Understanding Segmented Income Statements and the Contribution Approach

Segmented income statements help analyze segment profitability, make decisions, and measure segment manager performance. This approach involves traceable fixed costs, common fixed costs, and segment margins. Segment margin represents profitability after covering all costs associated with the segment

2 views • 16 slides

Fixed Asset Management Procedures and Contacts Overview

Comprehensive overview of fixed asset management procedures, contact information, asset categories, receiving new assets guidelines, inventory audits, responsibilities, and related forms. Includes details on controllable and capital equipment, asset definitions, categories, and the roles involved in

1 views • 15 slides

Understanding Valuation of Fixed Income Securities

Explore the valuation process for fixed income securities like bonds with a focus on characteristics, capitalization of cash flows, and bond yields. Learn about the features of fixed income securities and how to calculate their present value based on cash flows and discount rates.

0 views • 9 slides

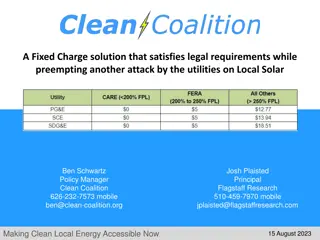

Clean Coalition's Fixed Charge Proposal for Local Solar Energy

Clean Coalition, a nonprofit organization, aims to accelerate the transition to renewable energy with a proposed Fixed Charge solution that meets legal requirements and defends against attacks by utility companies. The solution, represented by Ben Schwartz and Josh Plaisted, focuses on clean local e

0 views • 16 slides

Understanding Lipids: Waxes, Fats, and Fixed Oils

Lipids are organic compounds like waxes, fats, and fixed oils found in plants and animals. Fixed oils are reserve food materials, while fats are solid at higher temperatures. These substances are esters of glycerol and fatty acids, with various components giving them unique properties and flavors. C

0 views • 20 slides

Fixed Asset Management Procedures and Contacts Overview

This document provides an overview of fixed asset management procedures, contacts, categories, and responsibilities within the State of Connecticut. It covers the definition of fixed assets, capital vs. controllable equipment, receiving new assets, inventory audits, asset management responsibilities

0 views • 15 slides

Understanding Independent Branches in Accounting

Independent branches in accounting operate autonomously, making purchases externally, receiving goods from the head office, setting their selling prices, and managing expenses from their own cash flow. They keep complete books, prepare financial statements independently, and may engage in inter-bran

1 views • 10 slides

Accounting for Foreign Branches: Converting Trial Balances and Exchange Rates

A foreign branch maintains its accounts in a foreign currency, requiring the head office to convert the trial balance into its own currency before finalizing accounts. Fixed and fluctuating exchange rates impact the conversion process, with specific rules for fixed assets, liabilities, and current a

0 views • 7 slides

Introduction to Lipid Biosynthesis and Fixed Oils in Pharmacognosy Lecture

In this lecture by Asst. Prof. Dr. Ibrahim Salih, the focus is on lipid biosynthesis, specifically the three phases involved: glycerol formation, fatty acid biosynthesis, and triglyceride production. The classification of fixed oils into drying, semi-drying, and non-drying categories based on their

0 views • 13 slides

Understanding the Classification and Importance of Capital in Business

Capital is crucial for businesses, whether for promotion, functioning, growth, or expansion. It can be classified as promotional, long-term, short-term, or development capital. Factors influencing capital requirements include business activity, size, product nature, technology, business cycle, and l

2 views • 13 slides

Capital Gains and Assets Overview in Income Tax Law and Accounts

This content provides an overview of capital gains and assets in income tax law and accounts, covering topics such as types of capital assets, assets not considered capital assets, kinds of capital assets (short-term and long-term), transfer year of chargeability, computation of capital gains, and c

0 views • 15 slides

Monitoring of Returned Assets: Abacha's Legacy in Nigeria

International efforts led by civil society in Nigeria and Switzerland have successfully monitored the return of assets linked to the Abacha regime. Initiatives like the Nigerian Network on Stolen Assets and the Conditional Cash Transfer program demonstrate transparency and accountability in handling

0 views • 10 slides

Understanding Absorption and Marginal Costing in Accounting

Absorption costing, also known as full costing, encompasses all costs including fixed and variable related to production. It aids in determining income by considering direct costs and fixed factory overheads. Meanwhile, marginal costing focuses on only variable manufacturing costs and treats fixed f

0 views • 14 slides

Understanding IAS 39: Financial Instruments Recognition and Measurement

This content provides an overview of an IFRS seminar on IAS 39, focusing on key concepts such as the classification and measurement of financial assets, impairment, reclassification, and more. It covers definitions of financial instruments, financial assets, equity instruments, and financial liabili

1 views • 43 slides

Understanding Liquidation Estate and Key Asset Components

In the process of liquidation, the liquidator forms an estate comprising various assets of the corporate debtor for the benefit of creditors. These assets include ownership rights, tangible and intangible assets, proceeds of liquidation, and more. However, certain assets owned by third parties or he

0 views • 39 slides

University Asset Management Guidelines

University asset management guidelines cover the physical inventory policy, procedures, and fixed asset terminology for safeguarding, tracking, and reporting assets. Departments designate equipment liaisons to manage assets and conduct physical inventories regularly. Assets are categorized as capita

1 views • 21 slides

Conformal Window in SU(3) Gauge Theories: IR Fixed Points and Scaling Hypothesis

Study of temporal propagator behaviors near fixed points, effective masses in free fermion examples, and strategies to find zero of beta functions in SU(3) gauge theories. Investigation of coupling constants and lattice sizes to determine existence of Banks-Zaks fixed point.

0 views • 11 slides

Understanding Marginal Costing in Cost Accounting

Marginal Costing is a cost analysis technique that helps management control costs and make informed decisions. It involves dividing total costs into fixed and variable components, with fixed costs remaining constant and variable costs changing per unit of output. In Marginal Costing, only variable c

1 views • 7 slides

University Asset Management Procedures and Responsibilities

This presentation outlines the processes and responsibilities related to maintaining and controlling the university's capital assets. It covers tasks such as updating asset records, conducting audits, and serving as a liaison between units and the Fixed Assets Accountant. The slides detail the Fixed

2 views • 67 slides

A Comparison of ELI and UNIDROIT Principles on Digital Assets

A comparison between the principles of Electronic Liability Initiative (ELI) and the International Institute for the Unification of Private Law (UNIDROIT) regarding digital assets. ELI focuses on security over digital assets, while UNIDROIT covers a broader range, including transfers, custody, and m

0 views • 5 slides

Understanding Equitable Distribution in Florida

Equitable distribution in Florida, governed by statutes 61.075 and 61.076, determines the fair division of marital assets and liabilities in divorce cases. Key considerations include identification, valuation, distribution presumption, and justification for unequal distribution. Assets are classifie

0 views • 28 slides

Managing Debt and Protecting Client Assets in Victoria

Consumer Action Law Centre in Victoria focuses on assisting low-income clients in managing debt and protecting their assets. The presentation emphasizes assessing the need for debt payment, considering the client's financial position, and exploring options to handle debt where income and assets are

1 views • 29 slides

Understanding Society: Wealth and Assets Survey Research

The Wealth and Assets Survey (WAS) conducted by Oliver Tatum and Angie Osborn at the Understanding Society Research Conference in 2013 focuses on longitudinal issues, experiment design, research findings, and future plans related to the survey. The WAS background includes collecting data on personal

3 views • 28 slides

Accounting for Biological Assets and Agricultural Produce

At the end of this lesson, you will be able to identify the principal issues in accounting for biological assets and agricultural produce at the time of harvest. Topics include the recognition, measurement, presentation, and disclosure of biological assets in financial statements. Questions regardin

0 views • 26 slides

Accounting for Biological Assets and Agricultural Produce (LKAS 41: Agriculture) by Rangajewa Herath

This content provides insights into the accounting standards for biological assets and agricultural produce under LKAS 41, discussing classification, presentation, measurement, gain or loss recognition, and disclosure requirements. It covers the unique nature of biological assets, the scope of LKAS

0 views • 20 slides

Comprehensive Fixed Assets Management Guidelines for Educational Institutions

Explore a detailed guide on tracking and recording fixed assets in educational institutions, covering key aspects such as capital assets accounting procedures, general ledger accounts, and the definition of capital assets. Learn the minimum standards for valuing assets, recording guidelines, and the

0 views • 25 slides

Approaches to Planning in Leisure, Sport, and Tourism: A Detailed Analysis

This content discusses various approaches to planning for leisure, sport, and tourism, emphasizing stakeholder requirements, fixed standards, unmet needs, benefits provision, and increasing participation. It explores the types of approaches such as adopting fixed standards, providing opportunities,

0 views • 28 slides

Proposed Process Improvements for Fixed Assets Management

Implementing Oracle Fixed Assets for managing fixed assets and capital projects, the proposed process aims to streamline capitalization, improve financial reporting controls, and enhance operational efficiencies. By organizing accounts based on asset categories, tracking ownership, and providing det

0 views • 9 slides

Understanding Intangible Assets and Business Combinations in Accounting

In accounting, recognition of intangible assets as assets requires the expectation of future economic benefits flowing to the entity and reliable measurement of the asset's cost. Intangible assets acquired separately are recognized based on their fair value, while those acquired in business combinat

0 views • 23 slides

Understanding Impairment of Assets in Financial Management

Entities must periodically test for impairment to ensure assets are not overstated. An impairment loss occurs when an asset's carrying amount exceeds its recoverable amount. Assets like inventories and deferred tax assets may require testing. Learn when to undertake impairment tests, key indicators,

0 views • 19 slides

Understanding Net Investment in Capital Assets and Its Importance

Net Investment in Capital Assets is a critical component of an entity's financial position, reflecting the value of capital assets owned. It represents the portion of the net position that is not spendable as it is invested in assets. Calculating Net Investment in Capital Assets involves subtracting

1 views • 17 slides

Understanding Fixed Income Securities: Bonds Overview

Learn about fixed income securities in week 2 of the Fundamentals of Investment course, focusing on bond characteristics, types, and risks. Bonds are vital debt instruments issued by organizations to raise funds, with features like fixed maturity dates and interest rates. Explore various bond types

0 views • 20 slides

Understanding Final Accounts: Key Concepts and Definitions

Explore the essential key words related to final accounts such as Debtors, Creditors, Assets, Liabilities, Fixed Assets, Current Assets, Current Liabilities, Long-term Liabilities, Purchases, Sales, and Gains. These images provide a visual representation of the concepts to help you grasp the fundame

0 views • 12 slides

Understanding Net Worth: Integers and Financial Assets

Learn about net worth, liabilities, and assets by exploring how integers are used to determine the financial standing of individuals. Discover the concepts of liabilities, responsibilities, and assets through real-life examples of notable personalities. Dive into calculations and understand how net

0 views • 18 slides

Understanding Business Personal Property and Taxation Overview

Understanding Business Personal Property (BPP) is essential for businesses, as it encompasses tangible assets like fixed assets and inventory. BPP is used for income production and is subject to taxation in Texas. Properly reporting BPP through a rendition form is crucial to avoid penalties. Fixed a

0 views • 5 slides

CADCAI Audited Financial Report 2016 Summary & Analysis

The CADCAI Audited Financial Report for 2016 reveals key insights into the organization's financial performance. CADCAI is a not-for-profit organization with income tax exemption and registered GST. The report showcases a current year profit of $14,067 and total retained profit since 1986 of $412,30

0 views • 19 slides

Understanding Capital Assets in Financial Reporting

A capital asset is a long-term asset used in operations with a useful life extending beyond a single reporting period, such as land, buildings, and infrastructure. These assets are reported at historical cost, including ancillary charges. Special assets like works of art or historical treasures are

0 views • 35 slides

Understanding Fixed-Income Securities for Investment

Fixed-income securities offer fixed returns up to a redemption date or indefinitely, comprising long-term debt securities and preferred stocks. These investments involve various risk factors, including default risk. Long-term debt securities, such as bonds, provide a safe asset but require careful c

0 views • 47 slides

Understanding Balance Sheets and Income Statements in Financial Reporting

Balance sheets provide a snapshot of a company's assets, liabilities, and shareholders' equity at a specific point in time, with assets listed on the left and liabilities and equity on the right. Current assets are those expected to be converted into cash within a year, while non-current assets are

0 views • 34 slides

Digital Assets and Social Media Estate Planning

Explore the world of digital assets and social media estate planning presented by Patricia E. Kefalas Dudek & Howard H. Collens. Understand what digital assets entail, the categories they fall into, and how to assist clients in planning for their digital legacies. Learn about the importance of estat

0 views • 56 slides