Understanding Financial Markets in India

Financial markets play a crucial role in connecting lenders and borrowers, providing avenues for investment and capital generation. In India, the financial system includes money markets and capital markets, offering diverse financial products and opportunities for investors. Money markets deal with

2 views • 106 slides

Mastering Futures Trading Strategies

Master the art of Futures Trading with Structure2trade.com's comprehensive course. Learn proven strategies to boost your profits and success!\n\n\/\/structure2trade.com\/category\/futures-trading\/

6 views • 1 slides

Understanding Taxation and Reporting of Futures and Options (F&O) Transactions

Explore the taxation aspects and reporting requirements related to Futures and Options (F&O) transactions. Learn about the types of F&O transactions, relevant heads of income for reporting income/loss, and the provisions of Section 43(5) of the Income Tax Act, 1961, defining speculative tran

1 views • 24 slides

Understanding Markets and Economic Structures

Markets play a crucial role in bringing buyers and sellers together for transactions. This article discusses the concept of markets, different types of markets in a capitalist economy, focusing on perfect competition. It outlines the features and conditions of perfect competition, emphasizing the im

2 views • 42 slides

Step-by-Step Guide for Completing Dual Enrollment Application Using Ga Futures

Follow this step-by-step guide to complete the Dual Enrollment Application using Ga Futures. Starting from logging into the Ga Futures website to submitting the application, this guide covers each essential step to ensure a successful application process.

0 views • 18 slides

Bright Futures: Guidelines for Health Supervision of Infants, Children, and Adolescents

This content provides a comprehensive guide for health supervision of infants, children, and adolescents based on Bright Futures guidelines. It includes priorities and screening tables for various visits from newborn to 9 months, offering valuable insights into the developmental stages and health mo

0 views • 16 slides

Understanding Climate Finance in Green Futures

Explore the significance of Climate Finance in Green Futures through examples from Thailand and Costa Rica. Learn about mitigation and adaptation efforts, funding sources like the Green Climate Fund, and career opportunities in this pivotal sector. Discover how Climate Finance addresses climate chan

1 views • 27 slides

Understanding Futures and Swaps in FX Markets

Exploring the world of FX derivatives such as futures, options, and swaps, with insights into how futures contracts differ from forward contracts, the concept of long squeezes in the oil market, and the risks associated with specific investment products like Crude Oil Treasure. Discover the intricac

0 views • 47 slides

University of the South Pacific: Shaping Pacific Futures Through Academic Excellence

The University of the South Pacific, under the leadership of Professor Pal Ahluwalia, is committed to shaping Pacific futures by empowering students, staff, and alumni to become agents of positive change. With a focus on education, research, regional cooperation, and values like commitment, innovati

0 views • 15 slides

Understanding the Importance of Money Markets and Bond Markets

Money markets play a crucial role in the financial system by providing short-term, low-risk, and liquid investment options. Participants include institutional investors and dealers who engage in large transactions. Money market securities have specific characteristics, such as large denominations, l

0 views • 23 slides

Exploring Pathways to Future Scenarios: ADK Futures Update

ADK Futures Year 7 Update provides insights on strategic conversations about possible futures, event paths connected to end states, and the framework for monitoring progress. Stakeholders discuss desirable and undesirable end states, emphasizing proactive planning and adaptability. The database on A

0 views • 40 slides

Envisioning Potential Futures Facilitator Guide

This facilitator guide provides a structured exercise for participants to think across time, envision various future scenarios, and consider actions to shape those futures. The exercise consists of two phases focusing on understanding current issues, exploring potential futures, and strategizing act

0 views • 31 slides

Understanding Futures Markets: Mechanism and Pricing Dynamics

Futures markets play a crucial role in price convergence between futures and spot prices of underlying assets. Traders can exploit arbitrage opportunities when the futures price deviates from the spot price during the delivery period. Settlement of futures contracts can be done through offsetting, d

3 views • 13 slides

Understanding International Financial Markets: Key Insights and Considerations

International Financial Markets play a crucial role for Multinational Corporations (MNCs) in accessing foreign exchange, money, credit, bond, and stock markets. MNCs leverage the international money market for various purposes like borrowing short-term funds in foreign currencies and investing for h

0 views • 25 slides

Understanding Financial Instruments and Markets

Explore asset classes like fixed income securities, money market instruments, and capital market instruments. Learn about different financial instruments in various markets including money market, bond market, equity markets, and derivative markets. Dive into money market instruments like Treasury b

0 views • 47 slides

Understanding Futures and Daily Resettlement in Financial Trading

Explore the concepts of derivatives, futures contracts, and daily resettlement in financial markets. Learn about the differences between forward and futures contracts, standardizing features, and examples of daily resettlement with FX trading. Gain insights into how investors navigate risks and oppo

0 views • 16 slides

Understanding Commodity Hedging in Financial Markets

Commodity hedging involves mitigating risk associated with price fluctuations in raw materials by taking opposite positions in futures and physical markets. This strategy helps individuals and businesses safeguard against potential losses and ensure revenue certainty. An example with a wheat farmer

0 views • 10 slides

Supporting Youth: Collaboration Between Delaware Guidance Services and Delaware Futures

Delaware Guidance Services and Delaware Futures have joined forces to provide holistic support to youth. DGS offers clinical services and community-based support, while Delaware Futures focuses on academic enrichment and career preparation. Together, they have implemented trauma training programs an

0 views • 16 slides

Livestock Economics and Marketing: Understanding Markets and Classification

Livestock markets are essential for the buying and selling of livestock and related products. Markets can be classified based on various factors such as location, nature of commodities, time span, and more. Understanding the essentials of markets, livestock market components, and classification help

0 views • 18 slides

IIASA's Water Program: History, Strategy, and Progress

IIASA's Water Program focuses on addressing water insecurity, uncertain futures, food security, degraded water environments, and the impacts of floods and droughts. Their mission involves conducting interdisciplinary research to identify sustainable water solutions for improving human well-being thr

0 views • 10 slides

Understanding Foreign Exchange Markets and Risks

Financial managers need to grasp the operations of foreign exchange markets for global business success. These markets allow participants to trade currencies, raise capital, transfer risk, and speculate on currency values. Transactions expose businesses to foreign exchange risk, where fluctuations i

0 views • 40 slides

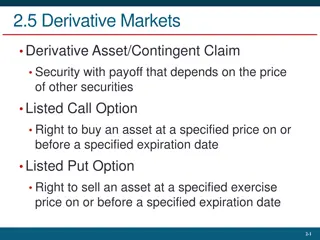

Understanding Derivative Markets and Investment Options

Explore the world of derivative markets through stock options on Apple, futures contracts, and the impact of exercise price, time to expiration, volume, and open interest on option values. Gain insights into listed call and put options, different option prices, and the dynamics of futures contracts

0 views • 9 slides

Understanding Forwards, Futures, and Swaps in Investment Finance

Dive into the world of investments with a detailed analysis of forwards, futures, and swaps. Discover how these derivatives work, their key characteristics, and practical examples of how they are utilized for hedging and risk management in the financial markets.

1 views • 36 slides

Imagining Futures with Aboriginal and Torres Strait Islander People

Creating a future involves principles for present action, studying the effects of the future, partisan and personal aspects of futures work, open and closed futures, open-ended and multiple possibilities, process-oriented approach, quest for alternatives, practical imagination, and challenging habit

0 views • 8 slides

Advancements in Electricity Markets and Regulation: Focus on Integration of Distributed Energy Resources

This article highlights the ongoing activities and discussions within the C5 Committee on Electricity Markets and Regulation, emphasizing the impacts of market approaches, regulatory roles, and emerging technologies in the electric power sector. Key areas of attention include market structures, regu

0 views • 14 slides

Implementing Voluntary Residual Capacity Markets for Clean Energy Policies

Explore the concept of voluntary residual capacity markets to support the implementation of state clean energy policies. Learn how these markets allow load-serving entities to meet capacity obligations outside traditional markets, respecting state goals and methods. Discover the workings and design

0 views • 9 slides

Understanding Financial Derivatives: An Overview of Forward Contracts, Futures, Options, Swaps, and Credit Derivatives

Financial derivatives play a crucial role in managing risk and speculation in financial markets. This overview covers the definitions and characteristics of forward contracts, futures contracts, options (calls and puts), swaps, and credit derivatives. Swaps involve exchanging payments over time, whi

1 views • 23 slides

Understanding the Significance of Financial Markets and Institutions

Studying financial markets and institutions is crucial as it facilitates the efficient transfer of funds, promotes economic growth, impacts personal wealth, influences business decisions, and plays a significant role in determining interest rates. Debt markets, including bond markets, enable borrowi

0 views • 15 slides

Understanding Money Markets and Their Role in the Economy

Money markets are financial markets where short-term, low-risk securities are traded. Unlike banks, they offer distinct advantages such as liquidity, active secondary markets, and cost efficiency in providing short-term funds due to lower regulations. Despite the presence of banks, money markets pla

0 views • 33 slides

Introduction to Security Types in Financial Markets

This chapter provides an overview of different types of securities traded in financial markets worldwide. It covers classifications of financial assets, including money market instruments, fixed-income securities, equities, futures, and options. The focus is on interest-bearing assets, such as Treas

0 views • 21 slides

Understanding Currency Derivatives and Exchange Rate Movements

Explore the history and significance of currency derivatives in global and Indian markets. Learn about currency appreciation, depreciation, and the impact on foreign exchange rates. Discover how to interpret changes in currency values and their implications for trading. Gain insights into the functi

0 views • 85 slides

Understanding Dynamics of Perfect Markets in Microeconomics

Explore the dynamics of perfect markets in microeconomics through this presentation by Mrs. L. Booi. Learn about the short and long run production, cost and revenue curves, and the concepts of perfect markets and imperfect markets. Gain insights into how things behave and affect other markets in the

0 views • 23 slides

Understanding Power Markets in Nordic Countries: Insights into Day-ahead and Intraday Markets

Delve into the intricate workings of power markets in Nordic countries, exploring key terms, market pricing strategies, vRES impact, and the significance of day-ahead and intraday markets. Discover how the merit order and bidding zones influence pricing and system operations, ensuring efficient elec

0 views • 11 slides

Evolution of Markets and Peddlers in New York City

Early markets in New York City date back to the 17th century, with the establishment of public markets and the emergence of peddlers playing a significant role in the city's history. The evolution of markets, corruption issues, the importance of peddlers to immigrants, and the challenges they faced,

0 views • 17 slides

Understanding Financial Markets: Mechanisms and Efficiency

Financial markets play a crucial role in connecting borrowers and lenders, facilitating the flow of funds for optimal allocation. Different financial phases involve borrowing, saving, and investing. Transfers of funds occur directly or through intermediaries. Efficiency in financial markets ensures

0 views • 15 slides

Understanding Stable Matching Markets in Unbalanced Random Matching Scenarios

In the realm of two-sided matching markets where individuals possess private preferences, stable matchings are pivotal equilibrium outcomes. This study delves into characterizing stable matchings, offering insights into typical outcomes in centralized markets like medical residency matches and decen

0 views • 49 slides

Understanding International Finance: Scope, Importance, and Challenges

International finance explores interactions between countries, including currency exchange rates, foreign direct investment, and risk management. The scope includes foreign exchange markets, MNC financial systems, and international accounting. It raises questions on liberalizing financial markets, I

0 views • 52 slides

Understanding Futures Contracts: Features and Examples

Futures contracts are standardized agreements between buyers and sellers, marked-to-market daily to manage risk. Features include maintenance and initial margins, with gains and losses reflected in margin accounts. Examples illustrate how to calculate gains and losses in futures trading scenarios.

0 views • 10 slides

Improving Futures Funding for Global Traders

Futures funding programs offer traders the capital to succeed. A superior model emphasizes transparency, flexible rules, generous payouts, and global reach, allowing traders to focus on strategy, growth, and success in the competitive futures market.

0 views • 2 slides

Exploring Overseas Markets for Beauty Looks Jewellery Business

The case study revolves around a Delhi-based partnership business, Beauty Looks, involved in the making and marketing of artificial jewellery. Partners Kunal and Gaurav consider venturing into the export market after being prompted by a regular international client. They send their marketing manager

0 views • 14 slides