effectiveness Advanced Research (GEAR) Center, including stakeholder feedback on priorities, operational models, and potential roles for the center. Stakeholders highlighted the importance of cros

0 views • 12 slides

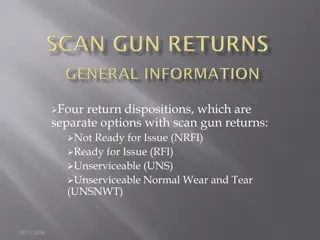

Guide to Processing RFI Returns on the Scan Gun Menu

Learn how to efficiently process RFI Returns using the scan gun menu. Follow step-by-step instructions, including entering incident details, adding return lines, handling mistakes, and completing the return process seamlessly. Images accompany each step for visual guidance.

0 views • 19 slides

Analysis of Irish Farmer Incomes Based on Income Tax Returns

This paper presents an analysis of Irish farmer incomes in 2010 using self-assessment income tax returns from the Revenue Commissioners. The study focused on various income sources such as trading income, rental income, employment income, social welfare transfers, and pension income. The dataset com

0 views • 12 slides

Understanding RFIs, RFQs, and RFPs in Government Contracting

Learn the key differences between Request for Information (RFI), Request for Quote (RFQ), and Request for Proposal (RFP) in the context of U.S. General Services Administration (GSA). Discover the core purposes, definitions, and where these processes fit in the acquisition process. Gain insights into

0 views • 21 slides

Genomic Prediction of Feed Intake in U.S. Holsteins

This study discusses the inclusion of feed intake data from U.S. Holsteins in genomic prediction, focusing on residual feed intake (RFI) as a new trait. The research involves data from research herds and genotypes of cows, with genetic evaluation models and genomic evaluation for predicting feed int

0 views • 17 slides

Promoting Global Health Equity Through Research and Innovation

This initiative led by the Council on Health Research for Development (COHRED) focuses on accelerating the development of research and innovation systems in low- and middle-income countries to improve health equity and sustainable development. The Research Fairness Initiative (RFI) aims to address u

0 views • 13 slides

Remote Sensing Panel Discussion: Addressing Challenges in RFI Reporting, Regulations, and Protection of Operations

The Remote Sensing panel discussion highlights key issues such as the lack of RFI reporting to the ITU, importance of RFI reporting for regulatory enforcement, obstacles in protecting remote sensing operations, desired changes in Radio Regulations, and potential discussion points for the research an

0 views • 7 slides

Understanding Return Dispositions and Remote Returns Process in Warehousing

Explore the concept of return dispositions like NRFI, RFI, UNS, and UNSNWT in warehouse management, along with insights into Remote Returns Process (RRP) nodes and Non-RRP nodes. Learn about Regular Returns, LPNs, and the choice between consolidating returns with LPNs for efficiency. Understand the

0 views • 11 slides

Overview of Upcoming Key Tasks in Procurement Process

Upcoming key tasks in the procurement process include the Request for Information (RFI), Webinar, Conference, and Request for Responses (RFR). RFIs are used to gather information and feedback from various stakeholders before drafting an RFR. Industry standards, best practices, and cost structures ar

0 views • 5 slides

EFA Funding Guidance for Young People 2016-2017: ILR Returns & Regulations Explained

Explore the detailed funding regulations and guidance for young people in the 2016-2017 academic year provided by the EFA Young People's Funding Team. The funding guidance covers topics such as funding rates, ILR funding returns, and sub-contracting control regulations. Institutions are advised on f

0 views • 42 slides

Understanding RFI Mitigation Strategies in Radio Astronomy

Explore the key considerations and challenges related to Radio Frequency Interference (RFI) in radio astronomy, including when to consider RFI, important categories of RFI, and examples of RFI mitigation efforts at OVRO-LWA. Learn about dealing with persistent narrow-band RFI and impulsive or transi

0 views • 5 slides

LAN Hardware Components and Connectivity Mediums

LAN hardware components, such as cables, repeaters, hubs, switches, and network interface cards, play a crucial role in transmitting electric signals between devices. Cables are the primary connectivity medium, with factors like bandwidth and distance affecting data transmission. External disturbanc

0 views • 26 slides

Insights into Enhancing Equity Returns Amid Unforeseen Events

The ongoing pandemic has highlighted the importance of factoring in rare extreme events when evaluating equity returns. By incorporating the probability of such events, traditional views on investments are challenged, leading to the realization that strategies emphasizing alpha are superior to smart

0 views • 26 slides