Penalties and Remedies for Trademark Infringement and Passing Off

Registration of a trademark grants exclusive rights to the proprietor and allows legal action against infringement. The Trademark Act, 1999 provides remedies like injunctions, damages, and penalties for unauthorized use of registered marks. Infringement occurs when a registered trademark is used wit

4 views • 8 slides

Understanding Colorado False Claims Act: Recent Changes and Best Practices

Colorado False Claims Act (CFCA) mirrors the federal False Claims Act, aiming to safeguard public funds. The act covers various entities and imposes penalties for false claims. Liable defendants face significant damages, including penalties, treble damages, and attorneys' fees. Cooperation can lead

0 views • 13 slides

Understanding VAWA and the Fair Housing Act

The Violence Against Women Act (VAWA) was passed in 1994 to provide funding for investigating and prosecuting violent crimes against women, establish housing protections for survivors of domestic violence, and more. The act has been reauthorized multiple times, most recently in 2022, with new provis

0 views • 17 slides

Understanding the Importance of Filing Income Tax Returns

Filing income tax returns is crucial as it involves declaring total income and tax payable. Deadlines are specified based on the type of assessee, with penalties for late filing. The process allows for claiming refunds, showing financial worth for visas, and ensuring eligibility for tenders. Failing

0 views • 26 slides

Understanding ACA Penalty Enforcement Roadmap for Employers

This material provides insights on ACA penalty enforcement for Applicable Large Employers (ALEs) under the Affordable Care Act (ACA). It covers ALE obligations, employer mandates, health coverage reporting, penalties for non-compliance, and potential changes in reporting requirements. Emphasis is pl

0 views • 13 slides

West Virginia Governmental Ethics Act & Pecuniary Interest Statute Overview

West Virginia Governmental Ethics Act applies to public servants and employees, setting rules to prevent private gain from public positions. Pecuniary Interest Statute addresses conflicts related to contracts and compensation. The Ethics Commission enforces these laws through advisory opinions and i

0 views • 45 slides

Reforming Penalties for Drug Possession in Illinois

Illinois is considering HB 3447 to reclassify penalties for low-level drug possession, shifting from felonies to misdemeanors. This overview explains the differences between felonies and misdemeanors, the impact of the proposed reform on various drugs, and how quantity affects penalties in drug poss

0 views • 26 slides

University Academic Misconduct Policy Overview

The University's academic misconduct policy applies to all levels of study and includes actions such as plagiarism, collusion, falsification, and breaching ethical standards. The policy outlines penalties for misconduct, ranging from capped grades to resubmission opportunities. Initial cases involve

3 views • 8 slides

Pecuniary Penalties for Competition Law Infringements in Australia

Explore the setting of pecuniary penalties for competition law violations in Australia compared to other jurisdictions around the world. The report discusses the drafting process, structure, penalty setting in Australia, international comparators, and recommendations.

0 views • 46 slides

Understanding Nevada Open Meeting Law and Penalties

This document provides a comprehensive overview of the Nevada Open Meeting Law (OML) tailored for the Nevada Commission on Autism Spectrum Disorders. It covers the relevance of OML, personal and practical overlaps, public participation, understanding roles, ensuring transparency, and related penalti

0 views • 26 slides

Official New Rules National Officiating Conference 2017 Details

The Official New Rules National Officiating Conference 2017 covers various aspects such as foul penalties, duties of coaches, team uniforms, and team equipment in basketball games. It emphasizes consistent penalties for disqualifying fouls, timely submission of team information, uniform guidelines,

0 views • 12 slides

Water Use Reporting Guidelines and Requirements in Texas

Water use reporting is mandatory for water right holders in Texas to track and manage the state's water resources effectively. Reporting deadlines, penalties for non-compliance, and specific requirements for temporary permit holders are outlined. Failure to submit reports can result in financial pen

2 views • 18 slides

The Impact of Progressive Muscle Relaxation Training on Hockey Athletes' Concentration During Penalties

Concentration is crucial for athletes, especially during penalties in hockey. Progressive Muscle Relaxation training can enhance concentration by requiring players to focus while relaxing. This study aims to investigate the effectiveness of PMR on improving hockey athletes' concentration during pena

0 views • 12 slides

Understanding Pure Economic Loss: Definition, Recoverability, and Legal Cases

Pure economic loss, a pecuniary or financial loss not directly resulting from physical damage, can be recoverable in negligence cases depending on jurisdiction. This article explores the concept, examples, and legal precedents surrounding pure economic loss, highlighting cases such as Spartan Steel

0 views • 15 slides

Understanding Penalty Stacking in Boys Lacrosse: NFHS Rules & Interpretations

Explore penalty stacking scenarios in boys lacrosse based on the 2014 NFHS rules and interpretations, covering situations like penalties served simultaneously, goal scored prior to penalty expiration, and penalties stacking when the time expires. Learn about the maximum of three players per team in

0 views • 11 slides

Understanding Rule 9.2 - Harassment of Officials in Sports

The content outlines Rule 9.2 regarding the harassment of officials and unsportsmanlike conduct in sports. It explains the responsibilities of team officials, potential penalties for challenging or disputing rulings, and examples of how penalties are assessed based on player behavior. The rules emph

0 views • 14 slides

Understanding Late Filing Penalty Appeals and Reasonable Excuses

Explore the process of appealing late filing penalties with HMRC, including what constitutes a reasonable excuse. Learn about common scenarios accepted as reasonable, as well as those that won't be considered valid reasons. Understand the importance of taking reasonable care in meeting tax obligatio

0 views • 21 slides

Lacrosse Fouls and Penalties: A Comprehensive Guide

This guide provides detailed explanations of various lacrosse fouls and penalties, including personal fouls, cross-checking, illegal body checks, slashing, tripping, unnecessary roughness, and unsportsmanlike conduct. Each section describes the specific actions that constitute a foul, the penalties

0 views • 24 slides

Understanding Lacrosse Fouls: Rulings and Penalties Explained

This information provides clarity on simultaneous fouls in lacrosse, detailing proper rulings and penalty time assignments for various scenarios involving player infractions. Examples include cases of pushing, slashing, tripping, and technical fouls, with a focus on understanding how penalties are s

0 views • 24 slides

Understanding LJMU Penalty Tariff for Academic Misconduct

The LJMU Penalty Tariff, implemented from September 2011, ensures fair and consistent penalties for academic misconduct at LJMU. Points are allocated based on criteria, with penalties ranging from allowing new work submissions to expulsion. AMP outcomes are recorded using Service Indicators that rem

0 views • 17 slides

Legal Compensation and Damages: A Closer Look at Tort Law

Delve into the intricate world of tort law and legal compensation through an exploration of intentional torts, exceptional conduct requirements, mental distress considerations, and recent court cases. Learn about the nuances of compensating for non-pecuniary losses and the evolving definitions and a

0 views • 45 slides

Underground Storage Tank Enforcement Update - February 2020

The update includes details of enforcement actions taken by the Division, such as orders issued, penalties imposed, and resolutions achieved in relation to underground storage tanks. Examples of resolved orders include violations like failure to monitor tanks regularly, lack of corrosion protection

0 views • 9 slides

Analysis of Pharmaceutical Industry Criminal and Civil Penalties from 1991-2015

This data presentation highlights the number of settlements and financial penalties incurred by the pharmaceutical industry over the span of 25 years, from 1991 to 2015. The charts reveal trends in both the number of settlements and the financial implications, broken down by federal and state levels

0 views • 29 slides

Understanding Texas Drug Offender Education Program and DWI Penalties

Explore the Texas Drug Offender Education Program, its course objectives, topics, Controlled Substances Act penalties, DWI penalties, intoxication definition in Texas, additional fines for DWI convictions, and trends in drug use history. Gain insight into the dangers of drug abuse, effects on person

0 views • 67 slides

Minimizing or Avoiding IRS Penalties on 1098-T Filing

Learn how to respond to IRS penalties on 1098-T filings, understand 972CG notices, reasons for reporting errors, steps for appealing penalties, and what to do after submitting an appeal. Take action within the 45-day window to avoid fines and potential interest charges.

0 views • 16 slides

Importance of Special Event Server Training for Alcohol Safety

Special Event Server Training focuses on eliminating over-serving of adult alcohol consumers, preventing underage access to alcohol, and ensuring the safety and integrity of event attendees. It aims to reduce the risks of injury, death, criminal charges, and civil litigation while promoting a safe e

0 views • 30 slides

Enforcement of EU and National Law on Industrial Emissions

This presentation delves into the enforcement of EU and national laws related to industrial emissions, focusing on inspections and penalties with a spotlight on Peter Vajda's insights. It covers applicable EU laws, overview of penalties in relation to environmental law, key enforcable provisions, in

0 views • 31 slides

Understanding Migration Costs and Policy Interventions

Much anecdotal evidence suggests high and rising migration costs, highlighting the need for comprehensive research to identify areas for policy intervention. This study aims to provide reliable evidence on low-skill workers' actual costs of migration, enable cross-country comparisons, and estimate n

0 views • 24 slides

New Jersey Driver Privileges and Penalties Overview

The chapter highlights the penalties and consequences related to driving under the influence, underage DUI, breath tests, motor vehicle violations, and driving while suspended in New Jersey. It covers various offenses, fines, license suspensions, community service requirements, and other legal impli

0 views • 15 slides

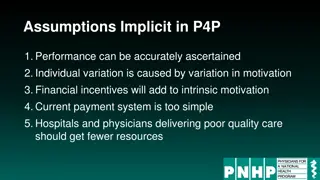

Impact of Payment for Performance Programs in Healthcare

Payment for Performance (P4P) programs in healthcare have assumptions that performance can be accurately measured, individual variation is due to motivation, financial incentives enhance intrinsic motivation, the current payment system is too simplistic, and poor quality care providers should receiv

0 views • 10 slides

Wrestling Rules and Misconduct Definitions

This content outlines rules and definitions related to wrestling, including definitions of bad time, penalties during bad time, coach misconduct penalties, and specifications for being inbounds while wrestling. It also covers the consequences for coach misconduct in wrestling matches.

0 views • 20 slides

Vocabulary Lesson 23: Wealth and Poverty

A vocabulary lesson focusing on words related to wealth and poverty. The lesson covers terms such as austerity, depreciate, equity, frugal, indigent, munificent, pecuniary, and recession, with definitions and examples provided for each. Enhance your vocabulary with these words linked to financial we

0 views • 11 slides

Explanation and Operation of New Rules in Racing Competitions

The new rule changes in racing competitions introduce time penalties as an option for breaking rules, in addition to disqualification. Competitors must adhere to fair racing practices to avoid disqualification or time penalties. Various scenarios like missing turn buoys, collisions, and wash hanging

0 views • 16 slides

Understanding German Criminal Fraud Law in the Context of the Corona Pandemic

Explore the intricacies of German criminal fraud law, particularly in the current Corona pandemic situation. Delve into the objective and subjective elements of the offense, characteristics of fraud, and subsidy fraud, along with detailed discussions on deception, error, disposition of property, and

0 views • 17 slides

SB 1718 Immigration Bill Overview

The SB 1718 Immigration Bill for Palm Beach County Intergovernmental Affairs addresses key aspects such as human smuggling, law enforcement cooperation, employment verification, and penalties for noncompliance. It enhances consequences for human smuggling, allows law enforcement agencies to share in

0 views • 13 slides

Overview of Qui Tam Litigation and the False Claims Act

Qui tam litigation under the False Claims Act (FCA) allows private citizens to bring civil actions on behalf of the government to address alleged false claims in various sectors. The FCA prohibits knowingly presenting false claims and provides penalties for such actions, including civil penalties an

0 views • 15 slides

Handling Medicare Set-Asides: Key Considerations and Compliance Updates

This comprehensive guide covers essential aspects of managing Medicare Set-Asides, including eligibility criteria, confirming Medicare status, compliance with the Medicare Secondary Payer Act, potential penalties for errors in reporting, and strategies to avoid violating the MSP statute. Stay inform

0 views • 59 slides

Turkey's Tax Amnesty Law: Restructuring and Benefits Explained

The Amnesty Law in Turkey, Law No: 7143, outlines provisions for restructuring tax receivables, including penalties and interests, related to periods before March 31, 2018. Taxpayers have the opportunity to write off penalties by meeting specific payment conditions. The Law aims to provide relief an

1 views • 17 slides

Understanding the False Claims Act: Liability, Response, and Consequences

Explore the intricacies of the False Claims Act, including potential liability and the importance of proper responses. Discover the implications, penalties, and Qui Tam actions associated with false claims against the government. Gain insights into what constitutes a false claim, the penalties invol

0 views • 24 slides

Legal Cases and Guidelines in Administrative Law

Cases involving assault, purse snatch attempts, and pecuniary losses under the Compensation for Victims of Crime Act are discussed. Issues of discretion, policy adoption, and guideline application in Board decisions are examined.

0 views • 20 slides