Understanding the Significance of Goodwill in Partnership Accounts

Goodwill plays a crucial role in partnership accounts, requiring adjustments during changes in profit-sharing ratios or when partners are admitted, retire, or pass away. It represents the intangible value attributed to a business's reputation and potential for future profits, influenced by factors l

3 views • 10 slides

NOT-FOR- PROFIT MAKING CONCERN

Not-for-profit organizations, such as educational institutions, public hospitals, and charitable trusts, operate with the main objective of providing services rather than making profits. These organizations rely on various sources of funding like contributions, donations, and grants. Accounting for

4 views • 4 slides

Historical Insights into Extraordinary Profits Taxation during the First World War

Explore the historical context of extraordinary profits taxation during the First World War, examining its introduction in various countries and the challenge of delineating war profits from other gains. The case of the United States illustrates the contentious debates and measures taken to address

3 views • 110 slides

Understanding the Essential Features of Partnership

Partnership is the relationship between two or more individuals who agree to share profits and losses in a business venture. Essential features include having two or more partners, a mutual agreement, conducting business activities, mutual agency among partners, sharing of profits and losses, and jo

1 views • 5 slides

Next-Level Trading: Harnessing Algo Trading Programs for Profits

In the ever-evolving landscape of financial markets, traders continually seek innovative methods to gain a competitive edge and maximize profits. Amidst this quest for success, the utilization of algo trading programs has emerged as a game-changer, propelling trading strategies to unprecedented leve

1 views • 5 slides

Mahaveerbook: Turn Your Predictions into Profits" with online cricket id.

\nWelcome to Mahaveerbook, Turn Your Predictions into Profits\" with online cricket id.\nthe chief objective for cricket wagering aficionados hoping to transform their expectations into benefits. At Mahaveerbook, we consolidate energy for the game with state of the art wagering instruments to give a

0 views • 6 slides

Why Renting Workstations Can Increase Your Business Profits?

VRS Technologies LLC can help you maximize profits with our workstation rentals. Our Workstation Rental Dubai services give you access to high-performance computers for a fraction of the cost of buying. For more information, Contact us at 0555182748.

3 views • 8 slides

Understanding Non-Aqueous Solvents: Types and Classification

Inorganic non-aqueous solvents play a crucial role in chemical research and industry. This article by Dr. Princy K.G. delves into the classification of solvents based on protonicity, polarity, and aqueous vs. non-aqueous nature. It explores the types of non-aqueous solvents, such as protonic and non

1 views • 29 slides

Understanding Market Sharing Cartel in Oligopolistic Markets

Market sharing cartels in oligopolistic markets involve firms entering agreements to share the market while retaining some autonomy in their operations. Two main methods are non-price competition and quota systems. Non-price competition involves firms agreeing on a common price to maintain profits w

0 views • 8 slides

Understanding Profits Prior to Incorporation in Company Law

This guest lecture at Smt. Maniben M.P. Shah Women's College delved into the topic of Profits Prior to Incorporation, covering definitions, legal provisions, accounting procedures, and treatment methods. The learning objectives included comprehending the concept, familiarizing with Companies Act reg

0 views • 20 slides

Understanding Arithmetic Sequences and Series in Business Profits

Learn how to model and calculate business profits using arithmetic sequences and series. Explore a scenario where profits increase annually until reaching a constant level, and see the impact of different growth rates on financial projections. Understand the implications of using mathematical models

0 views • 8 slides

Understanding Joint Profit Maximization Cartel

In a joint profit maximization cartel, member firms surrender price and output control to achieve maximum joint profits. The central administrative authority determines output quotas based on cost minimization. The cartel works by aligning industry MR with MC to maximize profits. Advantages include

0 views • 7 slides

Maximizing Profits in Production Scenarios

Explore two production scenarios to maximize profits using optimization models. The first scenario involves a cookie store with constraints on cookie production and labor hours. The second scenario features a computer factory maximizing profit considering production line and labor constraints. Learn

0 views • 14 slides

Understanding Non-Firm Quantities in Electricity Markets

Non-Firm Quantities in electricity markets involve units with non-firm access not being compensated for their non-firm capacity not getting accommodated on the system. The concept of Firm Access Quantity plays a key role in determining compensation levels for units, with differences in implementatio

0 views • 6 slides

Managing Inter-Departmental Transfers in Financial Accounting

Inter-departmental transfers involve recording and charging costs from one department to another, with different pricing bases like cost-based and market-based transfers. Unrealized profits in transfers are adjusted using stock reserves. Entries are made at the selling price to include costs and pro

1 views • 7 slides

Assessment of Various Income Types for Residents and Non-Residents

The solution presented details the assessment of different types of income for residents, non-residents, and non-ordinary residents as per Income Tax laws. It covers scenarios like salaries drawn outside India, profits earned abroad, dividends received, and more. The scope of taxable income based on

0 views • 14 slides

Understanding Non-Compete Agreements: Enforceability and Requirements

Non-compete agreements are commonly used in the United States to protect businesses from competition by former employees. To be enforceable, these agreements must meet certain requirements, including independent consideration, protection of legitimate business interests, and reasonableness in scope,

0 views • 26 slides

Understanding Market Sharing Cartels in Oligopolistic Markets

Perfect collusion in oligopolistic markets often involves market-sharing cartels, where member firms agree to share the market while allowing some degree of freedom in their decisions. This can be done through non-price competition or quota agreements. Non-price competition cartels involve setting a

8 views • 8 slides

The Long Island Way - Where Businesses and Non-Profits Grow Together

The Long Island Way fosters mutual growth between businesses and non-profits through community connections, cause marketing, and impactful social initiatives. They offer diverse networking events, volunteer opportunities, and cause marketing strategies to enhance brand awareness, customer loyalty, a

0 views • 9 slides

Comparison of Trigger-based vs. Non-Trigger-based Sensing Measurement in IEEE 802.11

The document discusses the differences between Trigger-based (TB) and Non-Trigger-based (Non-TB) sensing measurement instances in IEEE 802.11 standards, focusing on who initiates the sensing measurement. TB sensing is initiated by the AP, while Non-TB sensing is initiated by a non-AP STA, enabling o

6 views • 13 slides

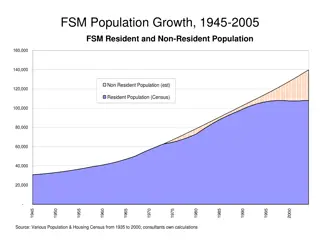

Economic and Demographic Trends in Federated States of Micronesia (1945-2004)

Population growth, employment trends, educational attainment, fishing enterprise profits, tourism statistics, subsistence economy share, and agricultural exports in Federated States of Micronesia between 1945 to 2004. The data covers resident and non-resident populations, employment in FSM and abroa

0 views • 9 slides

Linear Programming in Profit Maximization for Boutique Chocolatier

Linear programming is utilized to maximize profits for a boutique chocolatier offering two types of chocolates. By assigning values to the production quantities of each chocolate type, and considering constraints like demand limits and production capacity, the chocolatier can determine the optimal p

0 views • 24 slides

Mercer Farms Case Study Analysis: Corn Planting Decision

Mercer Farms, faced with the decision to switch from AA Corn to GM Corn, seeks to optimize profits while managing price uncertainties. Key issues include determining which corn type to plant in each field, handling GM corn price variations, and calculating profits from the recommended strategy. With

0 views • 12 slides

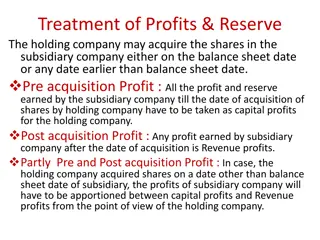

Understanding Treatment of Profits and Reserves in Holding Companies

The treatment of profits and reserves in holding companies when acquiring shares in subsidiary companies is essential for understanding the apportionment of pre-acquisition and post-acquisition profits. This involves distinguishing between capital profits and revenue profits, calculating the cost of

0 views • 8 slides

Managing Device Proliferation and BYOD Policies in SMB Non-Profits

Device proliferation and adoption of BYOD policies in SMB non-profits pose significant security challenges, such as encryption, password policies, data mixing, legal discovery, remote wiping, and security attestation. Neglecting these issues can lead to severe consequences, as illustrated by a case

0 views • 17 slides

Understanding Non-Profit Accounting Essentials

Learn the basics of non-profit accounting, including what defines a non-profit organization, common types of non-profits, governance structures, and legal responsibilities. Discover key insights on IRS and state requirements for non-profits in this informative presentation by Jessica Sayles, CPA fro

0 views • 55 slides

Convenience Store Industry Trends: A Look at Sales, Profits, and Competition

The convenience store industry experienced substantial growth in 2017, with record sales and profits. However, despite positive performance in 2018, increased competition from tech-savvy rivals like Amazon poses challenges for traditional players. As top C-stores outpace the bottom performers, the s

0 views • 10 slides

Understanding Monopolies in Economics

Monopolies are considered inefficient because they can earn long-term profits. In a monopoly equilibrium, the relationship between price, marginal revenue, and marginal cost differs. Natural monopolies can supply goods at lower costs. Compared to perfectly competitive firms, monopolies charge higher

0 views • 14 slides

The Polish Banking Sector 2013/2014 Overview

The data provides insights into the Polish banking sector for the years 2013 and 2014, including information on the number of banks, ownership structure, assets, profits, and the percentage of assets belonging to loss-bearing banks compared to other EU countries. There is a visible trend of increasi

0 views • 17 slides

Understanding Production, Economic Costs, and Profit Decisions

This lecture explores how firms make supply decisions by transforming inputs into outputs, incurring costs, and generating revenues to maximize profits. Topics covered include production theory, cost theory, economic profits, and short-run production relationships. Examples like managing a fast-food

0 views • 35 slides

Understanding Dividend Income, Trade, Business, and Professions

Dividend income is a share of profits distributed by a company to its shareholders in the form of money, shares, debentures, or other securities. Dividends are subject to tax, with resident companies typically paying a 10% tax on gross dividends. Certain exemptions apply for specific entities and si

0 views • 22 slides

Understanding Different Types of Shares in a Company

Shares in a company represent ownership in its share capital, with different classes like preference shares and equity shares offering varying rights and benefits to shareholders. Preference shares can be further categorized into cumulative, non-cumulative, participating, non-participating, redeemab

0 views • 11 slides

The Global Minimum Tax and MNE Profit Taxation

The OECD has conducted an extensive economic impact assessment of the Global Minimum Tax (GMT) for multinational enterprises (MNEs), focusing on tax rate differentials, profit shifting, low-taxed profits, and revenue gains. The research includes building a matrix of profit locations, assessing ETR h

0 views • 16 slides

Treatment of Expense Overruns and Lapse Profits in Asset Share Calculations

Exploring the adjustment of expense overruns against lapse profits in determining asset shares for participating businesses. The discussion covers factors, distribution of surplus, professional and regulatory frameworks, and scenarios from the UK. Questions and conclusions round off the analysis.

0 views • 20 slides

Concerns on NPRR649 Make-Whole Payments and Proposed Safeguards

Concerns have been raised regarding NPRR649 Make-Whole Payments in ERCOT, particularly focusing on the scope of compensation for lost profits and the potential risks associated with Option 1 and Option 2. Consumers proposed safeguards to limit exposure and manage make-whole payments effectively. The

0 views • 7 slides

Understanding Lost Profits in Business Contracts

Exploring key concepts related to lost profits in business contracts, including limitations clauses, acceptance criteria, material alterations, and the projection of future income. The instructions for calculating profits, descriptive statistics, and expected exposure in a business context are also

0 views • 9 slides

8 Ways to Help Scottish Businesses Reduce Energy Costs and Boost Profits

Learn how Zero Waste Scotland's Energy Efficiency Business Support Service funded by the Scottish Government and the European Regional Development Fund is offering free support and funding for Scottish businesses to reduce energy costs, cut carbon emissions, and increase profits. Discover informatio

0 views • 12 slides

Maximizing Profits with Sandy Dandy Dune Buggies

Learn how to maximize profits with Sandy Dandy Dune Buggies by solving a mathematical problem involving the number of Crawlers and Rovers. Through steps such as identifying variables, creating a summary table, stating inequalities, graphing the feasible region, and substituting vertex coordinates, y

0 views • 10 slides

Corporate Social Responsibility Legislation in India - Overview

The Corporate Social Responsibility (CSR) legislation in India mandates companies, including CPSEs, to allocate a portion of their profits towards CSR activities. This legislation came into force in 2014, requiring eligible companies to spend at least 2% of their average net profits from the past th

0 views • 9 slides

Tips for Maximizing Profits with Professional Flatbed Dispatch Services

Boost your logistics business with expert flatbed dispatch tips. Discover how to maximize efficiency and increase profits seamlessly

0 views • 6 slides