Understanding Bonds: Features and Importance in Finance

Bonds are high-security debt instruments that entities use to raise funds and meet capital needs. They provide investors with fixed or floating interest rates and the promise of repayment of the principal amount. Bond features such as face value, interest rate, tenure, credit quality, and tradability play crucial roles in investors' decisions. The credit quality reflects the company's ability to repay debt, influencing risk and return for investors. Bonds can have short, intermediate, or long tenures, offering varying levels of risk and reward potential in the market.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

By Dr. Muzaffar Ahmad Dar Dr. Muzaffar Ahmad Dar

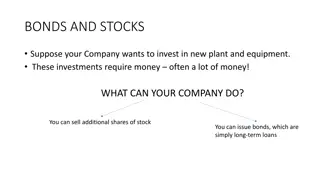

Bonds refer to high-security debt instruments that enable an entity to raise funds and fulfill capital requirements. It is a category of debt that borrowers avail from individual investors for a specified tenure. Organisations, including companies, governments, municipalities and other entities, issue bonds for investors in primary markets. The corpus thus collected is used to fund business operations and infrastructural development by companies and governments alike. Investors purchase bonds at face value or principal, which is returned at the end of a fixed tenure. Issuers extend a percentage of the principal amount as periodical interest at fixed or adjustable rates. Individual investors acquiring bonds have legal and financial claims to an organization's debt fund. Borrowers are therefore liable to pay the entire face value of bonds to these individuals after the term expires. As a result, bondholders receive debt recovery payments before stakeholders in case a company faces bankruptcy.

Bonds have several features that investors should take into account. The popularity of this debt instrument can be assigned to some intrinsic factors as mentioned below. Face Value Face value implies the price of a single unit of a bond issued by an enterprise. Principal, nominal, or par value is used alternatively to refer to the price of bonds. Issuers are under a legal obligation to return this value to the investor after a stipulated period. Bond example - an investor chooses to purchase a corporate bond at face value of Rs. 6,500. The company issuing the bond is thus obliged to return Rs. 6,500 plus interest to the investor after maturity of the tenor. Note that the face value of a bond is different from its market value as market operations influence the latter. Interest or Coupon Rate Bonds accrue fixed or floating rates of interest across their tenure, payable periodically to creditors. Bond interest rates are also called coupon rates as per the tradition of claiming interests on paper bonds in the form of coupons. Interest earned on a bond depends on various aspects such as tenure, the issuer s repute in the public debt market.

Tenure of Bonds Tenure or term refers to the period after which bonds mature. These are financial debt contracts between issuers and investors. Financial and legal obligations of an issuer to the investor or creditor are valid only until the tenure s end. They can thus be segregated as per the tenure applicable for them. Bonds with maturity periods below 5 years are called short-term bonds, whereas a tenure of 5-12 years is attributed to intermediate-term bonds. Long-term bonds refer to the ones with terms higher than 12 years. Also, longer tenures suggest the participation of issuing companies in prevailing businesses in the trade market in the long-term. Credit Quality The credit quality of a bond refers to the creditors consensus on the performance of a company s assets in the long-term. It is determined by the degree of confidence that investors have in an organisation s bonds. Credit rating agencies classify bonds based on the risk of a company defaulting on debt repayment. These agencies assign risk grading to private players in the market and categorise bonds into investment grade and non-investment grade debt instruments. Investment grade securities are susceptible to lower yields due to a steady market risk factor, whereas non-investment grade securities offer high returns at considerable risks. Tradable Bonds Bonds are tradable in the secondary market. The ownership can thus shift among various investors within a given tenure. These creditors often sell their bonds to other entities when market prices exceed the nominal values as they have an option to secure bonds with high yield and appropriate credit ratings.

Bonds are classified into different categories as per the model of return and validities of legal obligations. The prevailing types of bonds in the public debt market are - Fixed-interest bonds are debt instruments which accrue consistent coupon rates throughout their tenure. These predetermined interest rates benefit investors with predictable returns on investment irrespective of alterations in market conditions. Creditors have the benefit of being aware of the receivable interest amount periodically within the long term investment schedule. Floating-interest Bonds: hese bonds incur coupon rates which are subject to market fluctuations and elastic within their tenures. The return on investment through interest income is thus inconsistent as it is determined by market factors such as inflation, condition of the economy, and confidence of investors in an entity s bonds. Inflation-linked BondsI: nflation-linked bonds are special debt instruments designed to curb the impact of economic inflation on the face value and interest return. The coupon rates offered on inflation-linked bonds are usually lower than fixed-interest bonds. ILBs thus aim to reduce the negative consequences of inflation by adjusting coupons concerning prevailing rates in the debt market. Perpetual Bonds: Perpetual bonds are fixed-security investment options whereby issuers do not have to return the principal amount to the purchaser. This investment type does not have any maturity period, and customers benefit from steady interest payments for perpetuity. These debt instruments are also called consol bonds or perp . Other types of objective-specific bonds offered by corporations and governments include war and climate bonds.

Default risk, also known as credit risk, is the risk that a borrower or issuer will fail to meet their financial obligations, such as making interest payments or repaying principal on time. This risk is inherent in all forms of lending and investing in debt securities. Default risk is influenced by various factors, including the financial health of the borrower, the terms of the loan or bond, economic conditions, and external events. Default risk is an essential consideration for investors and lenders when evaluating the risk-return profile of debt securities and other credit instruments. By understanding and managing default risk effectively, investors can make informed decisions to protect their investment portfolios and achieve their financial objectives.

Credit rating is an assessment of the creditworthiness of an individual, business, government, or financial instrument. Credit ratings are assigned by credit rating agencies, which evaluate the borrower's ability to repay debt obligations and the likelihood of default. These ratings provide investors and lenders with valuable information to assess the risk associated with lending money or investing in debt securities issued by the borrower. Rating Agencies: Credit rating agencies, such as Standard & Poor's (S&P), Moody's Investors Service, and Fitch Ratings, are independent organizations that specialize in assessing credit risk. These agencies analyze various factors, including financial performance, cash flow, leverage, industry trends, and economic conditions, to assign credit ratings to borrowers and debt securities.

Rating Scale: Credit ratings are typically expressed using letter grades or alphanumeric symbols to indicate different levels of creditworthiness and default risk. The rating scale may vary slightly between rating agencies, but generally, higher ratings indicate lower credit risk, while lower ratings indicate higher credit risk. For example: Standard & Poor's and Fitch Ratings: AAA (Highest Credit Quality) AA, A, BBB (Investment Grade) BB, B, CCC, CC, C (Speculative or Junk Grade) D (Default) Moody's Investors Service: Aaa, Aa, A (High Grade) Baa (Medium Grade) Ba, B, Caa, Ca, C (Low Grade) D (Default)

Investment Grade vs. Speculative Grade: Credit ratings are often categorized as either investment grade or speculative grade (also known as junk or high yield). Investment-grade ratings represent lower default risk and are considered safer investments by investors and lenders. Speculative-grade ratings indicate higher default risk and are associated with higher yields to compensate investors for the increased risk. Credit Rating Impact: Credit ratings can have a significant impact on borrowing costs, investment decisions, and market perceptions. Borrowers with higher credit ratings typically enjoy lower interest rates and easier access to credit markets, while those with lower credit ratings may face higher borrowing costs and stricter lending terms. Similarly, investors may use credit ratings to evaluate the risk-return trade-off of different investment opportunities and adjust their investment strategies accordingly. Monitoring and Changes: Credit ratings are not static and may change over time in response to changes in the borrower's financial condition, market conditions, or other relevant factors. Investors and lenders should regularly monitor credit ratings and stay informed about any updates or changes that may affect their investment portfolios or lending decisions.