BUY AED 20 ONLINE — GLOBCOFF.COM

Many websites offer fake money online, but if you are new to this, it is simpler to investigate the providers of fake money because most of them are not very reliable. You risk losing your hard-earned money if you are not careful. Buy AED 20 Online from us now. Fortunately for you, globcoff.com a di

4 views • 1 slides

Understanding Financial Markets in India

Financial markets play a crucial role in connecting lenders and borrowers, providing avenues for investment and capital generation. In India, the financial system includes money markets and capital markets, offering diverse financial products and opportunities for investors. Money markets deal with

2 views • 106 slides

Understanding the Quantity Theory of Money

The quantity theory of money posits a direct relationship between the supply of money in an economy and price levels, assuming a constant velocity of money and economic activity. Increases in the money supply lead to price inflation, devaluing currency and decreasing purchasing power. Two main versi

2 views • 6 slides

Buy Fake Money Canada - undetectablecounterfeitbills.com

Buy Fake Money Canada, also known as prop money or play money, is currency that looks like real money but is not legal tender.\nText\/ WhatsApp: 1 (507) 544-8062\nEmail: info@undetectablecounterfeitbills.com\n

0 views • 3 slides

CAN YOU BUY COUNTERFEIT MONEY ONLINE - UNDETECTABLECOUNTERFEITBILLS.COM

The term \"counterfeit money\" describes counterfeit money that is created without official government approval and usually is an intentional attempt to mimic real money. The act of creating counterfeit money has a long history; the first instances can be found in ancient Greece and China. Contact:

1 views • 5 slides

Understanding Markets and Economic Structures

Markets play a crucial role in bringing buyers and sellers together for transactions. This article discusses the concept of markets, different types of markets in a capitalist economy, focusing on perfect competition. It outlines the features and conditions of perfect competition, emphasizing the im

2 views • 42 slides

Understanding the Quantity Theory of Money: Fisher vs. Cambridge Perspectives

The Quantity Theory of Money explains the relationship between money supply and the general price level in an economy. Fisher's Equation of Exchange and the Cambridge Equation offer different perspectives on this theory, focusing on money supply vs. demand for money, different definitions of money,

0 views • 7 slides

Evolution of Money: From Barter to Electronic Banking

Money has evolved from the barter system to electronic banking through various stages like animal money, metallic money, paper money, and credit money. The invention of money was crucial to overcome the limitations of barter, leading to the ideal utilization of resources and solving issues like the

0 views • 14 slides

Understanding the Significance of the Bond Market for Government and Corporations

The bond market serves as a crucial source for fundraising for governments and public corporations. Investors use money markets for short-term needs and capital markets for long-term investments to manage risks. Various types of bonds are available, including Treasury notes and bonds, agency bonds,

0 views • 20 slides

Understanding Financial Economics and Its Importance in Markets

Financial economics is a branch of economics focused on the distribution of resources in uncertain markets. It involves making decisions considering future events and creating models to analyze variables affecting decisions. Key aspects include working out portfolio risks and utilizing financial ins

0 views • 129 slides

Understanding the Value of Money and Standards

The value of money refers to its purchasing power, which is influenced by the price level of goods and services. Different standards, such as wholesale, retail, and labor, help measure the value of money. Money can have internal and external value, affecting domestic and foreign transactions. The Qu

0 views • 62 slides

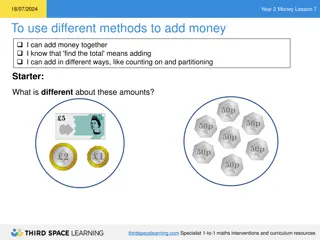

Understanding Money: Year 2 Lesson 7 on Adding Money Methods

Year 2 Money Lesson 7 focuses on using different methods to add money, such as counting on and partitioning. Students learn to find the total by combining amounts in various ways, including mixing notes and coins, differentiating values, and working with pounds and pence. The lesson includes activit

1 views • 26 slides

Understanding Say's Law of Markets in Economics

Say's Law of Markets, a theory from classical economics, posits that the ability to purchase is dependent on the ability to produce and generate income. This principle highlights that production drives economic growth, emphasizing the importance of encouraging production over consumption. The law re

0 views • 9 slides

Understanding the Importance of Money Markets and Bond Markets

Money markets play a crucial role in the financial system by providing short-term, low-risk, and liquid investment options. Participants include institutional investors and dealers who engage in large transactions. Money market securities have specific characteristics, such as large denominations, l

0 views • 23 slides

Understanding the Relationship Between Capital Market and Money Market

The relationship between the capital market and money market is significant as they are interconnected in various ways. Both markets cater to different fund requirements, but share common features such as inter-related interest rates, common institutions, similar users of funds, and common investors

0 views • 6 slides

Understanding the Time Value of Money in Finance

The time value of money is a crucial concept in finance, indicating the varying worth of money over time. It explains why receiving a sum of money today is more valuable than receiving the same amount in the future due to factors like investment opportunities, inflation, risk, and personal consumpti

0 views • 9 slides

Understanding Money and Monetary Policy in Economics

Money serves as a medium of exchange, store of value, and unit of account in an economy. It is vital for economic transactions and stability. The quantity of money is measured using concepts like liquidity and monetary aggregates. The demand for money is linked to the Quantity Theory of Money, which

2 views • 12 slides

Understanding International Financial Markets: Key Insights and Considerations

International Financial Markets play a crucial role for Multinational Corporations (MNCs) in accessing foreign exchange, money, credit, bond, and stock markets. MNCs leverage the international money market for various purposes like borrowing short-term funds in foreign currencies and investing for h

0 views • 25 slides

Understanding Financial Instruments and Markets

Explore asset classes like fixed income securities, money market instruments, and capital market instruments. Learn about different financial instruments in various markets including money market, bond market, equity markets, and derivative markets. Dive into money market instruments like Treasury b

0 views • 47 slides

Understanding Matching Theory in Two-Sided Markets

Matching theory explores the dynamics of two-sided markets where participants on both sides seek suitable matches without using money. Examples include marriage markets, medical residencies, school choice programs, and more. We delve into the marriage model, stable matching criteria, and the deferre

0 views • 28 slides

Sound Money and the Future of Money by Nicolas Cachanosky

Sound money ensures monetary equilibrium where money demand equals money supply, essential for a stable economy. Explore the evolution of monetary institutions, cashless economies, and cryptocurrencies with Professor Nicolas Cachanosky's insightful perspective on the future of money.

0 views • 27 slides

Understanding Money: Functions, Properties, and Importance

Explore the essential aspects of money, including its functions as a medium of exchange, standard of value, and store of value. Discover the key properties of money such as durability, portability, divisibility, economic stability, scarcity, and acceptability. Uncover the historical evolution of mon

0 views • 11 slides

Livestock Economics and Marketing: Understanding Markets and Classification

Livestock markets are essential for the buying and selling of livestock and related products. Markets can be classified based on various factors such as location, nature of commodities, time span, and more. Understanding the essentials of markets, livestock market components, and classification help

0 views • 18 slides

Understanding Foreign Exchange Markets and Risks

Financial managers need to grasp the operations of foreign exchange markets for global business success. These markets allow participants to trade currencies, raise capital, transfer risk, and speculate on currency values. Transactions expose businesses to foreign exchange risk, where fluctuations i

0 views • 40 slides

Advancements in Electricity Markets and Regulation: Focus on Integration of Distributed Energy Resources

This article highlights the ongoing activities and discussions within the C5 Committee on Electricity Markets and Regulation, emphasizing the impacts of market approaches, regulatory roles, and emerging technologies in the electric power sector. Key areas of attention include market structures, regu

0 views • 14 slides

Implementing Voluntary Residual Capacity Markets for Clean Energy Policies

Explore the concept of voluntary residual capacity markets to support the implementation of state clean energy policies. Learn how these markets allow load-serving entities to meet capacity obligations outside traditional markets, respecting state goals and methods. Discover the workings and design

0 views • 9 slides

Understanding the Significance of Financial Markets and Institutions

Studying financial markets and institutions is crucial as it facilitates the efficient transfer of funds, promotes economic growth, impacts personal wealth, influences business decisions, and plays a significant role in determining interest rates. Debt markets, including bond markets, enable borrowi

0 views • 15 slides

Understanding Money Markets and Their Role in the Economy

Money markets are financial markets where short-term, low-risk securities are traded. Unlike banks, they offer distinct advantages such as liquidity, active secondary markets, and cost efficiency in providing short-term funds due to lower regulations. Despite the presence of banks, money markets pla

0 views • 33 slides

Understanding Money Laundering Regulations and Professional Integrity in Financial Services

Money laundering is the process of disguising criminal proceeds to make them appear legitimate. This illicit activity involves three stages - placement, layering, and integration. International cooperation is essential in combating money laundering, with organizations like the Financial Action Task

0 views • 9 slides

Understanding Dynamics of Perfect Markets in Microeconomics

Explore the dynamics of perfect markets in microeconomics through this presentation by Mrs. L. Booi. Learn about the short and long run production, cost and revenue curves, and the concepts of perfect markets and imperfect markets. Gain insights into how things behave and affect other markets in the

0 views • 23 slides

Evolution of Money: From Barter to Fiat Currency

The evolution of money traces back to barter economies where a mutual coincidence of wants was necessary for trade. Settlers in Colonial America used commodity money and fiat money, with specie coins becoming popular due to their mineral content. The term "dollars" originated from the German pronunc

0 views • 60 slides

Understanding Power Markets in Nordic Countries: Insights into Day-ahead and Intraday Markets

Delve into the intricate workings of power markets in Nordic countries, exploring key terms, market pricing strategies, vRES impact, and the significance of day-ahead and intraday markets. Discover how the merit order and bidding zones influence pricing and system operations, ensuring efficient elec

0 views • 11 slides

Evolution of Markets and Peddlers in New York City

Early markets in New York City date back to the 17th century, with the establishment of public markets and the emergence of peddlers playing a significant role in the city's history. The evolution of markets, corruption issues, the importance of peddlers to immigrants, and the challenges they faced,

0 views • 17 slides

Difference Between Capital Market and Money Market: A Comprehensive Overview

The capital market and money market serve different purposes in the financial world. While the capital market provides funds for long-term investments in securities like stocks and debentures, the money market deals with short-term borrowing and lending of funds. The capital market acts as a middlem

0 views • 4 slides

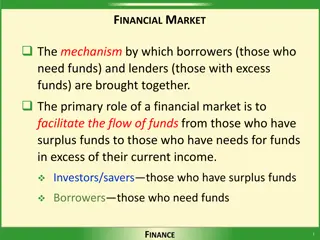

Understanding Financial Markets: Mechanisms and Efficiency

Financial markets play a crucial role in connecting borrowers and lenders, facilitating the flow of funds for optimal allocation. Different financial phases involve borrowing, saving, and investing. Transfers of funds occur directly or through intermediaries. Efficiency in financial markets ensures

0 views • 15 slides

Understanding Economics of Money and Banking

This course delves into monetary theories, the financial system, bank management, and regulation. The aim is to provide a comprehensive understanding of monetary policy, financial systems, and their impact on the economy. Through interactive lectures and discussions, students will grasp the fundamen

0 views • 30 slides

Understanding Stable Matching Markets in Unbalanced Random Matching Scenarios

In the realm of two-sided matching markets where individuals possess private preferences, stable matchings are pivotal equilibrium outcomes. This study delves into characterizing stable matchings, offering insights into typical outcomes in centralized markets like medical residency matches and decen

0 views • 49 slides

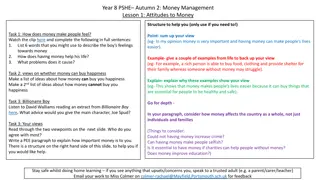

Money Management Lessons for Year 8 PSHE Students

Explore attitudes towards money, learn about budgeting, and consider the impact of money on happiness and life choices in this comprehensive PSHE lesson for Year 8 students. Activities include analyzing feelings towards money, discussing the relationship between money and happiness, budgeting hypoth

0 views • 9 slides

Understanding International Finance: Scope, Importance, and Challenges

International finance explores interactions between countries, including currency exchange rates, foreign direct investment, and risk management. The scope includes foreign exchange markets, MNC financial systems, and international accounting. It raises questions on liberalizing financial markets, I

0 views • 52 slides

Money Creation and Banking in Modern Economies

This content delves into the concepts of money creation, banking, balance sheets, assets, liabilities, equity, central bank reserves, credit money creation, credit money destruction, cash, different types of money, as well as risks for banks. It covers various aspects of modern banking systems and t

0 views • 24 slides