Functions of SEBI: Protective, Regulatory, Development

SEBI, the Securities and Exchange Board of India, performs various functions to protect investors, regulate the market, and promote development. Its protective function includes prohibiting insider trading and price rigging, and promoting fair practices. Its regulatory function involves establishing

7 views • 5 slides

FINANCIAL INTERMEDIARIES/FINANCIAL INSTITUTIONS

Discover the different types of financial intermediaries, including the unorganized and organized sectors. Learn about the institutions that facilitate financial transactions for individuals and corporations, such as local money lenders, commercial banks, and government agencies.

3 views • 6 slides

BUY AED 20 ONLINE — GLOBCOFF.COM

Many websites offer fake money online, but if you are new to this, it is simpler to investigate the providers of fake money because most of them are not very reliable. You risk losing your hard-earned money if you are not careful. Buy AED 20 Online from us now. Fortunately for you, globcoff.com a di

4 views • 1 slides

Understanding Anti-Money Laundering (AML) and Combating Financing of Terrorism (CFT) Framework

Learn about the essential components of Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) framework, including regulatory obligations, objectives, money laundering processes, stages, sanctions, and regulatory overview. Discover how money laundering, terrorist financing, and

1 views • 30 slides

Advantages of Having Money: Why Financial Stability Matters

Having sufficient money provides various advantages, including easier life management, ability to afford conveniences and luxuries, and financial stability during uncertain times. Money enables economic freedom, convenience in purchases, homogeneous experiences like vacations, and elasticity in payi

1 views • 5 slides

Buy Verified Cash App Accounts

Cash App is a platform through which you will get many other wonderful features including sending and receiving money, transferring money, adding money, saving money, round-ups for saving, invest in stocks and bitcoins which will make your life much easier and luxurious. Why am I talking about luxur

2 views • 16 slides

Buy Verified Cash App Accounts

Buy Verified Cash App Accounts\nCash App is a platform through which you will get many other wonderful features including sending and receiving money, transferring money, adding money, saving money, round-ups for saving, invest in stocks and bitcoins which will make your life much easier and luxurio

6 views • 16 slides

Understanding the Quantity Theory of Money

The quantity theory of money posits a direct relationship between the supply of money in an economy and price levels, assuming a constant velocity of money and economic activity. Increases in the money supply lead to price inflation, devaluing currency and decreasing purchasing power. Two main versi

2 views • 6 slides

Buy Fake Money Canada - undetectablecounterfeitbills.com

Buy Fake Money Canada, also known as prop money or play money, is currency that looks like real money but is not legal tender.\nText\/ WhatsApp: 1 (507) 544-8062\nEmail: info@undetectablecounterfeitbills.com\n

0 views • 3 slides

CAN YOU BUY COUNTERFEIT MONEY ONLINE - UNDETECTABLECOUNTERFEITBILLS.COM

The term \"counterfeit money\" describes counterfeit money that is created without official government approval and usually is an intentional attempt to mimic real money. The act of creating counterfeit money has a long history; the first instances can be found in ancient Greece and China. Contact:

1 views • 5 slides

SEBI's Role in Investor Protection and Stock Market Regulation

Securities and Exchange Board of India (SEBI) plays a crucial role in safeguarding investor interests and ensuring fair practices in the Indian stock market. By promoting transparency, enforcing regulations, and regulating market intermediaries, SEBI aims to maintain market integrity, protect invest

0 views • 23 slides

Understanding the Quantity Theory of Money: Fisher vs. Cambridge Perspectives

The Quantity Theory of Money explains the relationship between money supply and the general price level in an economy. Fisher's Equation of Exchange and the Cambridge Equation offer different perspectives on this theory, focusing on money supply vs. demand for money, different definitions of money,

0 views • 7 slides

Evolution of Money: From Barter to Electronic Banking

Money has evolved from the barter system to electronic banking through various stages like animal money, metallic money, paper money, and credit money. The invention of money was crucial to overcome the limitations of barter, leading to the ideal utilization of resources and solving issues like the

0 views • 14 slides

Understanding the Value of Money and Standards

The value of money refers to its purchasing power, which is influenced by the price level of goods and services. Different standards, such as wholesale, retail, and labor, help measure the value of money. Money can have internal and external value, affecting domestic and foreign transactions. The Qu

0 views • 62 slides

Understanding Money: Year 2 Lesson 7 on Adding Money Methods

Year 2 Money Lesson 7 focuses on using different methods to add money, such as counting on and partitioning. Students learn to find the total by combining amounts in various ways, including mixing notes and coins, differentiating values, and working with pounds and pence. The lesson includes activit

1 views • 26 slides

Understanding Beneficial Ownership and DNFBPs in The Bahamas

Corporate vehicles play a crucial role in the global economy but are also misused for illicit activities like money laundering and terrorism financing. This presentation by The Compliance Commission of The Bahamas focuses on defining beneficial owners, meeting regulatory obligations, and addressing

0 views • 22 slides

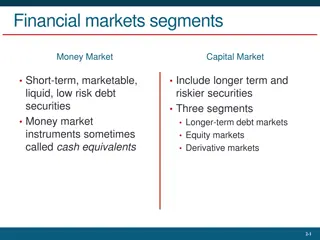

Understanding the Importance of Money Markets and Bond Markets

Money markets play a crucial role in the financial system by providing short-term, low-risk, and liquid investment options. Participants include institutional investors and dealers who engage in large transactions. Money market securities have specific characteristics, such as large denominations, l

0 views • 23 slides

Understanding the Relationship Between Capital Market and Money Market

The relationship between the capital market and money market is significant as they are interconnected in various ways. Both markets cater to different fund requirements, but share common features such as inter-related interest rates, common institutions, similar users of funds, and common investors

0 views • 6 slides

Understanding the Time Value of Money in Finance

The time value of money is a crucial concept in finance, indicating the varying worth of money over time. It explains why receiving a sum of money today is more valuable than receiving the same amount in the future due to factors like investment opportunities, inflation, risk, and personal consumpti

0 views • 9 slides

Understanding Money and Monetary Policy in Economics

Money serves as a medium of exchange, store of value, and unit of account in an economy. It is vital for economic transactions and stability. The quantity of money is measured using concepts like liquidity and monetary aggregates. The demand for money is linked to the Quantity Theory of Money, which

2 views • 12 slides

Overview of Indian Capital Market and Financial Institutions

The Indian Capital Market comprises securities market and financial institutions, facilitating the trading of government securities, industrial securities, and providing medium to long-term funds. Financial intermediaries like merchant bankers, mutual funds, and venture capital companies contribute

0 views • 5 slides

Understanding Blockchain Technology and Its Applications

Blockchain technology enables secure, decentralized transactions by utilizing open ledgers and cryptographic techniques. It eliminates the need for intermediaries, reduces fees, enhances privacy, and provides a permanent record of transactions. With a focus on concepts like open ledger, history, net

0 views • 35 slides

Understanding Financial Instruments and Markets

Explore asset classes like fixed income securities, money market instruments, and capital market instruments. Learn about different financial instruments in various markets including money market, bond market, equity markets, and derivative markets. Dive into money market instruments like Treasury b

0 views • 47 slides

Understanding Tourism Distribution and Commission in Small Business Marketing

Explore the significance of tourism distribution and commission in small business marketing, including the role of travel trade intermediaries, impact on pricing and competitiveness, and preferred supplier agreements. Learn about the cost of getting a sale, commission levels, and the influence of in

0 views • 20 slides

Sound Money and the Future of Money by Nicolas Cachanosky

Sound money ensures monetary equilibrium where money demand equals money supply, essential for a stable economy. Explore the evolution of monetary institutions, cashless economies, and cryptocurrencies with Professor Nicolas Cachanosky's insightful perspective on the future of money.

0 views • 27 slides

Understanding Money: Functions, Properties, and Importance

Explore the essential aspects of money, including its functions as a medium of exchange, standard of value, and store of value. Discover the key properties of money such as durability, portability, divisibility, economic stability, scarcity, and acceptability. Uncover the historical evolution of mon

0 views • 11 slides

Understanding Market Research for Business Success

Market research is crucial for businesses to gather information about their target market, customer needs, competition, and market trends. Primary and secondary research methods, market share analysis, demand assessment, and calculating market size are key aspects discussed in this content. Various

1 views • 5 slides

Exploring the Wealth Market Opportunities for Mortgage Intermediaries

Delve into the world of lending in the wealth market with a focus on the 1m plus market, Coutts proposition, and business development support available specifically for mortgage intermediaries. Learn about the market trends, distribution insights, and the range of products offered. Discover the proc

0 views • 12 slides

Livestock Economics and Marketing: Market Information and Institutional Approach

Market information plays a crucial role in livestock economics and marketing by providing essential knowledge on prices, quantities, and stocks, aiding decision-making for farmers and market intermediaries. It encompasses market news and market intelligence. The collection of market information is d

0 views • 11 slides

Role and Functions of SEBI in Financial Market Regulation

SEBI, the Securities and Exchange Board of India, plays a crucial role in protecting investor interests and ensuring fair practices in the financial market. It carries out protective functions by preventing insider trading and price rigging, promotes fair trade practices, and provides financial educ

0 views • 5 slides

Overview of Money Market Instruments

This detailed content provides an insight into various money market instruments such as Treasury Bills, Certificates of Deposit, Commercial Paper, Bankers' Acceptances, and Eurodollars. Each instrument's features including issuer, denomination, maturity, liquidity, default risk, interest type, and t

0 views • 29 slides

Understanding Money Laundering Regulations and Professional Integrity in Financial Services

Money laundering is the process of disguising criminal proceeds to make them appear legitimate. This illicit activity involves three stages - placement, layering, and integration. International cooperation is essential in combating money laundering, with organizations like the Financial Action Task

0 views • 9 slides

Evolution of Money: From Barter to Fiat Currency

The evolution of money traces back to barter economies where a mutual coincidence of wants was necessary for trade. Settlers in Colonial America used commodity money and fiat money, with specie coins becoming popular due to their mineral content. The term "dollars" originated from the German pronunc

0 views • 60 slides

Understanding the Call Money Market: Features, Participants, Advantages, and Drawbacks

The call money market is a short-term finance market where loans are provided against a call made by the borrower, often lasting from one day to fourteen days. Major participants include commercial banks, stock brokers, and the Discount and Finance House of India. This market offers high liquidity,

0 views • 5 slides

Understanding BCG Matrix: Market Growth and Relative Market Share

BCG Matrix, developed by Bruce Henderson of the Boston Consulting Group, categorizes business units into Question Marks, Stars, Cash Cows, and Dogs based on market growth and relative market share. Market share and market growth are crucial factors in determining a company's position in the market.

0 views • 31 slides

Difference Between Capital Market and Money Market: A Comprehensive Overview

The capital market and money market serve different purposes in the financial world. While the capital market provides funds for long-term investments in securities like stocks and debentures, the money market deals with short-term borrowing and lending of funds. The capital market acts as a middlem

0 views • 4 slides

Understanding Channels of Distribution in Business

Channels of Distribution play a crucial role in the movement of goods and services from manufacturers to end consumers. This involves the allocation and transfer of products through various intermediaries, impacting sales and availability. The types of channels include Direct, Indirect, and Hybrid c

0 views • 20 slides

Understanding Financial Markets: Mechanisms and Efficiency

Financial markets play a crucial role in connecting borrowers and lenders, facilitating the flow of funds for optimal allocation. Different financial phases involve borrowing, saving, and investing. Transfers of funds occur directly or through intermediaries. Efficiency in financial markets ensures

0 views • 15 slides

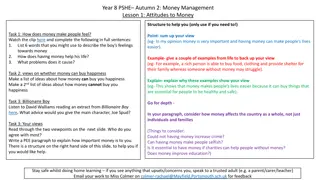

Money Management Lessons for Year 8 PSHE Students

Explore attitudes towards money, learn about budgeting, and consider the impact of money on happiness and life choices in this comprehensive PSHE lesson for Year 8 students. Activities include analyzing feelings towards money, discussing the relationship between money and happiness, budgeting hypoth

0 views • 9 slides

Money Creation and Banking in Modern Economies

This content delves into the concepts of money creation, banking, balance sheets, assets, liabilities, equity, central bank reserves, credit money creation, credit money destruction, cash, different types of money, as well as risks for banks. It covers various aspects of modern banking systems and t

0 views • 24 slides