Governance Mechanisms and Financial Risks Disclosure in Developing Economies

Examining the impact of governance mechanisms on financial risk disclosure in developing economies, this study delves into theories, literature reviews, findings, policy implications, and conclusions. The research emphasizes the importance of adequate risk disclosure for investor trust and regulatory compliance in the aftermath of financial crises. Various governance theories are explored to understand the relationship between corporate governance mechanisms and risk disclosure practices.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Keeping Investors Informed through Adequate Financial Risks Disclosure: Do Governance Mechanisms Matter in Developing Economies? By Adam Konto Kyari, PhD, FCA, ACCA (Department of Accounting, Imam Abdulrahman Bin Faisal University, Dammam)

Outline Introduction Theories and Literature Review Discussion of Findings Policy Implications Conclusion

Introduction The commentators have described it as the most serious financial crisis aside the great depression of the 1903s (Cheffins, 2009; Kirkpatrick, 2009). Huge failure in financial regulations across the globe and serious break down in corporate governance with firms behaving recklessly and taking too much risk. financial crisis of the last decade very severe . Some Financial crisis and stakeholders trust on the firm Firms face a lot of risk and because of information asymmetry the investors are demanding for increased risk disclosure (Ntim et Al, 2013). As a result, regulars and governments across the globe require that companies should disclosure the risks they faced Demand for increased risk disclosure objectified undesirable event. (Willett, 1951:6) possibility of failure to obtain the desired business effects, incurring unintended losses or expenses higher than expected. (Ehrlick, 1981:456) uncertainty regarding the occurrence of an Risk: Meaning and disclosure

Introduction (Continued) Risk disclosure can be mandatory or voluntary and is described as the communication of information regarding firm s strategies, operations and other external factors likely to affect results (Jorgensen and Kirschenheiter, 2003) Risk disclosure helps investors in so many ways including understanding the overall performance of management, and gives them insight into the future prospect of the business, among others. Triggered by the inability of firms in disclosing sufficient information related to risk they faced (Solomon et al., 2000), a number of studies governance mechanisms conducted (e.g. Linsmeier et al., 2002; Lajili and Zeghal, 2005; Beasley et al., 2005) Risk: Meaning and disclosure connecting risk corporate Corporate Governance Mechanisms with disclosure were

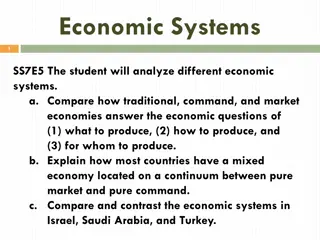

Theories and Literature Review There are many theories that justify studies connecting corporate governance mechanisms and risk disclosure - e.g. stakeholder s theory, signalling theory, and agency theory, legitimacy theory, and institutional theory, among others. Current study is guided by the agency and signalling theories Applicable Theories Literature is massive (e.g. Linsmeier et al., 2002; Beretta and Bozzolan, 2004; Lajili and Zeghal, 2005; Beasley et al., 2005; Linsley and Shrives, 2006; Konishi and Mohobbot, 2007; Deumes and Knechel, 2008). However, majority of the study uses one year coverage. The present study used three-year coverage. Literature review & gap identified

Results and Discussions Controlling for firm specific factors, the findings suggest that CG mechanisms account for almost 51% of the variation in financial risk disclosure (R = .505) Out of which CG mechanisms alone accounted for about 25% of the variations in risk disclosure Main findings On individual basis, board size, institutional ownership, managerial ownership, governmental ownership, audit committee independence, and audit committee expertise are positively associated with risk disclosure.. On the other hand, board independence, board diversity and audit committee size are negatively associated. CG Mechanisms

Results and Discussions(Continued) The findings are consistent with extant literature with a number of suggestions. First, it is clear that CGMs are important elements in financial risk disclosure. Second, it is also apparent that not all the results conform with requirements of the code and this call for some regulatory actions. For example, audit committee size was negatively associated with financial risk disclosure suggesting that recommended by the Nigerian CG code is not that large. Similarly, the negative relationship board diversity has with risk disclosure indicates that the board s demography is lopsided. Discussions maximum of six members

Policy Implications and Lessons for Saudi Business Transformation Agenda On average, the disclosure rate was impressive but not as expected under a mandatory regime. This could be a guide for Saudi Arabia towards ensuring that the compliance strategies in place are updated to move in harmony with the policy dynamics of the government. Some of the findings (e.g. board size, audit committee independence) met the expectation of the Nigerian CG code, while others (e.g. board independence, audit committee size) do not. This could be useful guide for Saudi to align the provision of its CG code, in the light of the changing business environment, with the business transformation drive of the Vision 2030.

Conclusion This study investigated the connection between corporate governance mechanisms and financial risk disclosure. Specifically, the paper examined three attributes each of board s characteristics, ownership structure and audit committee All the mechanisms studied were fond to be positively associated with financial risk disclosure, except board independence, board diversity and audit committee size that had negative association. Overall, the study concludes that CG mechanisms vital are important factors in influencing financial risk disclosure. It is also the conclusion of this study that the Nigerian experience could be useful to other developing countries particularly Saudi Arabia Further study is recommended to include both the qualitative and quantitative risk disclosure. Similarly, further research to both listed and unlisted commercial banks. A comparative study on the influence of corporate governance mechanisms on risk disclosure between Saudi and Nigeria is recommended.