City Revenue and Economic Forecast Update for Fiscal 2023

Council Finance projects a mild recession and weak recovery, with tax revenues exceeding OMB's forecast but constrained by inflationary pressures. Despite economic challenges, FY23 tax collections are higher, driven by strong consumer spending and real estate activity.

8 views • 5 slides

Long-term Health Risks Among Children HIV-Exposed

Study comparing risks of hospitalization and chronic diseases in HIV-exposed uninfected children vs. population control in Montreal, Canada. Data indicates heightened risks in CHEU including bacterial infections, mortality, hospitalization, poor growth, psychiatric disorders, and neurological outcom

0 views • 25 slides

Investing in Senior Living Development

Senior living development in South Africa presents a lucrative investment opportunity due to the increasing elderly population. With over 5.6 million people aged 60 or older in 2022, the sector is expected to grow significantly by 2050. Investing in senior living offers diversification and long-term

1 views • 18 slides

Managing Power Platform Risk with an Environment Strategy by Frank Shink, Senior Power Platform Design Engineer at Ameriprise Financial

Frank Shink, a seasoned professional, delves into the risks associated with Power Platform, from development risks to cost risks, and offers insights on tools and strategies to combat these risks effectively. He emphasizes the importance of environments, DLP policies, and licensing strategies in mit

1 views • 20 slides

Michigan Future Business Index Q2 2023 Insights

Insights from the Michigan Future Business Index Q2 2023 survey reveal that concerns for a deepening recession are softening, although wage inflation remains high. Sales and profits have seen declines, with hiring and investments holding steady. Overall satisfaction with the economy has improved, in

1 views • 27 slides

Understanding Genetic Testing and Cancer Screening

Genetic testing involves the analysis of germline genes to determine the risk of developing certain cancers or passing on risks to offspring. It can provide valuable insights into cancer risks, help inform relatives about potential risks, but may have limitations and risks such as cost and insurance

0 views • 10 slides

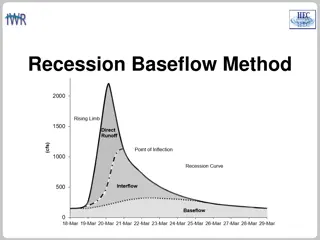

Understanding the Recession Baseflow Method in Hydrology

Recession Baseflow Method is a technique used in hydrology to model hydrographs' recession curve. This method involves parameters like Initial Discharge, Recession Constant, and Threshold for baseflow. By analyzing different recession constants and threshold types such as Ratio to Peak, one can effe

0 views • 8 slides

The Impact of Land Contracts and Foreclosure Crisis on Housing Market

Explore the consequences of land contracts and the foreclosure crisis on housing markets in Indiana and other regions. Learn about the increase in vacant and abandoned housing, bank walkaways, HUD programs, distressed asset sales, recorded land contracts, and disappearing small loans. Uncover key st

0 views • 49 slides

Enhancing Anti-Corruption Activities in Extractive Sector Work Plans

Reflecting on anti-corruption activities in MSG work plans is crucial for good governance of oil, gas, and mineral resources. The EITI provides guidance on addressing corruption risks, with a recommended three-step approach: assess risks, develop an activity plan, and monitor results. Step 1 involve

0 views • 11 slides

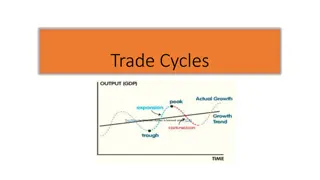

Understanding Trade Cycles and Economic Fluctuations

A trade cycle refers to the recurrent fluctuations in economic activities such as employment, output, income, prices, and profits. The cycle includes phases of prosperity, depression, recovery, and recession. These cycles are characterized by synchronicity, asymmetry, and international impact. Under

0 views • 17 slides

The Role of Actuaries in Addressing Environmental and Climate Changes

Actuaries play a crucial role in assessing and managing risks posed by environmental and climate changes, aiding the insurance industry in mitigating these challenges. They consider long-term risks with significant financial implications, such as physical, transitional, and liability risks. Actuarie

0 views • 20 slides

Banking Risks and Responses in Today's Financial Landscape

Anjan Thakor, Interim Dean at Wash U. Olin Business School, discusses various banking risks such as tension between fiscal and monetary policies, cyber security, rising consumer indebtedness, war and geopolitical risks, and more. The article explores how these risks can become systemic and suggests

7 views • 7 slides

Identifying and Mitigating GBV Risks in COVID-19 Response for Food Security in Rakhine State, Myanmar

Rakhine State faces challenges of conflict, displacement, and restricted movement, with many relying on food assistance. Cash assistance implementation did not escalate GBV risks. The COVID-19 restrictions heightened the need for adjustments in programming, requiring monitoring of assistance changes

0 views • 5 slides

Understanding Artificial Intelligence Risks in Short and Long Term

This content delves into the risks associated with artificial intelligence, categorizing them into short-term accident risks and long-term accident risks. Short-term risks include issues like robustness problems and interruptibility, while long-term risks focus on competence and alignment challenges

0 views • 15 slides

Contrasting Austrian Economics vs. Keynesian Macroeconomics

Austrian Economics emphasizes human action, voluntary saving, and analyzing the entire economic order, while Keynesian Macroeconomics views the economy as inherently unstable and focuses on factors like spending, investment, and interest rates to manage recession risks. The modern macroeconomics app

0 views • 15 slides

Global Economic Prospects January 2023 Overview

The January 2023 Global Economic Prospects report by the World Bank covers topics like Global Outlook, Regional Outlooks, Investment Growth After the Pandemic, and challenges faced by Small States. It includes growth forecasts, changes in growth forecasts for 2023, risks such as persistent inflation

0 views • 14 slides

Managing Finances During the COVID-19 Recession

Exploring the severe economic impact of the COVID-19 recession on local governments, jobs, and retail, with insights on budget shortfalls and strategies to address the crisis. The webinar provides tools for forecasting and understanding the implications of this unprecedented economic downturn.

0 views • 29 slides

General Government Fiscal Update - Seattle City Council Presentation 2010

The City of Seattle's general fund faces challenges due to the struggling economy, showing modest revenue improvements but pressures on expenditures. Issues like looming budget problems worsen the long-term financial outlook. The economic forecast, U.S. economic conditions, monthly employment change

1 views • 34 slides

Lost Potential: Adult Education in an Era of Recession

The research explores the impact of deep economic recession on adult education, highlighting the loss of opportunities for adult learners. It emphasizes the importance of adult education as an investment that leads to improved skills, productivity, and various intangible benefits beyond economic gai

1 views • 28 slides

The Evolving Landscape of U.S. Outlet Center Real Estate

Exploring the current state and development of U.S. outlet centers with insights into key players, growth patterns, and the shift from lifestyle centers. The journey from pre-recession dynamics to post-recession investment strategies showcases the rise of outlet centers as significant retail hubs. D

0 views • 19 slides

The UK and Western Productivity Puzzle: Exploring Arthur Lewis' Key

The UK and other Western countries have experienced a productivity puzzle post the Great Recession, with a slowdown in labor productivity and TFP growth. This phenomenon is attributed to constrained export demand and variations in labor market institutions across countries. The UK, in particular, ha

0 views • 53 slides

Understanding the Eurozone Crisis: A Critical Analysis

The Eurozone crisis of April 2013 was deemed unnecessary and self-inflicted by Mark Weisbrot. Contrary to conventional wisdom, the crisis was not solely a debt crisis but also a result of the world financial crisis and recession. Countries like Spain and Ireland, which were reducing their Debt/GDP r

0 views • 51 slides

Managing Financial Risks in a Changing Climate Environment

Assessing climate-related and environmental risks is vital for ensuring the safety and soundness of financial institutions. These risks include physical risk drivers like extreme weather events and transition risk drivers related to policy measures and technological changes. The complexity and uncer

0 views • 11 slides

Addressing Climate Change Risks: Guidance for Senior Managers and Board Members

This slide pack tool provides guidance on addressing climate change risks for senior managers and board members. It covers key messages such as understanding obligations and gaps, identifying climate change risks, exploring responsibilities, and implementing actions to address these risks effectivel

0 views • 11 slides

Understanding Financial Risks and Mitigation Strategies

Explore the concept of financial risks, learn how to identify and mitigate them, and improve your financial decision-making skills. This module covers definitions, typical risks, and strategies to safeguard your finances. Discover the four main clusters of financial risks and how to implement counte

0 views • 17 slides

Insights on Constructing Geopolitical Risk Audit

Details on constructing the audit for the paper "Measuring Geopolitical Risk" by Dario Caldara and Matteo Iacoviello are outlined. It covers the process of building the GPR index, designing the audit sample, and coding articles to identify geopolitical risks discussed in newspapers. The methodology

0 views • 17 slides

Enterprise Risk Management (ERM) Strategies for Mitigating Key Business Risks

Enterprise Risk Management (ERM) is a crucial strategic discipline that involves prospectively identifying, managing, and mitigating risks to reduce uncertainties and ensure organizational objectives are met. Risk rankings, mitigation strategies, and lead roles are outlined in the SJIEMS 2017 ERM Re

0 views • 38 slides

Current Challenges Facing Credit and Capital Markets

Risks to the economic outlook are mounting due to various factors such as Federal Reserve rate raises, inflation nearing the Fed target, and concerns about a recession. Specifically, the commercial real estate (CRE) sector is facing liquidity concerns with a significant amount of debt maturing in th

0 views • 14 slides

Advanced Investment Analysis: Financials Sector Overview and Recommendations

The Advanced Investment Analysis provides insights into the Financials sector, recommending an underweight position due to potential recession signals. Current holdings include diversified banks and credit services companies, with a suggestion to adjust the fund weight and reallocate investments to

0 views • 23 slides

Understanding the Risks of Cheap Natural Gas and Hydraulic Fracking

This introduction delves into the multifaceted risks associated with the exploitation of cheap natural gas and hydraulic fracking. Covering climate risks, economic consequences of petro-states, direct GHG risks, and local environmental risks, the content underscores the complex challenges and implic

0 views • 8 slides

Impact of COVID-19 on Commodity Markets: Developments, Outlook, and Risks

The COVID-19 pandemic has caused significant disruptions in global commodity markets, leading to forecasts of decreased global growth, oil price reductions, and shifts in metal and gold prices. The challenging economic outlook includes projections of a 5.2% contraction in global GDP in 2020, with ri

0 views • 18 slides

Economic Scenarios and Potential Outcomes for 2024

The presented information outlines four scenarios for developed markets in 2024: Soft Landing, Cyclical Recession, No Landing, and Balance Sheet Recession. Each scenario discusses possible growth patterns, inflation rates, monetary and fiscal policy implications. Factors such as inflation stickiness

0 views • 10 slides

Challenges and Opportunities for India in the Global Economy

Global economy faces challenges post-recession, impacting emerging markets like India. This presentation by Vaibhav Sharma and Dr. Raghuram Rajan highlights issues like slow growth, debt overhang, and capital outflow risks. Suggestions include promoting sustainable growth, reforming monetary policy,

0 views • 22 slides

Analyzing Shoreline Recession and Estuarine Current Velocities in South-Eastern Nigeria

Coastal submergence and shoreline retreat due to sea-level rise and climate change pose threats to shoreline management in the Niger Delta. This study focuses on analyzing shoreline recession and estuarine current velocities in south-eastern Nigeria, using techniques like shoreline mapping and beach

0 views • 19 slides

Understanding Corporate Climate Assessment Using NLP Clustering

This work explores a novel approach in corporate climate assessment through applied NLP clustering, highlighting the relationship between climate risk and financial implications. The use of advanced techniques like BERT embedding for topic representation and clustering in corporate reports is discus

0 views • 33 slides

Understanding Climate Risks in India: Insights from the 38th India Fellowship Webinar

Explore the impacts of climate risks in India through the lens of physical and transition risks detailed during the 38th India Fellowship Webinar on January 12, 2023. Key topics include climate change interactions, liability risks, and risk management strategies for a sustainable future.

0 views • 37 slides

Responding to Risks in OECD Due Diligence Guidance

Develop and implement a strategic response to identified risks in accordance with the OECD Due Diligence Guidance for responsible sourcing of minerals. The process involves reporting findings to management, devising a risk management plan, implementing the plan, and assessing ongoing risks. Mitigati

0 views • 7 slides

Understanding Economic Forecasting Challenges Amid the Recession

Executive Director Janet Harrah of Haile/US Bank College of Business discusses the factors influencing the depth and length of the recession, the impact on the Cincinnati MSA job market, and the importance of CARES Act funding in stabilizing various sectors of the economy amidst unprecedented econom

0 views • 13 slides

Oral Peptides for Gingival Recession & Mucosa Repair

Discover how oral peptides can aid in repairing gingival recession and strengthening oral mucosa health. These natural compounds work to support tissue regeneration, promote gum health, and enhance the resilience of your mouth's delicate tissues. Unl

1 views • 7 slides

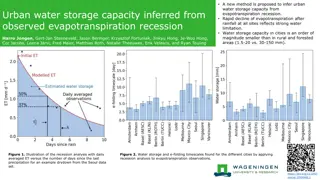

Inference of Urban Water Storage Capacity from Evapotranspiration Recession Analysis

A new method is proposed to estimate urban water storage capacity based on evapotranspiration recession analysis, showcasing the significant differences between urban and rural/forested areas. The study highlights the strong water limitations in cities, leading to smaller water storage capacities. F

0 views • 4 slides