Mercer Farms Case Study Analysis: Corn Planting Decision

Mercer Farms, faced with the decision to switch from AA Corn to GM Corn, seeks to optimize profits while managing price uncertainties. Key issues include determining which corn type to plant in each field, handling GM corn price variations, and calculating profits from the recommended strategy. With detailed case facts and key players outlined, the analysis revolves around price data, planting decisions, and understanding Mercer Farms' position as a price taker in a competitive market.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Mercer Farms Case Student Coaching Notes

Top Ten LDC Concepts in Case Micro: #1: Opportunity cost Micro: #2: Comparative advantage Micro: #4: How prices affect resource allocation. Management Accounting: #8. How to use cost data in decision-making. What is relevant? Statistics: # 5. The concept of expected value and how to calculate it

Case Facts Key Players Mercer Farms Client Allen Mercer CEO Michael Bell Operations Manager Karen Lee Team Leader You have been hired by Karen s team

Case Facts Overview Mercer Farms owns four different fields and grows AA Corn Michael Bell wants Mercer Farms to switch to GM Corn His profit analysis is contained in Exhibit 1 Is based on a price of $3.25 for GM corn Assumes entire acreage is devoted to either AA or GM corn Ignores price uncertainty of GM corn Productivity differs across farms (See Exhibit 2) Mercer s income statements are available (See Exhibit 3) Forecasted price for GM corn (See Exhibit 4)

Case Facts: Price Data AA Corn is expected to sell for $ 5.00/bushel GM Corn has two possible prices. GM Corn: $ 5.50/bushel GM Corn: $ 4.70/bushel

Case Facts Key Issue What type of corn to plant in which field? How to deal with the uncertainty around GM corn s prices? What is differential profit from the recommended growing strategy?

When Does BF Know Prices? Assumption: Prices revealed before planting decision Today Actual Outcome Prices of GM corn known Action Date Planting decision made Analysis being done

Mercer Farms is a Price Taker Firm (Most Competitive Market) Mercer Farms is one of thousands of firms producing the same product. As such, they have no market power to set price, but take the price from the market. The market price is determined by the interaction of all the buyers (demand) and sellers (supply) of yellow corn.

Economic & Accounting Concepts of Profit Business firms attempt to maximize economic profit. ( ) = Total Revenue Total Economic Cost Total Revenue = Price x Quantity Total Economic Cost = the Opportunity Cost of the resources used in production Accounting Profit = Total Revenue Total Variable and Fixed Costs Incurred Cost is the actual amounts paid or obligations entered into for future payments

Comparative Advantage A resource (farm) has a comparative advantage in the production of a good (GM corn) if it has the lowest opportunity cost of production The four farms have differing relative abilities to produce AA or GM corn The production decision should compare each farm s gain (contribution margin) with the opportunity cost of production

Opportunity Cost of Production The opportunity cost of any output is the value of the best alternative given up The economic (opportunity) cost of producing GM corn depends on the amount of AA corn given up and the contribution margin from producing AA corn

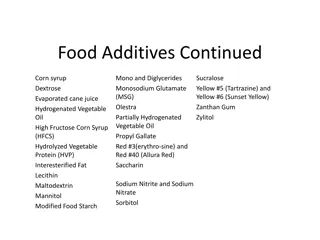

Cost Classifications Variable costs -- those that change with change in activity levels (e.g., units produced, service provided) in an organization Fixed costs -- those that do not vary with the activity level Incremental costs - the change in costs associated with changing the output above some base level or selecting one course of action over another Relevant costs - those costs that differ across alternative courses of action Opportunity costs - the benefit foregone by not using a limited resource in its best alternative use