Understanding Markets and Economic Structures

Markets play a crucial role in bringing buyers and sellers together for transactions. This article discusses the concept of markets, different types of markets in a capitalist economy, focusing on perfect competition. It outlines the features and conditions of perfect competition, emphasizing the importance of large numbers of buyers and sellers in maintaining a competitive market environment. The classification of markets based on various criteria by economists is also explored in detail.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Forms of Market 1 2 3 4 5 LECTURE LECTURE LECTURE LECTURE LECTURE 10 LECTURE 6 7 8 9 LECTURE LECTURE LECTURE LECTURE 11 LECTURE 12 LECTURE 13 LECTURE 14 LECTURE 2

Lecture 1 ?? ?? 3

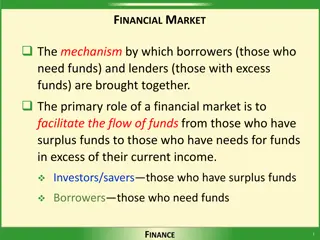

Market The Concept Market is defined as a complex set of activities by which potential buyers and potential sellers are brought in close contact for the purchase and sale of a commodity.

Bases of Markets Economists have defined and classified markets on the following four basis: 1. The number of buyers and sellers of the commodity. 2. The nature of the commodity produced by the seller. 3. Degree of freedom in the movements of goods and factors of production. 3. Degree of freedom in the movements of goods and factors of production. 4. Knowledge of the buyers and sellers regarding prices in the market. 5

On the basis of above mentioned criteria, economists have classified following types of market in a capitalist economy: 1. Perfect competition, 2. Monopoly, 3. Monopolistic competition, 4. Oligopoly, 5. Duopoly.

Perfect Competition Meaning of Perfect Competition Perfect competition is defined as a market structure in which an individual firm cannot influence the prevailing market price of the product on its own.

Features of Perfect Competition There is said to be perfect competition in an industry when certain conditions are satisfied. These conditions or assumptions are divided into two group: 1. Conditions of pure competition among the producers, plus 2. Conditions of perfect market for the commodity.

Conditions of Pure Competition 1. A Large Number of Buyers and Sellers: There are so many buyers and sellers that no individual buyer or seller can influence the price of the commodity in the market. Any change in the output supplied by a single firm will not affect the total output of the industry. To an individual producer the price of the commodity is given. He can sell whatever output he produces at the given price, i.e., an individual seller is a price-taker. Similarly, no individual buyer can influence the price of the commodity by his decision to vary the amount that he would like to buy, i.e., price of the commodity is given to the buyer. He is a price-taker having no bargaining power in the market.

Implication: The perfectly competitive firm is then a price-taker and can sell any amount of the commodity at the established price. d is then the demand curve facing a firm. It is infinity elastic and given by a horizontal line at the equilibrium market price, OP. d is also the price line or AR curve. Since AR is constant, MR curve coincides with AR curve. That is, d = P = AR = MR. Therefore, AR curve is also the MR curve of the firm.

2. Homogeneous Product: Firms in the market produce a homogeneous product. Homogeneity of a product implies that one unit of the product is a perfect substitute for another. Implication: Since the products are identical, buyers are indifferent between suppliers. For example, if A s bread is identical to B s bread, then it is immaterial for the consumer whether he buys the bread from A or from B. Homogeneous product ensures uniform price for the product of all the firms in the industry. 3. Free Entry or Exit of Firms: The industry is characterised by freedom of entry and exit of firms. In a perfectly competitive market, there are no barriers to entry or exit of firms. Entry or exit may take time, but firms have freedom of movement in and out of an industry. Since resources are assumed to be mobile, entry or exit is relatively costless.

Implication The implication of this assumption is that given sufficient time, all firms in the industry will be earning just normal profit. Suppose the existing firms are earning above normal profits, i.e., positive economic profits. Attracted by the positive profits, the new firms enter the industry. The industry s output, i.e., market supply goes up. The price comes down. New firms continue to enter till economic profits are reduced to zero. Now suppose the existing firms are incurring losses. The firms start leaving the industry. The industry s output starts falling and price starts going up. All this continues till losses are wiped out. The remaining firms in the industry once again earn just the normal profits.

Conditions of Perfect Market The market for a commodity is said to be perfect if at any given time the commodity sells at the same price in all parts of the market. the four conditions of perfect market are:

1. Perfect Knowledge Firms have all the knowledge about the product market and the input market. Buyers also have perfect knowledge about the product market. Implication: The implication of perfect knowledge about the product market is that any attempt by any firm to charge a price higher than the prevailing uniform price will fail. The buyers will not pay higher price because they have perfect knowledge. There is no ignorance about factors operating in the market. The sellers will not charge a higher price. The buyers will not pay a higher price. Thus, uniform price will prevail in the market.

2. Perfect Mobility of Factors of Production The factors of production can move easily from one firm to another. Workers can move between jobs and between places. Implication: It s implication is that skills can be learnt easily. 3. Absence of Transportation Cost. All goods are produced locally. Transportation costs are zero. 4. Absence of Selling Cost. Under perfect competition, there is no advertising or other sales promotion activities, i.e., selling costs are zero.

AR and MR Curves of a Firm under Perfect Competition 1. In perfect competition, a firm can sell any amount of output at a given market price. 2. It means firm s additional revenue (MR) from the sale of every additional unit of the commodity will be just equal to the market price (i.e., AR). Hence average revenue and marginal revenue become equal (AR = MR) and constant in that situation. 3. Consequently the AR and MR curves will be same and would be horizontal or parallel to the x-axis. It is shown in the diagram.

A Firm under Perfect Competition is Pricer-taker and not a Price-maker 1. There is a large number of firms. It implies that each firm is so small compared to the market that no single firm can influence the market price. 2. In a perfectly competitive market all firms produce the homogeneous products. It implies that all firms charge the same price for the products. If any firm attempts to charge a higher price, no buyer buys it from this firm. 3. Thus, homogeneous products and the existence of a large number of firms in the perfect competition market imply that all firms are expected to keep the same price for the products. 4. The price of a commodity is determined by the demand and supply of the whole industry. A firm working under the industry has to accept the price quoted. A firm can only decide how much amount of the commodity it wants to sell at a given price.

5. It means a firm cannot change the price, it takes the price as it is. It is also indicated by its horizontal AR = MR curve (as shown in figure). That is why a firm under perfect competition is said to be price-taker and not the price-maker . The market price is determined by the whole industry.

Demand curve facing a Firm under Perfect Competition 1. Since a firm is a price-taker, the demand curve facing a firm under perfect competition is perfectly elastic. 2. It takes the shape of horizontal curve parallel to the x-axis as shown in the diagram. 3. It implies that a firm under perfect competition can sell as much quantity as it likes at the given price. Monopoly The word Monopoly is made of two words: Mono + Poly. Here Mono means one and Poly implies the seller. Monopoly refers to that form of market organisation wherein there is a single firm (or producer) producing a commodity for which there are no close substitutes.

Features of Monopoly 1.Single Producer: There is a single firm producing the commodity in the market. Since there is single firm, the difference between firm and industry vanishes. 2. No Close Substitutes: There are no close substitutes for the commodity produced by the monopolist. The monopolist produces all the output in a particular market. The monopolist is a price-maker . It does not mean that monopolist can fix both price and the quantity demanded. If he fixes a high price, less commodity will be demanded.

There is no close substitute of the commodity in the market. This second condition would be even more difficult to fulfill than the first, since there are a few things for which there is no substitute. For instance, Usha fans are produced by a single firm alone but there are close substitutes of Usha fans that are available in the market in the form of Ralifans, Khaitan, Ashoka, Crompton etc. Hence, though the firm producing Usha fans is single, it cannot be termed as monopoly firm. It is, therefore, essential for a monopoly to exist that there is no close substitutes available in the market. This condition can be stated in other words as that the cross elasticity of demand for the output of the firm with respect to the price of every other firm s product is zero.

3. Barriers to the Entry: The entry into the industry is completely barred or made impossible. If new firms are admitted into the industry, monopoly itself breaks down. This ban on entry may be legal, natural or institutional but it must essentially be there. 4. Independent Price Policy: Monopolist firm can adopt independent price policy, i.e., it can increase or decrease price as it likes. A monopoly firm has a downward sloping average revenue curve. The downward sloping shape of the AR curve clearly indicates that a monopoly firm is a price-maker. 5. Price Discrimination is Possible: Under the conditions of monopoly, price discrimination is possible. It implies that a monopolist can sell its product at different prices to different customers. Price discrimination refers to the practice of charging different prices from different buyers at the same time for the same product.

Price discrimination is of three types 1. Personal Price discrimination: When the same commodity is sold at different prices to different buyers, it is known as personal price discrimination. For example, Railway ticket is cheaper for senior citizens as compared to the other people. 2. Place Price Discrimination: When a monopolist sells the same commodity at different places at different prices, then it is known as place discrimination. For example, electricity companies, like NDPL, generally charge lower rates in rural areas as compared to urban areas. 3. Use Price Discrimination: When different prices are charged for the same commodity on the basis of different uses, it is known as use price discrimination. For example, NDPL charges lower rates for residential use as compared to commercial use.

AR and MR Curves of a Monopol Firm 1. The Monopoly firm is like an industry, and faces downward sloping demand curve for its product; thus, it has to lower its price in order to sell more. 2. Thus, the average revenue curve, which is the same as the market demand curve, is downward sloping. 3. The result is an inelastic demand curve. The demand curve is a constraint facing a monopoly firm. Since AR is downward slipping, MR lies below AR curve and is twice as steep as the AR curve.

Demand Curve Facing a Monopoly Firm 1. The average revenue curve is also a demand curve for a firm. Because AR curve slopes downwards, a monopoly firm faces a downward sloping demand curve for its product. 2. The demand curve facing a monopoly firm will be less than perfectly inelastic. It indicates that if a firm reduces the price of the commodity, it can sell more goods and if it increases the price, it would sell less goods. elastic or

Reasons for the Emergence of Monopoly Market 1. Government restrictions: Sometimes government may impose restrictions on the entry of any other enterprise in a particular field. For instance, Indian government does not allow any other enterprise in the field of railway transport. Hence, government has monopoly in the railway transport. It is also possible that government may issue license only to one firm to work in a particular area or in a particular product. 2. Monopoly may arise because of patent rights as well. When a firm or producer gets official recognition that no one else can produce the product or use the technology developed or invented by this firm, it is patent rights. It is to promote and recognize the research and development (R&D) work by the firms and to cover their risk. The patent rights cannot be life-long. It may be for 15 or 20 years. It differs from country to country and product to product. The time period for which patent rights are granted is known as patent life.

3. In order to earn the maximum profits sometimes producers of a particular product, keeping their individual identity, come together and make an organisation, which is termed as cartel. They coordinate their output and pricing policy through this organisation which acts as a monopoly enterprise. A very good example of this type of cartel is of the OPEC (Organisation of Petroleum Exporting Countries) which works in the field of world oil market.

Table 6.1 Monopoly Difference between Perfect competition and Perfect competition Monopoly There is only one firm in the market and it has the power to influence the market. 1. There are large number of firms in the market and no single firm can influence the market. 2. A firm cannot adopt independent price policy. It is price-taker and not the price-maker. A independent price policy. It is a price- maker. monopolist firm can have 3. AR and MR curves are one and the same and parallel to the x-axis. AR = MR. AR and MR curves are downward sloping curves and MR curve always remains below the AR curve. MR < AR. 4. There is full freedom of entry and exit of the firms in the long-run. Hence a firm can get only normal profits in the long-run. There is restriction on the entry of firms. Hence a supernormal profits even in the long- run. firm can earn 5. Price discrimination is not possible, i.e., a firm charges here the same price from all customers. Price discrimination is possible.

Monopolistic Competition Monopolistic competition is a market situation in which there are many sellers of a particular product but the product of each seller is in some way differentiated in the minds of consumers from the products of every other seller. Monopolistic competition is a market situation, in which many firms compete with each other to sell their closely related differentiated products.

Features 1. Many Sellers: There are a large number of firms producing commodity in the market. Large number here implies that there are so many firms that the activities of one firm has no perceptible effect on the other firms in the industry. Each firm controls a very small or negligible share of the total output of the industry. The competitive element results from the fact that there are many firms in the market. 2. Freedom of Entry or Exit: Every firm is free to enter into the industry and come out from the industry as and when it wishes.

3. Product Differentiation: Under monopolistic competition, products of different firms are neither completely homogeneous as in perfect competition nor entirely distinct as in monopoly. Here each firm produces a product that is somewhat different from the products of its competitors, but not entirely distinct. It is very close to the products of other firms. Products of two or more firms, are not exact substitutes but at the same time are not entirely different from them. They are each other s close substitutes. But each firm is known for its own product, which has some unique distinction. Products may be differentiated in many ways, e.g., by changing brand name, trademark, design, packing, colour, size, weight, measurement, etc. Products may also be differentiated through advertisements and after sales-service.

Product differentiation means that though the product of one firm is differentiated from the product of another one, they are not entirely distinct products rather are close substitutes. The feature of product differentiation gives monopoly power to the firm. Thus, monopolistic firms have features of both perfect competition as well as monopoly.

4. Selling Costs: Since products are differentiated selling costs have an important place in this market. Every firm seeks to modify consumers preferences through advertisements and salesmanship. This gives rise to what is called selling costs. Thus, there is non-price competition among firms under monopolistic competition. In order to attract the consumers, monopolistic firms adopt the medium of manipulative or competitive or persuasive advertisements. Their main aim is to persuade a buyer to buy a particular product or brand rather than another or to buy from one seller rather than from another. Selling costs do not benefit the consumers at all. Rather, resources used for selling costs could have been used for production. Hence the selling costs are really wasteful expenditure from society s point of view. 5. Independent Price Policy: A firm under monopolistic competition can have an independent price policy. It is price maker for its product.

AR and MR curves of a Monopolistic Competition Firm 1. AR and MR curves facing a firm under monopolistic competition are downward sloping similar to the monopoly. 2. But there is an important difference between the AR and MR curves under monopoly and monopolistic competition. The AR curve under monopolistic competition is somewhat flatter than in the monopoly. It suggests that the demand for the product produced by a firm under monopolistic competition is highly elastic. 3. This is because differentiated products are close substitutes of each other. Therefore, s small increase in price results in sufficient change in demand as consumers shift to other substitutes.

Demand Curve facing a firm under Monopolistic Competition 1. Since competition sells a differentiated product, it can influence the price of the commodity to some extent. In this sense, it is price- maker for its determining the price he has to ensure that the price of the commodity is within the close range of the substitutes of the commodity that he is producing. a firm under monopolistic product. But while 2. Hence the demand curve facing a firm under monopolistic downward sloping curve. competition (negatively is a sloped) 3. This means that the firm can sell more goods at a lower price and less goods at a higher price.

Table 6.2 Difference between Perfect competition and Monopolistic competition Perfect competition Monopoly Many firms. Product differentiation. Both the situations exist side-by-side competition between sellers as well as monopoly of the firm. 1. A large number of firms. 2. Homogeneous product. 3. Perfect competition sellers in the market. among the 4. A firm cannot have independent price policy. It is price-taker, not the price-maker. A firm can have independent price policy. It is price-maker. 5. AR and MR curves are one and the same thing and parallel to the x- axis. AR = MR. 6. Perfect mobility of the factors of production. AR and MR curves are downward sloping and MR remains below the AR. MR < AR. No perfect mobility of the factors of production. 7. No need for selling costs. In perfect competition all homogeneous products, hence there is no need for persuasive advertisement. Significant impact of selling costs. firms produce

Table 6.3 Difference between Monopoly and Monopolistic competition Monopoly Monopolistic competition 1. Single firm. Many firms. 2. Homogeneous product. Product differentiation. 3. No close substitute of the commodity. Many close substitutes. 4. Price-discrimination is possible. Price-discrimination by an individual firm is not possible. Significant effect of selling costs. 5. No significant effect of selling costs. 6. Compete restriction on the entry of the firm. Hence monopoly firm earns super normal profits in the long-run as well. Freedom of entry. Hence there is no super normal profit in the long-sun.

Features 1. Few sellers: There are very few sellers in an oligopoly market. The number of sellers is so small that each and every seller is affected by the activities of others. 2. Interdependence: The most important characteristic feature of oligopoly is interdependence among its firms. The number of sellers is small in this market and each of these firms contributes a significant portion of the total sale.. As a result when any one of them undertakes any measure to promote its sale, it directly affects other firms and they also immediately react. Hence every firm decides its policy after taking into consideration the possible reactions of its rival firms. Thus, every firm is affected by the activities of other firms and it affects others also. This is the interdependence of firms

3. Indeterminateness of demand curve: In an oligopolistic market when a firm lowers down the price to promote its sale it affects other firms also. Hence as a reaction rival firms also starts to reduce their prices. In this situation the first firm may not be able to increase its sale as much as it has thought of at the time of reducing the price. Since it is difficult to estimate the probable reactions of rival firms, the demand curve (or average revenue curve) faced by an oligopolistic firm is indeterminate and shifting.

4.Group behavior: Sometimes in an oligopolistic market firms enter into a collusion and work as a group. Through this arrangement these firms try to earn maximum. But sometimes it is seen that a particular firm breaks this arrangement in order to increase its share. Then these firms start to work independently. We cannot say anything with certainty in oligopoly whether firms would work as a group through mutual agreement or they would act as independent units. When they work independently, there is price-war, they might agree on a price which may be profitable to all. Every firm does not disturb this price because of the fear from other firms reactions. This situation is called price-rigidity.

5. Advertising expenses: It is often seen in oligopoly that firms instead of price competition take up non-price competition in order to increase their shares in sales and profit. Under non-price competition they mainly utilise publicity and selling techniques for increasing the sales of their product. This increases their expenditure on publicity and sales. This can not be much beneficial to the society because its ultimate burden falls on the consumers. Besides, price-output decisions in an oligopolistic market are very difficult and indeterminate.