Understanding Governance, Risk, and Compliance Framework in Business

Governance, Risk, and Compliance (GRC) are essential components of a robust business strategy. Governance focuses on aligning objectives with stakeholder expectations, Risk Management involves identifying and mitigating threats, and Compliance ensures adherence to regulations. By integrating GRC pri

0 views • 5 slides

Mandatory Vendor Compliance Training & Regulatory Requirements Overview

Welcome to ECMCC's mandatory compliance training for vendors covering regulatory requirements, compliance program overview, fraud Prevention, OMIG compliance, Code of Ethical Conduct, and communication policies. Learn about Stark Law, Anti-Kickback Statute, and False Claims Act for ethical conduct a

0 views • 37 slides

Understanding CONFIA: The Brazilian Cooperative Compliance Program

Cooperative Compliance is a relationship between taxpayers and Tax Administration based on principles like good faith, collaboration, and transparency. CONFIA aims to provide legal certainty, prevent disputes, reduce compliance costs, and improve tax compliance through voluntary and cooperative deve

1 views • 14 slides

The Crucial Role of Compliance in Payroll Management Software!

Payroll management software is essential for businesses of all sizes, automating processes like wage calculation and tax deduction. Compliance ensures adherence to legal frameworks, safeguarding against penalties and fostering trust. Key features include robust security measures, tax compliance capa

3 views • 9 slides

Corporate Compliance Program: Ensuring Ethical Practices

Corporate Compliance program at King's Daughters focuses on ensuring adherence to laws, healthcare program requirements, Code of Conduct, and internal policies. It demonstrates commitment to ethics, integrity, and quality care. The program outlines guidelines for team members' behavior, corrective a

4 views • 54 slides

How HMRC Payroll Software Can Streamline Your Tax Compliance Process

Payroll management and compliance with HMRC laws may be complex and time-consuming for\nbusinesses of all sizes. However, with the correct HMRC payroll software, this process may be\nautomated to save time, reduce errors, and ensure tax compliance. In this blog, we'll look at\nhow HMRC payroll softw

11 views • 6 slides

Overview of UW Clinical Trial Office Budget Review

UW Clinical Trial Office conducts budget reviews to ensure compliance and financial accountability in clinical trials. The office collaborates with various departments to manage billing compliance, financial risks, and institutional policies. The primary focus is on avoiding patient billing errors,

0 views • 17 slides

RRH Student Re-Entry Process for Clinical Requests & Compliance

The RRH Student Re-Entry Process outlines steps for clinical request processing, approval, and compliance requirements for various disciplines within the nursing program and other departments. It includes sending requests to the Nursing Institute, communication procedures, compliance documentation,

0 views • 10 slides

Supplier Compliance Requirements and Evaluation Presentation

Responsibilities and functions of the Grants and Compliance Department in managing grants, compliance, governance, and risk issues. Supplier compliance requirements include timely quotations, tax-compliant invoices, full deliveries, and supplier evaluations. Feedback from suppliers is valued for pro

0 views • 6 slides

Participation of Distributed Energy Resource Aggregations in Wholesale Markets: Compliance with Order No. 2222

The presentation outlines the high-level market design approach by ISO New England to comply with Order No. 2222, allowing distributed energy resources to provide wholesale services. It covers compliance directives, participation models, metering requirements, registration coordination, operational

0 views • 77 slides

Understanding Low Income Housing Tax Credits (LIHTC)

LIHTC is a federal program established in 1986 to promote private investment in affordable housing, providing financing for the construction and renovation of affordable rental units. Developers receive credits which can be used or sold to investors, reducing debt and allowing for lower rents. The c

0 views • 35 slides

Best Practices for CRS/FATCA Compliance in Revenue Reporting

Enhance revenue compliance strategies by promoting good system design, understanding CRS/FATCA rules, and preventing errors. Implement interventions, checks, and validations to ensure accurate reporting. Stakeholder collaboration, governance, training, and documentation are key for effective complia

1 views • 11 slides

Understanding Single Audits for Federal Fund Compliance

Explore the process and requirements of single audits for federal fund compliance, including when they are required, the responsibilities involved, and the importance of OMB Compliance Supplement. Learn how single audits provide assurance to federal agencies about fund usage compliance and the stand

1 views • 33 slides

Understanding Low-Income Housing Tax Credit (LIHTC) Program

The LIHTC program subsidizes housing for individuals with incomes below 60% of the area median income. It benefits tenants by providing affordable housing and reduces debt for developers. Investors receive tax benefits and adhere to governing rules such as Code Section 42 and Regulations. The progra

0 views • 41 slides

Data Protection and Compliance in the Digital Age

DataPro Ltd., established in 1995, emphasizes practice over theory, offering solutions for NDPR compliance, RegTech, API functionality, and more. The company discusses the importance of NDPR, benefits to businesses, and how compliance can unlock opportunities. In a world driven by digitalization, da

0 views • 19 slides

Understanding Governance and Compliance in Today's World

Explore the essential concepts of governance and compliance in the corporate world, including the principles of good governance, the importance of compliance, and the relationship between management, governance, and strong compliance cultures. Delve into the significance of ethical practices, transp

0 views • 11 slides

Understanding Utility Allowances for Affordable Housing Programs

Utility allowances play a crucial role in determining rents for affordable housing properties financed with federal and state funding sources. This article covers the concept of utility allowances, determining the correct UA to use, LIHTC and HOME programs, responsibilities, implementation, document

0 views • 21 slides

Guidelines on Citizens Charter Compliance with RA 11032

Issued by the Anti-Red Tape Authority, Memorandum Circular No. 2019-002 outlines guidelines for the implementation of Citizen's Charter in compliance with RA 11032. It includes the issuance of a Certificate of Compliance (CoC) by government agencies and important deadlines for submission. Soft copie

0 views • 4 slides

Enhancing Compliance Monitoring in South African Public Service

The Compliance Monitoring Framework developed by the Office of Standards and Compliance aims to improve adherence to public administration norms and standards in South Africa. This framework is designed to reduce non-compliance through ongoing supervision, investigation, and promotion of proper beha

3 views • 19 slides

Effective Corporate Compliance Program Overview

Corporate compliance is essential to prevent fraud, waste, and abuse within organizations. This program aims to detect and prevent deceptive practices, unnecessary costs, and improper behaviors. Key elements include appointing a Compliance Officer, establishing policies and procedures, providing edu

1 views • 19 slides

International Challenges in Bahamian Banking Policy: Navigating Rules and Compliance

The speech delivered at the Nassau Conference in 2017 by Charles W. Littrell highlights the international challenges faced by Bahamian banking policies. It discusses the origins of prudential rules, compliance with Basel Committee and FATF standards, benefits and drawbacks of international rules, po

3 views • 18 slides

Post Award Fiscal Compliance: Who We Are and What We Do

Post Award Fiscal Compliance (PAFC) assists campus and central administrative units in mitigating non-compliance risks with sponsor terms and conditions by monitoring compliance, interpreting award requirements, providing training, and enhancing internal controls. The team includes Matt Gardner, Ass

0 views • 11 slides

Compliance Obligations and PAN Requirements for Financial Transactions

This outreach program by the Directorate of Income Tax in Nagpur, in collaboration with the Nagpur Branch of WIRC of ICAI, focuses on effective compliance with Statement of Financial Transactions (SFT). It covers PAN compliance obligations, forms, and penalties for non-compliance related to specifie

0 views • 14 slides

Rural Access Compliance Rules Proposal by Glenn Disher - PBM Investigator

Proposal by Glenn Disher, a PBM Compliance Investigator, outlines rules for rural access compliance. The proposal focuses on considering local conditions and enforcing rules for maximum impact. It includes recommendations for zip code rules, compliance mileage rules, and examples of non-compliant ru

0 views • 7 slides

September 7, 2024 - Payor Compliance: Report of Injury SROI Filings

The content discusses the Payor Compliance Subsequent Report of Injury (SROI) Filings scheduled for September 7, 2024. It covers various aspects including the bulletin notice, different SROI filings like Employer Paid (SROI EP), Initial Payment (SROI IP), Payment Report (SROI PY), and more. The Boar

1 views • 22 slides

Australia's Equipment Energy Efficiency (E3) Program and Compliance Measures

Australia's Equipment Energy Efficiency Program (E3) focuses on regulating energy efficiency in various sectors through mandatory and voluntary programs. The program includes verification testing, market surveillance, and education. To address compliance issues, enforcement is carried out by state r

2 views • 10 slides

Importance of Compliance Training in Ensuring Ethical Business Practices

Compliance training at West Cancer Center plays a vital role in educating employees on laws, regulations, and company policies to ensure ethical conduct. With a commitment to compliance, the center's Code of Ethics emphasizes activities that adhere to laws and regulations, prioritize quality care, a

0 views • 31 slides

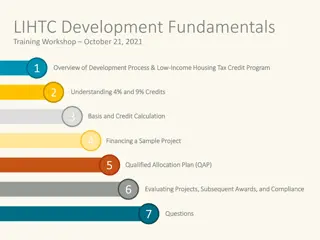

LIHTC Development Fundamentals Training Workshop Overview

This workshop covers the key aspects of the Low-Income Housing Tax Credit (LIHTC) program, including an overview of the development process, understanding 4% and 9% credits, basis and credit calculation, financing a sample project, qualified allocation plan (QAP), evaluating projects, subsequent awa

0 views • 70 slides

IRS 8823 Guide and OHCS LIHTC Compliance Training Overview

In this comprehensive training, the IRS 8823 Guide and OHCS LIHTC Compliance process are discussed by Jennifer Marchand, a technical advisor. The training covers the basics of tax credits, 8823 process, compliance tips, and more. Participants learn about reporting requirements, IRS processing, corre

0 views • 58 slides

Understanding Fair Housing Laws and LIHTC Basics

Explore the basics of Fair Housing laws and Low Income Housing Tax Credit (LIHTC) properties, including applicable regulations, reasonable accommodations, and key issues. Learn about protected classes, exemptions, and guidelines for ensuring compliance in housing provision.

0 views • 22 slides

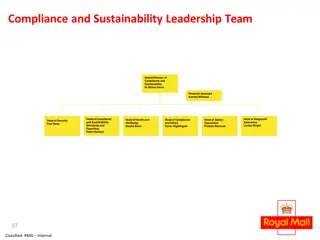

Compliance and Sustainability Leadership Team Overview

This document provides an overview of the Compliance and Sustainability Leadership Team structure, including key positions such as Global Director, Head of Compliance and Sustainability Standards, and various advisors and managers responsible for safety, health, compliance, ethics, and risk manageme

0 views • 6 slides

HUD Meeting Updates and Clarifications

Updates and clarifications discussed at a recent HUD meeting include changes to specifications and MAT guide regarding LIHTC and RAD programs, adjustments in assistance calculations, and procedures for handling negative assistance scenarios. Specific examples and calculations were provided to illust

0 views • 27 slides

Legislative Update: Statutory Issues in Tax for Affordable Housing Solutions

In 1997, the Texas Legislature enacted Tax Code Sec. 11.182, providing a 100% property tax exemption for affordable housing. The exemption was later expanded to include Low Income Housing Tax Credit (LIHTC) projects, with additional terms added in 2001. To qualify for this exemption, organizations m

0 views • 6 slides

Affordable Housing Development in Michigan: Understanding LIHTC and Housing Initiatives

Explore the key aspects of Low-Income Housing Tax Credits (LIHTC) in Michigan administered by MSHDA. Learn about the Qualified Allocation Plan, funding priorities, PSH requirements, and the development process to address homelessness and support affordable housing initiatives.

0 views • 16 slides

Compliance Assurance Report on Dental Services in Q1 2024

A compliance assurance report was conducted on dental services in Q1 2024 as part of the HSE Children First Compliance Assurance Checks. The report highlighted areas of compliance and partial compliance, with efforts noted to meet Children First requirements. Areas of improvement were identified in

0 views • 19 slides

Understanding LIHTC and HOME Compliance for Affordable Housing

Learn about the importance of combining LIHTC and HOME programs, key rules for compliance, the 5 Rs of compliance, differences in determining household size, and considerations for selecting the right people for affordable housing projects.

0 views • 53 slides

Compliance Testing by ERA for IT Systems Developed and Deployed for TAF TSI

Compliance testing for IT systems developed and deployed for TAF TSI involves checking if messages comply with TAF XSD and basic parameters, assessing compliance of IT tools against TSI requirements, and issuing compliance assessment reports. The process includes testing messages for mandatory eleme

0 views • 4 slides

Addressing Compliance Challenges in Ottawa's Housing Sector

Ottawa's housing organizations face compliance challenges related to fire safety, including lack of code adherence, non-compliance issues, and legacy structural issues. Efforts to achieve compliance involve daily inspections, addressing combustible materials and obstructions, and obtaining funds for

0 views • 11 slides

Compliance Requirements for HOME Assisted Units in LIHTC Projects

Review the key compliance requirements for HOME assisted units in LIHTC projects, including initial occupancy differences, ongoing compliance standards, rent limits, property standards, and affordability periods. Understand the rules related to income limits, occupancy percentages, rent calculations

0 views • 40 slides

Celebrating a Successful Year of NVHousingSearch.org

NVHousingSearch.org marks a successful first year with 76% of LIHTC units listed, nearly 36,000 housing units, and over 43,000 searches. The platform offers free advertising for properties, quick and easy listing options, and detailed listings with pictures and map links. Vacancy rates for LIHTC uni

0 views • 5 slides