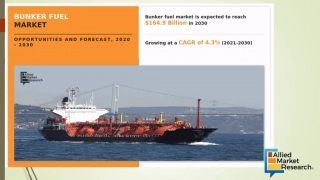

Bunker Fuel Market

Bunker fuel is a fuel oil used in marine vessels. It is poured into the ship bunkers to keep the engines running. Ships use three types of marine fuels, which include high sulfur fuel oil, low sulfur fuel oil, and diesel oil. Presently, growth in awareness toward reducing environmental pollution and

2 views • 6 slides

Bunker Fuel Market

Bunker fuel is a fuel oil used in marine vessels. It is poured into the ship bunkers to keep the engines running. Ships use three types of marine fuels, which include high sulfur fuel oil, low sulfur fuel oil, and diesel oil. Presently, growth in awareness toward reducing environmental pollution and

1 views • 6 slides

Bunker Fuel Market

Bunker fuel is a fuel oil used in marine vessels. It is poured into the ship bunkers to keep the engines running. Ships use three types of marine fuels, which include high sulfur fuel oil, low sulfur fuel oil, and diesel oil. Presently, growth in awareness toward reducing environmental pollution and

6 views • 6 slides

Egypt Retail Fuel Stations Market

A fuel station, also known as a petrol station, gas station, service station, or filling station, is a retail outlet that sells motor vehicle fuel to vehicle owners. Fuel stations provide various fuels including diesel, petrol, gasoline, kerosene, and ethanol. The main components of a fuel station i

5 views • 6 slides

Tax Considerations for Incentive, Recognition & Safety Programs

This presentation provides guidelines on tax implications, exemptions, and reporting obligations related to incentive, recognition, and safety programs. It emphasizes the importance of understanding tax considerations for program sponsors and participants to ensure compliance with applicable laws an

3 views • 14 slides

Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary

The public hearing on the 2023 Tax Rates and FY 2024 Schedule of Fees highlighted the importance of real estate taxes as the major revenue source for the Town's General Fund. The proposed tax rate of 16.25 per $100 assessed for FY 2024 was discussed, along with the impact on residential units and ta

1 views • 9 slides

Typical Delivery Times for Fuel Delivery Services in Vancouver

Need fuel but can't make it to the gas station? The mobile fuel companies will bring gas,\ndiesel, or other fuels right to your location on demand. But you might be wondering how\nlong it takes for the mobile fuel truck to arrive once you request a Vancouver fuel\ndelivery. However, delivery times c

9 views • 4 slides

Empowering NRIs: Indian Tax Services for England-Residing Individuals

Empowering NRIs: Indian Tax Services for England-Residing Individuals\" embodies our commitment to providing comprehensive tax solutions tailored specifically for Non-Resident Indians (NRIs) living in England. At NRI Taxation Bharat, we understand the unique challenges faced by NRIs abroad and striv

6 views • 11 slides

Professional Tax Assistance for NRIs in Canada from India

If you are a non-resident Indian (NRI) in Canada, we are here to help you with your tax needs. Our team of experts can handle all the international tax complexities to make sure you are compliant and get the maximum tax benefits. We offer NRI\u2019s tax filing, tax planning, and tax advisory service

0 views • 12 slides

Tax Benefits and Double Tax Treaties in Cyprus

Cyprus offers an attractive tax regime, with a corporate tax rate of 12.5%, exempt capital gains, and favorable personal tax rates for residents. Additionally, Cyprus has double tax treaties with numerous countries, making it an ideal location for individuals and businesses seeking tax efficiency.

0 views • 21 slides

Preliminary Analysis of Fuel Dependence and E-Mobility in the Pacific

This study by PhD Candidate Edoardo Santagata at UNSW delves into the fuel dependence and potential for e-mobility in the Pacific region. It includes data collection on energy consumption, fuel demand, vehicle registrations, and scenarios for electric vehicle integration. Preliminary findings highli

1 views • 17 slides

Fuel Pricing Mechanisms and Regulatory Framework Presentation

This presentation to the Portfolio Committee on Mineral Resources and Energy delves into the Basic Fuel Price (BFP) for liquid fuels, covering global fuel pricing forms, policy positions, key pricing mechanisms, regulatory mandates, and the intricate structure behind fuel prices. It explains how the

2 views • 28 slides

Understanding Taxes for Ministers

Explore the complex world of taxes for ministers, covering topics such as denial, anger, bargaining, depression, and acceptance. Learn about current and future tax obligations, including federal income tax, state income tax, Medicare tax, Social Security tax, and self-employment tax. Discover key di

2 views • 32 slides

Understanding the Fuel System of Diesel Engines

During operation, a diesel engine's fuel system plays a crucial role in delivering clean fuel to the combustion chamber. The system comprises components like fuel filter, fuel lift pump, fuel injection pump, atomizers, and high-pressure pipes. Proper maintenance is essential to ensure efficient oper

5 views • 12 slides

Fuel Pricing Mechanisms and Regulation Overview

Explore the various fuel pricing options and mechanisms available, including a discussion on alternatives for fuel pricing regulation. The objectives of fuel price regulation, classifications of fuel pricing in the Pacific Islands, and options such as regulating fuel price and tendering national fue

1 views • 11 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

Fuel Composition Transition Modeling in Two-Stage Recycling Reactors

Modeling the transition of fuel composition in a two-stage recycling reactor scenario poses a unique challenge that previous versions of VISION were unable to address. By tracking fuel mass and isotopics through various stages of the fuel cycle, VISION now enables the modeling of reactors with recip

0 views • 15 slides

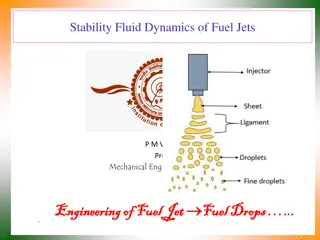

Insights into Fuel Jet Stability and Dynamics

Explore the complex realm of fuel jet stability and dynamics, including topics such as Kelvin-Helmholtz instability, liquid breakup postulations, geometric features of fuel sprays, penetration of spray into air, and more. Gain a deeper understanding of fuel drop formation, spray parameters, structur

1 views • 18 slides

Advances in Aviation Fuel Surrogates and Computational Modeling

This study explores the formulation of petroleum and alternative jet fuel surrogates, coupling chemical kinetics with computational fluid mechanics for engine design, and the variability of aviation fuels. It delves into the concept of surrogate fuel models, previous research on jet fuel surrogates,

0 views • 20 slides

Understanding Energy Poverty and Its Impact on Fuel Poverty in Europe

Evaluating the impact of energy efficiency on fuel poverty, this study examines the emergence of energy poverty in the EU, factors driving fuel poverty across Europe, and UK's definition of fuel poverty. It discusses various policies and strategies implemented to address fuel poverty, emphasizing th

0 views • 16 slides

Evolution of Progressive Income Tax Systems

The concept of modern progressive income tax, developed in the early 20th century in countries like the UK, US, France, India, and Argentina, is based on the principle of a comprehensive tax base encompassing various income categories. The system involves effective vs. marginal tax rates, different

0 views • 19 slides

Understanding Tax Morale and the Shadow Economy in Greece

Tax morale plays a crucial role in determining the size of the shadow economy in Greece. Factors such as unemployment, tax burden, and self-employment also influence the shadow economy. Tax compliance decisions are driven not only by enforcement but also by tax morale. Various determinants of tax mo

0 views • 21 slides

Understanding U.S. Income Tax for Nonresident Students

This presentation provides an overview of U.S. income tax requirements for nonresident alien students in the United States. It covers topics such as federal and state taxation, income tax treaties, tax filing obligations, and exemptions. Nonresident aliens may be subject to tax on income received in

0 views • 23 slides

Fuel Cycle Analysis Toolbox: Enhancing Understanding and Optimization

This presentation focuses on the analyses and evaluations essential for assessing the potential of a fuel cycle, emphasizing different time scales, system sizes, objectives, and audiences. It discusses the need for coupled analyses, various tools required, and opportunities for improvement through i

1 views • 11 slides

Understanding Tax Transparency and Revenue Cycles

Exploring the complexities of the tax gap, this piece highlights the hidden aspects of revenue cycles and tax evasion. It emphasizes the need for a new approach to assess tax expenditures and spillovers for a balanced tax system, contrasting it with the repercussions of poor tax design. Richard Murp

0 views • 11 slides

Tax Arrears Collection Methods in Liberia

Explore the tax arrears management practices in Liberia as per the Liberia Revenue Code. Learn about the legal provisions, tax treatment, and debt collection procedures, including adjustment in tax credit, closure of businesses, seizure, and sale of goods. Understand when tax arrears arise and the a

0 views • 45 slides

Analysis of State Tax Costs on Businesses: Location Matters

Explore the comprehensive analysis of state tax costs on businesses in "Location Matters." The study reveals varying tax burdens across different states, with insights on the impact on business operations. Findings highlight the significance of location in determining corporate tax liabilities and p

0 views • 32 slides

Tax Workshop for UC Graduate Students - Important Tax Information and Resources

Explore essential tax information for UC graduate students, featuring key topics such as tax filing due dates, IRS tax forms, California state tax forms, scholarships vs. fellowships, tax-free scholarships, emergency grants, and education credits. This informational presentation highlights resources

0 views • 18 slides

Understanding the Interaction Between Criminal Investigations and Civil Tax Audits in Sweden

The relationship between criminal investigations and civil tax audits in Sweden is explored, highlighting how tax audits and criminal proceedings run concurrently. The mens rea requirement for criminal sanctions and tax surcharge, as well as the integration between criminal sanctions and tax surchar

0 views • 13 slides

Comprehensive Overview of Aircraft Maintenance Engineering and Fuel Systems

Explore the intricate world of aircraft maintenance engineering encompassing fuel types, storage, lines, valves, filters, tanks, and more. Delve into AVGAS and JET fuels, their properties, and applications in operations. Gain insights into fuel tanks construction, fuel lines management, and the impo

1 views • 25 slides

Investigation of Swelling in Uranium-Plutonium Nitride Fuel for Helium Gas Fabrication and Liquid Metal-Bonded Test Fuel Rods

This study examines the specific details of swelling in uranium-plutonium nitride fuel used for fabrication of helium gas and liquid metal-bonded test fuel rods. Key irradiation parameters, examination techniques, and the structural and phase state of SNUP fuel after low-temperature irradiation are

0 views • 18 slides

Enhancing Safety and Management of Spent Fuel in High-Density Storage

This informative presentation delves into the safety measures and regulatory changes surrounding the storage of spent fuel in high-density pools. Topics covered include the design of spent fuel pools, historical regulatory activities, past studies on fuel uncovery risks, and advancements in analytic

0 views • 17 slides

Understanding the Basics of Income Tax on Death for Estate Planning

This informative content explores the essentials of income tax implications upon death, including notional sales triggering capital gains, inclusion of income in the deceased's final tax return, and considerations for minimizing tax burdens. It also highlights which assets trigger income tax on deat

0 views • 8 slides

Understanding Sales and Use Tax in Arizona

The University in Arizona is not tax-exempt and sales made to the University are subject to sales tax as per the Arizona Revised Statutes. This guide explains what is taxable under sales and use tax, the difference between sales tax and use tax, exceptions to tax rules, and reporting use tax on P-Ca

0 views • 13 slides

Guide to Reducing Tax Withholding for Nonresident Aliens

Learn how to reduce or stop tax withholding as a nonresident alien by completing the Foreign National Tax Information Form and following the steps outlined by the Tax Department. This guide includes instructions on logging into the Foreign National Information System, tax analysis, signing tax forms

0 views • 21 slides

Exploring Fuel and Cars: A Child's Guide

Cars need fuel to move, just like we need food to function. There are different types of fuels for cars, including diesel, petrol, liquid gas, and electricity. Learn how oil is formed, extracted from the earth, and processed into fuel. Explore the journey of fuel from oil rigs to your car's tank. Di

0 views • 6 slides

Hydrogen Fuel Cell Market

\nHydrogen Fuel Cells Market Size, Share & Segmentation By Product Type (Liquid-Cooled Type and Air-Cooled Type), By Technology Type (Polymer Exchange Membrane Fuel Cells (PEMFC), Phosphoric Acid Fuel Cells (PAFC), Solid Oxide Fuel Cells (SOFC), Dire

1 views • 8 slides

Washington State Ferries Fuel Efficiency Initiatives

Washington State Ferries (WSF) is implementing various fuel efficiency measures to reduce fuel consumption, including propeller redesign, hull coatings, and operational changes. The importance of fuel efficiency is highlighted as fuel represents a significant portion of the operating budget. WSF has

0 views • 12 slides

Overview of Minnesota State Airports Fund Revenue Sources

The Minnesota State Airports Fund, overseen by Aeronautics Director Cassandra Isackson, is funded through various sources including Aviation Fuel Tax, Airline Flight Property Tax, Aircraft Registration Tax, Aircraft Sales Tax, and more. Revenue sources like Aircraft Sales Tax, Airline Flight Propert

0 views • 11 slides

Overview of Goods and Services Tax (GST) in Nagaland

GST in Nagaland was introduced on July 1, 2017, with the aim of simplifying the tax structure by subsuming multiple indirect state taxes. It is a destination-based tax system that promotes ease of doing business, reduces tax burden, and creates a common market across India. The tax is levied on the

1 views • 18 slides

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)