Semi-Supervised Credit Card Fraud Detection via Attribute-Driven Graph Representation

Explore a novel approach for detecting credit card fraud using a semi-supervised attribute-driven graph representation. The technique leverages temporal aggregation and attention layers to automatically unify heterogeneous categorical attributes and detect fraudulent transactions without label leaka

1 views • 23 slides

Psychology Department Meeting Notes and Counseling Updates - Spring 2024

The Psychology Department meeting covered topics such as fraudulent student cases, modality balance in classes, and program descriptions. The Counseling Department shared updates on upcoming events, including university visits and career workshops. Encouragement was given for students to plan for th

4 views • 8 slides

Boost Your Business with SMS gateway for transactions : A Overview

\"Discover how leveraging an SMS gateway for transactions can propel your business forward in this comprehensive overview. Explore the benefits of seamless communication, enhanced customer engagement, and streamlined transactions. Unlock the potential to boost sales, improve efficiency, and cultivat

1 views • 6 slides

Taxation and Reporting of Futures and Options (F&O) Transactions

Explore the taxation aspects and reporting requirements related to Futures and Options (F&O) transactions. Learn about the types of F&O transactions, relevant heads of income for reporting income/loss, and the provisions of Section 43(5) of the Income Tax Act, 1961, defining speculative tran

2 views • 24 slides

Database System Concurrency Control and Transactions Overview

Studying relational models, SQL, database system architecture, operator implementations, data layouts, and query optimization laid the foundation for advanced topics like Concurrency Control and Recovery. Discover how transactions group related actions, ACID properties ensure data integrity, and the

0 views • 57 slides

Delete Expense Transactions in QuickBooks Online?

Delete Expense Transactions in QuickBooks Online?\nKeeping clean books in QBO requires managing expenses effectively. This includes deleting unnecessary transactions. Confused about how? Don't worry! This guide simplifies the process. Learn when to delete, what to consider beforehand, and follow the

1 views • 3 slides

Taxation of F&O Transactions under Indian Income Tax Law

This content discusses the taxation of Futures and Options (F&O) transactions in India under the Income Tax Act of 1961. It covers the types of F&O transactions, relevant heads of income for reporting income or loss, and the provisions of Section 43(5) related to speculative transactions. The articl

1 views • 24 slides

Accounting for Independent Branches: Salient Features and Transactions

Independent branches maintain separate sets of accounts and carry out business transactions autonomously. The accounting system of an independent branch involves double entry bookkeeping, reconciliation of accounts between the branch and head office, and recording transactions like dispatch of goods

2 views • 10 slides

Modus Operandi and Precautions against Fraudulent Transactions

The Reserve Bank of India highlights the various modus operandi used by fraudsters to deceive the public, cautioning against fraudulent messages, calls, links, and false notifications. To prevent falling victim to fraud, individuals must be vigilant against phishing links, vishing phone calls, fake

1 views • 23 slides

Legal Implications of the Digital Economy in Malawi

Explore the legal implications of the digital economy in Malawi as discussed at the ICAM Annual Lakeshore Conference. Topics include the Electronic Transactions and Cyber Security Act, principles of implementation, Malawi CERT, data privacy, and the significance of the digital economy in transformin

0 views • 44 slides

Essential Knowledge for Sales & Finance Transactions

Understanding the intricacies of titles in sales and finance transactions is crucial to avoid costly mistakes and ensure smooth processes. This guide highlights the importance of titles, handling trade-in packets, and managing drive-away transactions effectively. It emphasizes the significance of ve

0 views • 7 slides

Challenges Faced by Insolvency Resolution Professionals during Corporate Insolvency Resolution Process

Insolvency Resolution Professionals encounter various challenges during the Corporate Insolvency Resolution Process, such as the need for prompt public announcements, appointing valuers, handling difficult transactions like preferential deals and related party transactions, assessing fraudulent acti

3 views • 8 slides

UCPath vs KFS GL Reconciliation Tips & Audit Messages

Explore essential tips for reconciling UCPath and KFS GL transactions, including checking if transactions were posted, identifying period mismatches, and understanding audit messages in DOPE reports. Learn how to handle unposted transactions and recognize future or past period discrepancies to ensur

1 views • 10 slides

2019 Purchasing Card Conference Overview

The 2019 Purchasing Card Conference held on April 5, 2019 covered topics such as statistics, fraud transactions, disputable transactions, prevention measures, and recurring charges related to purchasing cards. The event included breakout sessions, giveaways, and important instructions on handling fr

1 views • 16 slides

Texas Standard Electronic Transactions (TX.SET) Overview

Texas Standard Electronic Transactions (TX.SET) provide an interactive platform for various transactions involving ERCOT and non-ERCOT entities. The TX.SET Version 4.0 includes a range of transaction names and documents related to service orders, outages, invoices, customer information maintenance,

0 views • 33 slides

ABSA Submission on National Qualifications Framework Amendment Bill

ABSA presented a submission on the National Qualifications Framework Amendment Bill regarding key matters such as processing times for qualification checks, third-party suppliers, and notification of fraudulent results. They expressed concerns about the verification process timelines and the impact

0 views • 6 slides

Compliance Obligations and PAN Requirements for Financial Transactions

This outreach program by the Directorate of Income Tax in Nagpur, in collaboration with the Nagpur Branch of WIRC of ICAI, focuses on effective compliance with Statement of Financial Transactions (SFT). It covers PAN compliance obligations, forms, and penalties for non-compliance related to specifie

1 views • 14 slides

Fraud, Waste, and Abuse Tutorial Certification for Small Businesses

The Fraud, Waste, and Abuse Tutorial Certification outlines the critical aspects small businesses must understand to prevent fraudulent activities in SBIR/STTR programs. It covers statutory requirements, definitions, consequences of fraud, and administrative remedies. It emphasizes the importance of

1 views • 25 slides

Efficient Submission of Forms Solution via EDI Transactions

Streamlining the submission of Forms Solution to the Bureau through mandated EDI transactions. Claims adjusters must provide injured workers with a copy of the form. Key features include form generation via accepted EDI transactions, avoiding paper versions, and ensuring timely filing. Details on Ag

0 views • 16 slides

Communication Studies Department Meeting Highlights - Fall 2023

The Communication Studies Department meeting discussed various topics including updates from the Counseling Department, upcoming events like the Transfer Center workshops and University Fair, as well as the rising concerns regarding AI and fraudulent students. The meeting agenda covered reports, sch

0 views • 14 slides

Benefits of E-Banking and Its Impact on Customer Service

E-banking provides various benefits such as offering extra service channels, convenience, flexibility with online banking, reduction in cash transactions, self-inquiry facilities, remote and anytime banking, branch networking, and electronic data interchange. These benefits enhance customer service

0 views • 22 slides

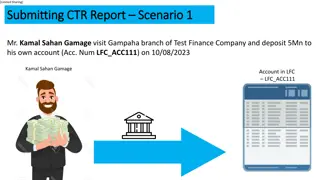

Financial Transactions Summary for Mr. Kamal Sahan Gamage

Mr. Kamal Sahan Gamage conducted two financial transactions at the Gampaha branch of Test Finance Company. On 10/08/2023, he deposited 5 million LKR into his account (LFC_ACC111). On 10/10/2022, he withdrew 1 million LKR via a cash cheque from the collection account (COL_ACC100). Both transactions w

0 views • 24 slides

High-Performance Transactions for Persistent Memories

Explore the optimization of transactions for persistent memories, focusing on ordering constraints, synchronous vs. deferred commit transactions, persistency models, and performance evaluation. The study aims to improve transaction performance in the presence of high persistent memory latencies by m

0 views • 26 slides

Building Effective Board Memos for City Transactions

Guidance on building a board memo for the Board of Estimates, a public board overseeing city transactions. Learn about the reviewing agencies involved, such as the Law Department, Dept. of Finance/BBMR, MWBOO, and Pre-Audits, and their roles in the approval process. Follow their guidelines to ensure

0 views • 18 slides

360 Control Manager & Cardholder Training Commercial Card Payment Solutions

Explore how 360 Control Manager provides an online Employee Expense Reporting tool for coding transactions related to the company's Visa business cards. Learn how to access the system, code transactions, split a transaction, add comments, attach receipts, and follow a 3-step process for coding, revi

0 views • 18 slides

Forensic Accounting and Fraud - Types and Definitions

Forensic accounting plays a crucial role in detecting and investigating various types of fraud such as financial reporting fraud, asset misappropriation, and employee embezzlement. Fraud is defined as intentional deception resulting in a loss and involves misrepresentation of material facts. Types o

0 views • 19 slides

Secure Electronic Transactions (SET)

Secure Electronic Transactions (SET) is an encryption and security specification designed to protect credit card transactions on the Internet. SET provides a secure way to utilize existing credit card payment infrastructure on open networks, such as the Internet, involving participants like clients,

1 views • 6 slides

Google Spanner: A Distributed Multiversion Database Overview

Represented at OSDI 2012 by Wilson Hsieh, Google Spanner is a globally distributed database system that offers general-purpose transactions and SQL query support. It features lock-free distributed read transactions, ensuring external consistency of distributed transactions. Spanner enables property

1 views • 27 slides

Optimizing Read-Only Transactions for Performance

Explore the nuances of performance-optimal read-only transactions in distributed storage systems. Focus on achieving high throughput and low latency while considering algorithmic properties and engineering factors. Learn how coordination overhead affects performance and strategies to design efficien

0 views • 42 slides

Ensuring Security and Trust in Online Transactions

Establishing trust and security is crucial for online transactions. Guidelines include verifying company legitimacy, safeguarding personal information, and using secure payment methods. In case of doubt, research the company and its reputation. Tips for secure transactions are highlighted, emphasizi

0 views • 6 slides

Simplifying Loan Transactions for Better Management

Explore the new functionality introduced for handling loan transactions easily, distinguishing between loan and lease agreements, and designating ownership effectively. Learn about different options for recording ownership changes and managing transactions seamlessly.

0 views • 27 slides

Fraudulent Claims in Insurance: Key Legal Aspects

Explore the intricacies of fraudulent insurance claims through legal perspectives, including the impact of the Fraudulent Claims Rule, the 2015 Insurance Act, and the dichotomy between civil and criminal law in prosecuting insurance fraud. Delve into the ethical debates surrounding dishonest claims

0 views • 31 slides

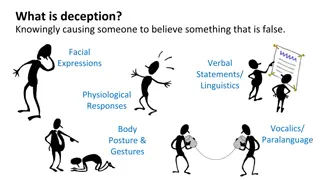

Deception and Financial Crime

Deception involves causing someone to believe false information through various means like facial expressions, verbal statements, and body language. In the realm of financial crime, money laundering is a significant concern where illegal proceeds are disguised to appear legal. Detection of deception

0 views • 4 slides

Protecting Against Fraudulent Emails - Business & Finance Campus Alert

Be vigilant against fraudulent emails targeting the Business & Finance campus community. Learn to identify suspicious emails, such as requests for gift cards or urgent demands. Remember, gift cards are only permitted for specific purposes, and employee purchases will not be reimbursed. Stay informed

0 views • 9 slides

Database Transactions in SQL

Database transactions in SQL ensure data integrity and consistency by allowing users to group SQL commands into atomic units that can be committed or rolled back as needed. Learn about the ACID properties of transactions, autocommit mode, and how to create and manage transactions effectively.

1 views • 29 slides

commercial real estate transactions in 2016

The presentation by Brennan Carroll discusses key aspects of commercial real estate transactions in 2016, focusing on the importance of identifying the parties involved to prevent issues such as conflicts of interest and potential fraudulent activities. One major emphasis is on the necessity of know

0 views • 23 slides

Challenges and Threats in E-Commerce: Ghana's Perspective

E-commerce in Ghana faces significant barriers including technical, financial, logistical, human, and policy/regulatory factors. Cyber threats are rampant, with Ghana being vulnerable to internet fraud and cyber-crime. The country struggles with a lack of infrastructure, financial investment, litera

1 views • 11 slides

Taxation Guidelines for Share and Derivative Transactions by CA Mahavir Atal

Guidelines by CA Mahavir Atal regarding taxation of share and derivative transactions, including determining business income vs. capital gain, treatment of shares as stock-in-trade, maintaining separate portfolios, and the classification of transactions as either business or investment. The circular

0 views • 31 slides

Distributed Transactions in Spanner: Insights and Mechanisms

Spanner, a strictly serializable system, leverages TrueTime for timestamping to enforce the invariant between transactions. It ensures efficient read-only transactions and multi-shard transactions. Mechanisms like 2PL, 2PC, and (Multi)Paxos contribute to Spanner's fault tolerance and scalability. Le

0 views • 21 slides

Spring 2024 Sociology Department Meeting Highlights and Updates

The Sociology Department meeting held on April 4, 2024, covered various topics including reports on fraudulent students, business modality balance, annual plans, and curriculum. Important announcements were made regarding Counseling and Career Center events, such as university visits, workshops, and

0 views • 8 slides