Understanding Corporate Climate Assessment Using NLP Clustering

This work explores a novel approach in corporate climate assessment through applied NLP clustering, highlighting the relationship between climate risk and financial implications. The use of advanced techniques like BERT embedding for topic representation and clustering in corporate reports is discussed. The background covers the risks associated with climate change, including physical risks like severe weather events and chronic changes, as well as transition risks due to the shift towards a low-carbon economy. The study emphasizes the importance of understanding these risks for businesses and investors in the context of a changing climate landscape.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Corporate Climate assessment: an applied NLP-clustering approach Giuseppe Bonavolonta, EIB*, Ali Hirsa, Columbia and Oleg Reichmann, ECB* 8th Annual Bloomberg-Columbia Machine Learning in Finance Workshop 2022, September 22, 2022, New York *The views expressed are those of the authors and do not necessarily reflect those of the ECB and/or the EIB.

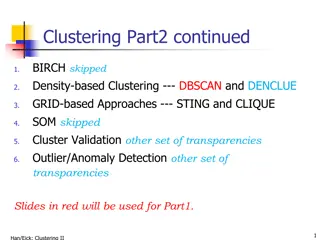

Agenda Part I: Background and Motivation Climate risk as financial risk Climate related disclosures Part II: NLP for corporate reports Representation based on topics BERT embedding Clustering and Numerical examples

Background Conclusion. (IPCC 2013) It is extremely likely that more than half of the observed increase in global average surface temperature from 1951 to 2010 was caused by the anthropogenic increase in greenhouse gas concentrations[ ]

Background Physical risk Acute risk: Risks due to likelihood of more frequent and more severe occurrence of natural hazards (e.g. floods, storms). They represent the economic costs and financial losses due to increasing frequency and severity of climate- related weather events (e.g. storms, floods or heat waves).

Background Physical risk Acute risk: Risks due to likelihood of more frequent and more severe occurrence of natural hazards (e.g. floods, storms). They represent the economic costs and financial losses due to increasing frequency and severity of climate- related weather events (e.g. storms, floods or heat waves). Chronic risk: Risks due to structural changes to the physical environment (e.g. reduction of perma-frost, sea-level rise, water scarcity, increase of the average temperature). They represent the effects of long-term changes in climate patterns (e.g. ocean acidification, rising sea levels or changes in precipitation).

Background Transition risk Risks for the business model of counterparties due to the transition towards a low-carbon economy (e.g. triggered by governments, technological advancement, and/or changing customer preferences). Transition risks are associated with the uncertain financial impacts that could result from a rapid low-carbon transition, including policy changes, reputational impacts, technological breakthroughs or limitations, and shifts in market preferences and social norms.

Climate risk as financial risk Source: BIS, Climate-related risk drivers and their transmission channels

Climate risk as financial risk ECB launched a supervisory climate risk stress test to assess how prepared banks are for dealing with financial and economic shocks stemming from climate risk. The exercise was conducted in the first half of 2022. Conclusion: Euro area banks must urgently step up efforts to measure and manage climate risk, closing the current data gaps and adopting good practices that are already present in the sector. The EIB Group Climate Bank Roadmap 2021-2025 outlines group goals for climate finance that supports the European Green Deal and helps make Europe carbon-neutral by 2050. It maps the next stages in the journey to a sustainable planet and provides a framework to counter climate change.

Disclosures and disclosure quality in central banking Bank of England: Riksbank: [ ] will only purchase corporate bonds issued by companies that report their annual direct and indirect emissions of greenhouse gases (scope 1 and scope 2) in accordance with the recommendations of the Task Force for Climate-related Financial Disclosures ECB: [ ] Better climate performance will be measured with reference to lower greenhouse gas emissions, more ambitious carbon reduction targets and better climate-related disclosures.

How to measure the quality of disclosures? Existence of dedicated climate report/climate chapter in annual binary variable with limited information report Publication of (verified) emission figures respect to emissions, however only one aspect of disclosures informative with Coverage of TCFD required topics (Strategy, Governance, Risk management, Metrics/Targets) potentially limited information binary variable with Alternatives?

NLP based approach Research question: can an automated assessment of climate related publications of corporates be meaningfully performed? Approach: Analyse corporate publications with respect to relevant content on transition and physical risk based on NLP. Characterize publications based on weights and concentration in topics. Cluster corporates publication based on representations.

Corporate disclosures: Corpus 1420 Companies; Annual Reports, Letter to investors, Sustainability reports Recent publications (2018 onwards) No predefined structures (paragraphs, templates, Q&A) No predefined labels (e.g. topic labels) No specific Industry sector focus

Topic definition Physical Risk Definition: refers to so-called acute risks , as the likelihood of more frequent and more severe occurrence of natural hazards (e.g. floods, storms), and to chronic risks , i.e. structural changes to the physical environment (e.g. reduction of perma-frost, sea-level rise, water scarcity, increase of the average temperature). They represent the economic costs and financial losses due to increasing frequency and severity of climate-related weather events (e.g. storms, floods or heat waves) and the effects of long-term changes in climate patterns (e.g. ocean acidification, rising sea levels or changes in precipitation). Physical Risk Topic ={heat wave, precipitation, floods, droughts, wildfires, storms, hazard, sea level, temperature increase, IPCC report. . . }

Topic definition Transition Risk Definition: refers to risks for the business model of counterparties due to the transition towards a low- carbon economy (e.g. triggered by governments, technological advancement, and/or changing customer preferences). Transition risks are associated with the uncertain financial impacts that could result from a rapid low-carbon transition, including policy changes, reputational impacts, technological breakthroughs or limitations, and shifts in market preferences and social norms. In particular, a rapid and ambitious transition to lower emissions pathways means that a large fraction of proven reserves of fossil fuel cannot be extracted, becoming stranded assets , with potentially systemic consequences for the financial system. Transition Risk Topic={polluting, green, Paris agreement, stranded, Kyoto, emissions, GHG, carbon tax, renewable, waste, well-below two degrees Celsius before pre-industrial age, TCFD-report,. . . }

BERT Embedding Bidirectional Encoder Representation via Transformer Some facts about BERT: State of the art embedding model published by Google. It is a context-based embedding model. It is used for question answering, text generation, sentence classification, translation and many more Two standard configurations BERT-base (110 M parameters) and BERT-large (340 M parameters) Pre-training: via Toronto BookCorpus and Wikipedia dataset

BERT Embedding Bidirectional Encoder Representation via Transformer by Google Base set-up: Number of encoder layers N=12 Number of attention head A=12 Hidden unit H=768 Pre-trained (110M parameters) Single Encoder BERT Base

Embedding Topic cluster: Physical Risk Cluster ={heat wave, precipitation, floods, droughts, wildfires, storms, hazard, sea level, temperature, . . . } Corpus:

Topic extraction ???? Illustrative purposes

Topic extraction ???? Avoid spurious data (remove if): Illustrative purposes

NLP & Von Mises-Fisher The density describes unit vectors distributed around the mean direction v with concentration parameter k k = 5 (left) and k = 50 (right) with v = [ 0.5, 0, 0.5]

Why the concentration matters? An example 1997

Why the concentration matters? An example 1997 2019

Why the concentration matters? An example 1997 The same company has moved from generic jargon to specialized technical vocabulary ! ?(????)> ?(????) 2019

VM-Mixtures Clustering on the Unit Hypersphere using von Mises-Fisher Distributions, Journal of Machine Learning Research 6 (2005) 1

Clustering Numerical experiments Transition Risk Measure Only concentration Concentration and weights DISTATIS Avg. Silhouette N Clusters 72% 53% 47% 3 3 5 Physical Risk Measure Only concentration Concentration and weights DISTATIS Avg. Silhouette N Clusters 36% 36% 35% 3 3 3

Conclusions and future research directions Conclusions: The BERT NLP-methodology definitely improves and automatises the assessment of climate related publications. The use of weights and concentrations for each topics allows to distinguish the physical and transition risk dimensions of climate disclosures. The overall machinery can be audited and validated (no black-box issue). Future research directions : (In our opinion) We need to leverage AI-ML in order to introduce new financial quantitative measures/methodologies supporting the green transition (climate finance and risk management). Disclosures is one dimension but others need to be investigated: e.g. emissions-paths, scenario generation, rare and plausible events, shocks simulation and new credit/market risk measures.