Filing a Candidate’s Statement of Organization

The process of filing a Candidate's Statement of Organization (CFA-1) in Indiana. Understand the deadlines based on the salary for the elected office and the campaign finance committee requirements.

1 views • 10 slides

RBI Directions on Filings of Supervisory Returns

RBI issues new Master Directions on 'Filing of Supervisory Returns,' emphasizing NBFCs. Timelines, revised applicability, and online portals introduced for streamlined filing. Physical submission required for Form A Certificate.

1 views • 5 slides

EANS-I Grant Deadlines and Requirements Overview

Understanding the EANS-I grant deadlines is crucial for proper utilization of funds. Learn about the obligation, performance, and liquidation deadlines, including flexibility and requirements for reimbursement and direct payments. Stay informed to ensure compliance with the grant program guidelines.

1 views • 14 slides

Online Consumer Complaint Filing and Response Process in India

Learn how to file a consumer complaint online and write a response as an opposite party in Consumer Forums of India through the Edaakhil portal. Understand the steps for registration, login, and filing a response for approved complaints and responses. Discover how to search for cases and access case

4 views • 15 slides

For Tax Filing - Analyze the Tax Regime

As the financial year closes, taxpayers would need to ensure that their books of accounts, pay slips, bank statements and other important documents are in place such that the details are available at the time of audit and filing the return of income. While filing the return of income, a taxpayer mu

0 views • 3 slides

Navigating Hart-Scott Act Filing Requirements (2024)

This guide provides an overview of the HSR filing process, including reportable transaction thresholds, exemptions, and filing requirements. It explains the key aspects like size-of-the-transaction test, size-of-the-persons test, types of transactions involved, and the valuation of voting securities

4 views • 60 slides

Local Assistance Update - Technical Advisory Committee Meeting April 26, 2023

Update on various topics discussed during the Technical Advisory Committee meeting including CTC Meetings deadlines, Inactive Invoices submission, Active Transportation Program updates, and Clean California Local Grant Program application deadlines. Details about each item and their respective deadl

0 views • 12 slides

Process for Filing a Petition for Divorce in India

Filing a Petition for Divorce in India\n\nFiling a Petition: The divorce process in India begins with the crucial step of filing a petition. This is the formal action taken by one spouse, known as the petitioner, to initiate the legal proceedings for divorce. The petition is filed in the appropriate

0 views • 4 slides

Simplifying Income Tax Filing_ A Friendly Guide

Get expert income tax return filing service providers in Punjagutta, Begumpet, Banjara Hills, Hyderabad. We offer online tax filing, ITR filing and tax preparation services.

1 views • 2 slides

Virginia ACA Carrier Teleconference 2025: Important Updates and Deadlines

The teleconference scheduled for today covers a range of important topics for the 2025 plan year in Virginia, including critical dates, rate filing information, new benchmark and Essential Health Benefits (EHBs), mental health parity, compliance binder filing reminders, the Commonwealth Health Reins

2 views • 26 slides

Understanding the Importance of Filing Income Tax Returns

Filing income tax returns is crucial as it involves declaring total income and tax payable. Deadlines are specified based on the type of assessee, with penalties for late filing. The process allows for claiming refunds, showing financial worth for visas, and ensuring eligibility for tenders. Failing

0 views • 26 slides

Annual Filing Requirements for Knights of Columbus Councils

Learn about the IRS annual filing requirements for Knights of Columbus Councils, including the need to file Form 990, obtain an EIN, and maintain tax-exempt status. Failure to comply can result in the revocation of tax-exempt status and reinstatement fees. Find detailed guidance on applying for an E

0 views • 23 slides

Guide to Filing for Conservatorship in Fresno, CA Probate Court

Comprehensive guide on filing for conservatorship in Fresno, CA Probate Court, covering basics, costs, required forms, service procedures, and due diligence efforts. Detailed information on the process including filing location, fees, required documents, and serving requirements. Includes tips on du

0 views • 22 slides

Tax Filing, Payment, and Penalties Overview for LRA Practitioners in Monrovia 2021

Comprehensive training module covering income tax, excise tax, goods and services tax filing requirements, due dates for tax returns, and more for taxpayers in Monrovia. Learn about the responsibilities of taxpayers, due dates for filing tax returns, and specific requirements for various types of ta

0 views • 43 slides

1099 Reporting Deadlines and Responsibilities in State Accounting Bureau

This detailed document outlines the deadlines and responsibilities related to 1099 reporting in the State Accounting Bureau (SAB). It covers important dates for filing and adjustments, interactions with agencies, and SAB's responsibilities in handling CP2100 notices and Bulk TIN Match processes. The

1 views • 14 slides

Comprehensive Guide to Filing in Business Organizations

Filing is essential for maintaining records in business organizations. It involves systematic arrangement of documents for easy access and reference. The objectives, functions, and importance of filing are discussed in this informative guide.

0 views • 16 slides

2024 UAE Corporate Tax Registration Deadlines: Key Dates to Remember

Stay compliant with UAE corporate tax regulations by keeping track of the 2024 registration deadlines. NH Management provides a comprehensive overview of essential deadlines for UAE corporate tax registration, ensuring your business meets all require

2 views • 9 slides

Year-End Processing and Deadlines for Accounts Payable, Reimbursements, and Card Services

The provided information outlines important deadlines and processes for year-end processing of accounts payable, reimbursements, and card services at a company. From submission deadlines to invoice processing schedules, this guide assists in navigating the fiscal year-end tasks efficiently.

0 views • 8 slides

NSF Career Workshop 2023: Tips and Deadlines

Overview of NSF CAREER proposal process, including eligibility criteria, important messages, and submission deadlines. Tips from experts on letters, budget, and document preparation. Emphasis on starting early, careful planning, and revision process. Highlighted deadlines and recommendations for suc

0 views • 26 slides

Understanding GST Returns: Types, Benefits, and Mechanisms

GST returns play a crucial role in the tax system by providing necessary information to the government in a specific format. They include details of outward and inward supplies, ITC availed, tax payable, and more. Filing returns ensures timely transfer of information, aids in tax liability determina

4 views • 38 slides

Texas DWC Medical Fee Dispute Resolution Overview

The Texas Department of Insurance, Division of Workers Compensation offers Medical Fee Dispute Resolution (MFDR) services to help healthcare providers resolve disputes with insurance carriers over medical bills. MFDR specializes in DWC medical fee guidelines, billing policies, and reimbursement calc

0 views • 24 slides

Security and Authentication in Electronic Filing Systems: Arkansas Subcommittee Report

Explore the subcommittee report on security and authentication in electronic filing systems for campaign and finance reports in Arkansas. Learn about user authentication, risks, mitigation strategies, and approaches used in other states. Discover the filing processes in both paper and electronic for

0 views • 24 slides

Introduction to Real-Time Systems and Real-Time OSes

Real-time systems are defined by the critical nature of timely results, where correctness depends not just on computation but also on when results are produced. Characteristics include timing constraints, deadlines, and different types of tasks categorized based on timing patterns. Understanding sof

0 views • 21 slides

Important End-of-Year Reminders and Deadlines for UCPath Users

Stay updated with key deadlines and announcements regarding UCPath transactions and important reminders for the year-end, including fee remission deadlines, training tips meetings, overpayments handling, and UCPath upgrade reminders. Ensure you are prepared and informed for a smooth transition into

0 views • 15 slides

Virginia ACA Filing Season 2022 Carrier Teleconference: Important Updates

Explore key topics discussed during the Virginia ACA filing season teleconference, including important dates, rate filing template changes, health care savings programs, mental health parity compliance, and more. Stay informed about crucial deadlines and regulatory requirements for carriers in Virgi

0 views • 19 slides

Election Filing Deadlines and Procedures for 2024

Detailed information on candidate filing deadlines and procedures for the 2024 election season, covering key dates for filing, deadlines for petitions, withdrawals, challenges, and ballot vacancies for Democratic, Republican, and Libertarian parties in Indiana.

0 views • 10 slides

Louisiana Department of Revenue Electronic Filing Guidelines

This content provides a comprehensive overview of the electronic filing process for individual income tax returns with the Louisiana Department of Revenue. It covers important details such as filing requirements, third-party filings, ERO application procedures, retention of paper documents, and more

0 views • 30 slides

Electric Vehicle Power Excise Tax Regulations Overview

This detailed document outlines the provisions of the Electric Vehicle Power Excise Tax, registration requirements for electric vehicle power dealers, tax filing procedures, and tax rate adjustments. Effective January 1, 2024, the tax imposes a base rate of three cents per kilowatt hour and applies

0 views • 11 slides

Tax Rates and Standard Deductions for Different Filing Statuses

This content provides information on tax rates and standard deductions for various filing statuses for tax years 2010 and 2011. It includes details on taxable income brackets and corresponding tax rates for single filers, all filers, and married filing jointly, along with standard deductions for dif

0 views • 10 slides

Professional Development Leave Application Procedures and Deadlines

Guidelines for faculty members applying for Professional Development Leave including application forms, deadlines, submission process, and approval criteria. Details on required documents, deadlines, and the submission process to ensure timely application processing.

0 views • 23 slides

Guide to Filing 2015 Federal Tax Return with 1040NR-EZ Form

Learn about filing your 2015 Federal Tax Return using the 1040NR-EZ form, including guidance on completing the form, using tax preparation software, and determining eligibility. Understand the criteria for completing the 1040NR-EZ form and find resources to help you navigate through the tax filing p

0 views • 78 slides

March 2023 Payroll and HR Deadlines Overview

Important deadlines in March 2023 for payroll transactions, HR actions, finance funding entries, and adjustments affecting postdoctoral scholars, ASEs, and GSRs. Includes blackout periods, approval deadlines, and freeze timelines for processing PayPath actions. Quick reminders to avoid rehire/reinst

0 views • 34 slides

Parameterized Workload Adaptation for Fork-Join Tasks with Dynamic Workloads and Deadlines

In dynamic environments, tasks may face unknown workloads and deadlines, leading to system overload and missed deadlines. This research focuses on adapting task workloads to provide results before the deadline by adjusting computational parameters. It explores how to minimize degradation of result u

0 views • 31 slides

ACA Reporting: Preparing for 2016 Deadlines Overview

Learn about the key components of ACA reporting for 2016 deadlines, including employer and individual mandates, subsidies, workflow administration, and form filing requirements. Stay informed about important updates and understand the significance of Forms 1094-C and 1095-C in demonstrating complian

0 views • 42 slides

Understanding UCC Article 9 Filing System

The UCC Article 9 filing system plays a crucial role in perfecting security interests and providing public notice for creditors' rights adjustments. It emphasizes the importance of proper filing, searchers' due diligence, and the neutral role of the filing office in maintaining accurate records. Key

0 views • 40 slides

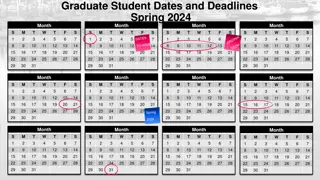

Important Dates and Deadlines for Graduate Students - Spring 2024

Key dates and deadlines for graduate students in Spring 2024 at the DC Metro Area Graduate School. Includes application for degree conferral, final exam defense, and electronic thesis/dissertation submission timelines. PhD/EDD students have slightly different deadlines from Masters/EDS students. Off

0 views • 17 slides

Graduate School Dates and Deadlines for Fall 2022

Discover important dates and deadlines for Fall 2022 at the Graduate School, including application for degree conferral, final exam defense deadlines, and electronic thesis/dissertation submissions for both Masters/EDS and PhD/EDD students. Get detailed information about key events and processes to

0 views • 17 slides

College Preparation Guide: Scholarships, Deadlines, and Applications

College preparation can be overwhelming without a plan. This guide covers important aspects like scholarships, deadlines, and application tips for a seamless transition. Learn how to stay organized, set goals, and be involved in the process without being overbearing. Make sure to plan ahead, meet de

0 views • 61 slides

Understanding the E-Filing Process for Guardianship/Probate

Explore the e-filing procedure and process for guardianship/probate cases, covering document formats, form/template modifications, and designations of emails for pro se parties and unrepresented individuals. Learn about acceptable document formats, necessary modifications, and recommendations for em

0 views • 17 slides

SMMPA Annual Meeting - Transmission Rate Update Summary

SMMPA, a not-for-profit serving Minnesota municipal utilities, provides power through its transmission assets. The organization annually establishes rates for open access use of its assets. The Attachment O historical template, approved by FERC, utilizes data from EIA 412 for this purpose. Key dates

0 views • 8 slides