Managing Interest Rate and Currency Risks: Strategies and Considerations

Interest rate and currency swaps are powerful tools for managing interest rate and foreign exchange risks. Firms face interest rate risk due to debt service obligations and holding interest-sensitive securities. Treasury management is key in balancing risk and return, with strategies based on expect

3 views • 21 slides

Supreme Court Raps SBI For Not Sharing Complete Data On Electoral Bonds

Supreme Court Raps SBI For Not Sharing \"Complete Data\" On Electoral Bonds\n\nThe Supreme Court today came down hard on the State Bank of India for not sharing the complete data on electoral bonds, a scheme that allowed individuals and businesses to donate anonymously to political parties. The cour

2 views • 4 slides

Improving Heat Rate Efficiency at Illinois Coal-Fired Power Plants

Heat rate improvements at coal-fired power plants in Illinois are crucial for enhancing energy conversion efficiency, reducing carbon intensity, and minimizing pollution. By increasing the heat rate/efficiency by 6%, these plants can generate more electricity while burning the same amount of coal. T

2 views • 11 slides

Understanding Zero-Coupon Bonds

Learn about valuing bonds, zero-coupon bonds, yield to maturity, and examples of calculating yields for various maturities. Explore concepts like face value, coupon rates, cash flows, and how risk-free interest rates impact bond pricing. Dive into the details of zero-coupon bonds, their unique chara

0 views • 34 slides

Understanding Corporate Bonds: Issuance, Trading, and Security Features

Corporate bonds are long-term debt instruments issued by listed companies to fund expansion and investment. They are traded primarily in the over-the-counter market, offering security to investors through various asset types. Different types include fixed rate bonds with fixed maturity dates.

0 views • 10 slides

Understanding Valuation of Fixed Income Securities

Explore the valuation process for fixed income securities like bonds with a focus on characteristics, capitalization of cash flows, and bond yields. Learn about the features of fixed income securities and how to calculate their present value based on cash flows and discount rates.

0 views • 9 slides

Understanding the Significance of the Bond Market for Government and Corporations

The bond market serves as a crucial source for fundraising for governments and public corporations. Investors use money markets for short-term needs and capital markets for long-term investments to manage risks. Various types of bonds are available, including Treasury notes and bonds, agency bonds,

0 views • 20 slides

Understanding Lipids: Waxes, Fats, and Fixed Oils

Lipids are organic compounds like waxes, fats, and fixed oils found in plants and animals. Fixed oils are reserve food materials, while fats are solid at higher temperatures. These substances are esters of glycerol and fatty acids, with various components giving them unique properties and flavors. C

0 views • 20 slides

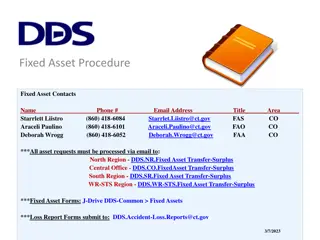

Fixed Asset Management Procedures and Contacts Overview

This document provides an overview of fixed asset management procedures, contacts, categories, and responsibilities within the State of Connecticut. It covers the definition of fixed assets, capital vs. controllable equipment, receiving new assets, inventory audits, asset management responsibilities

0 views • 15 slides

Understanding Data Rate Limits in Data Communications

Data rate limits in data communications are crucial for determining how fast data can be transmitted over a channel. Factors such as available bandwidth, signal levels, and channel quality influence data rate. Nyquist and Shannon's theoretical formulas help calculate data rate for noiseless and nois

0 views • 4 slides

Understanding Foreign Exchange Rate Systems and Their Impact on Economies

Foreign exchange plays a crucial role in the global economy, representing all currencies other than a country's domestic currency. Different exchange rate systems like fixed, flexible, and managed floating rates have distinct features and implications for trade, capital flows, and macroeconomic stab

1 views • 49 slides

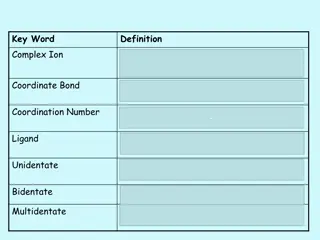

Understanding Complex Ions and Coordinate Bonds in Chemistry

Complex ions in chemistry are formed when transition metals or their ions bond with ligands through coordinate bonds. Ligands utilize their lone pairs of electrons to form dative covalent bonds with transition metals, determining the coordination number of the cation. Complex ions play a crucial rol

1 views • 29 slides

Introduction to Lipid Biosynthesis and Fixed Oils in Pharmacognosy Lecture

In this lecture by Asst. Prof. Dr. Ibrahim Salih, the focus is on lipid biosynthesis, specifically the three phases involved: glycerol formation, fatty acid biosynthesis, and triglyceride production. The classification of fixed oils into drying, semi-drying, and non-drying categories based on their

0 views • 13 slides

Understanding Covalent Bonds and Molecular Structure in Organic Chemistry

The neutral collection of atoms in molecules held together by covalent bonds is crucial in organic chemistry. Various structures like Lewis and Kekulé help represent bond formations. The concept of hybridization explains how carbon forms tetrahedral bonds in molecules like methane. SP3 hybrid orbit

0 views • 4 slides

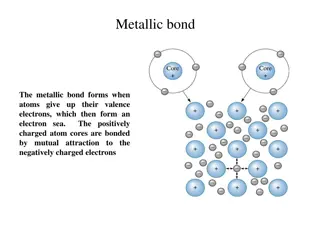

Understanding Different Types of Chemical Bonds

Metallic bonds involve atoms giving up valence electrons to form an electron sea, covalent bonds entail electron sharing to fill outer orbitals, ionic bonds form when atoms with different electronegativities attract, Van der Waals bonds include London forces between atoms, and hydrogen bonds occur i

0 views • 6 slides

Understanding Bonding in Chemistry

Delve into the world of chemical bonding through ionic, covalent, and metallic bonds. Explore how elements form bonds, from the attraction between sodium and chloride ions to the sharing of electrons in covalent bonds. Witness the formation of compounds like sodium chloride and magnesium oxide, unde

1 views • 12 slides

Understanding Polar Bonds and Molecules in Chemistry

Learn about polar and nonpolar covalent bonds, the classification of bonds based on electronegativity differences, and how to identify polar molecules through unequal sharing of electrons. Practice determining bond types and grasp the concept of partial charges in polar bonds.

0 views • 18 slides

Understanding Bonds and Financial Instruments in the Market

Bonds are financial instruments issued by corporations or governments to borrow money from investors. They promise to repay the borrowed amount with interest on a fixed schedule. Different types of bonds include U.S. Government Securities, Municipal Bonds, and Corporate Bonds, each carrying varying

0 views • 8 slides

Understanding Bonds and Stocks for Investments

Your company can raise funds for new investments by selling additional shares of stock or issuing bonds. Stocks represent ownership in a corporation, while bonds are long-term loans. Valuing bonds involves calculating present value based on coupon payments and face value. Examples with French and Ge

0 views • 30 slides

Understanding Residential Rate Design Trends

Explore the significant impact of rate design on residential utility bills, focusing on fixed charges, proposed increases, and trends seen in Q2 2016. Learn about existing and proposed fixed charge amounts, decisions made by utilities, and the overall landscape of residential rate design. Stay infor

0 views • 17 slides

Addressing Sewer Rate Changes and Structural Remedies

City's sewer rate changes history and underfunding issues due to lack of cost centering, overburdening the general fund, and inadequate capital project funding. The methodology for rate review highlights the need for reflective rates to cover service costs. The current rate structure shows deficienc

0 views • 19 slides

Understanding Polarity, Electronegativity, and Chemical Bonds

Delve into the concepts of polarity, electronegativity, and different types of chemical bonds by exploring the tug-of-war analogy and examples of polar, nonpolar, ionic, and covalent bonds. Learn how electronegativity values determine the nature of bonds and the sharing of electrons in molecules.

0 views • 17 slides

Understanding Callable Bonds and Bond Amortization

Callable bonds provide issuers with the right to redeem the bond before maturity under certain conditions. This article discusses the concept of callable bonds, bond amortization, premium bonds, discount bonds, and provides examples of calculating bond values based on specific scenarios.

0 views • 12 slides

Understanding Organic Chemistry and Macromolecules

Organic chemistry focuses on compounds with carbon bonds, while inorganic chemistry deals with other compounds. Carbon is unique due to its ability to form multiple bonds, creating diverse structures like chains and rings. Organic compounds, produced by living organisms, range from simple to complex

0 views • 32 slides

When is a Fixed Rate Loan Not a Fixed Rate Loan? Dissecting the Swift Report Bank Confidential 1st March 2022

Loans with embedded swaps, such as Fixed Rate Loans (FRL), can present challenges and risks that may make them toxic financial products. Tailored Business Loans (TBLs) were sold by various banks, including high street names like Yorkshire Bank/Clydesdale Bank, RBS/NatWest, Nationwide, Lloyds Bank, H

0 views • 11 slides

Understanding Bonds: Characteristics, Issuers, and Investment Insights

Bonds are financial instruments representing loans, allowing companies and governments to raise funds. This article explores the characteristics of bonds, including tradeability, issuer profiles, terms like face value and coupon rate, and the importance of bonds in investment portfolios.

0 views • 12 slides

Understanding Construction Surety Bonds

An overview of construction surety bonds including the parties involved, the differences between bonds and insurance, and how to set up a bonding program for contractors. Surety bonds provide financial security for projects by guaranteeing that contractors will perform as promised and pay their obli

0 views • 8 slides

Understanding Fixed Income Securities: Bonds Overview

Learn about fixed income securities in week 2 of the Fundamentals of Investment course, focusing on bond characteristics, types, and risks. Bonds are vital debt instruments issued by organizations to raise funds, with features like fixed maturity dates and interest rates. Explore various bond types

0 views • 20 slides

Understanding Municipal Bonds in Public Finance

Explore the world of municipal bonds in public finance, essential for financing capital projects and spreading budgetary impacts over time. Learn how bonds are a burden-spreading tool, not a financing tool, and how they impact project funding decisions. Discover the real impacts of bonds, the volume

0 views • 35 slides

Understanding Chemical Bonds and Molecular Geometry

Chemical bonds are the forces that hold atoms together, with valence electrons playing a crucial role. Ionic bonds involve complete electron transfer between metals and nonmetals, while covalent bonds see electrons being shared. Lewis dot diagrams help in visualizing the valence electrons of atoms,

0 views • 68 slides

Understanding Bond Valuation and Types

Explore the world of bond valuation, from the definition of bonds to the different types such as zero-coupon, coupon, self-amortizing, and perpetual bonds. Learn about bond issuers, including the US government and agencies, and delve into the specifics of US government bonds like Treasury Bills, Not

0 views • 39 slides

Understanding Bonds: Features and Importance in Finance

Bonds are high-security debt instruments that entities use to raise funds and meet capital needs. They provide investors with fixed or floating interest rates and the promise of repayment of the principal amount. Bond features such as face value, interest rate, tenure, credit quality, and tradabilit

0 views • 10 slides

Understanding Fixed-Income Securities for Investment

Fixed-income securities offer fixed returns up to a redemption date or indefinitely, comprising long-term debt securities and preferred stocks. These investments involve various risk factors, including default risk. Long-term debt securities, such as bonds, provide a safe asset but require careful c

0 views • 47 slides

Understanding Chemical Bonds: Covalent, Ionic, and Metallic

Explore the fascinating world of chemical bonds, including covalent bonds where atoms share electron pairs (e.g., water), ionic bonds where oppositely charged ions attract (e.g., sodium chloride), and metallic bonds formed between positively charged atoms sharing free electrons (e.g., copper wire).

0 views • 6 slides

Understanding Bail Bonds, Surety Bonds, and Their Differences

Bail bonds and surety bonds are legal mechanisms used to secure a defendant's release from custody before trial. Bail involves the payment of a set amount to ensure the defendant's appearance in court, while surety bonds involve a third party guaranteeing the defendant's attendance. The article expl

0 views • 6 slides

Revolutionizing Bail Bonds: The Shift to Electronic Processes

Explore the future of bail bonds with the advent of electronic systems. Discover how electronic bonds are created, issued, and audited, benefitting both sheriffs and court clerks. Learn how to submit electronic bonds hassle-free, without additional software requirements.

1 views • 7 slides

Understanding Ionic Bonding and Lattice Energy in Chemistry

Chemical bonds play a crucial role in holding atoms together in molecules. This course explores the concept of chemical bonding, focusing on ionic bonds and lattice energy. Topics covered include the different types of chemical bonds, such as electrovalent and coordinate bonds, as well as the models

0 views • 22 slides

Understanding Heart Rate and Pulse: Key Differences and Measurement

Heart rate, also known as pulse, is the number of times your heart beats per minute. It varies based on factors like age, fitness level, and emotions. Pulse is a direct measure of heart rate. Learn about the differences between heart rate and blood pressure, how to measure heart rate, and what const

0 views • 8 slides

Understanding Security Bonds and Guarantees in Road Construction Business

This training session focuses on the importance of security bonds and guarantees in road construction projects. It covers bid bonds, performance bonds, advance payment bonds, retention bonds, and contractors' all-risk insurance. Participants will learn about the significance of these financial instr

0 views • 16 slides

Understanding Bond Lengths and Strengths in Chemistry

Bond lengths represent the critical distance between bonded atoms for maximum stability, while bond strengths are measured through dissociation energy and average bond energy. Methods for measuring bond lengths include X-ray diffraction and spectroscopic methods, with bond energies reflecting the st

0 views • 38 slides