Understanding Diffusion Weighted Imaging (DWI) in Neuroimaging Research

This content delves into the significance of Diffusion Weighted Imaging (DWI) in studying the motion of water molecules in brain tissue. It explains how water diffusion varies in different brain matter types and explores techniques like Diffusion Tensor Imaging (DTI). The impact factors on diffusion

4 views • 25 slides

Understanding Non-Weighted Codes and Excess-3 Code in Binary Systems

Explore non-weighted binary codes like Excess-3 code, learn how to convert decimal numbers to XS-3 code, advantages and disadvantages of BCD codes, and steps to convert Excess-3 code to binary. Discover the intricacies of binary coding systems with practical examples.

5 views • 55 slides

Understanding the Quantity Theory of Money

The quantity theory of money posits a direct relationship between the supply of money in an economy and price levels, assuming a constant velocity of money and economic activity. Increases in the money supply lead to price inflation, devaluing currency and decreasing purchasing power. Two main versi

2 views • 6 slides

Buy Fake Money Canada - undetectablecounterfeitbills.com

Buy Fake Money Canada, also known as prop money or play money, is currency that looks like real money but is not legal tender.\nText\/ WhatsApp: 1 (507) 544-8062\nEmail: info@undetectablecounterfeitbills.com\n

0 views • 3 slides

CAN YOU BUY COUNTERFEIT MONEY ONLINE - UNDETECTABLECOUNTERFEITBILLS.COM

The term \"counterfeit money\" describes counterfeit money that is created without official government approval and usually is an intentional attempt to mimic real money. The act of creating counterfeit money has a long history; the first instances can be found in ancient Greece and China. Contact:

1 views • 5 slides

Understanding Your GPA: Weighted vs. Unweighted, College Admission, and Scholarships

GPA, or Grade Point Average, plays a crucial role in college admission and scholarship opportunities. Understanding the difference between weighted and unweighted GPAs is essential. Weighted GPAs give more weight to advanced classes like AP and Dual Enrollment, impacting your overall GPA calculation

0 views • 11 slides

Understanding the Quantity Theory of Money: Fisher vs. Cambridge Perspectives

The Quantity Theory of Money explains the relationship between money supply and the general price level in an economy. Fisher's Equation of Exchange and the Cambridge Equation offer different perspectives on this theory, focusing on money supply vs. demand for money, different definitions of money,

0 views • 7 slides

Evolution of Money: From Barter to Electronic Banking

Money has evolved from the barter system to electronic banking through various stages like animal money, metallic money, paper money, and credit money. The invention of money was crucial to overcome the limitations of barter, leading to the ideal utilization of resources and solving issues like the

0 views • 14 slides

Understanding Sale or Return (or Sale on Approval) in Financial Accounting

In financial accounting, the concept of Sale or Return (or Sale on Approval) involves sending goods to parties with the option to approve, accept, purchase, or return them within a specified time. This system is commonly used for introducing new products, where ownership transfer occurs only upon ac

0 views • 5 slides

SHRA Performance Appraisal Policy Guidelines

The SHRA Performance Appraisal Policy outlines the performance cycle, expectations, responsibilities, calibration sessions, setting of expectations, weighted goals, and more. Employees are encouraged to actively participate, ask questions, and keep supervisors informed. Supervisors are expected to p

0 views • 39 slides

Understanding Risk and Return in Corporate Finance

Exploring risk and return in market history is crucial for determining appropriate returns on assets. By analyzing dollar returns, percentage returns, holding period returns, and capital market returns, investors can grasp the risk-return tradeoff. Lessons from capital market return history emphasiz

4 views • 18 slides

Understanding the Value of Money and Standards

The value of money refers to its purchasing power, which is influenced by the price level of goods and services. Different standards, such as wholesale, retail, and labor, help measure the value of money. Money can have internal and external value, affecting domestic and foreign transactions. The Qu

0 views • 62 slides

Understanding Money: Year 2 Lesson 7 on Adding Money Methods

Year 2 Money Lesson 7 focuses on using different methods to add money, such as counting on and partitioning. Students learn to find the total by combining amounts in various ways, including mixing notes and coins, differentiating values, and working with pounds and pence. The lesson includes activit

1 views • 26 slides

Primal-Dual Algorithms for Node-Weighted Network Design in Planar Graphs

This research explores primal-dual algorithms for node-weighted network design in planar graphs, focusing on feedback vertex set problems, flavors and toppings of FVS, FVS in general graphs, and FVS in planar graphs. The study delves into NP-hard problems, approximation algorithms, and previous rela

0 views • 17 slides

Lateral Ankle Sprains Return to Basketball Presentation

This presentation focuses on the return-to-sport guidelines for basketball players after a lateral ankle sprain. It covers the prevalence of ankle sprains in basketball, the PAASS framework for assessment, specific tests for return-to-sport decisions, common impairments, athlete perception, sensorim

6 views • 16 slides

Understanding the Time Value of Money in Finance

The time value of money is a crucial concept in finance, indicating the varying worth of money over time. It explains why receiving a sum of money today is more valuable than receiving the same amount in the future due to factors like investment opportunities, inflation, risk, and personal consumpti

0 views • 9 slides

Understanding Money and Monetary Policy in Economics

Money serves as a medium of exchange, store of value, and unit of account in an economy. It is vital for economic transactions and stability. The quantity of money is measured using concepts like liquidity and monetary aggregates. The demand for money is linked to the Quantity Theory of Money, which

2 views • 12 slides

Understanding the Capital Asset Pricing Model (CAPM) for Required Return Calculation

Learn about the Capital Asset Pricing Model (CAPM) and how to calculate the required return on an investment using this model. Explore key concepts such as stock return, market return, beta calculation, and more with a practical example involving Riyad Bank and Tadawul All Shares Index. Utilize dail

1 views • 35 slides

Understanding Weighted Moving Average Charts for Process Monitoring

Weighted moving average charts are powerful tools for detecting small shifts and trends in process means. By utilizing Uniformly Weighted Moving Average (UWMA) charts and Exponentially Weighted Moving Average (EWMA) charts, organizations can monitor and identify changes in process means with precisi

1 views • 29 slides

Noise & Error Shaping in Discrete-Time DSMs EECT 7V88 - Fall 2021

Explore the intricacies of noise and error shaping in DSMs with Professor Y. Chiu's course on Discrete-Time DSMs for EECT 7V88 in Fall 2021. Delve into DAC architectures including Nyquist, binary-weighted, and more. Learn about Binary-Weighted CR DAC, CP Cu, capacitor arrays, gain errors, nonlineari

0 views • 30 slides

Understanding the Cost of Capital in Finance

The cost of capital is crucial for businesses to determine the average cost of their finance. The Weighted Average Cost of Capital (WACC) is used as a discount rate in financial calculations. It involves estimating the cost of each source of finance and calculating a weighted average. Additionally,

0 views • 14 slides

Understanding Weighted Price Indices in Economics

Weighted price indices are essential in economics to measure changes in prices over time. Different methods such as Laspeyre's and Paasche's price indices offer ways to calculate these indices using weighted averages. Fisher's index combines both methods to provide a comprehensive view. The weighted

3 views • 9 slides

Sewing Club Making Weighted Bibs for Infants at MUSC Children's Hospital

Our Buist Sewing Club, inspired by the unity during the Bosnian War, creates weighted bibs for infants at MUSC Children's Hospital. These bibs provide comfort and aid in circulation post-surgery, benefitting over 137,000 children annually. Through our diverse group, we aim to make a positive impact

0 views • 15 slides

District Campus Return Plan Overview

The District Campus Return Plan, led by Bret Watson, VP of Finance & Administrative Services, outlines a phased approach for the safe return of students and staff to campus following state and county guidelines. The plan includes pre-planning, preparing buildings and classrooms, acquiring PPE, imple

0 views • 9 slides

Sound Money and the Future of Money by Nicolas Cachanosky

Sound money ensures monetary equilibrium where money demand equals money supply, essential for a stable economy. Explore the evolution of monetary institutions, cashless economies, and cryptocurrencies with Professor Nicolas Cachanosky's insightful perspective on the future of money.

0 views • 27 slides

Understanding Money: Functions, Properties, and Importance

Explore the essential aspects of money, including its functions as a medium of exchange, standard of value, and store of value. Discover the key properties of money such as durability, portability, divisibility, economic stability, scarcity, and acceptability. Uncover the historical evolution of mon

0 views • 11 slides

Effect of Weighted Sled Towing and Weighted Vest on Sprinter Acceleration Performance

Short distance running involves crucial phases affecting sprint performance, with acceleration being particularly important. Training methods like weighted sled towing and weighted vest usage have been found effective in enhancing sprint acceleration. This study investigated the impact of these meth

0 views • 8 slides

Understanding Internal Rate of Return (IRR) in Investments

Internal Rate of Return (IRR) is a method used to assess the profitability of potential investments by calculating the discount rate that makes the net present value of an investment zero. It considers the time value of money and helps in comparing projects based on their returns relative to costs.

0 views • 5 slides

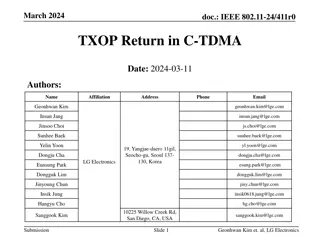

IEEE 802.11-24/411r0 TXOP Return in C-TDMA

This document discusses the TXOP return mechanism in C-TDMA operation for IEEE 802.11 networks. It explores the importance of timely TXOP return for efficient utilization of medium and proposes considerations for implementing TXOP return in C-TDMA. Various TXOP return scenarios and frame types are a

0 views • 11 slides

Choosing Between Money-Weighted Return & Time-Weighted Return in CFA Level 1 Exam

Learn the differences and implications of Money-Weighted Return (MWRR) and Time-Weighted Return (TWRR) for your CFA Level 1 exam. Understand how to calculate these returns, their characteristics, and when each method is appropriate. Clear your calculator before computations, and remember the key tip

0 views • 12 slides

Understanding the Investment Process and Rate of Return

Investors choose to invest by saving instead of spending to trade off present consumption for larger future consumption. The rate of return on an investment is measured by factors such as the pure rate of interest, time value of money, inflation impact, and risk premium. Investments involve committi

0 views • 41 slides

Understanding Markowitz Risk-Return Optimization

Modern portfolio theory, introduced by Harry Markowitz, aims to maximize expected return while managing risk. Efficient portfolios are represented by points on the efficient frontier, diversifying investments for optimal risk-return trade-offs. The risk-expected return relationship is depicted graph

0 views • 16 slides

Understanding Cost Variants in Healthy Diets: Least Cost vs Preference Weighted

The discussion delves into the concept of least-cost versus preference-weighted healthy diets, highlighting the differences in cost and food selection. It explores how preference weighting takes into account food preferences of low-income consumers, providing insights into the affordability and cult

0 views • 18 slides

Understanding Weighted Average Cost Method in Accounting

The weighted average cost method is a crucial approach in valuing inventory for businesses. It calculates the average cost of all inventory items based on individual costs and quantities held in stock. By dividing the cost of goods available for sale by the number of units available, this method det

0 views • 5 slides

Return Migration and Development: Theoretical Perspectives and Insights from the Albanian Experience

Keynote lecture by Russell King at the 2nd Annual Conference of the Western Balkans Migration Network discussing the relationship between return migration and development. Topics include definitions and measures of migration and development, unpacking the migration-development nexus, theorizing retu

1 views • 20 slides

Understanding Money Laundering Regulations and Professional Integrity in Financial Services

Money laundering is the process of disguising criminal proceeds to make them appear legitimate. This illicit activity involves three stages - placement, layering, and integration. International cooperation is essential in combating money laundering, with organizations like the Financial Action Task

0 views • 9 slides

Evolution of Money: From Barter to Fiat Currency

The evolution of money traces back to barter economies where a mutual coincidence of wants was necessary for trade. Settlers in Colonial America used commodity money and fiat money, with specie coins becoming popular due to their mineral content. The term "dollars" originated from the German pronunc

0 views • 60 slides

Difference Between Capital Market and Money Market: A Comprehensive Overview

The capital market and money market serve different purposes in the financial world. While the capital market provides funds for long-term investments in securities like stocks and debentures, the money market deals with short-term borrowing and lending of funds. The capital market acts as a middlem

0 views • 4 slides

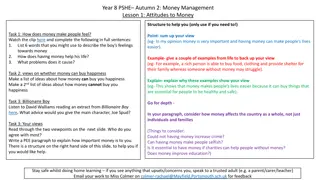

Money Management Lessons for Year 8 PSHE Students

Explore attitudes towards money, learn about budgeting, and consider the impact of money on happiness and life choices in this comprehensive PSHE lesson for Year 8 students. Activities include analyzing feelings towards money, discussing the relationship between money and happiness, budgeting hypoth

0 views • 9 slides

Money Creation and Banking in Modern Economies

This content delves into the concepts of money creation, banking, balance sheets, assets, liabilities, equity, central bank reserves, credit money creation, credit money destruction, cash, different types of money, as well as risks for banks. It covers various aspects of modern banking systems and t

0 views • 24 slides