Financial Ratio Analysis and Profitability Ratios Overview

This unit focuses on financial ratio analysis, specifically profitability ratios like gross profit margin, designed to assess a business's financial performance based on its financial statements. By comparing information such as revenues, costs, assets, and liabilities, businesses can evaluate their

1 views • 13 slides

Overview of Working Capital Management in Financial Management

Working capital management involves strategic decision-making regarding a company's current assets and liabilities to optimize liquidity, profitability, and risk. This process includes understanding working capital concepts, financing current assets, managing liability structure, and maintaining the

1 views • 26 slides

Understanding Independent Branches in Accounting

Independent branches in accounting operate autonomously, making purchases externally, receiving goods from the head office, setting their selling prices, and managing expenses from their own cash flow. They keep complete books, prepare financial statements independently, and may engage in inter-bran

1 views • 10 slides

Family Assets for Independence in Minnesota (FAIM) Program Overview

The Family Assets for Independence in Minnesota (FAIM) program helps individuals achieve financial independence through a structured process involving eligibility criteria, opening a savings account, financial coaching, obtaining assets, and closing the account. Eligibility requirements include inco

0 views • 25 slides

Understanding Capital Assets and Financial Reporting

This presentation delves into the world of capital assets, focusing on their categorization, ownership, and reporting in financial statements. Key topics include the distinction between tangible and intangible assets, responsible asset management, and the implications of capital leases on ownership.

0 views • 61 slides

Understanding Impairment of Assets in IFRS for SMEs - 2019

This content discusses the Impairment of Assets in IFRS for SMEs, focusing on determining the true economic benefits of assets for accurate financial representation. It covers exceptions, impairment tests, inventory valuation, and recognizing valuation/impairment losses for inventory categories. A c

1 views • 23 slides

Capital Gains and Assets Overview in Income Tax Law and Accounts

This content provides an overview of capital gains and assets in income tax law and accounts, covering topics such as types of capital assets, assets not considered capital assets, kinds of capital assets (short-term and long-term), transfer year of chargeability, computation of capital gains, and c

0 views • 15 slides

Monitoring of Returned Assets: Abacha's Legacy in Nigeria

International efforts led by civil society in Nigeria and Switzerland have successfully monitored the return of assets linked to the Abacha regime. Initiatives like the Nigerian Network on Stolen Assets and the Conditional Cash Transfer program demonstrate transparency and accountability in handling

0 views • 10 slides

Understanding IAS 39: Financial Instruments Recognition and Measurement

This content provides an overview of an IFRS seminar on IAS 39, focusing on key concepts such as the classification and measurement of financial assets, impairment, reclassification, and more. It covers definitions of financial instruments, financial assets, equity instruments, and financial liabili

1 views • 43 slides

Understanding Liquidation Estate and Key Asset Components

In the process of liquidation, the liquidator forms an estate comprising various assets of the corporate debtor for the benefit of creditors. These assets include ownership rights, tangible and intangible assets, proceeds of liquidation, and more. However, certain assets owned by third parties or he

0 views • 39 slides

University Asset Management Guidelines

University asset management guidelines cover the physical inventory policy, procedures, and fixed asset terminology for safeguarding, tracking, and reporting assets. Departments designate equipment liaisons to manage assets and conduct physical inventories regularly. Assets are categorized as capita

1 views • 21 slides

Working Capital and Current Ratio in Accounting

Understanding indicators like net current assets (working capital) and current ratio is crucial in accounting. Net current assets reflect the ability to settle current liabilities and the capital required for operational functions. Managing working capital effectively involves factors like stock man

0 views • 12 slides

Understanding Cost of Credit and Financial Statements

The cost of credit refers to the additional amount a borrower must pay, including interest and fees, while financial statements are crucial reports that present a business's financial position and performance. These statements help users make informed economic decisions by providing clear, relevant,

0 views • 17 slides

A Comparison of ELI and UNIDROIT Principles on Digital Assets

A comparison between the principles of Electronic Liability Initiative (ELI) and the International Institute for the Unification of Private Law (UNIDROIT) regarding digital assets. ELI focuses on security over digital assets, while UNIDROIT covers a broader range, including transfers, custody, and m

0 views • 5 slides

Understanding Equitable Distribution in Florida

Equitable distribution in Florida, governed by statutes 61.075 and 61.076, determines the fair division of marital assets and liabilities in divorce cases. Key considerations include identification, valuation, distribution presumption, and justification for unequal distribution. Assets are classifie

0 views • 28 slides

Managing Debt and Protecting Client Assets in Victoria

Consumer Action Law Centre in Victoria focuses on assisting low-income clients in managing debt and protecting their assets. The presentation emphasizes assessing the need for debt payment, considering the client's financial position, and exploring options to handle debt where income and assets are

1 views • 29 slides

Understanding Society: Wealth and Assets Survey Research

The Wealth and Assets Survey (WAS) conducted by Oliver Tatum and Angie Osborn at the Understanding Society Research Conference in 2013 focuses on longitudinal issues, experiment design, research findings, and future plans related to the survey. The WAS background includes collecting data on personal

3 views • 28 slides

Accounting for Biological Assets and Agricultural Produce

At the end of this lesson, you will be able to identify the principal issues in accounting for biological assets and agricultural produce at the time of harvest. Topics include the recognition, measurement, presentation, and disclosure of biological assets in financial statements. Questions regardin

0 views • 26 slides

Accounting for Biological Assets and Agricultural Produce (LKAS 41: Agriculture) by Rangajewa Herath

This content provides insights into the accounting standards for biological assets and agricultural produce under LKAS 41, discussing classification, presentation, measurement, gain or loss recognition, and disclosure requirements. It covers the unique nature of biological assets, the scope of LKAS

0 views • 20 slides

Comprehensive Fixed Assets Management Guidelines for Educational Institutions

Explore a detailed guide on tracking and recording fixed assets in educational institutions, covering key aspects such as capital assets accounting procedures, general ledger accounts, and the definition of capital assets. Learn the minimum standards for valuing assets, recording guidelines, and the

0 views • 25 slides

Update on BSEE Program and Action Plan for Orphan Assets

Advisory updates on BSEE program focusing on bankruptcies, orphan assets, and decommissioning liabilities. Actions include contracting procedures, financial assurance coverage, and funding strategies to address wells, pipelines, and structures. Attention given to MIGO, ANGLO SUISSE, and ATP/BENNU as

0 views • 22 slides

Proposed Process Improvements for Fixed Assets Management

Implementing Oracle Fixed Assets for managing fixed assets and capital projects, the proposed process aims to streamline capitalization, improve financial reporting controls, and enhance operational efficiencies. By organizing accounts based on asset categories, tracking ownership, and providing det

0 views • 9 slides

Overview of Commercial Banks in the Financial Industry

Commercial banks play a crucial role in the financial industry by accepting customer deposits, providing loans, and facilitating the transmission of monetary policy. They differ from nonfinancial firms in their balance sheets, with assets mainly composed of loans and other financial assets. Regulate

0 views • 23 slides

Understanding Intangible Assets and Business Combinations in Accounting

In accounting, recognition of intangible assets as assets requires the expectation of future economic benefits flowing to the entity and reliable measurement of the asset's cost. Intangible assets acquired separately are recognized based on their fair value, while those acquired in business combinat

0 views • 23 slides

Understanding Impairment of Assets in Financial Management

Entities must periodically test for impairment to ensure assets are not overstated. An impairment loss occurs when an asset's carrying amount exceeds its recoverable amount. Assets like inventories and deferred tax assets may require testing. Learn when to undertake impairment tests, key indicators,

0 views • 19 slides

Financial Concepts Review in Jeopardy Style

Explore financial concepts through a Jeopardy-style game with categories like Short-term Assets, Long-term Assets, Liabilities, Equity, Financial Statements, and Ratio Analysis. Test your knowledge with questions on accounts receivable, borrowers, and more. Prepare for the final Jeopardy round as yo

0 views • 73 slides

Understanding Net Investment in Capital Assets and Its Importance

Net Investment in Capital Assets is a critical component of an entity's financial position, reflecting the value of capital assets owned. It represents the portion of the net position that is not spendable as it is invested in assets. Calculating Net Investment in Capital Assets involves subtracting

1 views • 17 slides

Islamic Finance Task Team on Economic Ownership of Non-Financial Assets

This task team focuses on determining the economic ownership of non-financial assets in Islamic finance practices like sales, lease, and equity financing. Recommendations are being developed to address issues related to economic ownership, including recording assets on balance sheets and handling de

0 views • 11 slides

Understanding Net Worth: Integers and Financial Assets

Learn about net worth, liabilities, and assets by exploring how integers are used to determine the financial standing of individuals. Discover the concepts of liabilities, responsibilities, and assets through real-life examples of notable personalities. Dive into calculations and understand how net

0 views • 18 slides

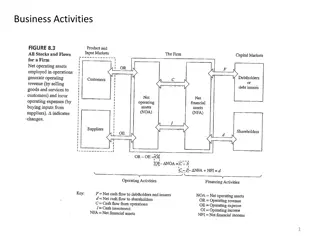

Understanding Reformulated Balance Sheets in Financial Analysis

Reformulated balance sheets in financial analysis involve categorizing assets and liabilities into operating and financial components for a more detailed credit analysis. This process helps differentiate between assets and liabilities used in business operations versus financing activities, providin

0 views • 17 slides

Financial Literacy Empowerment in Eastern and Southern Africa

Developing countries in Eastern and Southern Africa are prioritizing financial education to empower consumers in making sound financial decisions. Financial literacy enhances financial inclusion, stability, and economic growth. It involves awareness, knowledge, skills, attitudes, and behaviors essen

0 views • 23 slides

CADCAI Audited Financial Report 2016 Summary & Analysis

The CADCAI Audited Financial Report for 2016 reveals key insights into the organization's financial performance. CADCAI is a not-for-profit organization with income tax exemption and registered GST. The report showcases a current year profit of $14,067 and total retained profit since 1986 of $412,30

0 views • 19 slides

Understanding Financial Instruments in IFRS: Key Concepts and Overview

This content provides an overview of financial instruments under IFRS, focusing on their classification as assets, liabilities, or equity. It explains the presentation of compound financial instruments and outlines key concepts related to financial assets, financial liabilities, and equity instrumen

0 views • 28 slides

Exploring Regulatory Barriers in the Development of Safe Assets

The ESRB High-Level Task Force on Safe Assets, led by Philip Lane, delves into the challenges surrounding safe assets like sovereign bonds. The task force's technical contribution sheds light on the unique properties of Sovereign Bond-Backed Securities (SBBS) and their potential role in enhancing fi

0 views • 17 slides

Financial Literacy and Education Commission: Coordinating Federal Efforts

Financial capability empowers individuals to manage financial resources effectively, make informed choices, avoid pitfalls, and improve their financial well-being. The Financial Literacy and Education Commission (FLEC) works to improve the financial literacy of individuals in the United States throu

0 views • 16 slides

Understanding Capital Assets in Financial Reporting

A capital asset is a long-term asset used in operations with a useful life extending beyond a single reporting period, such as land, buildings, and infrastructure. These assets are reported at historical cost, including ancillary charges. Special assets like works of art or historical treasures are

0 views • 35 slides

Understanding Accounting for Borrowing Costs in Financial Management

Borrowing costs in financial management refer to interest and other expenses incurred when borrowing funds. These costs are crucial to account for correctly to ensure accurate financial reporting. Borrowing costs directly attributable to acquiring, constructing, or producing a qualifying asset are c

0 views • 8 slides

Understanding Asset Types and Definitions in Financial Management

Exploring various asset types like real property, personal property, and equipment, along with definitions such as capital assets and Comptroller-controlled assets. Learn about capitalization thresholds and the classification of assets based on value and risk factors.

0 views • 7 slides

Understanding Balance Sheets and Income Statements in Financial Reporting

Balance sheets provide a snapshot of a company's assets, liabilities, and shareholders' equity at a specific point in time, with assets listed on the left and liabilities and equity on the right. Current assets are those expected to be converted into cash within a year, while non-current assets are

0 views • 34 slides

Digital Assets and Social Media Estate Planning

Explore the world of digital assets and social media estate planning presented by Patricia E. Kefalas Dudek & Howard H. Collens. Understand what digital assets entail, the categories they fall into, and how to assist clients in planning for their digital legacies. Learn about the importance of estat

0 views • 56 slides