Financial Ratio Analysis and Profitability Ratios Overview

This unit focuses on financial ratio analysis, specifically profitability ratios like gross profit margin, designed to assess a business's financial performance based on its financial statements. By comparing information such as revenues, costs, assets, and liabilities, businesses can evaluate their

1 views • 13 slides

Understanding Financial Leverage and Its Implications

Financial leverage refers to a firm's ability to use fixed financial costs to amplify the impact of changes in earnings before interest and tax on its earnings per share. It involves concepts like EBIT, EBT, preference dividends, and tax rates, and can be measured through the degree of financial lev

1 views • 7 slides

Understanding Piecemeal Distribution of Cash in Partnership Dissolution

Piecemeal distribution of cash in partnership dissolution involves systematically distributing cash over stages as assets are realized and liabilities settled. Realization expenses, contingent liabilities, outside liabilities, partners' loans, and partners' capitals are settled in a specific order.

0 views • 6 slides

Rights and Liabilities of Minors in Partnership according to Sec. 30 by Dr. Satyendra Kumar Singh

Minors can be admitted to the benefits of partnership with the consent of all partners. They have rights to share property and profits, access firm accounts, and sue for accounts. However, minors have liabilities and limitations in partnership, where their share is initially liable for firm acts but

0 views • 9 slides

Introduction to Principles of Accounts Level 1: Basics of Accounting and Bookkeeping

Understanding the fundamentals of accounting including bookkeeping, classification of data, users of accounting information, assets, liabilities, and capital. Practice exercises to classify items and review concepts of assets, liabilities, and equity.

0 views • 24 slides

Accounting for Foreign Branches: Converting Trial Balances and Exchange Rates

A foreign branch maintains its accounts in a foreign currency, requiring the head office to convert the trial balance into its own currency before finalizing accounts. Fixed and fluctuating exchange rates impact the conversion process, with specific rules for fixed assets, liabilities, and current a

0 views • 7 slides

Albanian National Financial Education Strategy 2022-2027

The Albanian National Financial Education Strategy (NFES) aims to promote financial education for individuals, households, and MSMEs to enhance financial well-being and economic stability. It focuses on key interventions, foundational enablers, institutional coordination, funding, and monitoring. Fi

0 views • 19 slides

Statistical Treatment of Islamic Financial Instruments

Explore the classification and examples of Islamic financial instruments, such as Restricted Mudaraba and Waqf Funds. Understand the scope, process, and economic substance of these instruments, along with their classification in terms of financial assets and liabilities. Learn how to analyze and cla

0 views • 10 slides

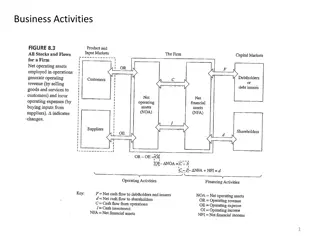

Understanding Financial Statements and Cash Flow in Chapter 2

This chapter delves into the importance of financial statements in making crucial financial decisions by highlighting the disparities between accounting value and market value as well as accounting income and cash flow. It explains the balance sheet, assets, liabilities, owner's equity, and networki

1 views • 34 slides

Financial Highlights and Audit Results for Town of Beech Mountain, North Carolina

The Town of Beech Mountain, North Carolina, under Misty D. Watson, CPA, saw positive financial outcomes in the fiscal year ending June 30, 2017. Key highlights include an increase in assets exceeding liabilities, strong property tax collection rates, and prudent management of funds. The independent

1 views • 7 slides

Understanding Financial Accounting Principles and Practices

Explore the key concepts in financial accounting, such as assets, owner's equity, liabilities, expenses, and income. Learn about entering transactions from source documents, bank reconciliation, control accounts, and evaluating the results of a sole proprietor at the end of a financial year.

3 views • 29 slides

Understanding Final Accounts Preparation in Business

Final accounts, including Income Statement and Balance Sheet, are crucial for stakeholders to assess a company's financial progress. The objectives of final account preparation involve determining profits or losses, showcasing financial status, and providing vital information to users. Income statem

0 views • 10 slides

Understanding Financial Statements Analysis in Business Finance

Understanding the analysis of financial statements is crucial for assessing the financial performance and position of an organization. This course provides knowledge, competencies, and skills necessary to apply basic financial statement analysis techniques, interpret financial numbers, and generate

0 views • 18 slides

Understanding IAS 39: Financial Instruments Recognition and Measurement

This content provides an overview of an IFRS seminar on IAS 39, focusing on key concepts such as the classification and measurement of financial assets, impairment, reclassification, and more. It covers definitions of financial instruments, financial assets, equity instruments, and financial liabili

1 views • 43 slides

Understanding Non-Profit Financial Statements: Key Insights

Delve into the fundamental disparities between non-profit and for-profit financial statements, exploring key indicators, such as balance sheets, assets, liabilities, and net assets. Discover the distinct financial structures and reporting methods that differentiate non-profit organizations from thei

0 views • 16 slides

Understanding IFRS 9 Financial Instruments & Impairment: Key Principles and Impact

Explore the key principles of IFRS 9 Financial Instruments, focusing on classification, measurement, impairment, and expected credit loss overview. Gain insights into the impact on financial statements across different stages, accounting for modifications, and identifying impairment in various finan

0 views • 12 slides

Understanding Provisions, Contingent Liabilities, and Assets in Accounting

This content covers the concept of provisions, contingent liabilities, and contingent assets in accounting, highlighting the criteria for recognizing a liability as a provision. It explains the types of obligations, the importance of a reliable estimate, and specific applications such as onerous con

0 views • 13 slides

Working Capital and Current Ratio in Accounting

Understanding indicators like net current assets (working capital) and current ratio is crucial in accounting. Net current assets reflect the ability to settle current liabilities and the capital required for operational functions. Managing working capital effectively involves factors like stock man

0 views • 12 slides

Understanding Cost of Credit and Financial Statements

The cost of credit refers to the additional amount a borrower must pay, including interest and fees, while financial statements are crucial reports that present a business's financial position and performance. These statements help users make informed economic decisions by providing clear, relevant,

0 views • 17 slides

Guide to Filling Out Parent's Financial Statement Section 4: Assets and Liabilities

Learn how to accurately complete Section 4 - Assets and Liabilities of the Parent's Financial Statement. This section covers details on rental payments, homeownership information, bank accounts, investments, retirement savings, and education funds. Follow the instructions provided to showcase the fa

0 views • 8 slides

Understanding Ledger Accounts and Financial Position

Ledger accounts play a crucial role in recording individual item changes affecting financial position. Each balance sheet item has its own account, ensuring accurate financial tracking. The accounting equation dictates where assets, liabilities, and owner's equity are located on the balance sheet, w

0 views • 64 slides

Money Mindset Guide: Path to Financial Success

Explore the key concepts of generating wealth outlined in Jaak Roosaare's book "Getting Rich Guide in E1." Learn about the crucial principles of managing your finances effectively, distinguishing between income, assets, liabilities, and expenses. Discover various money game scenarios illustrating di

0 views • 22 slides

Financial Concepts Review in Jeopardy Style

Explore financial concepts through a Jeopardy-style game with categories like Short-term Assets, Long-term Assets, Liabilities, Equity, Financial Statements, and Ratio Analysis. Test your knowledge with questions on accounts receivable, borrowers, and more. Prepare for the final Jeopardy round as yo

0 views • 73 slides

Understanding Liabilities of Directors under Companies Act, 2013

Director's liabilities under the Companies Act, 2013 include definitions of directors, shadow directors, officers, and those in default. Responsibility for default and potential prosecutions for wrongful actions are discussed. Changes in definitions and concepts are highlighted to illustrate the leg

0 views • 37 slides

Essential Guide to Budgeting: Learn to Manage Your Finances Effectively

Explore the fundamental concepts of budgeting, including the importance of setting financial goals, prioritizing expenses, and creating a flexible budget plan. Discover how to allocate your income wisely, pay yourself first, and track your cash flow to achieve financial stability. Gain insights into

0 views • 55 slides

Understanding Final Accounts: Key Concepts and Definitions

Explore the essential key words related to final accounts such as Debtors, Creditors, Assets, Liabilities, Fixed Assets, Current Assets, Current Liabilities, Long-term Liabilities, Purchases, Sales, and Gains. These images provide a visual representation of the concepts to help you grasp the fundame

0 views • 12 slides

Understanding Net Worth: Integers and Financial Assets

Learn about net worth, liabilities, and assets by exploring how integers are used to determine the financial standing of individuals. Discover the concepts of liabilities, responsibilities, and assets through real-life examples of notable personalities. Dive into calculations and understand how net

0 views • 18 slides

Legal Provisions Regarding Affidavits and Liabilities in Financial Matters

The ARAA 2003 mandates that all plights must be supported by affidavits and payment of court fees. Affidavits are considered substantive evidence in court proceedings, allowing for judgment without witness deposition. Financial liabilities for mortgagees and guarantors are joint and several, with a

0 views • 14 slides

Understanding Reformulated Balance Sheets in Financial Analysis

Reformulated balance sheets in financial analysis involve categorizing assets and liabilities into operating and financial components for a more detailed credit analysis. This process helps differentiate between assets and liabilities used in business operations versus financing activities, providin

0 views • 17 slides

Liability of the Mediator in Mediation Processes: A Comparative Perspective

Exploring the liability aspects of mediators in various jurisdictions, this academic session discusses different types of liabilities, submitting liability claims, and scenarios where mediators may face liability issues. It delves into contractual, tortious, and criminal liabilities, examining the n

0 views • 11 slides

Financial Analysis of Marble Mountain Ranch, Inc.

Bryan Elder, a Senior Water Resource Control Engineer at the State Water Resources Control Board, presents a comprehensive financial analysis of Marble Mountain Ranch, Inc. The analysis covers the company's financial health, ability to pay, cash flow, IRS tax filings, and more. Bryan Elder's qualifi

0 views • 15 slides

Understanding Directors and Officers Liability Insurance

Explore the intricacies of Directors and Officers Liability Insurance, including coverage scope, directors' duties, potential liabilities, recent cases, and Employment Practices Liability. Learn about the evolution of D&O insurance, claims trends, and premium trends. Understand wrongful acts, Compan

0 views • 21 slides

Financial Literacy Empowerment in Eastern and Southern Africa

Developing countries in Eastern and Southern Africa are prioritizing financial education to empower consumers in making sound financial decisions. Financial literacy enhances financial inclusion, stability, and economic growth. It involves awareness, knowledge, skills, attitudes, and behaviors essen

0 views • 23 slides

CADCAI Audited Financial Report 2016 Summary & Analysis

The CADCAI Audited Financial Report for 2016 reveals key insights into the organization's financial performance. CADCAI is a not-for-profit organization with income tax exemption and registered GST. The report showcases a current year profit of $14,067 and total retained profit since 1986 of $412,30

0 views • 19 slides

Understanding the Role and Liabilities of Promoters in Company Formation

Promotion in the formation of a company involves the initial groundwork by a promoter, who assembles funds, property, and managerial expertise. Promoters have a fiduciary duty towards the company and original shareholders, necessitating full disclosure of all material facts. They can be held liable

0 views • 20 slides

Understanding Financial Instruments in IFRS: Key Concepts and Overview

This content provides an overview of financial instruments under IFRS, focusing on their classification as assets, liabilities, or equity. It explains the presentation of compound financial instruments and outlines key concepts related to financial assets, financial liabilities, and equity instrumen

0 views • 28 slides

Financial Literacy and Education Commission: Coordinating Federal Efforts

Financial capability empowers individuals to manage financial resources effectively, make informed choices, avoid pitfalls, and improve their financial well-being. The Financial Literacy and Education Commission (FLEC) works to improve the financial literacy of individuals in the United States throu

0 views • 16 slides

Understanding Balance Sheets and Income Statements in Financial Reporting

Balance sheets provide a snapshot of a company's assets, liabilities, and shareholders' equity at a specific point in time, with assets listed on the left and liabilities and equity on the right. Current assets are those expected to be converted into cash within a year, while non-current assets are

0 views • 34 slides

Understanding Debt Capital in Chapter 8 of Accounting for Managers

Explore the concept of debt capital and liabilities in Chapter 8 of Accounting for Managers by Professor Zhou Ning from Beihang University. Learn about the nature of liabilities, legal obligations, contingencies, and levels of likelihood in financial reporting. Discover how to differentiate between

0 views • 21 slides

Understanding Balance Sheets in Financial Management

A balance sheet is a crucial financial statement that reflects the assets, liabilities, and owner's equity of a business at a specific point in time. It provides a snapshot of the financial health of a company, helping stakeholders assess its overall standing. Assets are items of value owned by the

0 views • 9 slides