FINANCIAL INTERMEDIARIES/FINANCIAL INSTITUTIONS

Discover the different types of financial intermediaries, including the unorganized and organized sectors. Learn about the institutions that facilitate financial transactions for individuals and corporations, such as local money lenders, commercial banks, and government agencies.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

FINANCIAL INTERMEDIARIES/FINANCIAL INSTITUTIONS

Different kinds of organizations/institutions which intermediate and facilitate financial transactions of both individual and corporate customers are called as financial intermediaries or financial institutions. Basically they are classified into two types: 1.Unorganized Sector 2.Organized Sector

UNORGANIZED SECTOR The sector that is not governed by any statutory or legal authority is known as unorganized sector. This sector consists of the individuals and institutions for whom there are no standardized rules and regulations governing their financial dealings.They are not under the supervision and control of RBI or any other regulatory body. This sector consists of the individuals and institutions like Local money lenders,Brokers,Traders,Landlords,Indigenous bankers,etc.,who lend money to needy persons and institutions.

ORGANIZED SECTOR The sector that is governed by some statutory or legal authority is known as organized sector. This sector consists of the institutions like Commercial Banks, Non Banking Financial Institutions, etc. They are further classified into two: 1. Capital Market Intermediaries 2. Money Market Intermediaries

CAPITAL MARKET INTERMEDIARIES Capital Market refers to the market for long term finance. The intermediaries provide long term finance to individuals and corporate customers. IDBI, SFCs, LIC, GIC, UTI, MFs, EXIM BANK, NABARD, NHB, NBFCs (Hire Purchasing, Leasing, Investment and Finance Companies) Government (PF, NSC) etc., are in the organized sector providing long term finance.

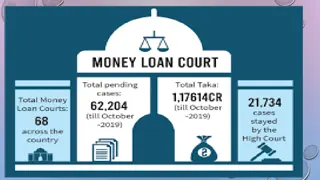

MONEY MARKET INTERMEDIARIES Money Market refers to the market for short term finance. The intermediaries provide short term finance to individuals and corporate customers. RBI, Commercial Banks, Co-operative Banks, Post Office Savings Banks, Government (Treasury Bills) are in the organized sector providing short term finance.