Understanding Profits Prior to Incorporation in Company Law

This guest lecture at Smt. Maniben M.P. Shah Women's College delved into the topic of Profits Prior to Incorporation, covering definitions, legal provisions, accounting procedures, and treatment methods. The learning objectives included comprehending the concept, familiarizing with Companies Act regulations, and grasping the accounting logic behind profits before incorporation.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Guest Lecture at Smt. Maniben M.P. Shah Women's College of Arts & Commerce, Matunga. By CS Charul Y. Patel Asst. Professor, Department of Accountancy, SIES College of Commerce & Economics, Sion - East. 1

PROFITS PRIOR TO INCORPORATION 2

LEARNING OBJECTIVES ::::::: Understand the meaning of Profits Prior to Incorporation Learn various provisions of the Companies Act relating to Profits Prior to Incorporation Familiarize yourself with accounting procedure and modes of accounting Understand the logic behind the Profits Prior to Incorporation Learn the accounting treatment for Profits Prior to Incorporation 3

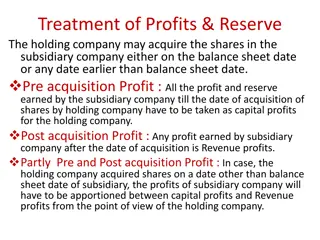

USE OF PPI : 10

EXAMPLE - IF THE DATE OF PURCHASE OF A RUNNING BUSINESS IS 1ST JANUARY 2005 , INCORPORATION IS 30TH JUNE 2005 AND THE YEAR ENDING IS 31ST DECEMBER 2005. THE DATE OF COMMENCEMENT OF BUSINESS IS 31ST OCTOBER 2005 13

Dt of Purchase of Co. : 01/10/08, Dt of Inc. : 01/02/09, Dt of commencement : 01/03/09 Sales from 01/10/08 to 01/02/09 : Rs. 2,00,000, Total Sales Rs. 12,00,000. Total Gross Profit Rs. 1,20,000. Year ending on 31st May. 17

Summary STEPS : 1) Calculate Time Ratio 2) Calculate Sales Ratio 3) Prepare Profit & Loss Account with columns for Profit prior to incorporation (PPI) and Profits Post incorporation 4) Allocate expenses 5) Compute the Profit prior to incorporation (PPI) to be transferred to Capital Reserve Account and Profits Post incorporation to be transferred to Goodwill Account 19