Relevance of Countercyclical Fiscal Policy and Fiscal Acyclicality

This literature review examines the effectiveness of countercyclical fiscal policies in stabilizing output and enhancing welfare, with a focus on the correlation between public spending cycles and GDP cycles. The study analyzes examples from Sweden and Argentina to showcase the impact of fiscal poli

2 views • 29 slides

Enhancing Completion of TB Preventive Therapy with Financial Incentives

Study in Tanzania shows that financial incentives and targeted peer counseling increase completion of isoniazid preventive therapy among ART initiates. Providing short-term socioeconomic support benefits TB prevention efforts and improves outcomes for individuals with HIV. Effective strategies may i

1 views • 14 slides

Understanding Decentralization: Insights from International Experience

Insights from international experiences on decentralization policies, focusing on fiscal and political decentralization, with examples from Africa, China, and Latin America. Discusses the limitations of fiscal decentralization and the role of Constituency Development Funds in enhancing accountabilit

1 views • 24 slides

Impact of Pillar Two on Corporate Tax Incentives Post-Pillar Two

This presentation by Prof. Dr. Vikram Chand discusses the impact of Pillar Two on corporate tax incentives, focusing on the scope, ETR calculation mechanism, and overall assessment. It covers different types of tax incentives, such as immediate expensing and deductions, and explains how Pillar Two a

4 views • 29 slides

Investment Incentives in Katsina: Federal and State Offerings

Investment incentives in Katsina state, Nigeria, aim to support direct investments in priority sectors through tax waivers, land allocation, and other benefits at both federal and state levels. The Nigeria Investment Promotion Commission plays a key role in promoting investments. Federal incentives

2 views • 13 slides

Investment Incentives in Katsina State for Investors

Explore the investment incentives in Katsina State for direct investments in priority sectors, including tax waivers, land allocation, and federal incentives like pioneer status, general tax incentives, and more. Learn about federal tax incentives for designated pioneer industries and research and d

0 views • 13 slides

Essentials of Export Marketing: Syllabus, Concepts, and Incentives

Explore the syllabus covering Introduction to Export Marketing, Global Framework, India's Foreign Trade Policy, Export Incentives, and more. Learn about the concept and features of export marketing, the importance of exports for a nation, and the various incentives available to Indian exporters. Gai

0 views • 45 slides

Understanding Compensation and Incentives in the Workplace

Compensation and incentives play a vital role in attracting and retaining talented employees. Compensation refers to what employees receive in return for their work, including wages, salaries, and incentives. Incentives are extra rewards that encourage employees to perform better. They are important

0 views • 20 slides

Overview of Chhattisgarh Rural Medical Corps (CRMC)

Chhattisgarh Rural Medical Corps (CRMC) is a program under the Department of Health and Family Welfare in Chhattisgarh aimed at providing health services in difficult and remote rural areas by engaging specialist doctors, medical officers, and staff nurses. CRMC addresses the lack of healthcare prof

0 views • 10 slides

Enhancing Fiscal Policy Planning through Public Participation and Transparency

Explore the importance of public participation and meaningful transparency in fiscal policy planning and public expenditure management. Learn about the GIFT Network, its champions and stewards, and how fiscal transparency and public participation can lead to improved fiscal and development outcomes

0 views • 22 slides

Fiscal Policy Guidance for State Long-Term Care Ombudsmen

Overview of the fiscal management responsibilities for State Long-Term Care Ombudsmen under the Older Americans Act requirements. Covers topics such as fiscal management, funding allocations, state plan requirements, and fiscal responsibilities. Details the OAA and LTCOP rule provisions related to f

6 views • 22 slides

Principles of Fiscal Deficits and Debt Management According to Kalecki

Economist Kalecki advocated for a permanent regime of fiscal deficits to manage public debt, emphasizing the importance of debt management for liquidity in the financial system. His principles involve splitting the government budget into functional and financial parts, each influencing aggregate dem

0 views • 6 slides

Government Schemes and Incentives for Entrepreneurship Development

Government schemes and incentives play a crucial role in promoting entrepreneurship by providing support, subsidies, and concessions to entrepreneurs. These incentives aim to address economic constraints, promote regional parity in development, and prepare entrepreneurs for competition in a globaliz

0 views • 13 slides

Understanding Fiscal Federalism and Decentralization in Government Systems

Fiscal federalism involves the allocation of responsibilities and resources between central and local governments, addressing key issues such as regulation, incentives for resource transfer, and financial balance. Fiscal decentralization, on the other hand, focuses on transferring taxing and spendin

0 views • 16 slides

Exciting Incentives for Popcorn Sales 2019

Explore a variety of rewards and incentives for popcorn sales in 2019, including Amazon gift cards, scholarships, Chicago Wolves tickets, Star Wars movie screenings, and more. Scouts have the opportunity to earn fantastic prizes through sales achievements and special programs. From Golden Ticket sca

0 views • 11 slides

Understanding Student Incentives and Guidelines for Effective Implementation

Delve into the world of student incentives, exploring how they can enhance outcomes when used strategically. Discover the rules governing the use of Title I funds for rewards, considerations for determining the allowability of initiatives, and key factors like necessary, reasonable, and allocable co

0 views • 14 slides

Understanding Incentives in Organizational Management

Incentives are objects that satisfy employee needs and can be positive or negative. Financial incentives like money and non-financial incentives such as status and job security play a crucial role in motivating employees. While financial incentives can satisfy lower-order needs, non-financial incent

4 views • 11 slides

Examination of Interim Fiscal Policy Paper for Financial Year 2019-2020

An independent auditor's report on the interim fiscal policy paper laid before the Houses of Parliament, confirming compliance with the requirements of the FAA Act. The report assesses the components, conventions, and assumptions underlying the paper for fiscal responsibility, macroeconomic framewor

1 views • 15 slides

Butte County Office of Education Fiscal Oversight Role Overview

The Assembly Bill (AB) 1200 provides insights into the fiscal oversight role of Butte County Office of Education (BCOE). It outlines the responsibilities of local boards of education, BCOE as an intermediary agent, and the creation of the Financial Crises and Management Assistance Team (FCMAT) in 19

0 views • 12 slides

California's Fiscal Outlook Presentation to California School Boards Association

California's fiscal outlook was presented to the California School Boards Association by the Legislative Analyst's Office in December 2016. The report highlights a decrease in revenues and expenditures for the 2016-17 fiscal year, leading to a revised reserve down by $1 billion. However, the state i

0 views • 22 slides

AmeriCorps California Volunteers Fiscal Training Conference 2017 Details

In July 2017, the AmeriCorps Grantee Training Conference took place, focusing on fiscal procedures, compliance, desk reviews, and monitoring. The conference covered topics such as improper payments elimination, common audit findings, and the fiscal desk review process implemented by California Volun

2 views • 22 slides

Understanding Incentive Programs and Strategies for Behavioral Change

An incentive program is designed to encourage positive behaviors by offering rewards and recognition. By focusing on individual strengths and goals, incentives can motivate individuals to achieve desired outcomes. Rewards should be personalized, delivered consistently, and align with the individual'

0 views • 9 slides

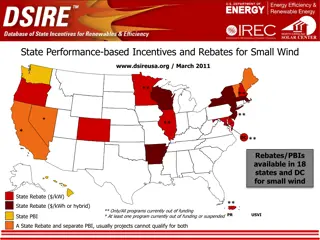

Small Wind Incentives and Rebates Overview

Explore state-based performance incentives, rebates, grants, and utility programs available for small wind projects as of March 2011. Discover the range of financial support offered across different states, including rebates per kW, rebates per kWh or hybrid, cash incentives, grants, and net meterin

0 views • 11 slides

Practical Application of Incentives and Sanctions for Behavior Change in the Court System

This resource discusses the practical application of incentives and sanctions in behavior change within the context of drug courts. It covers the purpose of sanctions and incentives, reliable detection methods like urine drug testing, and includes real-life examples such as phone transcripts from co

0 views • 42 slides

Enterprise Zones in Indiana: Revitalizing Communities Through Tax Incentives

Enterprise Zones in Indiana, led by Anita Yadavalli, Ph.D., aim to uplift traditional downtown and industrial areas facing decline by offering tax incentives to designated businesses. Majority of the incentives are claimed by manufacturing firms, showcasing their impact on employment and economic de

0 views • 8 slides

Fiscal Year 2023 Budget Overview

The content presents detailed information on the fiscal year 2023 budget, including budget cycles, comparisons between fiscal years, source of funds, expenditure plans, and top projects for the Consolidated Municipal Agency (CMA). It covers budget development processes, funding sources, expenditure

0 views • 11 slides

Building and Using an Incentives and Sanctions Matrix for Behavior Modification

Learning to lead a drug-free lifestyle for the chronically addicted can be challenging, often involving repeated relapses and frustrations. This article explores the use of incentives and sanctions, emphasizing the importance of balancing positive reinforcement with punishment for behavior modificat

0 views • 15 slides

Emerging Markets Investors Alliance and GIFT: Promoting Fiscal Transparency

The Emerging Markets Investors Alliance, in partnership with GIFT (Global Initiative for Fiscal Transparency), aims to educate institutional investors about fiscal transparency and facilitate investor advocacy with governments. Through roundtable discussions and engagements with finance ministers, t

0 views • 5 slides

Political Determinants of Incentives in Local Governance: Bangladesh Context

Study delves into the political determinants shaping incentives of Union Parishad (UP) leaders in Bangladesh for creating inclusive, participatory, and pro-poor governance. It explores the nuanced relationship between citizens and elected representatives, highlighting the role of social accountabili

0 views • 12 slides

Understanding Fiscal Reports and Budgeting Process

Dive into the world of fiscal reports and budgeting with a presentation led by Stephanie Dirks. Explore the Budget Code Story, different types of reports, and examples of Fiscal 04 & Fiscal 06 reports. Learn about Fund allocations, Object Codes, and responsible oversight of funds. Get insights into

0 views • 17 slides

Building Financial Systems Around Fiscal Data in Early Childhood Programs

Understand the importance of fiscal data in program management, identify key fiscal data elements, address policy questions, and learn from a state's cost study design. Explore the significance of fiscal data for decision-making, policy development, and program management, with a focus on revenue so

0 views • 31 slides

Global Practices in Fiscal Rule Performance

The study explores the implementation and impact of fiscal rules on macro-fiscal management, focusing on international experiences. It discusses the presence and compliance with fiscal rules, highlighting differences in pro-cyclicality among small and large countries. The rise in adoption of nationa

0 views • 23 slides

Understanding Fiscal Notes in Government Legislation

Fiscal notes are essential documents accompanying bills affecting finances of state entities. They detail revenue, expenditure, and fiscal impact, requiring a 6-day processing timeline. The need for a fiscal note may be determined by legislative services, committees, sponsors, or agencies. The proce

1 views • 30 slides

Fiscal Note Preparation Process and Guidelines

Fiscal notes are essential for bills affecting state finances. This includes the total processing time, exceptions, and what to do if there is disagreement on the fiscal note. The process involves multiple steps, including drafting, review, and resolution of disagreements. The President of the Senat

0 views • 29 slides

Understanding Capital Structure, Stockholder Incentives, and Risk-Taking in Financial Decision-Making

Explore the impact of capital structure on stockholder incentives such as risk-taking, short-term focus, underinvestment, and excessive dividends. Dive into scenarios illustrating leverage, credit rationing, and firm liquidation decisions. Delve into a case study of Baxter, Inc., facing financial di

0 views • 37 slides

Understanding Government Tools for Economic Stability

The government uses fiscal and monetary policies to stabilize the economy. Fiscal policy involves Congress's actions through government spending or taxation changes, while monetary policy is driven by the Federal Reserve Bank. Discretionary fiscal policy involves new bills designed to adjust aggrega

0 views • 36 slides

Leveraging Advertising Growth Incentives for Business Expansion

Explore how utilizing advertising growth incentives can significantly boost your business through strategic mail campaigns. Learn about earning postage credits, volume commitments, and real examples of businesses achieving success with these incentives. Maximize your marketing efforts and drive grow

0 views • 17 slides

Investment Promotion Assistance Toolkit for Industries in Madhya Pradesh

User Manual Investment Promotion Assistance Toolkit by the Department of Commerce, Industry, and Employment, Government of Madhya Pradesh provides detailed information on fiscal incentives, post-GST policies, and proposed solutions to support industries. The toolkit includes insights on the backgrou

0 views • 15 slides

Understanding Incentives for Community Wind Energy

Explore the landscape of incentives for community wind energy projects, including federal and state programs like the Business Energy Investment Tax Credit, Renewable Electricity Production Tax Credit, and more. Learn about key policies, tools like DSIRE, and how these incentives impact wind energy

0 views • 15 slides

Empowering Wellness through Incentives: The WIN Program

Learn about the Medicaid Incentives for Prevention of Chronic Disease (MIPCD) initiative and the Wellness Incentives and Navigation (WIN) program in Texas. MIPCD offers grants for projects focusing on tobacco cessation, weight loss, cholesterol control, blood pressure management, and diabetes preven

0 views • 29 slides