Managing Interest Rate and Currency Risks: Strategies and Considerations

Interest rate and currency swaps are powerful tools for managing interest rate and foreign exchange risks. Firms face interest rate risk due to debt service obligations and holding interest-sensitive securities. Treasury management is key in balancing risk and return, with strategies based on expect

4 views • 21 slides

Elevate your Dream Mortgage Companies in Raleigh NC

Looking for reputable mortgage companies in Raleigh, NC? Navigate the local market with ease by bookmarking this guide. Discover trusted lenders offering competitive rates and personalized service tailored to your needs. Make informed decisions when securing your dream home in Raleigh, NC, by bookma

2 views • 5 slides

Lowering the Burden: Tax Deduction Strategies for NRIs in England from India

Discover efficient tax deduction strategies tailored for Non-Resident Indians (NRIs) residing in England but originating from India. Our comprehensive guide, 'Lowering the Burden,' explores nuanced tax-saving approaches, ensuring NRIs maximize benefits while meeting legal obligations. From understan

4 views • 3 slides

Smooth Homeownership with a Home Mortgage Broker in Raleigh, NC

Purchasing a home is one of the most significant financial decisions you'll make in your lifetime. To ensure a smooth and successful journey, enlisting the help of a knowledgeable Home Mortgage Broker In Raleigh, NC, Blackwell Mortgage offers expert guidance and personalized services to help you nav

11 views • 5 slides

Residential Mortgage Solutions | Thehomeloanarranger.com

Utilize Residential Mortgage Solutions offered by Thehomeloanarranger.com to effortlessly locate your ideal residence. We are available to help you secure the perfect loan for your new home.\n\n\/\/thehomeloanarranger.com\/mortgage-calculator\/

3 views • 1 slides

Colorado Mortgage Refinance Calculator | Thehomeloanarranger.com

Utilize Thehomeloanarranger.com Colorado Mortgage Refinance Calculator to ascertain your potential savings. Immediately reduce your mortgage expenses and discover the most favorable interest rates!\n\n\/\/thehomeloanarranger.com\/home-refinance-loans\/

4 views • 1 slides

Overview of Tanzania Mortgage Refinance Company Limited (TMRC)

TMRC is a private financial institution in Tanzania that supports banks in mortgage lending by refinancing their portfolios. It operates as a mortgage liquidity facility for long-term mortgage lending activities by Primary Mortgage Lenders. TMRC's model is based on successful liquidity facilities an

0 views • 22 slides

Understanding Mortgage Derivatives and Risk Management

Mortgage derivatives such as Interest Only (IO) and Principal Only (PO) strips, as well as Collateralized Mortgage Obligations (CMOs), offer investors a way to manage risk more precisely than traditional mortgage-backed securities. By allowing control over interest rate and default risks, these soph

0 views • 80 slides

Understanding Compound Interest and Simple Interest Formulas

Interest rates play a crucial role in financial transactions. Compound interest is earned on both the principal and accumulated interest, while simple interest is earned solely on the principal amount. Different compounding frequencies affect the overall interest earned. Learn how to calculate simpl

1 views • 14 slides

Understanding Compound Interest in Class VIII Mathematics

In this chapter, students will learn about simple interest and compound interest, memorize their formulas, derive compound interest formula from simple interest concept, calculate compound interest with different compounding frequencies, understand growth and depreciation concepts, and derive formul

1 views • 29 slides

Understanding Syndicated Mortgage Investments: Key Information and Regulations

Syndicated Mortgage Investments (SMIs) involve multiple lenders participating in a mortgage, with distinctions between Qualified SMIs (QSMIs) and Non-Qualified SMIs (NQSMIs). The presentation covers the definition of SMIs, requirements for QSMIs, registration processes, compliance obligations, and c

0 views • 22 slides

Evolution of Computer Logic: From Axioms to Natural Deduction

Delve into the fascinating pre-history of computer logic, starting from David Hilbert's foundational problems in mathematics to the development of the Dedekind-Peano axioms for natural numbers. Explore Hilbert's finitist consistency program and the evolution of logic systems from Hilbert's axioms to

0 views • 26 slides

Impact of 2018 Tax Act: Key Changes Explained

Explore how the new 2018 tax act impacts taxpayers, including changes to deductions, tax brackets, and the SALT deduction. Learn about the standard deduction increase, personal exemptions elimination, new tax brackets, and more insights from a CPA.

0 views • 34 slides

Mortgage Origination in South Africa: Role and Regulation Overview

Mortgage originators, key players in the home loan industry, connect banks and consumers to facilitate competitive credit access. The regulatory landscape, governed under the Financial Sector Regulation Act, ensures transparency and consumer protection. The issue of dual regulation raises concerns,

0 views • 11 slides

Find the Right Solutions with a Mortgage Broker in Melbourne

Finding the ideal mortgage can be overwhelming, particularly given the myriad options available. Many people find themselves unsure of where to start or how to secure better rates. \n\nAs an expert mortgage broker in Melbourne, we simplify the proces

5 views • 5 slides

Code Assignment for Deduction of Radius Parameter (r0) in Odd-A and Odd-Odd Nuclei

This code assignment focuses on deducing the radius parameter (r0) for Odd-A and Odd-Odd nuclei by utilizing even-even radii data from 1998Ak04 input. Developed by Sukhjeet Singh and Balraj Singh, the code utilizes a specific deduction procedure to calculate radius parameters for nuclei falling with

1 views • 12 slides

Understanding Consumer Duty in Mortgage and Protection

The Mortgage and Protection Event discussed the new FCA Consumer Duty rules and guidance, emphasizing the importance of good consumer outcomes. Mortgage intermediary firms need to assess their current practices against the new standards to ensure fair treatment and monitoring of outcomes. The scope

3 views • 12 slides

Understanding Interest Rates and Time Value of Money

This chapter delves into interest rate measurement, defining the force of interest, simple interest, and variable force of interest, along with the concept of time value of money. It explains amount functions, compound interest, effective rate of interest, and includes examples to illustrate calcula

0 views • 20 slides

Understanding Mortgage Arrears, Repossessions, and Legal Obligations in Ireland

Explore the laws surrounding mortgage arrears, repossession figures, key statistics, the Code of Conduct on Mortgage Arrears (CCMA), and legal standings in Ireland. Learn about the implications of arrears lasting over two years, the mandatory pre-litigation resolution process, and recent court rulin

0 views • 15 slides

Overview of Association of Fundraising Professionals (AFP) and Charitable Act Impact

AFP comprises 27,000+ members across 180 chapters globally who raise over $115 billion annually for charitable causes. Members must adhere strictly to the AFP Code of Ethics, promoting honesty, integrity, and transparency in fundraising efforts. The Charitable Act (S.566/H.R.3435) aims to renew the

0 views • 5 slides

Understanding Logic in Research: Abduction, Deduction, and Induction

Explore the fundamental concepts of logic in research including abduction, deduction, and induction. Learn about hypothesis testing, material implication, and the relationship between theory and data. Gain insights into how knowledge is generated through accumulating data and the self-correcting pro

0 views • 28 slides

Overview of Residential Mortgage Types and Borrower Decisions

This content delves into various types of residential mortgages and borrower decisions, covering topics such as the primary and secondary mortgage markets, 30-year fixed-rate mortgages, prime conventional mortgage loans, FHA mortgages, and other types like purchase money mortgages, piggyback loans,

0 views • 12 slides

Understanding Compound Interest: A Practical Guide

Compound interest is a powerful financial concept that can significantly impact your savings and investments. This guide explains how compound interest works using geometric series and provides a step-by-step solution to a compound interest problem. Learn about the types of interest, the difference

0 views • 26 slides

Ohio Small Business Investor Income Deduction Overview

Ohio offers a 50% Small Business Investor Income Deduction for individuals, allowing up to $250,000 of small business investor income to be deducted at 50% for taxable years 2013 and beyond. This deduction is reported on Schedule IT SBD and Form IT1040 Schedule A. The deduction is favorable for busi

0 views • 46 slides

Exploring the Wealth Market Opportunities for Mortgage Intermediaries

Delve into the world of lending in the wealth market with a focus on the 1m plus market, Coutts proposition, and business development support available specifically for mortgage intermediaries. Learn about the market trends, distribution insights, and the range of products offered. Discover the proc

0 views • 12 slides

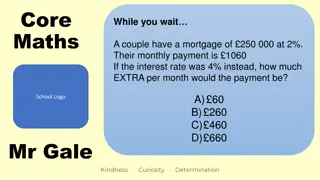

Personal Finance: Mortgage Payment Calculation

This content discusses a personal finance scenario involving a couple with a $250,000 mortgage at 2% interest. It explains how to calculate the extra monthly payment amount if the interest rate increases to 4%. The formula for the mortgage calculation is also provided. Additionally, it mentions a qu

0 views • 19 slides

Refinancing Cross-Subsidies in the UK Mortgage Market Analysis

In-depth analysis of price dispersion and cross-subsidies in the UK mortgage market, exploring winners and losers, benchmark models, measurement of cross-subsidies through data analysis, and the impact of contract structures. The study delves into the micro-foundations of adjustment costs and the ro

0 views • 13 slides

Nevada Department of Business & Industry Division of Mortgage Lending Information

The Nevada Department of Business & Industry's Division of Mortgage Lending regulates mortgage-related activities in the state, aiming to foster professionalism and compliance while ensuring consumer protection. Mortgage brokers can find valuable resources, updates, and guidance on the MLD website,

0 views • 32 slides

Understanding Reverse Mortgage Math and Rate Sheets

This comprehensive guide explains how to read a rate sheet, understand reverse mortgage math, and navigate the factors influencing loan pricing. Topics covered include Principal Limit, Principal Limit Factor, Margin, Initial Rate, Expected Rate, and Loan Comparison. By delving into these details, pa

0 views • 19 slides

Evolution of Mortgage Market Through the Years

Explore the timeline of the mortgage market evolution from the early 1900s to the creation of Fannie Mae, Freddie Mac, and the CDCU Mortgage Center. Learn about key milestones such as the introduction of 30-year fixed-rate loans, secondary market development, and specialized loan programs. Discover

0 views • 11 slides

Updates and Reconciliation Information for WRS Central Benefits

This document provides updates on earnings codes, deduction remittance, and December 2019 remittance reporting for WRS Central Benefits. It outlines new processes, deadlines, and responsibilities related to annual reconciliation and reporting. Key points include the creation of new earnings codes, a

0 views • 18 slides

Enhancing Literature Analysis Skills Through Inference and Deduction

Explore a lesson plan focused on developing inference and deduction skills in literature analysis. Students will engage with texts, answer differentiated questions, and work collaboratively to analyze themes, characters, language, and structural features. The lesson includes practice in selecting qu

0 views • 17 slides

Division of Mortgage Lending in the State of Nevada

The Division of Mortgage Lending in Nevada oversees mortgage brokers, bankers, agents, and servicers to ensure industry compliance and consumer protection. Their mission includes promoting professionalism, education, and ethics while fostering a competitive market. Mortgage brokers can find resource

0 views • 32 slides

Understanding the Impact of Mortgage Interest Deduction on the Housing Market

The Mortgage Interest Deduction (MID) is a significant tax expenditure in the U.S., often associated with promoting homeownership. However, research suggests that its impact on increasing affordability and homeownership is limited, particularly for high-income households. The regressive nature of th

0 views • 6 slides

Analysis of Political and Economic Factors in the U.S. Mortgage Default Crisis

This research paper by Justin Wolfers delves into the correlations between voting patterns, constituent interests, and economic conditions amidst the U.S. Mortgage Default Crisis. It highlights how legislators respond to constituent interests, including voting for bills that impact mortgage default

0 views • 24 slides

Government Support Program "Abhaile" for Resolving Home Mortgage Arrears

Abhaile is a government-supported program aimed at providing free advice and assistance to homeowners facing mortgage arrears, helping them find the best solutions to remain in their homes. The program offers access to expert financial and legal guidance, with various initiatives such as Dedicated M

0 views • 14 slides

Managing Mortgage Interest Payments and Buy-Downs in Rising Rates Scenario

Understanding Mortgage Interest Differential (MID) payments and the concept of buy-downs to adjust mortgage terms in the face of rising interest rates. Learn about calculations and necessary information for managing mortgage payments effectively.

0 views • 19 slides

Understanding the Mortgage Market: Key Concepts and Trends

The mortgage market is a critical component of the financial system, providing long-term loans secured by real estate. This comprehensive overview covers topics such as mortgages types, loan characteristics, lending institutions, and the history of mortgages. It explores the evolution of mortgage fi

0 views • 42 slides

Improve Your Cash Flow with Mortgage Refinance Solutions

Mortgage refinance allows homeowners to replace their existing mortgage with a new one, often with better terms. \nThis process can lower your monthly repayments, shorten the loan term, or switch you from an interest-only to a principal and interest

1 views • 4 slides

Understanding Interest and Calculating Simple Interest

In the realm of financial education, interest plays a crucial role both in savings and debt. Interest on savings helps you earn money, while interest on debt results in paying back more than borrowed. This article explains the concept of interest, how to calculate simple interest, and the difference

0 views • 8 slides