What is the monthly income of a hotel owner

Determining the monthly payment of a hotel owner can be fairly intricate and variable, as it counts on considerable elements such as the size and location of the hotel, its occupancy rate, average room rates, functioning expenditures, and other revenue rivulets such as food and potable usefulness, m

1 views • 4 slides

What is the monthly income of a hotel owner in India

Determining the monthly payment of a hotel owner can be fairly intricate and variable, as it counts on considerable elements such as the size and location of the hotel, its occupancy rate, average room rates, functioning expenditures, and other revenue rivulets such as food and potable usefulness, m

1 views • 4 slides

Tax Considerations for Incentive, Recognition & Safety Programs

This presentation provides guidelines on tax implications, exemptions, and reporting obligations related to incentive, recognition, and safety programs. It emphasizes the importance of understanding tax considerations for program sponsors and participants to ensure compliance with applicable laws an

3 views • 14 slides

Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary

The public hearing on the 2023 Tax Rates and FY 2024 Schedule of Fees highlighted the importance of real estate taxes as the major revenue source for the Town's General Fund. The proposed tax rate of 16.25 per $100 assessed for FY 2024 was discussed, along with the impact on residential units and ta

1 views • 9 slides

Stay Close: Hotel Rooms Near Me

Stay at Hotel Rio Vista for the best hotel rooms near you! Our luxurious hotel offers unbeatable amenities and unbeatable customer service. Experience the ultimate comfort and convenience today!\n\n\/\/hotelriovista.com\/local-events\/

4 views • 1 slides

Hotel Reservation System Design

Travelopro is an Award-winning travel technology company that provides a hotel reservation system to travel agencies, tour operators and travel companies Hotel Reservation System is a perfect strategy for travel agencies, tour operators and travel companies. We deliver online travel solutions for B2

16 views • 15 slides

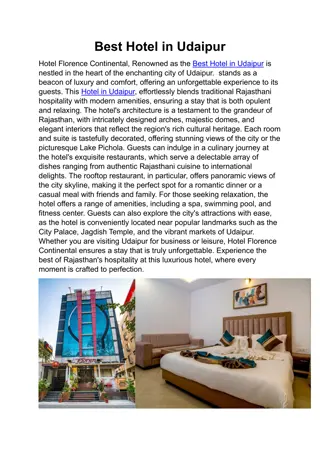

Best Hotel in Udaipur

Hotel Florence Continental, Renowned as the Best Hotel in Udaipur is nestled in the heart of the enchanting city of Udaipur. stands as a beacon of luxury and comfort, offering an unforgettable experience to its guests. This Hotel in Udaipur, effortlessly blends traditional Rajasthani hospitality wi

2 views • 1 slides

Best 3 star hotel in Udaipur

In the realm Best 3 star hotel in Udaipur, Hotel Florence Continental shines as a beacon of comfort and value. This charming hotel offers a delightful blend of modern amenities and traditional Rajasthani hospitality, ensuring a memorable stay for every guest. The rooms at Hotel Florence Continental

4 views • 1 slides

Best luxury hotel in Udaipur

Hotel Florence Continental is renowned as one of the Best hotel with dining in Udaipur, offering a culinary journey that is as memorable as it is delectable. The hotel's dining options cater to every palate, promising a gastronomic experience that is sure to delight even the most discerning of guest

3 views • 1 slides

Best hotel with dining in Udaipur

Hotel Florence Continental is renowned as one of the Best hotel with dining in Udaipur, offering a culinary journey that is as memorable as it is delectable. The hotel's dining options cater to every palate, promising a gastronomic experience that is sure to delight even the most discerning of guest

1 views • 1 slides

Empowering NRIs: Indian Tax Services for England-Residing Individuals

Empowering NRIs: Indian Tax Services for England-Residing Individuals\" embodies our commitment to providing comprehensive tax solutions tailored specifically for Non-Resident Indians (NRIs) living in England. At NRI Taxation Bharat, we understand the unique challenges faced by NRIs abroad and striv

6 views • 11 slides

Luxury Boutique Hotel in Udaipur

Hotel Varju Villa epitomizes luxury and sophistication, standing as a premier Luxury Boutique Hotel in Udaipur, this hotel offers a truly enchanting experience for discerning travelers. Each room at Hotel Varju Villa is a masterpiece of elegance and comfort, meticulously designed to create a harmoni

0 views • 1 slides

Professional Tax Assistance for NRIs in Canada from India

If you are a non-resident Indian (NRI) in Canada, we are here to help you with your tax needs. Our team of experts can handle all the international tax complexities to make sure you are compliant and get the maximum tax benefits. We offer NRI\u2019s tax filing, tax planning, and tax advisory service

0 views • 12 slides

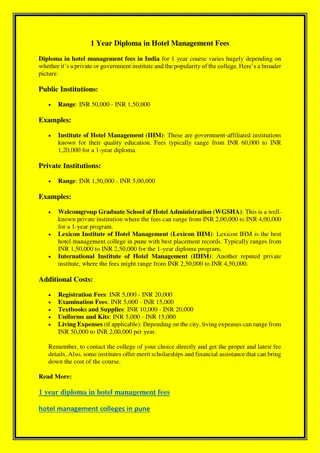

1 Year Diploma in Hotel Management Fees

The 1-year diploma in hotel management fees at Lexicon Institute of Hotel Management are sufficiently inexpensive to enable students from all socioeconomic situations to pursue post-12 affordable education. It provides two hotel management diploma programs: the Advanced Diploma in Hospitality Studie

0 views • 1 slides

White Label Hotel Booking Engine

Travelopro's White Label Hotel Booking Engine will enable you to offer customers a seamless travel booking experience, increase customer engagement and loyalty, and drive revenue. We deliver a state-of-the-art white-label hotel booking engine specifically crafted for travel agencies, tour operators,

2 views • 15 slides

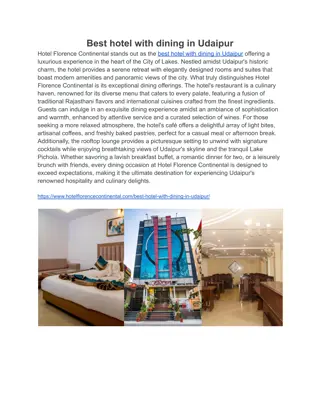

Best hotel with dining in Udaipur

Hotel Florence Continental stands out as the best hotel with dining in Udaipur offering a luxurious experience in the heart of the City of Lakes. Nestled amidst Udaipur's historic charm, the hotel provides a serene retreat with elegantly designed rooms and suites that boast modern amenities and pano

0 views • 1 slides

Hotel Internet Booking Engine

Discover Travelopro's cutting-edge hotel internet booking engine. Elevate your hospitality experience with our tailored services, designed for hotels of all sizes. A hotel Internet booking engine is a software tool on the hotel's own website to ensure that guests can easily book directly with the ho

2 views • 15 slides

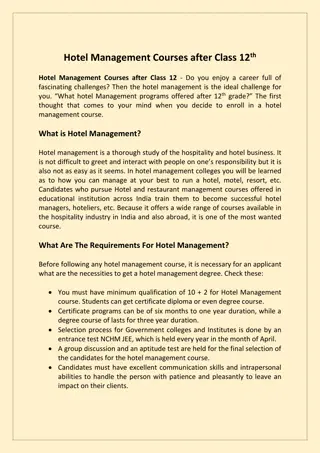

Hotel Management Courses after Class 12th

Hotel management is a thorough study of the hospitality and hotel business. It is not difficult to greet and interact with people on one\u2019s responsibility but it is also not as easy as it seems. In hotel management colleges you will be learned as to how you can manage at your best to run a hotel

0 views • 3 slides

Hotel Module

Discover Travelopro's cutting-edge Hotel Module. Elevate your hospitality experience with our tailored services, designed for hotels of all sizes. The Hotel Module is developed to cater to the needs of the hotel industry. The Hotel Module enables you

2 views • 15 slides

Tax Benefits and Double Tax Treaties in Cyprus

Cyprus offers an attractive tax regime, with a corporate tax rate of 12.5%, exempt capital gains, and favorable personal tax rates for residents. Additionally, Cyprus has double tax treaties with numerous countries, making it an ideal location for individuals and businesses seeking tax efficiency.

0 views • 21 slides

Understanding Taxes for Ministers

Explore the complex world of taxes for ministers, covering topics such as denial, anger, bargaining, depression, and acceptance. Learn about current and future tax obligations, including federal income tax, state income tax, Medicare tax, Social Security tax, and self-employment tax. Discover key di

2 views • 32 slides

Understanding Hotel Classification and Types

Hotel classification and types cover various aspects such as facilities, services, amenities, guest types, and factors influencing hotel classification. From resort hotels to airport hotels and city center accommodations, each hotel type serves different purposes and caters to diverse guest preferen

0 views • 44 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

Hotel Ebeye - Your Island Getaway in the Marshall Islands

Hotel Ebeye is a charming hotel located on the island of Ebeye in the Kwajalein Atoll, Marshall Islands. Managed by Majuro's Marshall Islands Resort, the hotel offers 18 rooms including suites, deluxe rooms, and double rooms. Enjoy delicious cuisine at the on-site restaurant and relax in comfortable

0 views • 6 slides

Ramada Chelsea Hotel Al Barsha - Deluxe 4-Star Hotel in New Dubai

Located in the heart of New Dubai, Ramada Chelsea Hotel Al Barsha is a brand new 4-star deluxe hotel offering 277 well-appointed rooms and suites with stunning views of the city. With a large conference and banquet facility, health club and spa, multiple dining options, and proximity to major landma

0 views • 13 slides

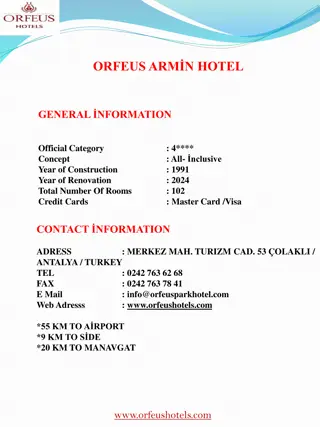

Orfeus Armn Hotel - All-Inclusive Beachfront Retreat in Antalya, Turkey

Orfeus Armn Hotel is a 4-star all-inclusive beachfront hotel in Antalya, Turkey. Featuring 102 rooms, this hotel offers comfortable accommodations with modern amenities. Enjoy a range of facilities including beach and pool access, multiple dining options, and a variety of sports and entertainment ac

0 views • 4 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Understanding Tax Morale and the Shadow Economy in Greece

Tax morale plays a crucial role in determining the size of the shadow economy in Greece. Factors such as unemployment, tax burden, and self-employment also influence the shadow economy. Tax compliance decisions are driven not only by enforcement but also by tax morale. Various determinants of tax mo

0 views • 21 slides

Understanding U.S. Income Tax for Nonresident Students

This presentation provides an overview of U.S. income tax requirements for nonresident alien students in the United States. It covers topics such as federal and state taxation, income tax treaties, tax filing obligations, and exemptions. Nonresident aliens may be subject to tax on income received in

0 views • 23 slides

Understanding Tax Transparency and Revenue Cycles

Exploring the complexities of the tax gap, this piece highlights the hidden aspects of revenue cycles and tax evasion. It emphasizes the need for a new approach to assess tax expenditures and spillovers for a balanced tax system, contrasting it with the repercussions of poor tax design. Richard Murp

0 views • 11 slides

Tax Arrears Collection Methods in Liberia

Explore the tax arrears management practices in Liberia as per the Liberia Revenue Code. Learn about the legal provisions, tax treatment, and debt collection procedures, including adjustment in tax credit, closure of businesses, seizure, and sale of goods. Understand when tax arrears arise and the a

0 views • 45 slides

Analysis of State Tax Costs on Businesses: Location Matters

Explore the comprehensive analysis of state tax costs on businesses in "Location Matters." The study reveals varying tax burdens across different states, with insights on the impact on business operations. Findings highlight the significance of location in determining corporate tax liabilities and p

0 views • 32 slides

Hotel Tax Distribution Overview for House Oversight Subcommittee

Hotel Tax Distribution presentation covers changes in hotel tax distribution, including how it is distributed, what is taxed, and the shared regional districts in Rhode Island. It details the breakdown of occupancy taxes, state funds distribution, and the impact on various municipalities and tourism

0 views • 17 slides

Tax Workshop for UC Graduate Students - Important Tax Information and Resources

Explore essential tax information for UC graduate students, featuring key topics such as tax filing due dates, IRS tax forms, California state tax forms, scholarships vs. fellowships, tax-free scholarships, emergency grants, and education credits. This informational presentation highlights resources

0 views • 18 slides

Understanding the Interaction Between Criminal Investigations and Civil Tax Audits in Sweden

The relationship between criminal investigations and civil tax audits in Sweden is explored, highlighting how tax audits and criminal proceedings run concurrently. The mens rea requirement for criminal sanctions and tax surcharge, as well as the integration between criminal sanctions and tax surchar

0 views • 13 slides

Understanding the Basics of Income Tax on Death for Estate Planning

This informative content explores the essentials of income tax implications upon death, including notional sales triggering capital gains, inclusion of income in the deceased's final tax return, and considerations for minimizing tax burdens. It also highlights which assets trigger income tax on deat

0 views • 8 slides

Understanding Sales and Use Tax in Arizona

The University in Arizona is not tax-exempt and sales made to the University are subject to sales tax as per the Arizona Revised Statutes. This guide explains what is taxable under sales and use tax, the difference between sales tax and use tax, exceptions to tax rules, and reporting use tax on P-Ca

0 views • 13 slides

Guide to Reducing Tax Withholding for Nonresident Aliens

Learn how to reduce or stop tax withholding as a nonresident alien by completing the Foreign National Tax Information Form and following the steps outlined by the Tax Department. This guide includes instructions on logging into the Foreign National Information System, tax analysis, signing tax forms

0 views • 21 slides

Overview of Minnesota State Airports Fund Revenue Sources

The Minnesota State Airports Fund, overseen by Aeronautics Director Cassandra Isackson, is funded through various sources including Aviation Fuel Tax, Airline Flight Property Tax, Aircraft Registration Tax, Aircraft Sales Tax, and more. Revenue sources like Aircraft Sales Tax, Airline Flight Propert

0 views • 11 slides

Overview of Goods and Services Tax (GST) in Nagaland

GST in Nagaland was introduced on July 1, 2017, with the aim of simplifying the tax structure by subsuming multiple indirect state taxes. It is a destination-based tax system that promotes ease of doing business, reduces tax burden, and creates a common market across India. The tax is levied on the

1 views • 18 slides

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)