Understanding Incentives for Community Wind Energy

Explore the landscape of incentives for community wind energy projects, including federal and state programs like the Business Energy Investment Tax Credit, Renewable Electricity Production Tax Credit, and more. Learn about key policies, tools like DSIRE, and how these incentives impact wind energy development.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Bringing Wind Home: Incentives for Community Wind Community Wind Across America Mid-Atlantic Regional Conference February 9, 2011 Justin Barnes North Carolina Solar Center Database of State Incentives for Renewables and Efficiency (DSIRE) www.dsireusa.org

Things to Cover DSIRE and wind energy incentives The federal incentive landscape State incentives options and examples

DSIRE and Wind The DSIRE Search Tool is your best friend: http://www.dsireusa.org/searchby/index.cfm?ee=1&RE=1

The Federal Incentive Landscape Tax Incentives - Business Energy Investment Tax Credit (ITC) - Renewable Electricity Production Tax Credit (PTC) - Modified Accelerated Cost Recovery System + Bonus Depreciation - New Market Tax Credits Other Programs - Rural Energy for America (REAP): Grants + Loan Guarantees - Department of Treasury 1603 Grant in Lieu of Tax Credit - Clean Renewable Energy Bonds (CREBS) - Renewable Electricity Production Incentive (REPI)

Renewable Electricity PTC Placed in service by 12/31/2012 Inflation adjusted 1.5 cents/kWh (1993 dollars). Currently set at 2.2 cents/kWh Available for first 10 years of facility operation Electricity must be produced by the taxpayer and sold to an unrelated person Subject to anti-double dipping haircuts (up to 50%) ITC or 1603 Grant election available Incentive terms and limitations generally make the PTC less valuable than the ITC or the 1603 Grant for community wind

MACRS + Bonus Depreciation MACRS - Allows wind property to be depreciated over five years (rather than useful life) using a 200% declining balance method - No expiration date - Basis is reduced by 50% of tax credit or 1603 grant claimed - Non-taxable incentives also reduce basis Bonus Depreciation - 100% first year depreciation for facilities placed in service from September 8, 2010 through 2011 - 50% first year through 2012 - Bonus depreciation reduces the depreciable basis for claiming normal MACRS depreciation by an equivalent amount

New Market Tax Credits Availability stems from a Qualified Equity Investment in a Community Development Entity A CDE can invest in qualifying low-income businesses for projects that may include community wind projects. 39% investment tax credit is claimed over seven years - 5% for first three years, 6% for next four years Promising, but only recently used for clean energy applications and may entail high transaction costs.

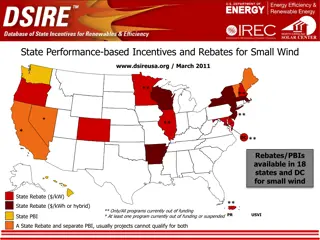

State Incentives and Examples Major RPS (i.e., REC sales) Tax Incentives Direct Incentives: Production, Grants, Loans Supplemental Property Tax Incentives Sales Tax Incentives Customer-Side Shared Ownership??

RPS Policies www.dsireusa.org / January 2011 ME: 30% x 2000 New RE: 10% x 2017 NH: 23.8% x 2025 MA: 22.1% x 2020 New RE: 15% x 2020 (+1% annually thereafter) RI: 16% x 2020 CT: 23% x 2020 PA: ~18% x 2021 VT: (1) RE meets any increase in retail sales x 2012; (2) 20% RE & CHP x 2017 WA: 15% x 2020* MN: 25% x 2025 (Xcel: 30% x 2020) MT: 15% x 2015 MI: 10% + 1,100 MW x 2015* OR: 25% x 2025(large utilities)* 5% - 10% x 2025 (smaller utilities) ND: 10% x 2015 SD: 10% x 2015 WI: Varies by utility; 10% x 2015 statewide NY: 29% x 2015 NV: 25% x 2025* IA: 105 MW OH: 25% x 2025 CO: 30% by 2020(IOUs) 10% by 2020 (co-ops & large munis)* IL: 25% x 2025 WV: 25% x 2025* VA: 15% x 2025* NJ: 22.5% x 2021 MD: 20% x 2022 DE: 25% x 2026* DC: 20% x 2020 CA: 33% x 2020 KS: 20% x 2020 UT: 20% by 2025* MO: 15% x 2021 AZ: 15% x 2025 OK: 15% x 2015 DC NC: 12.5% x 2021(IOUs) 10% x 2018 (co-ops & munis) NM: 20% x 2020(IOUs) 10% x 2020 (co-ops) PR: 20% x 2035 TX: 5,880 MW x 2015 29 states + DC and PR have an RPS (7 states have goals) HI: 40% x 2030 Renewable portfolio standard Renewable portfolio goal Includes non-renewable alternative resources

RPS and Community Wind The value of a renewable energy certificate (REC) depends on a variety of factors but is based generally on supply and demand Factors: RE target, eligibility, alternative compliance payments, facilitating policy measures PA Tier I (08-09): $3.65/MWh ;NY Main Tier: ~$20/MWh EXAMPLES: Maine - New RE 10% by 2017, long-term bundled contract option, community multiplier (1.5X), NE-ISO delivery New York - ~8% incremental increase by 2015, central procurement, 10-year contracts (REC only), no community bonus, NYISO delivery

State Tax Incentives for Community Wind State tax incentives may suffer from the usefulness limitations similar to federal tax incentives. Remedies may include: Allow credits against a variety of different taxes. Allow transfer or sale of credits Make the tax credit refundable MA: 100% corporate excise tax deduction and exemption KY: Negotiated, up to 50% of capital exp. MD: $0.0085/kWh for 5 yrs., up to $2.5M NC: 35% up to $2.5M GA: 35% up to $500,000 A note on depreciation: Most states generally conform to the MACRS system through coupling with the federal tax system, but many disallow a portion or all of federal bonus depreciation.

Direct Incentives Production incentives - Vermont SPEED: Energy + RECs; $0.118/kWh (closed) - NJ Grid-Connected Renewables: Incentive only, not energy or RECs; proposal- based but likely $0.02 - $0.029/kWh; option for limited up-front payment for development costs. Grants & Loans - Massachusetts Community Wind Initiative: Spectrum of grants and loans for feasibility, pre-development, and construction - Rhode Island Renewable Energy Fund: Combination of grants, recoverable grants, and financing. - Pennsylvania (multiple programs); Wind and Geothermal Incentives (grants & loans); Alternative and Clean Energy Program (grants and loans); possibly Sustainable Energy Funds; PEDA - Vermont Clean Energy Development Fund: Loans, does not support feasibility studies. Former CEDF grant program now closed.

Customer-Side Shared Ownership Might be referred to as community renewables or aggregated net metering Comes in different flavors. The most expansive policies may allow community-owned assets coupled with benefits similar to traditional net metering A different model than a typical wholesale sale EXAMPLES: Rhode Island Government/non-profit only, up to 10 electric accounts; 3.5 MW limit Massachusetts At least 10 residential customers; other customers, including commercial eligible once minimum is met; up to 2 MW generally (10 MW for public) Delaware Regulations forthcoming; few apparent limits; customers on same distribution feeder receive retail NEG credit, others energy supply rate NEG credit.

Sales Tax Incentives for Wind Property Tax Incentives for Wind ME: Community wind only (10 MW or less) MI: Alternative energy personal property VT: 250 kW or less VT: Local option RI: Local option NY: Local option PA: Alternative assessment OH: Payment in lieu of taxes for 250 kW or larger KY: $1M investment minimum

Justin Barnes North Carolina Solar Center DSIRE (www.dsireusa.org) justin_barnes@ncsu.edu 919-513-0792