Understanding Financial Disclosure and Lifestyle Audits Frameworks

The financial disclosure framework was introduced in 2016 by the Minister for the Public Service and Administration to manage conflict of interest situations in the public service. Designated employees disclose their financial interests annually via the eDisclosure system, and these disclosures are

2 views • 11 slides

Managing Power Platform Risk with an Environment Strategy by Frank Shink, Senior Power Platform Design Engineer at Ameriprise Financial

Frank Shink, a seasoned professional, delves into the risks associated with Power Platform, from development risks to cost risks, and offers insights on tools and strategies to combat these risks effectively. He emphasizes the importance of environments, DLP policies, and licensing strategies in mit

1 views • 20 slides

Understanding Financial Leverage and Its Implications

Financial leverage refers to a firm's ability to use fixed financial costs to amplify the impact of changes in earnings before interest and tax on its earnings per share. It involves concepts like EBIT, EBT, preference dividends, and tax rates, and can be measured through the degree of financial lev

1 views • 7 slides

Understanding Conflict of Interest in ACCME Accredited Activities

Conflict of Interest (COI) refers to financial relationships that may create biases in Continuing Medical Education (CME) activities when individuals have ties to commercial interests and can influence the content. ACCME requires disclosure to prevent potential bias in CME content. Non-disclosure ca

0 views • 18 slides

Federal Agencies Guidance on Ethics, Compliance, and Audit Services under NSPM-33

The White House OSTP released guidance for federal agencies to implement NSPM-33 focusing on disclosure requirements, digital identifiers, consequences for violations, information sharing, and research security programs. The guidance emphasizes supporting open scientific inquiry and nondiscriminator

0 views • 10 slides

Understanding Financial Risks and Insurance: Course Overview

Learn about financial decision-making, protecting against fraud, and mitigating financial risks in this 9-week course. Explore the basics of insurance, including key terminology such as contracts, risk aversion, and premiums. Understand the importance of insurance in managing financial risks and inv

0 views • 61 slides

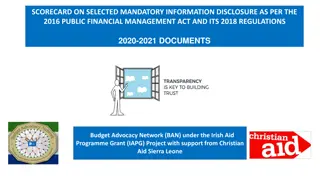

Scorecard on Mandatory Information Disclosure under 2016 Public Financial Management Act

The Scorecard on Mandatory Information Disclosure analyzes compliance with the 2016 Public Financial Management Act in Sierra Leone. The report shows that 23% of required documents are not produced, 24% of produced documents are not published, and highlights key findings to improve transparency and

0 views • 15 slides

Managing Neuro Emergencies: Faculty Disclosure and Financial Support

This presentation focuses on neuro emergencies with insights from faculty disclosure of financial relationships with sponsors and organizations. It also highlights financial support received and the mitigation of potential bias in the content.

0 views • 10 slides

Comprehensive Disclosure Guidelines for CE Presentations

Ensure proper disclosure in CE presentations by using the provided templates for financial relationships, conflicts of interests, and off-label medication discussions. These guidelines cover disclosing ineligible companies, nature of financial relationships, and off-label medication use. Adhere to t

4 views • 4 slides

Understanding Artificial Intelligence Risks in Short and Long Term

This content delves into the risks associated with artificial intelligence, categorizing them into short-term accident risks and long-term accident risks. Short-term risks include issues like robustness problems and interruptibility, while long-term risks focus on competence and alignment challenges

0 views • 15 slides

Understanding the Impact of the Insurance Act 2015 on Brokers and Insurers

The Insurance Act 2015 brings significant changes in insurance contract law, shifting from Duty of Disclosure to Fair Presentation. This Act influences both Brokers and Insurers, requiring clear and accessible disclosure of material circumstances. The remedies for misrepresentation and non-disclosur

0 views • 19 slides

Updated Disclosure Rules for Financial Relationships in Continuing Education

ACCME updated its Standards for Integrity and Independence in Continuing Education, requiring disclosure of financial relationships with specific "ineligible companies" by all involved parties. The rules aim to enhance transparency and mitigate conflicts of interest in accredited continuing educatio

1 views • 5 slides

Understanding Disability Disclosure in Employment: Practical and Ethical Considerations

This presentation touches on the practical and ethical issues supported employment professionals face when dealing with disability disclosure. The agenda includes ADA provisions, successful disclosure strategies, the professional's role in the process, and available resources. The session covers dis

0 views • 33 slides

Understanding Disclosure of Adverse Clinical Events in Healthcare

Exploring the essential elements of disclosing adverse clinical events to patients and families in healthcare settings. It covers why disclosure is crucial, barriers to disclosure, triggers for disclosure, policies and procedures, and the other important aspects related to the disclosure process.

0 views • 8 slides

Understanding the Capital Budgeting and Disclosure Process

This content provides a comprehensive overview of the capital budgeting and disclosure process, focusing on fiscal years, budget terms, and the sequential steps involved in the capital budget process. It explains the timeline from the Governor's capital budget release to the final approval by the go

2 views • 23 slides

Example of COI Disclosure Formats in Academic Presentations

These images provide examples of Conflict of Interest (COI) disclosure formats for oral and poster presentations in academic settings. They outline how authors can disclose any potential COIs in relation to their work over the past three years, including details on employment, stock ownership, paten

1 views • 4 slides

Detailed Guidance and Requirements for Implementing NSPM-33

The update provides detailed guidance on implementing NSPM-33's disclosure requirements and other provisions discussed in the January 2022 CLASP Meeting. It includes areas such as disclosure requirements, digital persistent identifiers, consequences for violations, information sharing, and research

1 views • 19 slides

Analyzing Systemic Climate Risk in the Financial Sector

This study discusses systemic climate risk in the financial sector by examining the effects of climate risks on financial institutions. It aims to design a market-based framework to assess the vulnerability of financial institutions to climate risks and analyze potential contagion effects. The frame

0 views • 39 slides

Understanding the Risks and Privacy Challenges in the Internet of Things

The Internet of Things (IoT) presents vast opportunities for interconnected devices, but also introduces significant risks to security and privacy. With billions of connected devices expected by 2020, the IoT landscape is expanding rapidly, leading to concerns such as insecure interfaces, authentica

0 views • 42 slides

Managing Financial Risks in a Changing Climate Environment

Assessing climate-related and environmental risks is vital for ensuring the safety and soundness of financial institutions. These risks include physical risk drivers like extreme weather events and transition risk drivers related to policy measures and technological changes. The complexity and uncer

0 views • 11 slides

Transparency in Banking: Examining Disclosure and Regulation

Discussion on the importance of transparency in the banking industry, focusing on the level of information disclosure by banks and its impact on market discipline, lending practices, and regulatory intervention. Papers explore different facets of transparency, including the disclosure audience, natu

0 views • 10 slides

Understanding Financial Risks and Mitigation Strategies

Explore the concept of financial risks, learn how to identify and mitigate them, and improve your financial decision-making skills. This module covers definitions, typical risks, and strategies to safeguard your finances. Discover the four main clusters of financial risks and how to implement counte

0 views • 17 slides

Enterprise Risk Management (ERM) Strategies for Mitigating Key Business Risks

Enterprise Risk Management (ERM) is a crucial strategic discipline that involves prospectively identifying, managing, and mitigating risks to reduce uncertainties and ensure organizational objectives are met. Risk rankings, mitigation strategies, and lead roles are outlined in the SJIEMS 2017 ERM Re

0 views • 38 slides

Evolution of Vulnerability Disclosure Practices

The history of vulnerability disclosure, from the early days of mailing lists and zines to the emergence of Full Disclosure and the debates around anti-disclosure groups. The timeline covers key events like the Morris worm, Code Red, the founding of Bugcrowd, and more, illustrating the evolution of

0 views • 11 slides

Impact of Management of Offenders Act on Disclosure Awareness Session

On 30 November 2020, new legislation including the Age of Criminal Responsibility (Scotland) Act 2019 and the Management of Offenders (Scotland) Act 2019 came into force, transforming the disclosure system in Scotland. These changes raise the age of criminal responsibility, reduce rehabilitation per

0 views • 10 slides

Understanding Disclosure of Designs under CDR - Key Insights

The article explores the disclosure of designs under the Community Design Regulation (CDR) and Community Design Invalidity Regulation (CDIR). It discusses the criteria for public availability, evidence required for proving prior disclosure, and the basic rules for establishing the disclosure of a pr

0 views • 9 slides

Financial Literacy Empowerment in Eastern and Southern Africa

Developing countries in Eastern and Southern Africa are prioritizing financial education to empower consumers in making sound financial decisions. Financial literacy enhances financial inclusion, stability, and economic growth. It involves awareness, knowledge, skills, attitudes, and behaviors essen

0 views • 23 slides

Financial Disclosure Guidelines for Investment Funds

Explore key aspects of financial disclosure for investment funds, including requirements for excepted investment funds, conflicts analysis, and valuation of stock options. Learn about exemptions, reporting obligations, and considerations for unvested options in this comprehensive guide.

0 views • 21 slides

Gamifying Vulnerability Reporting for Coordinated Disclosure at Microsoft Security Response Center

Christa Anderson, a Senior Security Program Manager at Microsoft's Security Response Center, discusses the importance of gamifying vulnerability report data to encourage coordinated disclosure. The MSRC Top 100, announced at Black Hat USA, plays a crucial role in the public credit strategy by recogn

0 views • 13 slides

Understanding Paternalism in Corporate Financial Disclosure

Regulatory paternalism in corporate financial disclosure can offer short-term benefits to investors but may lead to long-term harm. Jeremy Bertomeu's analysis explores the implications of applying parental metaphor to regulatory practices in corporate reporting. The balance between protecting invest

0 views • 15 slides

Financial Literacy and Education Commission: Coordinating Federal Efforts

Financial capability empowers individuals to manage financial resources effectively, make informed choices, avoid pitfalls, and improve their financial well-being. The Financial Literacy and Education Commission (FLEC) works to improve the financial literacy of individuals in the United States throu

0 views • 16 slides

Governance Mechanisms and Financial Risks Disclosure in Developing Economies

Examining the impact of governance mechanisms on financial risk disclosure in developing economies, this study delves into theories, literature reviews, findings, policy implications, and conclusions. The research emphasizes the importance of adequate risk disclosure for investor trust and regulator

0 views • 9 slides

The Use of Self in Probation Practice: Understanding Self-Disclosure and Its Implications

Explore the concept of self-disclosure in probation practice, examining different methods, findings, and implications. Discover the two schools of thought regarding self-disclosure and delve into the various realms and subtypes of self-disclosure practices. Gain insights into the forms of self-discl

0 views • 25 slides

Understanding Cultural Influence on Delayed Child Sexual Abuse Disclosure in the Vhavena Tribe

Exploring the intersection of culture, tradition, and delayed disclosure of child sexual abuse within the Vhavena Tribe. The study delves into the complexities of disclosure, the unique context of CSA in cultural norms, and behaviors, guided by the Afrocentric theory. Methodology involves interviews

0 views • 15 slides

Enhancing Governance through Systematic Disclosure and Transparency

Systematic disclosure and transparency play a crucial role in the governance and management systems of countries. This involves routine disclosure of information, such as financial data, to promote accountability and address gaps in information. The EITI Standard emphasizes the importance of mainstr

0 views • 23 slides

Conflict of Interest Disclosure for EAPC 2024 Congress

This disclosure statement outlines the conflict of interest policy for speakers at the EAPC 2024 Congress. Speakers are required to disclose any affiliations or financial interests that may potentially influence their presentations. The purpose of the disclosure is to inform attendees so they can ev

0 views • 4 slides

Testing Effectiveness of Consumer Financial Disclosure: Experimental Evidence

This study explores the impact of consumer financial disclosure on savings accounts, investigating the importance of design and presentation. It questions whether optimized disclosures can enhance consumer outcomes and delves into the challenges posed by consumer inertia. The UK savings market backg

0 views • 24 slides

Understanding Risk Management in Islamic Finance Institutions

Islamic Financial Institutions (IFIs) face various types of risks, including Shariah compliance, rate of return, displaced commercial equity investment, and operational risks. This content delves into how IFIs manage these risks through Shariah auditing, risk management for financial contracts, and

0 views • 35 slides

Mitigating Bias and Disclosure of Financial Support in Educational Program

The educational program detailed in the content emphasizes the disclosure of financial support received and the mitigation of potential bias. Faculty members have provided disclosures regarding any financial interests or affiliations that could pose conflicts of interest. This ensures transparency a

0 views • 9 slides

New Disclosure Rules for Continuing Education

ACCME updated its Standards for Integrity and Independence in Accredited Continuing Education in December 2020, leading to changes in ACLP's disclosure reporting rules. Key changes include reporting only financial relationships with "ineligible companies," extending the reporting period to 24 months

0 views • 5 slides