Department of Personnel Management Reforms Workshop on Retirement Strategy

The Department of Personnel Management held a workshop on the retirement strategy focusing on key policy directives, retirement process overview, and compulsory age retiree cleansing from government payroll data to reduce expenditure. The workshop emphasized the importance of proper management of re

0 views • 13 slides

Health and Welfare Benefits for Retirees: Eligibility and Coverage Details

Detailed information on retiree health benefit eligibility criteria, including requirements based on service history, age at retirement, enrollment in sponsored plans, eligible family members, and potential changes after enrollment. The content covers various aspects such as employer contributions,

0 views • 17 slides

NSFAS Annual Report 2021/22 - Adverse Audit Findings and Resolutions Update

Significant delays affected the compilation of NSFAS Annual Financial Statements for 2021/22, leading to an adverse audit opinion due to material misstatements and limitations in various financial areas. The report highlights issues with amounts owed, receivables, bursaries, cash flows, irregular ex

0 views • 38 slides

Understanding Management of Receivables in Business

Covering various aspects of receivables management, this session explores the importance of managing credit sales effectively. Topics include defining receivables, cost-benefit analysis, credit evaluation, credit terms, policy control, and more. Learn about the benefits and costs of receivables, asp

1 views • 26 slides

Improving Customer Service: Challenges and Strategies in 2024

Despite rising customer demands and declining staffing levels, efforts are underway to enhance customer service in SSA. Challenges include administrative funding constraints, increased retiree numbers, and staff attrition. Strategies involve leadership changes, increased onsite presence, and perform

1 views • 7 slides

Understanding U.S. GAAP and Federal Accounting Standards

Explore the relationship between FASAB, OMB, and Treasury in setting accounting standards for federal entities under U.S. GAAP. Learn about the issuance of financial reporting requirements, uniform chart of accounts, and definitions of accounts receivable and payable. Discover the guidance provided

0 views • 6 slides

State ORP Retirement Information Overview

State ORP (Optional Retirement Program) provides retirement benefits without strict eligibility requirements like SCRS or PORS. Participants can request distributions, leave funds until retirement, and roll over balances. Benefits based on account balance, with fees and taxes affecting it. Open enro

0 views • 7 slides

Capistrano Unified School District Retirement Benefits Guide

Qualifying for retiree health benefits, coverage details, enrollment process, and key eligibility criteria for certificated and classified employees of Capistrano Unified School District. Learn about the one-time offer for medical and dental plans, end-of-contracted-year retirement transitions, and

0 views • 23 slides

Comprehensive Guide to Retirement Process for EACS Employees in 2022-2023

Detailed information about the retirement process for EACS employees in the upcoming years, including steps to retirement, what employees can expect to receive, and current retiree monthly insurance premium amounts for 2023. The guide covers essential aspects such as submitting a retirement letter,

0 views • 15 slides

Managing Account Receivables in Business Operations

Firms commonly offer credit terms to clients, creating trade credit and receivables. High trade receivables signify investment in clients, balancing sales growth with risks of bad debts and credit default. Efficient management of receivables is crucial for optimizing working capital and minimizing c

1 views • 31 slides

AGSA Findings Action Plan Presentation for Portfolio Committee: Progress and Remedial Steps

The presentation focuses on progress made on AGSA action plans, addressing material findings leading to a qualified audit opinion. It highlights the split of 2022 Age Analysis in finance, remedial steps taken, and the ongoing process for 2023 Age Analysis. The report also discusses the misstatement

5 views • 10 slides

Preparing Your Dynamics GP Database for Migration to Business Central

Streamline your GP database migration process with insights on tools like the GP to BC Migration Tool, focusing on areas such as General Ledger, Cash Management, Sales & Receivables, and Purchasing & Payables. Get ready for a successful transition with expert guidance and practical tips tailored for

0 views • 11 slides

Understanding Retiree Insurance Eligibility and Funding

Retiree insurance eligibility is a crucial aspect that retirees should understand before retiring. The process involves determining eligibility for retiree group insurance, which is separate from retirement eligibility. By meeting certain requirements such as having served consecutively in a full-ti

0 views • 12 slides

Overview of Retirement, Disability, and Death Insurance Benefits

This overview provides information on retiree insurance eligibility, funding, and important considerations for employees planning for retirement. It emphasizes the complexity of determining eligibility for retiree group insurance, the requirements for funding, and the need to contact PEBA for accura

0 views • 30 slides

Sears Canada Employee and Retiree Claims Process Webinar Overview

In this webinar, key representatives provide information on Sears Canada CCAA proceedings, pension plan status, claims process, and various post-employment benefits. Details include court approvals, special payments, and the appointment of investigators. The presentation aims to assist Sears Canada

0 views • 34 slides

Understanding Medicare and Retiree Health Benefits

Explore details about Medicare, retiree health benefits, enrollment periods, and available health plans for retirees. Learn about eligibility criteria, coverage options, and enrollment processes to make informed decisions for your retirement healthcare needs.

0 views • 63 slides

Maryland State Health Benefits Eligibility and Subsidy Information

This information outlines the eligibility criteria for health benefits and subsidies offered by the Maryland State for employees and retirees of higher education institutions. It covers conditions based on hire date, years of service, retirement age, and creditable service duration. The details incl

0 views • 36 slides

Retiree Parking Permit Policies in Universities

Various universities have different policies regarding retiree parking permits, with some offering free permits, discounted rates, or no permits at all. Issues of misuse, such as students using permits belonging to relatives and retirees giving permits to family members for daily use, have been repo

0 views • 9 slides

Retiree Health Benefit Plan Options at Yosemite Community College District

A presentation on retiree health benefit plan options at Yosemite Community College District, including available plan options, overview of Blue Shield PPO and Kaiser Permanente plans, details on Medicare enrollment and plans for retirees turning 65. The presentation covers plan details, costs, enro

0 views • 22 slides

Onondaga County Retirement Insurance Benefits Overview

This presentation by C. Tracy Grimm, Employee Benefits Specialist, provides an overview of retirement insurance benefits for Onondaga County employees, including eligibility criteria, coverage options, and cost details. The information covers different tiers, enrollment choices for union and non-uni

0 views • 22 slides

Retiree Benefits in Bergen County

Discover the contractual rights and benefits available to retirees from Bergen County, including coverage for medical expenses depending on hire date, eligibility criteria, Medicare considerations, and limitations on post-retirement coverage. Additionally, learn about the USWU Retiree Chapter offeri

0 views • 9 slides

Optimizing Retiree Receivables Management Process

Explore the transition of balances from Banner into new reconciliation processes, review previous models to define issues, and streamline retiree receivables management for better accuracy and efficiency. Address challenges with direct bill file interfaces, retro-active transactions, and accounting

0 views • 34 slides

Caltech Retiree Annual Open Enrollment 2021 Information

Caltech is hosting its Retiree Annual Open Enrollment for 2021, providing key details on plan changes, contact information, and important updates such as Defined Dollar Credits (DDCs) increase and supplemental benefits. Retirees can make plan changes by calling the Caltech Retiree Service Center bef

0 views • 16 slides

Retirement Benefits Eligibility and Rules

Understanding the retirement benefits eligibility rules, including the Rule of 80 and Rule of 65, counting years of service, and retirement age criteria for TRS and ERS members. Learn about service year requirements, age thresholds, and legislative changes impacting retiree health insurance. Plan yo

0 views • 8 slides

The Impact of Retiree Health Costs on Medicare and Medicaid Programs

This content discusses how retiree health costs affect individuals and government programs, specifically focusing on the rising Medicare and Medicaid spending projections. It highlights the challenges posed by out-of-pocket expenses for retirees and the gaps in Medicare coverage that contribute to h

0 views • 11 slides

Managing Health Financing Volatility in Developing Countries

Health financing volatility in developing countries poses challenges that lead to value destruction and adverse impacts on procurement systems and end users. Examples of negative impacts include stock-outs, higher costs, and additional emergency expenses due to unpredictable aid disbursements. Lever

0 views • 7 slides

Understanding a Typical PPSA Scheme by Professor Hugh Beale

This comprehensive outline delves into the key aspects of a typical PPSA scheme, covering creation, attachment, perfection, registration, priority issues, rights and duties pre-default, remedies on default, and more. It explores the scope of application, quasi-securities, registration of similar-loo

0 views • 16 slides

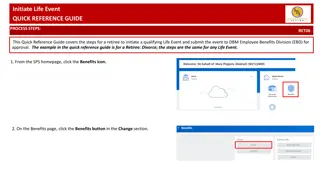

Retiree Qualifying Life Event Submission Process

Detailed guide on how retirees can initiate and submit a qualifying life event for approval, including steps for selecting the event, submitting supporting documentation, and receiving approval for benefit election changes.

0 views • 6 slides

Harnessing the Power of Older Adult and Retiree Volunteers: National Trends and Museum Profiles

Embrace the valuable contributions of older adult and retiree volunteers in the United States, exploring national volunteerism trends and highlighting profiles of volunteer programs in renowned museums like the U.S. Botanic Garden and the Smithsonian National Air and Space Museum. Discover the signi

0 views • 12 slides

Turkey's Tax Amnesty Law: Restructuring and Benefits Explained

The Amnesty Law in Turkey, Law No: 7143, outlines provisions for restructuring tax receivables, including penalties and interests, related to periods before March 31, 2018. Taxpayers have the opportunity to write off penalties by meeting specific payment conditions. The Law aims to provide relief an

1 views • 17 slides

Insights on Prohibitions and Assignments in Business Law

Explore the complexities of assignments of trade receivables, the significance of BoAs in loan agreements, and the impact of established wisdom on receivables financing. Delve into legal nuances from various jurisdictions, including the US, Canada, and New Zealand, regarding the effectiveness of BoA

0 views • 17 slides

Understanding Control Accounts and Reconciliation in Accounting

Control accounts in accounting are essential for summarizing a large number of transactions and verifying the accuracy of the ledger system. They include receivables and payables balances, with entries for credit sales and purchases. Reconciliation of these accounts ensures that financial records ar

0 views • 12 slides