Adversarial Machine Learning

Evasion attacks on black-box machine learning models, including query-based attacks, transfer-based attacks, and zero queries attacks. Explore various attack methods and their effectiveness against different defenses.

21 views • 60 slides

Understanding Grant Fraud: Insights from DOJ Office of the Inspector General

Explore the world of grant fraud awareness with insights from Special Agent Jason P. LeBeau of the United States Department of Justice Office of the Inspector General. Learn about the investigation of fraud, waste, and abuse in various sectors like bank fraud, money laundering, tax evasion, and more

2 views • 27 slides

Overview of Enforcement Initiatives and Outcomes at National Conference of Enforcement Officers

Delve into the insights shared at the National Conference of Enforcement Officers on 4th March 2024, focusing on enforcement initiatives such as National Special Drive, actions by the Centre and State, technology interventions, and policy changes. Uncover details on fake billing structures, motives

3 views • 32 slides

National Conference of Enforcement Chiefs: Enhancing Tax Compliance and Enforcement Practices

The National Conference of Enforcement Chiefs held by the Commercial Taxes Department, Government of Andhra Pradesh, focused on nurturing tax compliance, targeting evasion cases, preventing harassment, and overseeing tax administration to curb high-pitch demands. The enforcement wing emphasized data

0 views • 16 slides

National GST Enforcement Officer’s Conference. 4th March,2024

The State Tax Department of Uttarakhand has organized the National GST Enforcement Officers Conference and has been actively involved in enforcing taxation regulations and conducting investigations. They have a well-structured enforcement setup with mobile units and special investigation branches to

1 views • 21 slides

Psychology Department Meeting Notes and Counseling Updates - Spring 2024

The Psychology Department meeting covered topics such as fraudulent student cases, modality balance in classes, and program descriptions. The Counseling Department shared updates on upcoming events, including university visits and career workshops. Encouragement was given for students to plan for th

4 views • 8 slides

Fascinating Facts About Iguanas: From Skills to Survival

Iguanas, part of the Iguanidae family, are unique reptiles with special skills like tree climbing and predator evasion. They face threats due to human consumption and environmental hazards, such as oil spills for marine iguanas. Their sensory organ, Jacobson's organ, helps them navigate their surrou

0 views • 10 slides

Rugby Skill Games for Player Development

Engage coaches with 10 stock games based on different team strengths to enhance player skills. Each game focuses on specific aspects like go-forward, evasion, and scanning, utilizing a game zone and skill zone structure. Develop players' technical skills through engaging training sessions.

1 views • 11 slides

Modus Operandi and Precautions against Fraudulent Transactions

The Reserve Bank of India highlights the various modus operandi used by fraudsters to deceive the public, cautioning against fraudulent messages, calls, links, and false notifications. To prevent falling victim to fraud, individuals must be vigilant against phishing links, vishing phone calls, fake

1 views • 23 slides

Mechanisms of Immune Evasion by Parasites in Immunoparasitology

Understanding how parasites evade the immune system of their hosts is crucial in the field of immunoparasitology. Parasites have developed various strategies such as anatomical seclusion, antigenic variation, and intracellular living to avoid host immune responses. Examples include Plasmodium within

0 views • 26 slides

Understanding Illicit Financial Flows and Their Implications

This content delves into the conceptual framework for measuring Illicit Financial Flows (IFFs), highlighting how IFFs intersect with various policy agendas such as tax evasion, corruption, and terrorism financing. It also emphasizes the importance of addressing IFFs for sustainable development, peac

1 views • 10 slides

Implementation of Excise Stamps on Alcoholic Products for Tax Administration

The implementation of excise stamps on alcoholic products, including beer and wine, is presented by the Excise Section. This initiative aims to combat tax evasion and smuggling by extending the obligation to affix tax stamps on bottles of beer and wine. The process involves using temporary excise st

0 views • 23 slides

Understanding GST Returns: Types, Benefits, and Mechanisms

GST returns play a crucial role in the tax system by providing necessary information to the government in a specific format. They include details of outward and inward supplies, ITC availed, tax payable, and more. Filing returns ensures timely transfer of information, aids in tax liability determina

4 views • 38 slides

Understanding Arrest, Remand, and Bail under GST by Adv. Vineet Bhatia

Exploring the significance of remand, offenses under GST, arrest, bail, anticipatory bail, non-bailable offenses, and bailable offenses. The offenses include issues related to invoicing, tax evasion, input tax credit misuse, wrongful availment, obstructing officers, and dealing with goods liable for

0 views • 25 slides

Analyzing Security Resource Allocation in Railway Networks

Analyzing the best security resource allocation strategy in a railway network involving stations, lines, and potential threats like pickpocketing, fare evasion, and terrorism. Discusses the importance of predictive models, constraints, and optimal resource allocation to combat organized adversaries.

0 views • 38 slides

ABSA Submission on National Qualifications Framework Amendment Bill

ABSA presented a submission on the National Qualifications Framework Amendment Bill regarding key matters such as processing times for qualification checks, third-party suppliers, and notification of fraudulent results. They expressed concerns about the verification process timelines and the impact

0 views • 6 slides

Fraud, Waste, and Abuse Tutorial Certification for Small Businesses

The Fraud, Waste, and Abuse Tutorial Certification outlines the critical aspects small businesses must understand to prevent fraudulent activities in SBIR/STTR programs. It covers statutory requirements, definitions, consequences of fraud, and administrative remedies. It emphasizes the importance of

0 views • 25 slides

Understanding State Transfer Pricing in the Current Tax Landscape

Delve into the intricacies of state transfer pricing with a focus on federal and state regulations, arm's-length pricing, tax evasion prevention, and updates on cooperation initiatives. Explore the significance of intercompany transactions and pricing in today's business environment.

1 views • 27 slides

High-profile Legal Cases Involving Mr. and Mrs. Lam

Legal cases involving Mr. and Mrs. Lam include charges of fraudulent evasion of VAT, laundering proceeds, criminal lifestyle assessment, and disputes over property ownership. Mrs. Lam's involvement, the marital home's value, and the establishment of a constructive trust are central issues in these c

0 views • 46 slides

Communication Studies Department Meeting Highlights - Fall 2023

The Communication Studies Department meeting discussed various topics including updates from the Counseling Department, upcoming events like the Transfer Center workshops and University Fair, as well as the rising concerns regarding AI and fraudulent students. The meeting agenda covered reports, sch

0 views • 14 slides

Client Code Modification and Tax Evasion: Regulatory Issues in Stock Exchanges

Client Code Modification (CCM) is a service provided by Stock Exchanges to rectify errors in client codes during trading hours, but it has been misused for tax evasion by some brokers. Investigations revealed significant modifications leading to tax evasion. Regulatory bodies like SEBI and CBDT have

0 views • 41 slides

Dealing with Dyed Diesel: Methods, Risks, and Consequences

Learn about methods used to remove or mask dyed diesel, including risks and legal implications. Explore strategies like leaving it in the sun, sulfuric acid treatment, and adding oil. Discover the impact on taxes, evasion schemes, and the complexities of handling dyed diesel fuel.

1 views • 20 slides

Understanding Mechanisms of Viral Infection and Spread

Viral infection involves a replicative cycle within the host, leading to a range of cellular responses from no apparent effect to disease. Factors such as virulence genes, host characteristics, and viral genome influence the pathogenicity and virulence of a virus. The process includes entry into the

0 views • 16 slides

The Black Money and Imposition of Tax Act, 2015 Overview

Introduction to The Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, focusing on the significance of combating tax evasion through stringent laws, international agreements, and investigations targeting undisclosed incomes and assets held abroad.

0 views • 43 slides

Understanding Tax Transparency and Revenue Cycles

Exploring the complexities of the tax gap, this piece highlights the hidden aspects of revenue cycles and tax evasion. It emphasizes the need for a new approach to assess tax expenditures and spillovers for a balanced tax system, contrasting it with the repercussions of poor tax design. Richard Murp

0 views • 11 slides

Overview of GAAR in the Netherlands

GAAR in the Netherlands, including statutory GAAR, richtige heffing, and fraus legis. Learn about the requirements, limitations, and application of fraus legis in Dutch taxation law. Understand how the judge and tax inspector handle cases involving tax evasion.

0 views • 6 slides

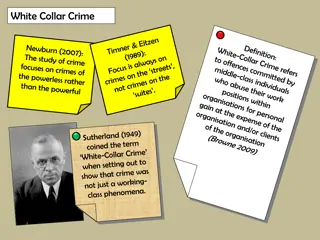

Understanding White Collar Crimes and Their Impacts

White collar crimes involve illegal activities committed by individuals of higher social class in professional settings. These crimes can include bribery, embezzlement, forgery, tax evasion, and fraud. They have significant economic repercussions and can erode investor trust in the market. Various t

2 views • 14 slides

Understanding Forensic Accounting and Fraud - Types and Definitions

Forensic accounting plays a crucial role in detecting and investigating various types of fraud such as financial reporting fraud, asset misappropriation, and employee embezzlement. Fraud is defined as intentional deception resulting in a loss and involves misrepresentation of material facts. Types o

0 views • 19 slides

Understanding White Collar Crime and Occupational Crime

White collar crime encompasses various offenses such as fraud, embezzlement, forgery, collusion, and tax evasion. This type of crime can often go undetected due to its complex nature and the difficulty in investigating it. Occupational crime, on the other hand, involves employees stealing from their

0 views • 7 slides

Ocean Industrialization and Environmental Thought

Explore the intersection of ocean industrialization, environmental challenges, and innovative solutions such as floating cities and sustainable aquaculture. Uncover the historical perspectives and contemporary debates shaping environmental thought in the face of climate change and pollution. Delve i

0 views • 8 slides

Survival Strategies in the Animal Kingdom

Evolutionary adaptations such as teeth for catching prey, eyes for spotting predators, colors for attracting mates, legs for escaping, ears for evasion, and camouflage help determine which creatures survive to reproduce in a competitive environment. However, some traits like red or blue colors can b

0 views • 14 slides

Understanding Tensions in Political Analysis: Lessons from Cambodia and the Pacific

Explore the nuances of political and institutional analysis post-conflict, examining the intertwined dynamics of political settlements, economies, and institutional arrangements. Discover the complexities of structural antecedents, pacting, and instrumentalization, alongside insights from political

0 views • 19 slides

Understanding Fraudulent Claims in Insurance: Key Legal Aspects

Explore the intricacies of fraudulent insurance claims through legal perspectives, including the impact of the Fraudulent Claims Rule, the 2015 Insurance Act, and the dichotomy between civil and criminal law in prosecuting insurance fraud. Delve into the ethical debates surrounding dishonest claims

0 views • 31 slides

Protecting Against Fraudulent Emails - Business & Finance Campus Alert

Be vigilant against fraudulent emails targeting the Business & Finance campus community. Learn to identify suspicious emails, such as requests for gift cards or urgent demands. Remember, gift cards are only permitted for specific purposes, and employee purchases will not be reimbursed. Stay informed

0 views • 9 slides

Understanding Sin Taxes in State and Local Public Finance

Sin taxes are levied on products with negative externalities, such as alcohol, tobacco, and gambling. While they generate revenue and aim to discourage consumption, their long-term revenue potential is limited. Policy changes may be needed to strengthen sin tax revenue growth and prevent tax evasion

0 views • 54 slides

Impact of Audits on Tax Compliance: Insights from Research Studies

Studies conducted by researchers such as Erich Kirchler have explored the impact of audits on tax compliance. While audits generally have a positive effect on compliance, there are cases where they can backfire, leading to unintended consequences. High auditing levels may not always deter tax evasio

0 views • 14 slides

Ensuring Financial Security in Cyberspace: Legal and Regulatory Measures

Financial fraud involves intentional deception for personal gain, encompassing various illegal activities like tax evasion, identity theft, and investment scams. Laws such as the Information Technology Act of 2000 and the Prevention of Money Laundering Act of 2002 play crucial roles in protecting fi

0 views • 12 slides

Dispute over VAT Liability in Car Purchase Case

Cartrader A bought cars from B Ltd., paid VAT, but B Ltd. didn't remit VAT. C involved in evasion. A held liable initially, successful appeal against VAT evasion assessment. Dispute over A's knowledge of C's intentions.

0 views • 10 slides

Enhancing Transparency in Company Ownership: UK Legislation and Public Registers

Tim Moss, Chief Executive of Companies House, and other officials highlight the importance of beneficial ownership transparency in UK companies. The UK legislation mandates the maintenance of a Register of People with Significant Control (PSC Register), ensuring information on individuals controllin

0 views • 15 slides

Spring 2024 Sociology Department Meeting Highlights and Updates

The Sociology Department meeting held on April 4, 2024, covered various topics including reports on fraudulent students, business modality balance, annual plans, and curriculum. Important announcements were made regarding Counseling and Career Center events, such as university visits, workshops, and

0 views • 8 slides