Understanding the Time Value of Money in Finance

The time value of money is a crucial concept in finance, indicating the varying worth of money over time. It explains why receiving a sum of money today is more valuable than receiving the same amount in the future due to factors like investment opportunities, inflation, risk, and personal consumption preferences. Techniques like compounding and discounting help in calculating the time value of money.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Time Value of Money An important principle in finance is that the value of money is time dependent. The value of a unit of money is different in different time periods. The value of a sum of money received today is more than its value received after some time. Conversely, a sum of money received in future is less valuable than it is today. The time value of money is also referred as time preference for money.

Reasons for Time Value of Money Investment Opportunities: Money has the potential to grow over a period of time because it can be invested somewhere. For example, if Rs. 1000 can be invested in a fixed deposit for one year at 7% p.a., the money will grow to Rs, Rs. 1070 at the end of one year. Therefore, given the choice of Rs. 1000 now or the same amount in one year s time, it is always preferable to take Rs. 1000 now. Inflation: Inflation is the fall in the purchasing power of money. It makes money cheaper and the goods and services costlier. Suppose you can buy 1 kg of rice with Rs. 50 today. If the inflation rate is 10%, You need Rs. 55 to buy 1 kg of rice a year from now.

Reasons for Time Value of Money Risk: Money received now is certain, whereas money tomorrow is less certain. This bird in the hand principle is extremely important in investment appraisals. Personal consumption preference: Many people have a strong preference for immediate rather than delayed consumption. For a hungry man, promise of a meals next month means nothing.

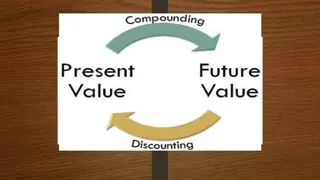

Techniques Two methods to calculate the time value of money Compounding Technique Discounting Technique

Compounding Technique In compounding technique, interest is added (compounded) to the initial deposit (principal) and becomes part of the principal at the end of each compounding period. Annual compounding, semi-annual compounding, quarterly compounding, monthly compounding etc.

Compounding Technique Formula A = P (1+i)n In which A = Amount at the end of the period P= Principal at the beginning of the period i = Rate of interest N= number of years

Compounding Technique Formula For semi-annual compounding, the formula is: A = P (1+i/2)n x2 For quarterly compounding, the formula is: A = P (1+i/4)n x4 Alternatively, for compounding more than once a year, the formula can be expressed as: A = P (1+i/m)n xm Where m = number of times per year compounding is made.

Compound value table file:///C:/Users/JM/Documents/Financial%20management/compound%20valu e%20table.jpg

Present value table APPENDIX B_ PRESENT VALUE AND FUTURE VALUE TABLES - Taxation for Decision Makers, 2012 Edition [Book].html