Understanding Taxes: An Overview of Taxation Principles and Collection in Ireland

This content covers the fundamental aspects of taxation, including its definition, purpose, principles (fairness, certainty, efficiency, convenience), and tax collection in Ireland by the Revenue Commissioners. It explores key concepts related to taxation and aims to enhance understanding of tax sys

2 views • 26 slides

Accounting and Taxation of Securities Organized by Belgaum Branch of ICAI

Explore the accounting treatment and taxation of securities in a seminar organized by the Belgaum branch of ICAI. Learn about various types of securities, their accounting principles, taxation rules, and important points through case studies and insightful discussions led by CA Kinjal Shah. Gain val

4 views • 74 slides

Progressive Approach to Relational Entity Resolution

In this research paper authored by Yasser Altowim, Dmitri Kalashnikov, and Sharad Mehrotra, a progressive approach to relational entity resolution is presented. The study focuses on balancing cost and quality in entity resolution tasks for relational datasets. The goal is to develop a method that ac

1 views • 20 slides

Understanding the Progressive Movement in United States History II

Explore the Progressive Movement in US History II Module 5, focusing on major movements, politics, muckrakers' role, reform leaders, women's rights, civil rights, and progressive policies under Roosevelt, Taft, and Wilson. Learn about grassroots Progressivism, social justice reformers, the Triangle

4 views • 38 slides

English Grammar Exercises: Simple Present and Present Progressive

Practice forming sentences in simple present and present progressive tenses through a series of exercises. The exercises include questions, affirmatives, negatives, and short forms of the verb "to be." Improve your English grammar skills with these interactive tasks.

3 views • 14 slides

Pragmatic Analysis of Directive Verbs in Progressive Relaxation

In this study, the Enaction Model and Impositive Strategy are applied to analyze the directive speech acts in Progressive Relaxation, a technique used in hypnosis. The research uses qualitative methods to examine the scripts and classifies the directive speech acts based on specific models. Previous

3 views • 9 slides

Stay Ahead in NRI Taxation in England with Bharat's Lower Tax Service

Stay ahead of the curve in NRI taxation in England with Bharat's Lower Tax Service. Our specialised solutions cater to the unique tax needs of Non-Resident Indians, ensuring compliance and maximising returns. With expert guidance and personalised strategies, navigate the complexities of cross-border

7 views • 3 slides

Best Progressive Lenses in Alexandra

ORIAN @ Anchorpoint provides the Best Progressive Lenses in Alexandra. They are redefining value in eyewear. Their passionate team goes above and beyond to ensure every customer finds the perfect pair of glasses that not only enhances their vision but also complements their style. Visit them today a

1 views • 6 slides

nritaxationbharat_blogspot_com_2024_05_nri_income_tax_return

Mastering NRI Taxation: Guidelines for Delhi Residents\" offers comprehensive insights into navigating the complexities of taxation for Non-Resident Indians (NRIs) residing in Delhi. This resource provides expert guidance on understanding tax laws, claiming exemptions, and optimizing deductions spec

3 views • 3 slides

Understanding the Purpose of Taxation: Financial, Social, Legal, and Ethical Perspectives

Taxation is a crucial method governments use to collect funds for public services. This chapter delves into the principles of a fair tax system, exploring how taxes should be related to income, predictable, cost-effective to collect, and convenient for taxpayers. It also discusses the redistribution

0 views • 19 slides

Almira School District Progressive Design-Build K8 School Project

Almira School District's application for project approval highlights the progressive design-build approach for replacing a K8 school. The project team, led by experienced professionals, aims to negotiate scope, manage budget, secure funding, and ensure code compliance while building a new facility f

0 views • 14 slides

Understanding Principles of Taxation

Principles of taxation, including concepts such as public revenue, sources of revenue, types of taxes (direct and indirect), and non-tax revenue, are essential for students of commerce to grasp. Taxation serves as a means for the government to collect revenue for the common good through compulsory c

0 views • 12 slides

Understanding Progressive Hedging Algorithm in Operations Research Seminar

Explore the Progressive Hedging algorithm discussed in the Graduate Seminar on Operations Research. Topics include general framework, resource allocation examples, and handling non-convexity in decision-making. Dive into scenario decomposition and scenario-specific decision-making for well-hedged so

0 views • 28 slides

Exploring Taxation Acts and Their Impact on Revolutionary Sentiments

The provided content delves into historical taxation acts, including their specifics and potential implications on the onset of the American Revolution. It also draws parallels to modern-day examples of product taxation, prompting reflection on the fairness and consequences of such levies. The disco

4 views • 6 slides

Enhancing State Revenue Generation Through Effective Taxation Strategies

State governments rely on taxation to finance their expenditures, prioritizing revenue generation over borrowing. By engaging taxpayers in voluntary compliance, taxation strengthens government accountability and citizen participation in governance. Understanding the tax landscape, including federal,

0 views • 27 slides

Taxation Procedures and Authorities

Explore the principles and application of taxation laws, tax provisions, duties of tax authorities, and obligations during taxation procedures. Learn about the essential role of tax authorities in determining facts crucial for legitimate decision-making, benefiting taxpayers diligently, and conducti

0 views • 35 slides

Windfall Profit Taxation: Past, Present, and Future

The presentation discusses windfall profit taxation measures in Europe, specifically in Italy, comparing the old Robin Hood tax with new contributions. It explores the aims, issues, tax rates, and bases of windfall profit taxation, highlighting its redistributive purposes and challenges in constitut

1 views • 14 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

Challenges Faced by African Americans During the Progressive Era

African Americans in the Progressive Era faced significant challenges in education, employment, and social acceptance. They were oppressed, segregated in schools, limited to non-skilled jobs with lower wages, and were victims of racial violence and discrimination, such as lynching. Leaders like Book

0 views • 21 slides

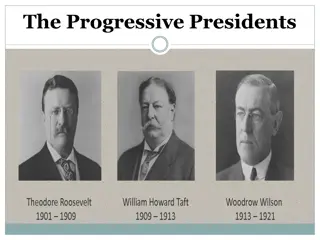

Progressive Presidents' Initiatives and Reforms in the US

Explore the impact of Progressive Presidents like Theodore Roosevelt on business regulation, consumer protection, labor conditions, and environmental conservation in the early 20th century. Learn about key laws passed, initiatives taken, and the overall drive towards reform during this period.

5 views • 20 slides

Efforts to Reform American Society in the Progressive Era

Major reform efforts in the Progressive Era included Upton Sinclair's expose of the meatpacking industry in "The Jungle," resulting in federal oversight. Women played a significant role in reform movements, with Jane Addams establishing Hull House to aid immigrants. The era also saw the rise of Jim

0 views • 34 slides

Exposing Corruption and Fighting for Change in the Progressive Era

Journalists, artists, and reformers played pivotal roles during the Progressive Era, exposing corruption and advocating for social change. Muckrakers like Ida Tarbell and Upton Sinclair highlighted injustices, while reformers such as Jane Addams and Booker T. Washington sought to improve living cond

0 views • 7 slides

Learning Present Progressive in PA Dutch

Explore the concept of Present Progressive in PA Dutch through examples and practice exercises. Understand the differences between the two present tense forms and learn how to form sentences in Present Progressive. Practice translating sentences using both normal conjugation and the Present Progress

0 views • 7 slides

Understanding Verb Forms: Simple, Progressive, and Emphatic

English verbs have three forms: simple, progressive, and emphatic. The progressive form consists of a form of "to be" followed by the -ing form of the verb. While some may consider progressive forms as separate tenses, they mainly reflect aspects rather than time differences. Excerpts from "Twilight

0 views • 17 slides

Impact Analysis of New Corporate Taxation Regime Under Taxation Laws (Amendment) Ordinance, 2019

The new corporate taxation regime introduced through the Taxation Laws (Amendment) Ordinance, 2019 brings significant changes, including a lower tax rate for domestic companies. The regime allows companies to opt for a 22% tax rate, with implications on exemptions and deductions. Companies opting fo

0 views • 31 slides

Nevada Department of Taxation Guidelines for Repair and Reconditioning Services

Tax guidelines for repair and reconditioning services in Nevada provided by the Department of Taxation. Covers taxable repair labor, treatment of parts, repairmen as retailers or consumers, fabrication vs. refurbishing labor, painters, polishers, finishers, and replacement parts taxation.

0 views • 11 slides

Colorado Department of Transportation Progressive Discipline Course Overview

This course offered by the Colorado Department of Transportation focuses on Progressive Discipline, covering topics such as the process of progressive discipline, resolving performance issues, connecting performance management with discipline, and resources available for supervisors/managers. Partic

0 views • 55 slides

Understanding Verbs: Perfect vs Progressive

The concept of verbs in English is explored through the perfect and progressive forms. The National Curriculum references the use of progressive forms in Year 2 and the present perfect form in Year 3. Tense, aspect, perfect, and progressive aspects of verbs are explained with examples to illustrate

0 views • 8 slides

Understanding Future Progressive Tense in English Grammar

Future Progressive Tense, also known as Future Continuous Tense, is used to indicate actions that will be ongoing at a specific point in the future. This tense emphasizes the continuous nature of an action happening in the future. Learn how to form and use the Future Progressive Tense through exampl

0 views • 22 slides

Understanding Taxation in Australia: Income Declaration and Assessment

Australian taxation laws require residents to declare worldwide income while non-residents are taxed on Australian-sourced income. The tax liability calculation involves taxable income, tax offsets, other liabilities such as Medicare levy, and PAYG credits. Assessable income includes various sources

0 views • 13 slides

Understanding Economic Porosity and Primitive Capital Accumulation in Mozambique

In this presentation by Carlos Nuno Castel-Branco, the concept of economic porosity and its consequences in Mozambique are examined. The discussion includes the historical rationale for economic porosity, magnitude of economic dynamics, taxation issues, investment patterns, capital flight, and publi

0 views • 36 slides

Overview of International Taxation in Italian Law

International taxation refers to rules governing tax laws in different countries, covering various aspects such as cross-border trade, investments, and taxation of individuals working abroad. Tax treaties play a crucial role in limiting the taxation power of treaty partners, with over 2,000 bilatera

0 views • 25 slides

Taxation Challenges for Cross-Border Teleworkers Post Covid-19

Challenges in international taxation arise for cross-border teleworkers post-Covid-19, especially regarding the taxation of income from employment under Article 15 of the OECD Model Tax Treaty. Issues such as physical presence, bilateral agreements during the pandemic, and future taxation scenarios

0 views • 7 slides

Understanding the Progressive Era: Origins, Movement, and Goals

The Progressive Era in late 19th century America was marked by significant political, economic, and social reforms. Originating from the need to address injustices and restore economic opportunities, the Progressive Movement aimed to create lasting changes in society. With goals including protecting

0 views • 12 slides

Understanding Taxation of Digital Goods and Tangible Personal Property in Alabama

Explore the taxation laws in Alabama regarding the digital delivery of tangible personal property and the classification of tangible personal property in sales tax cases. This content delves into specific court cases, definitions, and perspectives on the taxability of digital goods and software purc

0 views • 10 slides

Negative List Based Taxation of Services by S.B. Gabhawalla & Co.

This content delves into the conceptual framework of negative list based taxation of services, including the definition of service, elements such as service territory and value, and the framework dissecting the charge at 12%. It also explains what services are excluded from taxation and provides exa

0 views • 36 slides

Progressive Contracting Methods in Infrastructure Projects

Progressive contracting methods, such as Progressive Design Build (PDB) and Construction Manager/General Contractor (CM/GC), are being actively utilized by KYTC for infrastructure projects. These methods offer benefits like better risk mitigation and price certainty. Learn about the differences betw

0 views • 14 slides

Public Economics Course Summary - EHESS & Paris School of Economics

The Public Economics course at EHESS & Paris School of Economics offers an introduction to taxation history, government intervention theories, and policy incidence across developed and developing countries. The syllabus covers topics like welfare analysis, wealth taxation, and optimal taxation strat

0 views • 11 slides

The Case for Progressive Taxation: Ensuring Equality Through Fair Contributions

Progressive taxation involves higher tax rates for individuals with higher incomes or greater wealth, aiming to bridge economic and gender inequalities. This system can be achieved through well-designed tax scales, exemptions, and thresholds, ultimately contributing to fair distribution of contribut

0 views • 8 slides

The Radical Center: Jane Addams and the Progressive Movement

This chapter explores the life journey of Jane Addams and her role during the Progressive Era. It reflects on how societal changes, women's independence, and collective struggles shaped the middle class, challenging traditional norms. The chapter discusses the emergence of the progressive movement d

0 views • 5 slides