GASB 96: Subscription-Based Information Technology Arrangements (SBITAs) Overview

GASB 96 provides guidance on accounting for subscription-based information technology arrangements for government end users. It outlines criteria for determining control of IT assets, distinguishes SBITAs from leases, and explains the recognition and measurement of subscription liabilities and asset

0 views • 26 slides

Understanding GST Nuances in Real Estate

The realm of GST in real estate, particularly works contracts and property sales, is intricate and crucial to the country's GDP growth. This includes transactions like leases, constructions, and sales, all of which have specific provisions under the CGST Act. While some real estate transactions are

2 views • 36 slides

A College Student's Guide to Signing a Lease at Western Kentucky University

Explore essential information for college students about signing a lease, covering individual vs. joint leases, the importance of a cosigner, and key details within a lease agreement. Learn how to protect your rights and responsibilities as a renter at Western Kentucky University Student Legal Educa

0 views • 16 slides

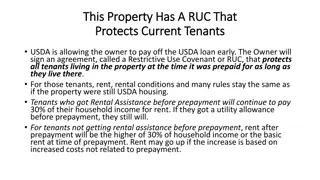

Tenants' Rights in Properties with Restrictive Use Covenant (RUC)

In properties with a Restrictive Use Covenant (RUC), current tenants are protected even after an owner pre-pays a USDA loan early. The RUC safeguards tenants' rental conditions, limits rent increases, and provides additional protections such as the right to a grievance process. Tenants have options

0 views • 5 slides

Understanding Royalty, Minimum Rent, and Short Working in Leases

Royalty in leasing is a periodical payment based on output or sales made by a lessee to a lessor. Minimum rent is the guaranteed amount paid by the lessee in low-output years, and short working is the excess of minimum rent over actual royalty. Recoupment of short working allows recovering shortages

0 views • 7 slides

Financial Reporting Standards Overview for 2021/2022 FY

Overview of financial reporting standards for the fiscal year 2021/2022 focusing on topics like mergers, transfers of functions, consolidated financial statements, events after the reporting date, accounting principles, related party disclosures, provisions, leases, and more. It also explores the de

4 views • 22 slides

Otay Mesa Enhanced Infrastructure Financing District Public Financing Authority Meeting Summary

The Otay Mesa Enhanced Infrastructure Financing District Public Financing Authority meeting held on June 13, 2022, discussed various agenda items including audit responsibilities, financial statements, upcoming GASB pronouncements, and audit standards. The responsibilities and deliverables of the au

2 views • 8 slides

Understanding Capital Assets and Financial Reporting

This presentation delves into the world of capital assets, focusing on their categorization, ownership, and reporting in financial statements. Key topics include the distinction between tangible and intangible assets, responsible asset management, and the implications of capital leases on ownership.

0 views • 61 slides

Comprehensive Guide to IFRS 16 Implementation

Leases under IFRS 16 are recognized on the lessee's financial statement, with a single accounting model for most leases. There are exemptions for short-term leases and low-value assets. Lessor accounting remains largely unchanged from IAS 17, with new disclosure requirements. Effective from 1 April

1 views • 48 slides

Major Accounting Issues Affecting Private Clubs and Not-for-Profit Entities

Condon O'Meara McGinty & Donnelly LLP discusses current accounting issues impacting private clubs, including ASU 2016-14 on not-for-profit financial statements, ASC 606 revenue recognition, ASC 842 on accounting for leases, and ASC 715 on compensation retirement benefits. The presentation covers rea

0 views • 49 slides

Guidelines for ISDEAA P.L. 93-638 Section 105(l) Lease Proposals

Guidelines under ISDEAA P.L. 93-638 Section 105(l) state that the Indian Health Service (IHS) must engage in leases with Tribes for delivering services in tribal buildings. These 105(l) leases are not standard leases but facility cost agreements to cover operational expenses. Lease proposals must be

0 views • 21 slides

Legal Considerations for Affordable Housing Land Trusts

Explore legal issues and regulations surrounding Community Land Trusts in DC, Virginia, and Maryland. Learn about the implications of ground leases, ownership rights, and separation of land and improvements in affordable housing initiatives. Discover the responsibilities and restrictions imposed on

0 views • 13 slides

Understanding IFRS 16: Accounting Treatment of Leases

The accounting treatment of leases under IFRS 16 involves recognition, measurement, presentation, and disclosure. IFRS 16 removes the distinction between finance leases and hire purchase contracts, requiring all leases to be capitalized. This standard aims to provide a consistent approach to lease a

1 views • 13 slides

PNG Continuation Government of Alberta - Roles and Responsibilities Overview

This document outlines the roles and responsibilities within the Government of Alberta's ETS system for managing user accounts, assigning roles, and processing various form types. It covers the different roles required for authorizing actions related to Crown petroleum and natural gas licenses or le

0 views • 14 slides

PNG Continuation Authorization Training Module for Alberta Government

Comprehensive training module focusing on the authorization process for companies acting on behalf of designated representatives for Crown petroleum and natural gas licenses or leases in Alberta. Learn how to submit, check the status, concur, reject, and revoke authorization requests within the PNG

0 views • 42 slides

Comparison of Ownership Concepts in the Iraqi and Louisiana Civil Codes

The preliminary part of the Iraqi Civil Code recognizes various rights in rem, including ownership, disposal, usufruct, use, habitation, servitudes, and leases. It details the concept of ownership, perfect ownership rights, and additional rights such as "surface right" and tasarruf. The Iraqi Code a

0 views • 5 slides

Understanding GASB 87 Leases: Key Information and Implementation Guidelines

This informational material focuses on GASB 87 Leases, covering aspects like the definition of leases, exclusions, accounting treatments, and implementation steps for government entities. GASB 87, issued in 2017, aims to enhance accounting and financial reporting for leases by governments through a

0 views • 23 slides

A Comprehensive Guide to Long-Term Leasing for Landlords

Exploring Long-Term Leasing (LTL) as a new option in the Victorian housing market, this guide covers what LTL is, what it entails, how to start and end an LTL agreement, and what is covered under such leases. With a focus on providing stability and certainty for both landlords and tenants, this guid

0 views • 8 slides

New Tenant-Friendly Laws in Virginia - July 2019

Virginia has introduced new laws aimed at providing more protection and clarity for tenants, addressing issues such as written leases, eviction processes, and affordability. These changes seek to tackle the high eviction rates in various cities and factors such as poverty, unfavorable laws, and gent

0 views • 30 slides

Understanding Leases in Medicaid DD Waiver Residential Settings

Exploring the importance of leases in residential settings covered by the HCBS Settings Rule for Medicaid DD Waiver programs. The presentation highlights key terms, provisions, and protections for individuals with developmental disabilities living in provider-owned or controlled residential settings

0 views • 19 slides

Fundamentals of Computer Networks

Explore the essentials of computer networks, covering topics such as DHCP, NAT, IPv6, server operations, and IP address allocation. Understand how DHCP servers control IP address pools and provide network configurations to clients. Learn about address leases for dynamic allocation and how DHCP clien

0 views • 35 slides

Understanding Leases and Tenancies: Responsibilities of Landlords, Tenants, and Room Hirers

Explore the intricate world of leases and tenancies, learning the distinct responsibilities of landlords, tenants, and room hirers. From commercial buildings to residential properties, delve into obligations such as building maintenance, emergency preparedness, and compliance with regulations like s

0 views • 16 slides

MST Operating and Capital Budget FY 2025 Summary

The MST Operating and Capital Budget for FY 2025 focuses on maximizing revenues, increasing bus advertising rates, promoting transit services, seeking grants for capital projects, and maintaining stable staffing levels. The budget priorities also include operating a Better Bus Network at Board-adopt

0 views • 10 slides

Federal Reporting Entity Update: Highlights from FASAB Review

Explore the latest updates from the Federal Accounting Standards Advisory Board (FASAB) review, including insights on the reporting model, risk considerations, assumed leases, and public-private partnerships. Learn about the significant changes in federal financial reporting entities and the impleme

0 views • 25 slides

Federal Government Accounting and Auditing Conference Update

CliftonLarsonAllen presents the Federal Government Accounting and Auditing Conference update, discussing topics such as fiscal sustainability, fiscal projections, social insurance, and standards-setting over the past 25 years. The event highlights important projects related to risk, assumed leases,

0 views • 31 slides

Understanding Greek Housing Deal Structures

Explore the nuances of ground leases, financing, and deal risks in Greek housing arrangements with Sean P. Callan, Esq. Learn about common deal structures, inherent risks, and considerations for owning, leasing from private landlords, and leasing from host institutions. Gain insights into the comple

0 views • 32 slides

Valuation Using the Income Approach in Real Estate

The income approach to appraisal in real estate involves converting future income into a present value through income capitalization. This method utilizes direct capitalization and discounted cash flow techniques to estimate property value based on net operating income. Estimating net operating inco

0 views • 17 slides

Understanding Termination of Lease in Residential Premises

Explore the termination process in residential leases, covering legal regulations, succession rights, and the roles of the lessor and lessee. Discover how leases can end through various means such as termination by court, lessee, or lessor. Learn about Polish Civil Code and Acts protecting inhabitan

0 views • 15 slides

Equipment Leasing & Finance Industry Overview

The equipment leasing and finance industry is a dynamic and global sector that plays a crucial role in enabling businesses to acquire essential equipment through financing options such as loans and leases. With an estimated $1.8 trillion invested annually by U.S. businesses, nonprofits, and governme

0 views • 43 slides

Wappingers Central School District Transportation Budget Analysis 2016-2017

The Wappingers Central School District's transportation budget for 2016-2017 highlights changes in expenses such as salaries, health insurance, BOCES services, and vehicle leases compared to the previous year. This analysis showcases a detailed breakdown of cost adjustments and areas of increase and

0 views • 21 slides

Understanding Tenant Transfer Procedures and Income Verification in Housing Management

This content discusses important questions and answers related to tenant transfer effective dates, income verification during self-certification, rental fees for month-to-month leases, compliance with housing division policies, and verification requirements for Temporary Assistance for Needy Familie

0 views • 12 slides

Nevada Department of Taxation Leases Overview

Overview of types of leases in Nevada, including long-term and short-term options for vehicles, heavy-duty equipment, computer hardware, and more. Details on general leasing definitions, regulations, and tax implications for lessors and lessees in the state.

0 views • 17 slides

Equipment Leasing & Finance Industry Overview: A Dynamic Global Sector

The equipment leasing and finance industry plays a vital role in enabling businesses to acquire necessary equipment for operations and growth. In the U.S. alone, businesses, nonprofits, and government agencies invest trillions in capital goods annually, with a significant portion financed through lo

0 views • 43 slides

Overview of Lease and Tenancy Laws in Great Britain

Understand the lease and tenancy laws in Great Britain, including the Landlord and Tenant Act 1954 for commercial properties and the Housing Act 1985 for secure tenancies. Learn about the operation of break clauses, security of tenure for tenants, and how landlords can end leases with security of te

0 views • 10 slides

Virginia Landlord-Tenant Law Overview by Martin Wegbreit, Esq.

Explore the key aspects of Virginia landlord-tenant law through an in-depth training session presented by Martin Wegbreit, Esq., Director of Litigation at Central Virginia Legal Aid Society. Topics covered include sources of the law, leases, fair housing, tenant selection policies, security deposits

0 views • 50 slides

Legal Guide for Housing and Landlord/Tenant Issues in Wisconsin

This comprehensive guide covers various aspects related to housing, mortgages, foreclosures, landlord/tenant issues, leases, security deposits, repairs, and more in Wisconsin. It provides valuable information on resolving disputes, contacting relevant authorities, handling evictions, and seeking leg

0 views • 46 slides

Updates to MCS and Related Documents 2021/2022

The 2021/2022 updates to the Modified Cash Standard (MCS) include both minor and significant amendments across various chapters, such as changes in the presentation of financial statements, revenue definitions, disclosures on employee benefits, and accounting for capital assets and leases. These upd

0 views • 10 slides

Regulations Update: COVID-19 Commercial Leases and Licences Extension

The COVID-19 Omnibus (Emergency Measures) Regulations have been extended to 31st December 2020, creating a new regulatory regime for rent relief. Changes include an extended time period, updated definition of eligible leases, and clarifications regarding turnover.

0 views • 16 slides