Understanding Fiscal Federalism and Decentralization in Government Systems

Fiscal federalism involves the allocation of responsibilities and resources between central and local governments, addressing key issues such as regulation, incentives for resource transfer, and financial balance. Fiscal decentralization, on the other hand, focuses on transferring taxing and spending powers to sub-national levels for better administration, accountability, and economic welfare generation. Centre-State financial relations in India exemplify the division of functions between the central and state governments, emphasizing developmental and non-developmental aspects. Various components of decentralization like expenditure sharing, loans, and tax sharing play crucial roles in enhancing governance efficiency.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

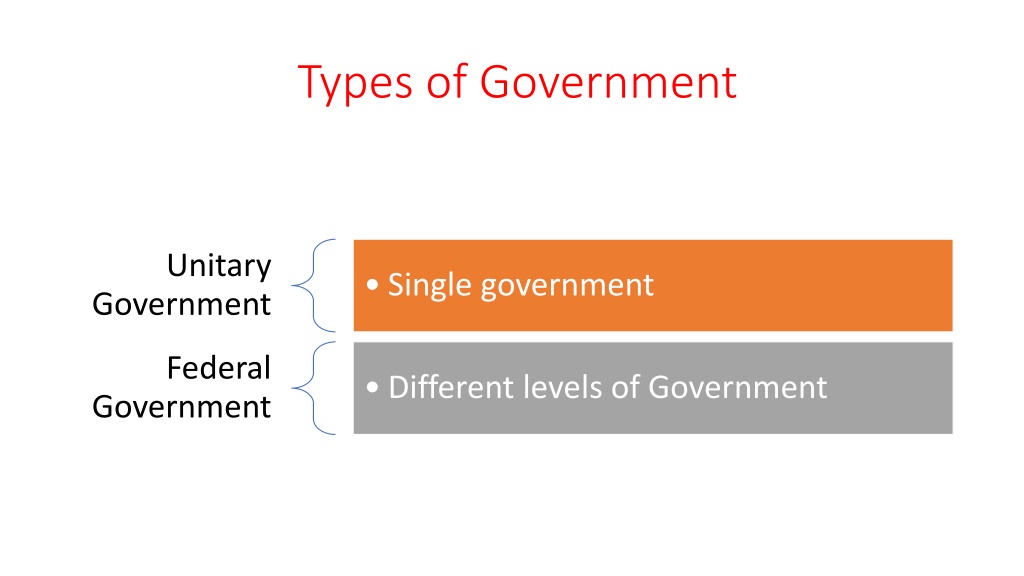

Types of Government Unitary Single government Government Federal Different levels of Government Government

Fiscal Federalism According to Joseph E. Stiglitz Fiscal federalism is concerned with the responsibilities between the central (or federal government) and the states and local governments division of economic

Key Issues under Fiscal Federalism 1. Division of Responsibilities and Resources between central and state governments 2. Regulation 3. Incentives for Resource Transfer 4. Tax expenditures 5. National and local public goods 6. Tax composition 7. Tax Subsidies 8. Financial imbalance between function and financial resources.

Fiscal Decentralization It refers to the transfer of taxing and expenditure powers from the control of central government to sub-national levels of government like state and local governments. The main purpose is improved administration, better accountability, larger participation in the democratic process by people and ultimately generation of economic welfare.

Components of Decentralization Expenditure sharing Loans Tax sharing Supplementary levies Intergover nmental transfer of grants Local taxes User charges

Centre-State Financial Relations in India According to the Constitution, the division of responsibilities between the centre and state areas follows A. Division of Functions Central Government (a) developmental : (i) Social functions to promote growth and welfare eg. Education, health, science and technology, labour and employment,

(ii) Economic services like agriculture, industry, transport and communication, foreign trade etc (iii) Grants in aid to states for developmental purposes. (b) Non-developmental : Maintenance of law and order maintenance of external relations, grants to states State Government (a)Developmental social, community and economic services (b)Non-developmental pensions, interest payments on loans

Problems in this type of division 1. Overlapping of functions 2. No required freedom and autonomy in designing and implementation B. Division of Resource Raising Powers Receipts of central government (i) Taxes on income and expenditure eg income tax, expenditure tax, corporate tax (ii) Taxes on property and capital expenditure wealth tax , estate duty

(iii) Taxes on commodities GST (iv) Central GST : tax on intra-state supplies of goods and services (v) State GST : levied on the intra-state supply of goods and services but will be governed by the state government. (vi) Integrated GST : governed by IGST ACT. Tax on inter-state supplies, will be shared between centre and state governments. (vii) Revenues from other sources : dividends from railways, posts and telegraphs, RBI, PSUs and interest receipts on loans given to states.

(viii) Capital Receipts borrowing from domestic and international institutions and governments Receipts of State Government (i) Tax receipts : Revenue receipts and capital receipts : taxes on agricultural income, profession tax, property and capital transactions like stamp and registration, land revenue, urban immovable property tax and surcharge on cash crops. And GST. (ii) Non-tax receipts : interest receipts, dividends from state enterprises etc.

(iii) Receipts on capital account : loans in the form of bonds from centre (iv) Share in central taxes, grants-in-aid etc Transfer of Resources from Centre to States Due to financial inadequacy of states, the constitution has made a provision for the transfer of resources from centre to states. These are of the types 1. Transfer of part of tax proceeds : Through Finance Commission

2. Transfer in the form of grants and loan :Through Finance Commission 3. Transfer in the form of plan assistance of plan projects : Through Planning Commission C . The Finance Commission The Finance Commission is a Constitutionally mandated body that is at the centre of fiscal federalism. Set up under Article 280 of the Constitution, its core responsibility is to evaluate the state of finances of the Union and State Governments, recommend the sharing of taxes between them, lay down the principles determining the distribution of these taxes among

States. Its working is characterised by extensive and intensive consultations with all levels of governments, thus strengthening the principle of cooperative federalism. Its recommendations are also geared towards improving the quality of public spending and promoting fiscal stability. The first Finance Commission was set up in 1951 and there have been fifteen so far. Each of them has faced its own unique set of challenges. The Finance Commission has appointed every five years and consists of a chairman and four other members.

The Finance Commission has the following functions or duties: 1. The Commission makes recommendations to the President of India on the distribution of tax proceeds between the Union and the States and the share of each state. 2. The Commission also decides the principles that govern the payment of grants-in-aid to states from the Consolidated Fund of India. 3. The President of India can also refer any other matter to the Finance Commission in the interest of building a sound financial system.

The Fourteenth Finance Commission of India was a finance commission constituted on 2 January 2013. The commission's chairman was former Reserve Bank of India governor Y. V. Reddy and its members were Sushma Nath, M. Govinda Rao, Abhijit Sen, Sudipto Mundle, and AN Jha. The recommendations of the commission entered force on April 2015; they take effect for a five-year period from that date. The 15th Finance Commission The 15th Finance Commission was constituted by the President of India in November 2017, under the chairmanship of NK Singh, a former member of the Planning Commission.

This Commission is expected to submit its report by October 2019. Its recommendations will cover a period of five years from April 2020 to March 2025.