Affordable Housing Solutions for Alameda County Communities

A-1 Community Housing Services, a non-profit HUD-approved agency, offers services such as first-time homebuyer education, rental counseling, and foreclosure prevention in California. With a focus on improving housing situations, they have assisted over 7000 households in various housing needs. Renta

1 views • 20 slides

Addressing Australia's Social Housing Needs: Insights from Prof. Hal Pawson

Prof. Hal Pawson's presentation at the Affordable Housing Development and Investment Summit in Melbourne delves into the necessity of social housing in Australia. The presentation covers the existing social housing landscape, the projected needs, and the comparison of construction numbers with the s

1 views • 15 slides

Housing and Healthcare in Ireland and the EU: A Comprehensive Overview

The European Union does not have direct authority over housing policies, as Member States are responsible for building, renting, and selling houses. However, various EU regulations impact housing, such as those concerning freedom of movement, non-discrimination, consumer protection, and environmenta

0 views • 16 slides

Understanding Income Tax in India: Gross vs Total Income

In India, income tax is calculated based on the total income or taxable total income. The gross total income includes earnings from all sources like salary, property, business, and capital gains. Various additions such as clubbing provisions, adjustments for losses, unexplained credits, investments,

0 views • 7 slides

Sustainable Urbanization and Housing Programme Overview

The Sustainable Urbanization and Housing Programme, part of the NDP III framework, focuses on addressing urbanization and housing challenges in Uganda. Led by the Ministry of Lands, Housing and Urban Development, the programme aims to reduce urban unemployment, housing deficit, improve infrastructur

0 views • 45 slides

Understanding Tax Obligations and Assessable Income in Australia

In Australia, residents are taxed on worldwide income while non-residents are taxed only on Australian-sourced income. The tax liability is calculated based on taxable income, tax offsets, other liabilities like Medicare levy, and PAYG credits. Assessable income includes employment income, super pen

0 views • 13 slides

Addressing Housing Needs in Waltham Forest: A Closer Look at the New Local Plan

The New Local Plan in Waltham Forest focuses on addressing the housing needs by emphasizing intermediate housing, genuinely affordable homes, and other housing types. It defines intermediate housing as above social rent but below market prices, aiming to cater to a diverse range of incomes. The plan

0 views • 15 slides

Middle Income Housing Solutions for Credit Unions and Members

Providing practical approaches for middle income housing solutions beneficial to Credit Unions and members. Addressing the lack of assistance for middle income housing and the needs of Credit Unions, developers, and members for quality housing solutions, loans, and affordable payments.

0 views • 14 slides

Mississippi Home Corporation - National Housing Trust Fund Program Overview

Mississippi Home Corporation (MHC) administers the National Housing Trust Fund (HTF) Program in Mississippi to address housing needs for low-and-moderate-income residents. The program aims to enhance economic viability by providing safe, decent, and affordable housing options, helping families build

2 views • 95 slides

Housing Assistance Program Overview - Supporting Individuals and Families in Need

Providing temporary housing assistance to individuals and families in need is a vital aspect of the Client Benefit Division led by Yvette Ortiz Baugh. The program prioritizes preventive housing measures, such as assisting with rent arrears and home repairs, in an effort to maintain stable housing si

0 views • 22 slides

Understanding Income from House Property in Taxation

House property income refers to rent received from properties owned by an individual, charged under income tax. It is based on the concept of annual value, representing the expected rental income or market value of the property. The annual value is taxable under the head "Income from House Property.

1 views • 12 slides

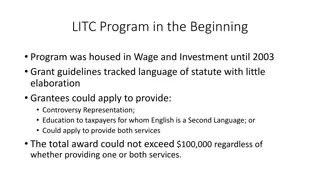

Evolution of Low Income Taxpayer Clinics (LITC) Program

The Low Income Taxpayer Clinics (LITC) Program has evolved over the years to ensure fairness and integrity in the tax system for low-income taxpayers and those who speak English as a second language. Initially housed in Wage and Investment, the program now reports to the National Taxpayer Advocate.

0 views • 10 slides

Housing Opportunities of Northern DE INC: Fair Housing Advocacy

Housing Opportunities of Northern DE INC (HOND) is a non-profit organization advocating for fair housing in Delaware. They promote equal access to housing for all residents and conduct educational workshops on Fair Housing Laws. HOND provides assistance to individuals facing housing discrimination a

1 views • 10 slides

Overview of Joe Serna, Jr. Farmworker Housing Grant Program

The Joe Serna, Jr. Farmworker Housing Grant Program by the California Department of Housing and Community Development aims to address the housing needs of agricultural workers through funding for housing construction and rehabilitation projects. The program provides grants and loans for multifamily

0 views • 49 slides

Fresno County CalWORKs Housing Support Program Overview

The County of Fresno, in partnership with the Fresno Housing Authority, offers the CalWORKs Housing Support Program to address the housing needs of families in the region. With a focus on assisting homeless individuals and those in need of supportive housing, the program aims to serve a significant

0 views • 13 slides

Office of Native American Programs at the U.S. Department of Housing and Urban Development

Office of Native American Programs (ONAP) at the U.S. Department of Housing and Urban Development works with tribal governments and other entities to address housing and community development needs in Indian Country. ONAP's mission is to ensure safe, decent, and affordable housing for Native America

1 views • 14 slides

Understanding Clubbing of Income in Taxation

Clubbing of income refers to including another person's income in the taxpayer's total income to prevent tax avoidance practices like transferring assets to family members. This concept is addressed in sections 60 to 64 of the Income Tax Act. Key terms include transferor, transferee, revocable trans

1 views • 16 slides

Housing Authority of Savannah: Providing Affordable Housing Programs

The Housing Authority of Savannah (HAS) was established in 1938 to address the housing needs of the low-income population in Savannah, Georgia. Through a diverse portfolio of affordable housing programs, HAS offers a range of housing assistance, including public housing, rental assistance demonstrat

0 views • 15 slides

Second Year Housing Options and Resources at Virginia Tech

Discover second-year housing options at Virginia Tech, including on-campus residences, off-campus housing resources, and legal services available to students. Explore living learning programs, Corps of Cadets housing, general student housing application processes, and information on becoming a resid

0 views • 24 slides

Challenges and Solutions in Bay Area Housing Market

The documents highlight the housing challenges in the Bay Area, focusing on high rents, low housing production, income disparity, and federal disinvestment. It discusses the affordable rent and ownership gaps based on median income levels, as well as rent increases and housing supply trends from 200

1 views • 14 slides

CCBC Accessible Housing Service Overview

CCBC Accessible Housing Service in Caerphilly County Borough provides unified housing services catering to various tenures. Challenges include deprivation and topography. The service deals with housing options, strategy, and allocations, focusing on Welsh Housing Quality Standards. Private Sector Ho

0 views • 36 slides

Addressing Richmond's Housing Crisis: A Call to Action

Amid an intensifying housing crisis, Richmond's RPA Housing Action Team is convening to discuss strategies in response to the lack of affordable housing. The session aims to provide updates on regional efforts, engage with nonprofit developers, and set clear housing goals. Key data highlights the pr

0 views • 45 slides

Understanding the Housing Improvement Program (HIP)

The Housing Improvement Program (HIP) is a grant program aimed at providing home repair, renovation, and replacement assistance to Native American and Alaska Native individuals facing housing challenges. HIP targets the neediest individuals to eliminate substandard housing and homelessness in Indian

0 views • 8 slides

Minnesota Housing Reform: Addressing Segregation and Affordable Housing Challenges

This content covers various aspects of housing reform in Minnesota, ranging from the Legalizing Affordable Housing Act HF2235, addressing Twin Cities housing segregation, challenges faced by cities in recovering infrastructure costs, and proposed reforms like enabling development impact fees and env

0 views • 18 slides

Housing Best Practices Forum: Enhancing Housing Options and Resource Collaboration

Explore the key agenda items, logistical details, forum format, goals, and best practices review from a recent Housing Best Practices Forum. The forum aims to amplify housing choices, improve resource utilization, foster collaboration among stakeholders for innovative housing solutions, share succes

0 views • 44 slides

Comprehensive Guide to Housing Element Annual Progress Reporting in California

This guide provides insights into the Housing Element Annual Progress Report form and submittal requirements for the California Department of Housing and Community Development. It covers learning objectives, major changes, new reporting requirements, legal context, benefits of APRs, and preview of t

0 views • 25 slides

Affordable Housing Task Force Report Overview

This report from the Affordable Housing Task Force delves into the concept of affordable housing in New Jersey, outlining the criteria for affordability, eligibility categories based on income levels, and a brief history of affordable housing regulation in the state. It covers crucial milestones suc

0 views • 20 slides

Analysis of Irish Farmer Incomes Based on Income Tax Returns

This paper presents an analysis of Irish farmer incomes in 2010 using self-assessment income tax returns from the Revenue Commissioners. The study focused on various income sources such as trading income, rental income, employment income, social welfare transfers, and pension income. The dataset com

0 views • 12 slides

Understanding Retirement Income for Low-Income Seniors in Ontario

Exploring the income system for retirees in Ontario, including Old Age Security, Canada Pension Plan, and private pensions. Addressing the concept of low income, eligibility for Guaranteed Income Supplement, and debunking common misconceptions with a top 10 list of bad retirement advice. Highlightin

0 views • 11 slides

Target Areas for Sanitation Marketers Training in Urban Low-Income Areas

Target areas for sanitation marketers training in urban low-income areas include informal settlements, planned urban areas with low-income housing, informal housing in planned residential areas, urban IDP settlements, and urban sub-centers. These areas present challenges with water supply and sanita

0 views • 18 slides

Housing Initiatives in Texas School Districts

Several Texas school districts have implemented workforce housing initiatives to provide affordable housing options for teachers and staff. Initiatives include property ownership, rental units, and partnerships with housing finance corporations. Examples include Ector County ISD's housing for teache

0 views • 13 slides

Valuation Using the Income Approach in Real Estate

The income approach to appraisal in real estate involves converting future income into a present value through income capitalization. This method utilizes direct capitalization and discounted cash flow techniques to estimate property value based on net operating income. Estimating net operating inco

0 views • 17 slides

Pathways to Affordable Housing in Birmingham

Pathways to Removing Obstacles to Housing (PRO Housing) initiative, sponsored by the U.S. Department of Housing and Urban Development, aims to address barriers to affordable housing in Birmingham. The city faces challenges of housing scarcity and deteriorating properties, especially in vulnerable co

0 views • 12 slides

Indian Housing Block Grant 2023 Competitive Priorities

The Fiscal Year 2023 Indian Housing Block Grant (IHBG) Competitive NOFO Training focuses on Soundness of Approach with a maximum of 42 points. Subfactor 3.1 emphasizes IHBG Competitive Priorities, including new housing construction projects, housing rehabilitation projects, acquisition of units, and

0 views • 23 slides

Rural Affordable Housing: A National and East Midlands Perspective

Explore the challenges and solutions of rural affordable housing presented by Jo Lavis of Rural Housing Solutions. Delve into the importance of affordable housing, who resides in such housing, Housing Association developments, affordability definitions, and the affordability problem in the rural Eas

0 views • 17 slides

Affordable Housing in San Diego: Meeting the Needs?

San Diego Housing Federation, through its voice for affordable housing, aims to address the housing needs of low-income families in the region. With insights into growth projections, income levels, job salaries, and rental affordability gaps, the city faces challenges in providing adequate housing o

0 views • 9 slides

Understanding Set-off of Losses in Income Tax

Set-off of losses in income tax allows taxpayers to reduce their taxable income by offsetting losses from one source against income from another source. This process helps in minimizing tax liability and optimizing tax planning strategies. There are specific rules and exceptions regarding the set-of

0 views • 4 slides

Intensive Case Management Toolkit for Housing First Programs

Explore the Intensive Case Management Toolkit designed to establish and maintain effective Housing First programs. Learn about the paradigm shift in managing homelessness, the cost benefits of housing vs. homelessness, system use reduction with Housing First, and the principles of Housing First emph

0 views • 8 slides

Understanding Subsidized Housing Programs for Domestic Violence Survivors

Domestic violence often leads to housing instability, making it crucial for survivors to access safe housing. This article explores the intersection between domestic violence and housing, highlighting the barriers faced by survivors. It delves into the importance of subsidized housing programs, such

0 views • 34 slides

Water Utilities Update on Low-Income Oversight Board - September 16, 2019

This update provides information on low-income programs related to water utilities, including total enrollments, discounts, lead testing in schools, and proposed statewide water low-income programs. It also discusses measures to increase the effectiveness of low-income programs through community-bas

0 views • 9 slides