IPO in India: Overview and Eligibility Norms

An overview of the IPO process in India, including eligibility criteria for issuers. Covers net tangible assets, average operating profits, net worth, and lock-in periods.

12 views • 15 slides

www-systemskills-in-what-is-net-a-beginner-guide-to-learn-net-in-2024- (2)

.NET is a free, cross-platform, open-source framework developed by Microsoft. It supports the development and execution of various types of applications, including web, desktop, mobile, gaming, IoT, and more. A .NET developer is responsible for developing software using .NET technologies.

3 views • 2 slides

www-systemskills-in-what-is-net-a-beginner-guide-to-learn-net-in-2024- (2)

.NET is a free, cross-platform, open-source framework developed by Microsoft. It supports the development and execution of various types of applications, including web, desktop, mobile, gaming, IoT, and more. A .NET developer is responsible for developing software using .NET technologies.

0 views • 2 slides

Understanding Concepts of National Income in Economics

Explore the concepts of national income presented by Dr. Rashmi Pandey, covering key indicators such as Gross National Product (GNP), Gross Domestic Product (GDP), Net National Product (NNP), Net Domestic Product (NDP), Personal Income, Disposable Income, Per Capita Income, and Real Income. Gain ins

0 views • 22 slides

Emergency Communication Volunteer Training Overview

Introduction to Emergency Communication course covers a wide range of topics including net operations, net types, example net formats, net missions, and more. Participants will learn about the importance of structured communication networks during emergencies and disaster situations. The training em

1 views • 15 slides

Understanding Capital Assets and Financial Reporting

This presentation delves into the world of capital assets, focusing on their categorization, ownership, and reporting in financial statements. Key topics include the distinction between tangible and intangible assets, responsible asset management, and the implications of capital leases on ownership.

0 views • 61 slides

Macroeconomic Theory of the Open Economy by Udayan Roy

This presentation discusses key concepts related to the open economy, such as net exports equaling net capital outflow, national saving equaling domestic investment plus net capital outflow, the loanable funds theory of the real interest rate, and the relationship between saving, investment, and net

0 views • 31 slides

Capital Gains and Assets Overview in Income Tax Law and Accounts

This content provides an overview of capital gains and assets in income tax law and accounts, covering topics such as types of capital assets, assets not considered capital assets, kinds of capital assets (short-term and long-term), transfer year of chargeability, computation of capital gains, and c

0 views • 15 slides

Monitoring of Returned Assets: Abacha's Legacy in Nigeria

International efforts led by civil society in Nigeria and Switzerland have successfully monitored the return of assets linked to the Abacha regime. Initiatives like the Nigerian Network on Stolen Assets and the Conditional Cash Transfer program demonstrate transparency and accountability in handling

0 views • 10 slides

Understanding Net Force in Physics

Explore the concept of net force in physics, including balanced and unbalanced forces, the relationship between force and motion, and how net force affects an object's movement. Learn about scenarios where net force is zero, one force acts on an object, multiple forces cancel out, or combine to prod

0 views • 11 slides

Understanding IAS 39: Financial Instruments Recognition and Measurement

This content provides an overview of an IFRS seminar on IAS 39, focusing on key concepts such as the classification and measurement of financial assets, impairment, reclassification, and more. It covers definitions of financial instruments, financial assets, equity instruments, and financial liabili

1 views • 43 slides

Understanding Liquidation Estate and Key Asset Components

In the process of liquidation, the liquidator forms an estate comprising various assets of the corporate debtor for the benefit of creditors. These assets include ownership rights, tangible and intangible assets, proceeds of liquidation, and more. However, certain assets owned by third parties or he

0 views • 39 slides

University Asset Management Guidelines

University asset management guidelines cover the physical inventory policy, procedures, and fixed asset terminology for safeguarding, tracking, and reporting assets. Departments designate equipment liaisons to manage assets and conduct physical inventories regularly. Assets are categorized as capita

1 views • 21 slides

Working Capital and Current Ratio in Accounting

Understanding indicators like net current assets (working capital) and current ratio is crucial in accounting. Net current assets reflect the ability to settle current liabilities and the capital required for operational functions. Managing working capital effectively involves factors like stock man

0 views • 12 slides

A Comparison of ELI and UNIDROIT Principles on Digital Assets

A comparison between the principles of Electronic Liability Initiative (ELI) and the International Institute for the Unification of Private Law (UNIDROIT) regarding digital assets. ELI focuses on security over digital assets, while UNIDROIT covers a broader range, including transfers, custody, and m

0 views • 5 slides

Understanding Equitable Distribution in Florida

Equitable distribution in Florida, governed by statutes 61.075 and 61.076, determines the fair division of marital assets and liabilities in divorce cases. Key considerations include identification, valuation, distribution presumption, and justification for unequal distribution. Assets are classifie

0 views • 28 slides

Managing Debt and Protecting Client Assets in Victoria

Consumer Action Law Centre in Victoria focuses on assisting low-income clients in managing debt and protecting their assets. The presentation emphasizes assessing the need for debt payment, considering the client's financial position, and exploring options to handle debt where income and assets are

1 views • 29 slides

Understanding Society: Wealth and Assets Survey Research

The Wealth and Assets Survey (WAS) conducted by Oliver Tatum and Angie Osborn at the Understanding Society Research Conference in 2013 focuses on longitudinal issues, experiment design, research findings, and future plans related to the survey. The WAS background includes collecting data on personal

3 views • 28 slides

Accounting for Biological Assets and Agricultural Produce

At the end of this lesson, you will be able to identify the principal issues in accounting for biological assets and agricultural produce at the time of harvest. Topics include the recognition, measurement, presentation, and disclosure of biological assets in financial statements. Questions regardin

0 views • 26 slides

Accounting for Biological Assets and Agricultural Produce (LKAS 41: Agriculture) by Rangajewa Herath

This content provides insights into the accounting standards for biological assets and agricultural produce under LKAS 41, discussing classification, presentation, measurement, gain or loss recognition, and disclosure requirements. It covers the unique nature of biological assets, the scope of LKAS

0 views • 20 slides

Comprehensive Fixed Assets Management Guidelines for Educational Institutions

Explore a detailed guide on tracking and recording fixed assets in educational institutions, covering key aspects such as capital assets accounting procedures, general ledger accounts, and the definition of capital assets. Learn the minimum standards for valuing assets, recording guidelines, and the

0 views • 25 slides

Overview of Strong Motion Networks K-NET and KiK-net in Japan

The Strong Motion Networks K-NET and KiK-net in Japan, managed by the National Research Institute for Earth Science and Disaster Prevention, provide crucial data on ground motion during earthquakes. K-NET consists of surface stations in populated areas, while KiK-net comprises pairs of surface and b

1 views • 7 slides

Proposed Process Improvements for Fixed Assets Management

Implementing Oracle Fixed Assets for managing fixed assets and capital projects, the proposed process aims to streamline capitalization, improve financial reporting controls, and enhance operational efficiencies. By organizing accounts based on asset categories, tracking ownership, and providing det

0 views • 9 slides

Understanding Intangible Assets and Business Combinations in Accounting

In accounting, recognition of intangible assets as assets requires the expectation of future economic benefits flowing to the entity and reliable measurement of the asset's cost. Intangible assets acquired separately are recognized based on their fair value, while those acquired in business combinat

0 views • 23 slides

Understanding Impairment of Assets in Financial Management

Entities must periodically test for impairment to ensure assets are not overstated. An impairment loss occurs when an asset's carrying amount exceeds its recoverable amount. Assets like inventories and deferred tax assets may require testing. Learn when to undertake impairment tests, key indicators,

0 views • 19 slides

Understanding Net Investment in Capital Assets and Its Importance

Net Investment in Capital Assets is a critical component of an entity's financial position, reflecting the value of capital assets owned. It represents the portion of the net position that is not spendable as it is invested in assets. Calculating Net Investment in Capital Assets involves subtracting

1 views • 17 slides

Introduction to ASP.NET 4.5.1 - Building Dynamic Websites

Explore the fundamentals of ASP.NET 4.5.1, learn about the benefits of using ASP.NET for web development, understand the difference between static and dynamic websites, and discover the features of ASP.NET that make it a powerful web runtime engine. Get started with creating a new website using Visu

0 views • 25 slides

Understanding Net Worth: Integers and Financial Assets

Learn about net worth, liabilities, and assets by exploring how integers are used to determine the financial standing of individuals. Discover the concepts of liabilities, responsibilities, and assets through real-life examples of notable personalities. Dive into calculations and understand how net

0 views • 18 slides

Understanding Business Personal Property and Taxation Overview

Understanding Business Personal Property (BPP) is essential for businesses, as it encompasses tangible assets like fixed assets and inventory. BPP is used for income production and is subject to taxation in Texas. Properly reporting BPP through a rendition form is crucial to avoid penalties. Fixed a

0 views • 5 slides

Understanding ASP.NET Core: Features, Ecosystem, and Differences

ASP.NET Core is a modern framework for building web applications with cross-platform capabilities. It offers a leaner and modular approach compared to ASP.NET Framework. With support for both .NET Core and full .NET Framework, ASP.NET Core enables developers to create applications that can run on Wi

0 views • 9 slides

Understanding ADO.NET Architecture in VB.NET

ADO.NET is a crucial technology for connecting .NET applications to data sources, allowing access to databases. Its architecture includes components like Connection, Command, DataReader, DataAdapter, and DataSet. Each component plays a specific role in establishing connections, executing SQL queries

0 views • 13 slides

Understanding Tangible Property Regulations and Improvements

Explore the guidelines presented by David W. Jennings, CPA regarding tangible property regulations and determining the unit of property. Learn about amounts paid to improve tangible property, how to determine the unit of property, specifics related to buildings, and definitions of improvements and b

0 views • 17 slides

The Polish Banking Sector 2013/2014 Overview

The data provides insights into the Polish banking sector for the years 2013 and 2014, including information on the number of banks, ownership structure, assets, profits, and the percentage of assets belonging to loss-bearing banks compared to other EU countries. There is a visible trend of increasi

0 views • 17 slides

Comparative Financial Ratio Analysis 2018 for Higher Education Institutions

This analysis compares the Viability Ratio and Primary Reserve Ratio of peer and next-tier higher education institutions in 2018. The Viability Ratio assesses an institution's ability to cover its debt with expendable net assets, while the Primary Reserve Ratio measures how long an institution can o

0 views • 15 slides

Understanding Capital Assets in Financial Reporting

A capital asset is a long-term asset used in operations with a useful life extending beyond a single reporting period, such as land, buildings, and infrastructure. These assets are reported at historical cost, including ancillary charges. Special assets like works of art or historical treasures are

0 views • 35 slides

Understanding Taxation of Digital Goods and Tangible Personal Property in Alabama

Explore the taxation laws in Alabama regarding the digital delivery of tangible personal property and the classification of tangible personal property in sales tax cases. This content delves into specific court cases, definitions, and perspectives on the taxability of digital goods and software purc

0 views • 10 slides

Understanding Balance Sheets and Income Statements in Financial Reporting

Balance sheets provide a snapshot of a company's assets, liabilities, and shareholders' equity at a specific point in time, with assets listed on the left and liabilities and equity on the right. Current assets are those expected to be converted into cash within a year, while non-current assets are

0 views • 34 slides

Digital Assets and Social Media Estate Planning

Explore the world of digital assets and social media estate planning presented by Patricia E. Kefalas Dudek & Howard H. Collens. Understand what digital assets entail, the categories they fall into, and how to assist clients in planning for their digital legacies. Learn about the importance of estat

0 views • 56 slides

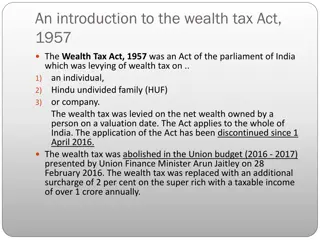

Introduction to Wealth Tax Act, 1957 in India

The Wealth Tax Act, 1957 was a legislation in India that imposed a tax on the net wealth of individuals, Hindu undivided families (HUFs), and companies. The Act ceased to be applied from April 1, 2016, and was replaced with a surcharge on the super-rich. The Act defined net wealth as the difference

0 views • 12 slides

Updates on Nonprofit Financial Statements and Net Assets

Stacy Smith, a CPA Shareholder at Mize Houser & Company, discusses key changes in nonprofit financial statements brought about by ASU 2016-14. The update includes improvements in presenting operating cash flows, net asset classes, liquidity information, expense reporting, and investment return. The

0 views • 32 slides