Purpose And SARS Vision 2024

Automated refunds and drawbacks system of the South African Revenue Service (SARS). It explains the purpose, SARS Vision 2024, challenges with the current process, new refund and drawback process, benefits, and transitional arrangements.

1 views • 21 slides

Living Off-Campus as a Scholar

Explore the financial aid options available for students at Indiana University Bloomington, including details on the 21st Century Scholars Program, non-tuition aid, semester refund estimates, and the Covenant award. Learn how these resources can support your education and living expenses as a schola

0 views • 32 slides

Virgo Polymer (India) Ltd. ESG Report 2022-23: Sustainability Commitment & Strategic Management

Virgo Polymer (India) Ltd. presents its inaugural Environmental, Social, and Governance (ESG) Report for 2022-23, showcasing a steadfast dedication to sustainability principles. Covering practices, governance, and sustainability initiatives from April 1, 2022, to March 31, 2023, the report details t

0 views • 30 slides

NCAA Faculty Athletic Representative Annual Report 2022-2022 Highlights

Dr. Stephen D. Engle led the NCAA Faculty Athletics Representative team for the 2022-2023 academic year, focusing on academic performance, student-athlete welfare, and institutional control. The report covers evaluation of academic metrics, student-athlete GPA, volunteer hours, and the potential mer

0 views • 8 slides

Nevada Department of Taxation Compliance Division Audit Process Overview

Responsible for ensuring taxpayer compliance with various taxes, the Nevada Department of Taxation Compliance Division conducts audits locally and nationwide. From refund verification to audit selection criteria, learn about the audit process, taxes audited, time periods, initial contact procedures,

5 views • 18 slides

How do I Chnage My Flight on Air France

Depending on the fare category and booking circumstances, Finnair has different cancellation policies. If a reservation is made at least one week in advance of departure, passengers may typically cancel their tickets within 24 hours of making the reservation without incurring fees. After this time,

0 views • 6 slides

How Can I Cancel My KLM Flight After Booking?

If a flight is canceled within 24 hours of booking, KLM Airlines offers a full refund. Flexible tickets are fully refundable for cancellations made after this time, but limited tickets may have costs or are not refundable. In line with this , KLM Flight Cancellation Policy travelers may choose to ge

1 views • 5 slides

How Can I Cancel my Delta Airline flight

Travelers on Delta Airlines can cancel their tickets and get a full refund within 24 hours of making the reservation. If a non-refundable ticket is canceled within 24 hours, the cost can be applied to another trip, deducted from the cancellation fee. Delta Airlines Flight Cancellation Policy If tick

8 views • 5 slides

What is the Process For Breeze Airways Flight Cancellation

With Breeze Airways, you may cancel without taking any chances. If you do so within 24 hours of making your reservation and the scheduled flight is at least 7 days away, you can receive a full refund. Tickets may be returned for travel credits, even if many companies don't offer a refund policy. Com

1 views • 5 slides

How Do I Cancel My Air Canada Flight After Booking

To cancel your Air Canada flight after booking, log in to your Air Canada account and navigate to the \"Manage Bookings\" section. Enter your booking reference number and passenger details to access your reservation. Select the flight you wish to cancel and follow the prompts to finalize the cancell

0 views • 5 slides

How Can I cancel my Finnair Air flight within 24 hours of booking?

To cancel your Finnair Air flight within 24 hours of booking, you can typically do so online through their website or by contacting their customer service. Make sure to check Finnair Flight Cancellation Policy for any specific guidelines or fees applicable. Provide your booking details and follow th

1 views • 7 slides

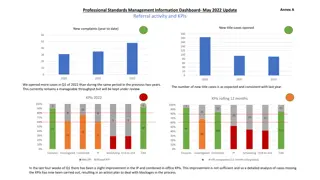

Professional Standards Management Information Dashboard - May 2022 Update

The May 2022 update of the Professional Standards Management Information Dashboard highlights an increase in new cases opened compared to previous years. Key Performance Indicators (KPIs) for 2022 are on track, with some improvements noted in the last quarter. The Registration and Accreditation Mana

0 views • 12 slides

Clover Flex Annual Security Awareness Training for Point of Service Collections Staff

Welcome to the Clover Flex Annual Security Awareness Training for Point of Service Collections Staff! This training module covers essential activities involving the Clover Flex, such as processing sales, voids, refunds, running reports, managing settings, and relocating the device. Learn how to hand

0 views • 13 slides

Overview of 2022 Indiana Estate & Trust Legislation

Detailed presentation of 2022 Indiana estate and trust legislation enacted during the 2022 Session, including changes in statutes effective July 1, 2022, and beyond. Covering topics such as technical corrections, updates, distributions from supervised estates, small estate affidavits, and the enactm

0 views • 45 slides

Overview of TRAIN Revenue Regulations No. 13-2018 on Value-Added Tax

These regulations under the Tax Reform for Acceleration and Inclusion (TRAIN) Act (RA 10963) focus on Value-Added Tax provisions, amending Revenue Regulations No. 16-2005. They cover zero-rated sales, VAT-exempt transactions, claims for input tax, refund procedures, and more. Conditions for VAT appl

1 views • 54 slides

Understanding Child and Dependent Care Expenses Credit

The Child and Dependent Care Expenses Credit allows taxpayers to reduce their tax liability by a portion of expenses incurred for caring for qualifying persons. Qualifying persons include children under 13, incapacitated spouses or dependents, and certain criteria must be met to claim the credit. Th

7 views • 10 slides

May Trucking Co. v. ODOT - Ninth Circuit Case Analysis

May Trucking Company, an interstate motor carrier, challenged an assessment by the Oregon Department of Transportation (ODOT) for underpaid fuel taxes. The dispute centered on whether fuel consumed during idling should be taxable under the International Fuel Tax Agreement (IFTA). The Administrative

2 views • 9 slides

Admission, Transfer, and Discharge Guidelines for Virtual Resident Family Action Council

Explore essential information on admission procedures, rights, services, and practitioner affiliations for Virtual Resident Family Action Council members. Understand the materials you should receive, refund and bed hold policies, assessments, and resident rights. Be informed before signing any agree

0 views • 52 slides

Insights from 2022 National Survey on Drug Use and Health Among AIAN Population

The 2022 National Survey on Drug Use and Health provides comprehensive insights into substance use, mental health, and treatment services among the American Indian or Alaska Native population aged 12 and older. It covers a wide range of topics, including substance use disorders and the receipt of tr

1 views • 35 slides

Understanding Transportation Refunds and Inventory Shortages in NC DPI Services

Explore the intricacies of transportation refunds and inventory shortages in North Carolina Department of Public Instruction (NC DPI) Transportation Services led by Derek Graham, Steve Beachum, and Kevin Harrison. Learn about the purpose of PRC 056, special provisions, and why refunds are necessary

1 views • 27 slides

Reforming Automatic Renewal and Continuous Service Offers Act

The bill aims to regulate automatic renewal and continuous service offers by requiring businesses to provide clear terms and obtain customer consent. It includes provisions for free trials, cancellation policies, refund processes, and notification of changes. Exemptions are provided for specific ind

0 views • 7 slides

Enhancing Customer Service with Effective Staffing & Technology

Improving customer service through optimal staffing strategies, technological advancements, and a culture focused on efficient problem-solving rather than call routing. The approach involves recruiting skilled personnel, creating a supportive environment, implementing high-level management plans, an

0 views • 26 slides

Early Childhood Data System 2022-2023 Updates

Focus on changes for official XML data submissions during the 2022-2023 school year. Agenda includes program area updates, submission reminders, known issues, changes for 2022-2023, and technical resources. Guidance provided on KG Assessment Data Submission Support and the importance of early submis

0 views • 19 slides

Common Mistakes in Expense Reports that Delay Refunds

In submitting expense reports, several common mistakes can lead to delays in receiving refunds. Issues such as missing receipts, incorrect documentation, inadequate information, and incorrect claim submissions can all hinder the reimbursement process. This guide outlines key errors to avoid when pre

0 views • 11 slides

Latest Amendments Under Refund FA 2022 and Inverted Duty Structure in GST Law

Latest amendments under Refund FA 2022 include extension of time limit for filing refunds, addressing inverted duty structure issues, and procedural changes for various refund scenarios under GST law. The amendments aim to streamline refund processes and provide relief to taxpayers. The changes also

0 views • 59 slides

Capacity KPIs Advisory Meeting Details and Timetable Offer for 2022

Details about the Capacity KPIs Advisory Group Meeting held on 14th April 2021, including pre-arranged paths offer for the timetable in 2022. The offer includes various connections and pairs of PaP per day, along with the evolution of timetables from 2021 to 2022. Commercial speed of PAPs for 2022 r

0 views • 7 slides

2022 National Survey on Drug Use and Health Among Asian Population Aged 12+

The 2022 National Survey on Drug Use and Health focuses on the Asian population aged 12 and older in the United States. Conducted by the Center for Behavioral Health Statistics and Quality, this comprehensive survey provides insights on substance use, mental health, and treatment services. The data

0 views • 39 slides

Medicaid Program Expenditure Analysis August 2022

Analysis of Medicaid program expenditures in August 2022 reveals interesting insights. Total enrollees in August 2022 were 1,358,275 with total expenditures amounting to $304,664,691.2. The report delves into expenditure distribution across various services, top drug classes per fiscal year, and Med

0 views • 12 slides

Updates on 2022 H-2A Temporary Labor Certification Program

The United States Department of Labor conducted a stakeholder webinar on November 17, 2022, to discuss the final rule of the 2022 H-2A Temporary Labor Certification Program. The webinar covered topics such as filing preparations, effective dates, and important forms like ETA-790A and ETA-9142A. The

0 views • 47 slides

Key Issues in Shipbuilding Law

The classic problem in shipbuilding law arises when a buyer seeks refunds either from the shipyard under the shipbuilding contract (SBC) or from the guarantor under a Refund Guarantee (RG), and the shipyard alleges illegality or matters contrary to public policy. The complexities of English law on i

0 views • 62 slides

Important Dates and Information for CUET (UG) 2022

Mark your calendar for key events related to CUET (UG) 2022! The online application submission period is from April 6 to May 6, 2022. Don't miss the deadline for fee transactions on May 6, 2022. The examination will be held in the first and second weeks of July 2022, with two time slots available. G

0 views • 11 slides

Winslow Township 2022 Budget Presentation Overview

The budget presentation for Winslow Township in 2022 highlights key financial aspects such as no reduction in services, a slight increase in the municipal purpose tax rate, continued funding for Economic Development initiatives, and strategic financial planning to maintain a stable balance for bond

0 views • 20 slides

Dealing with IRS Assessments: Options for Challenging Unfair Tax Claims

Learn how to address erroneous IRS assessments through various options like audit reconsideration, doubt-as-to-liability, offers in compromise, refund litigation, and bankruptcy. Make an informed choice based on factors like refund eligibility, ability to pay, receipt of the Notice of Deficiency, an

0 views • 5 slides

INCOSE Texas Gulf Coast Chapter (TGCC) May 2022 Monthly Meeting Highlights

INCOSE Texas Gulf Coast Chapter (TGCC) held its May 2022 monthly meeting on May 19, 2022, discussing new members, proposed changes in the TGCC By-Laws, an introduction to the INCOSE International Symposium (IS) 2022, and more. The meeting also featured the introduction by Rusty Eckman, ESEP. Check o

0 views • 9 slides

Law Enforcement and School Activities Report - November 2022

In November 2022, law enforcement activities recorded various incidents, including theft, assault, drug offenses, and more. Criminal investigations in November 2022 revealed cases related to theft, assault, sex offenses, and other crimes. Additionally, schools were actively focused on administrative

0 views • 15 slides

PTA Financial Guidance on Fund Handling and Event Management

Learn about important financial considerations for PTAs, including handling restricted funds, managing event postponements, refund policies, and budget amendments. Ensure compliance with regulations and best practices to effectively allocate resources for the benefit of school programs and projects.

0 views • 13 slides

GST Refund Procedure and Guidelines

Introduction to GST refunds focusing on refund of accumulated credit under GST for zero-rated supplies, the procedure for claiming refund of accumulated ITC, and filing and obtaining GST refund. It covers the eligibility criteria, required documents, formula for calculating refund amount, and step-b

0 views • 7 slides

Strategies for Enhancing Extended Producer Responsibility System in Bulgaria

Korea-Bulgaria Knowledge Sharing Program focused on sharing strategies to enhance Bulgaria's Extended Producer Responsibility (EPR) system. The program discusses the current status, performance evaluation, issues, and recommendations related to the EPR system in Korea. It covers topics like beverage

0 views • 38 slides

Understanding Income Tax Basics

Income tax is a fundamental part of contributing to a civilized society, with various taxes like sales tax, gas tax, and alcohol tax playing a role. This guide explains how income tax works, including taxable income calculations and refund processes. It also covers what amounts are taxable, such as

0 views • 14 slides

Child Find Program 2022-2023 Updates and Guidance

This presentation focuses on the changes for the official XML data submissions during the 2022-2023 school year. It covers updates in the Child Find program area, submission updates for 2021-2022, changes in application and data elements for 2022-2023, and guidance provided. Special attention is giv

0 views • 33 slides