Challenges and Opportunities for Reforms of Non-Oil Revenues Administration in South Sudan

The presentation highlights the reliance on oil revenues in South Sudan and the need for reforms in non-oil revenue administration. It discusses sources of non-oil revenue, factors hindering revenue mobilization, and opportunities for reforms to diversify the economy. The objectives of non-oil reven

3 views • 23 slides

Enhancing Domestic Revenue Mobilization in South Sudan: NRA Initiatives

The presentation by Hon. Athian Ding Athian, NRA Commissioner General, at the 1st National Economic Conference in South Sudan focused on the National Revenue Authority's mandate, strategic plan, revenue performance, and policy options for boosting non-oil revenue. The NRA aims to achieve a Tax-to-GD

1 views • 21 slides

San Francisco Business Tax Revenue Forecast Update Fall 2023

San Francisco is facing a significant loss in business tax revenue compared to budget projections, with estimates ranging from $40M to $55M in annual losses for current and future fiscal years. The Homelessness Gross Receipts Tax (HGR) is a key source of revenue, but its revenue has been volatile an

0 views • 7 slides

An Introduction to Cargo Revenue Management

\nIn the bustling world of air cargo, where efficiency and profitability are paramount, Cargo Revenue Management (CRM) emerges as a pivotal strategy for airlines and logistics companies. This intricate process involves the optimization of cargo space to maximize revenue, ensuring that every inch of

3 views • 5 slides

Revenue Management Systems (RMS) for Cargo

In the competitive and dynamic world of cargo transportation, optimizing revenue is crucial for the sustainability and growth of businesses. Revenue Management Systems (RMS) for cargo have emerged as vital tools in this endeavor, leveraging advanced technology to enhance profitability. This blog pro

1 views • 7 slides

Revenue Management for Air Cargo by Revenue Technology Services

Revenue management for air cargo is a crucial aspect of modern logistics, aimed at maximizing revenue through effective planning and strategic pricing. Revenue Technology Services (RTS) offers innovative cargo solutions designed to optimize the use of air cargo space, enhance operational efficiency,

1 views • 6 slides

Collaborative Planning in Cargo Revenue Management

In today's fast-paced and competitive logistics industry, effective cargo revenue management is crucial for maximizing profitability and ensuring operational efficiency. Revenue Technology Services (RTS) has been at the forefront of providing innovative solutions for the cargo industry, emphasizing

1 views • 6 slides

Compliance and Regulatory Considerations in Cargo Revenue Management

Cargo revenue management is an intricate balancing act that involves maximizing revenue while managing the capacity and pricing of cargo space. For companies like Revenue Technology Service (RTS), the key to successful cargo revenue management lies not only in optimizing these factors but also in en

1 views • 5 slides

Training and Development for Cargo Revenue Managers

In today's fast-paced and ever-evolving business environment, the role of a cargo revenue manager is more critical than ever. The field of cargo revenue management is a dynamic and complex area that requires professionals to stay updated with the latest industry trends, technologies, and strategies.

1 views • 6 slides

Advanced Analytics for Cargo Revenue Enhancement

In the fast-evolving world of logistics and transportation, optimizing revenue streams is crucial for maintaining competitive advantage. One of the most effective ways to achieve this is through advanced analytics. Leveraging sophisticated data analysis techniques, revenue technology services can tr

1 views • 5 slides

Understanding Public Revenue and Taxation Fundamentals

Public revenue encompasses all income sources of the government, ranging from taxes to non-tax revenue. Taxes, the primary revenue source, are compulsory payments collected without direct benefits to taxpayers and play a crucial role in public finance and economic development. Non-tax revenue includ

0 views • 54 slides

Virgin Islands Police Department Revenue Estimation Conference Highlights

The Virgin Islands Police Department held a revenue estimating conference on March 14, 2023, led by Commissioner Ray Martinez. The event discussed current fees for various services provided by the department, revenue generation and projections over fiscal years, annual revenues and projections, as w

1 views • 10 slides

Understanding Revenue Concepts in Different Market Conditions

Explore revenue concepts like Total Revenue (TR), Marginal Revenue (MR), and Average Revenue (AR) along with elasticity of demand in various market structures such as perfect competition, monopoly, monopolistic competition, and oligopoly. Learn about short and long-run equilibrium conditions and the

0 views • 21 slides

Understanding Petroleum Fraction Distillation Curves

Characterization and properties of petroleum fractions are essential for understanding their behavior, particularly through distillation curves. These curves depict the boiling points of crude oil or petroleum fractions, highlighting components' volatility ranges. Various methods like ASTM D86, True

0 views • 28 slides

Bulk Petroleum Products Handling Procedures at Fuel System Supply Point

Learn how to receive and issue bulk petroleum products using the Fuel System Supply Point (FSSP) in the army. This training covers safety precautions, procedures, and best practices for handling petroleum products efficiently and safely in the field.

0 views • 59 slides

County Government Revenue Sources and Allocation in Kenya

The county government revenue in Kenya is sourced from various avenues such as property rates, entertainment taxes, and service charges. Equitable share forms a significant part of this revenue, allocated based on a formula developed by the Commission on Revenue Allocation. The funds given through t

0 views • 14 slides

Proper Petroleum Marking and Inspection Guidelines for Vehicles and Equipment

As a petroleum supervisor, it is essential to inspect vehicles and equipment to ensure proper markings, preventing commingling of products and ensuring safety. This lesson covers the inspection of petroleum markings on tank vehicles, safety markings for bulk transportation, marking requirements for

0 views • 152 slides

Revenue synergy

,\n\nI'm excited to introduce Revenue Synergy's exceptional revenue cycle management and medical billing services. As the top medical billing company in the US, we offer innovative solutions that optimize your revenue cycle and enhance financial performance. Our team ensures precise billing, minimiz

0 views • 5 slides

Petroleum Exploration Activities in Nicaragua: A Comprehensive Overview

Nicaragua has a rich history of petroleum exploration, with activities dating back to 1930. The country has seen significant seismic acquisition and drilling efforts both onshore and offshore in the Caribbean and Pacific regions. Wells drilled in Nicaragua have shown promising oil and gas indication

0 views • 16 slides

Overview of Ghana's Petroleum Downstream Industry

The Ghana Petroleum Downstream Industry plays a vital role in the transportation, processing, distribution, and marketing of refined petroleum products. The industry has seen key policy objectives focusing on deregulation and liberalization to promote competition and efficiency. Historical milestone

3 views • 23 slides

Understanding the Petroleum Driver Passport (PDP) Program

The Petroleum Driver Passport (PDP) program aims to standardize training for petroleum tanker drivers in the UK, ensuring a consistently high level of classroom and practical training. The PDP is a driver card that all drivers must possess, regardless of employer or type of vehicles used. Industry-a

0 views • 36 slides

Overview of Norwegian Petroleum Directorate and Offshore Oil Fields

The Norwegian Petroleum Directorate (NPD) plays a vital role in regulating petroleum resources on the Norwegian continental shelf to ensure optimal allocation with minimal environmental impact. Haltenbanken area in the Norwegian Sea hosts challenging oil and gas fields like sgard, Heidrun, and Krist

0 views • 18 slides

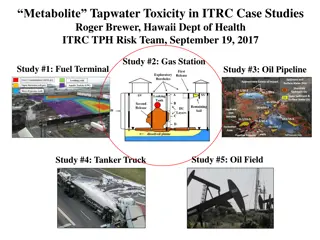

Understanding Petroleum Metabolite Toxicity in Environmental Case Studies

Exploring the impact of metabolites from petroleum degradation on tap water toxicity through case studies involving gas stations, fuel terminals, oil pipelines, oil fields, and tanker trucks. The assessment of TPH risk levels in different settings, calculation of screening levels for drinking water,

0 views • 17 slides

ALA FY 2017 Financial Report Summary

ALA's FY 2017 financial report highlights total revenues, expenses, net operating revenue, revenue sources, general fund summary, and detailed revenue and expense breakdowns. Revenues amounted to $48,808,627 with net revenue of $314,944. Key revenue sources included dues, contributions, grants, and

1 views • 16 slides

Montana Petroleum Tank Releases and Closures Analysis

The provided content details data on Montana's petroleum tank releases, confirmations, closures, and cleanup efforts from 1987 to 2020. It includes information on confirmed and resolved releases, annual averages, legacy releases, EPA regulations, risk-based corrective action guidance, and screening

0 views • 14 slides

Understanding Petroleum Contact Water (PCW)

Petroleum Contact Water (PCW) refers to water containing petroleum products in various contexts such as condensate, tank bottoms, spill containment areas, and more. This definition excludes certain materials like equipment wash water and groundwater contaminated with hazardous constituents. A PCW tr

0 views • 9 slides

Challenges and Goals of Petroleum Marketers in Environmental Compliance

Facing compliance challenges in maintaining underground storage tanks, petroleum marketers aim to invest in real estate, technology, and environmental protection to secure their investments. Issues such as vapor recovery, EMV upgrades, and regulatory developments impact the petroleum retail sector.

0 views • 10 slides

Alisal Union School District 2021-2022 Budget Workshop Overview

The Alisal Union School District held a budget workshop to review revenue projections, expenditure projections, enrollment and staffing projections, additional federal and state funding, and supplemental and concentration expenditures. The workshop highlighted revenue sources, including local contro

2 views • 26 slides

Somalia's Petroleum and Mining Legal Framework

The legal and commercial framework governing petroleum and mining in Somalia involves the separation of powers between key institutions such as the Ministry of Petroleum and the Somali National Oil Company. The Directorate of Minerals/Mining oversees the mining sector, while various regulations and

0 views • 11 slides

Evaluation of Petroleum Hydrocarbon Degraders in Wastewater Canal Supplemented with Organic Carbon Source

This study explores the potential of native bacterial populations in wastewater for bioremediation of petroleum hydrocarbon-polluted environments. The research involved exposing Bonny light crude oil to wastewater canal samples supplemented with dry maize cob as an organic carbon source. Results sho

0 views • 26 slides

Petroleum Restoration Program Site Managers Workshop in Orlando, Florida

The division of Waste Management organized the Petroleum Restoration Program (PRP) Site Managers Workshop in Orlando, Florida on March 25-26, 2014. The workshop covered various topics related to PRP, including procurement workflow, scope of work development, remediation strategies, site closure, and

0 views • 48 slides

Understanding Revenue Limits and Calculation Process in School Financial Management

This educational material covers topics such as revenue limits, the components within revenue limits, what falls outside of the revenue limit, and a four-step process for revenue limit calculation in the context of school financial management. It includes detailed information on the regulation of re

0 views • 34 slides

Long-Term Management of Contaminated Soil and Groundwater in Iwilei District, Honolulu

The Iwilei District in Honolulu, Hawaii, spans 315 acres with multiple landowners and responsible parties. It features commercial and industrial use, including bulk fuel terminals, former MGP site, active/inactive petroleum pipelines, and Dole Cannery. The area has been impacted by petroleum-contami

0 views • 25 slides

Understanding Revenue Requirements for Non-program Food Sales

Non-program food revenue plays a crucial role in school food service operations. Schools need to ensure that the revenue from non-program food sales meets a specified proportion to cover costs effectively. Failure to comply may result in corrective action during reviews by the state agency. To meet

0 views • 9 slides

Louisiana Department of Revenue Operational and Tax Policy Initiatives

Louisiana Department of Revenue (LDR) is focused on efficiently collecting state tax revenue, regulating charitable gaming, alcohol, and tobacco sales, and supporting state agencies in debt collection. The LDR's leadership team is dedicated to various aspects of revenue management and compliance, wi

0 views • 32 slides

Rules for Treating Petroleum Releases: 15A NCAC 02L Section

The rule-making aims to establish consistent rules for addressing petroleum releases, specifically focusing on risk-based remediation for non-UST petroleum releases. The new rules in the 15A NCAC 02L Section aim to prevent misuse of statutes and federal regulations. A comparison is made between non-

0 views • 19 slides

Understanding Petroleum Hydrocarbons and Their Properties

Petroleum is a complex mixture of hydrocarbons, including paraffins, olefins, naphthenes, and aromatics. Paraffins are fully saturated and stable, olefins are unsaturated with double bonds, naphthenes are cyclic saturated hydrocarbons, and aromatics are cyclic unsaturated hydrocarbons containing ben

0 views • 19 slides

Analysis of State Budget Trends by John Gilbert - Nov. 1, 2020

This comprehensive analysis by John Gilbert, a Budget and Revenue Analyst, delves into the multiyear trend of state budget outlook, general revenue fund trends, sources, growth, and projections. The analysis includes comparisons between revenue and expenditures, trend-based revenue projections, grow

0 views • 5 slides

Regulation of Petroleum Products and Pricing in Atlantic Canada

Island Regulatory & Appeals Commission (IRAC) in Prince Edward Island plays a crucial role in regulating the distribution and pricing of petroleum products within the province. The Petroleum Products Act ensures fair pricing for consumers and licensees, with IRAC overseeing price regulation and lice

0 views • 22 slides

The Economics and Politics of Foreign Aid and Domestic Revenue Mobilization

This study explores the relationship between foreign aid, taxation, and domestic revenue mobilization, highlighting the impact of aid on tax/GDP ratios and the constraints faced in revenue systems. It discusses how aid influences policy choices, accountability, and bureaucratic costs, impacting reve

0 views • 25 slides