Understanding IRB Review Process for Research Studies

The content provides an overview of the IRB review process for research studies, including what necessitates IRB review, the levels of IRB review (exempt, expedited, full board), examples of full board research, and criteria for an Investigational New Drug.

1 views • 17 slides

Challenges of EU Foreign Subsidies Regulation in Public Procurement

The EU Foreign Subsidies Regulation (FSR) imposes EU State aid rules on foreign vendors in EU Member States, creating disclosure requirements and review processes. This regulation poses administrative burdens and strategic challenges for vendors, particularly impacting EU-based vendors purchasing fr

2 views • 7 slides

Tax Considerations for Incentive, Recognition & Safety Programs

This presentation provides guidelines on tax implications, exemptions, and reporting obligations related to incentive, recognition, and safety programs. It emphasizes the importance of understanding tax considerations for program sponsors and participants to ensure compliance with applicable laws an

3 views • 14 slides

UCC Research Support and Strategies Overview

UCC's Research Support, Policy & Strategy function, led by David O'Connell, PhD, provides comprehensive support for research activities at the university. The office manages research funding, monitors performance, and facilitates engagement with external stakeholders. UCC's involvement in Horizon Eu

3 views • 17 slides

Understanding GST Nuances in Real Estate

The realm of GST in real estate, particularly works contracts and property sales, is intricate and crucial to the country's GDP growth. This includes transactions like leases, constructions, and sales, all of which have specific provisions under the CGST Act. While some real estate transactions are

2 views • 36 slides

Revising ETSI Standard for License-Exempt Operation in 6 GHz Band

Work has commenced on revising the ETSI standard EN 303.687 for license-exempt operation in the 6 GHz band to expedite completion. This revision project outlines the history, New Work Item approval, ETSI processes, and the upcoming steps. It traces back to 2017 when Switzerland and ECC administratio

0 views • 10 slides

Understanding IRB Review Levels and Exempt Determinations

Explore the levels of IRB review for human participant research, including Exempt, Expedited, and Full Board reviews. Learn about the categories of Exempt Determinations and the criteria for Limited IRB Review. Understand if your study requires IRB review based on research and human subject involvem

1 views • 12 slides

Oklahoma Department of Public Safety Driver Compliance Division: Information on Suspensions and Withdrawals under the Bail Bond Procedure Act 2021

This information provides details on driver license suspensions for failure to appear, contact information for assistance, and guidelines to follow when filling out suspension notices. Certain violations are not eligible for failure to appear actions, and the document outlines what to remember about

0 views • 28 slides

Understanding H-1B Visa Program for Professional Employees

The H-1B visa is a popular choice for professional employees in specialty occupations, requiring at least a Bachelor's degree. It has a validity period of up to six years, with exceptions, and an annual cap of 65,000 visas. Certain institutions are exempt from the cap. Employers need to follow speci

3 views • 20 slides

Analysis of GST Provisions in the Banking Industry

The Goods and Services Tax (GST) regime replaced the old service tax regime on July 1, 2017. In the context of the banking industry, the provisions governing GST for services provided by Cooperative Banks and Banking Cooperative Societies are similar to those of the service tax regime. While interes

1 views • 13 slides

Tax Benefits and Double Tax Treaties in Cyprus

Cyprus offers an attractive tax regime, with a corporate tax rate of 12.5%, exempt capital gains, and favorable personal tax rates for residents. Additionally, Cyprus has double tax treaties with numerous countries, making it an ideal location for individuals and businesses seeking tax efficiency.

0 views • 21 slides

NIMH Clinical Research Education and Monitoring Program Overview

NIMH's Clinical Monitoring and Clinical Research Education, Support, and Training Program (CREST) aims to ensure the proper conduct, recording, and reporting of clinical trials. This program includes clinical monitoring plans, guidelines for site monitoring activities, and independent clinical monit

1 views • 29 slides

Annual Filing Requirements for Knights of Columbus Councils

Learn about the IRS annual filing requirements for Knights of Columbus Councils, including the need to file Form 990, obtain an EIN, and maintain tax-exempt status. Failure to comply can result in the revocation of tax-exempt status and reinstatement fees. Find detailed guidance on applying for an E

0 views • 23 slides

Exempt Employee LoboTime Navigation and Common Tasks Guide

This job aid provides an overview for exempt employees on navigating and performing common tasks in the LoboTime system. It covers logging on and off, accessing different workspaces, managing widgets, requesting time off, and retracting time off requests. Visual aids accompany detailed step-by-step

0 views • 7 slides

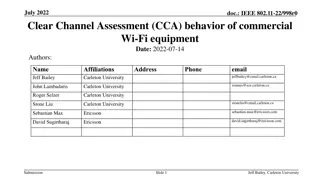

Clear Channel Assessment (CCA) Behavior of Commercial Wi-Fi Equipment

This document, dated July 2022, delves into the Clear Channel Assessment (CCA) behavior of commercial Wi-Fi equipment in response to Narrowband Frequency Hopping (NB FH) signals. It explores the regulatory framework around license-exempt frequency bands in the USA and Europe, highlighting the specif

0 views • 22 slides

Understanding Plea Bargaining in Criminal Cases

Plea bargaining is a negotiation process where the accused admits guilt in exchange for a reduced punishment. It helps in resolving cases faster and reducing court congestion. The concept is applicable to cases with a maximum sentence of 7 years, not involving women or children under 14, and not imp

2 views • 14 slides

United States Food Safety and Inspection Service: Ensuring Meat and Poultry Products' Safety

The United States Department of Agriculture's Food Safety and Inspection Service (FSIS) oversees the federal inspection of meat and poultry products to ensure their safety for human consumption. The statutes governing this process include the Federal Meat Inspection Act, the Poultry Products Inspect

0 views • 23 slides

Overview of Research Problem Identification and Formulation

Understanding the importance of defining a research problem, this content delves into the selection and formulation of research problems, the definition of a research problem, reasons for defining it, methods for identifying research problems, sources of research problems, and considerations in sele

1 views • 11 slides

Understanding Compensation, Overtime, and Time Reporting Policies

This content discusses important topics such as compensation, overtime, exempt vs. non-exempt classification, and salary thresholds. It aims to provide a comprehensive understanding of the rules and regulations surrounding time reporting and compensation for staff and academic employees. Topics cove

0 views • 39 slides

Understanding Disposition of Assets for Less Than Fair Market Value in Affordable Housing

In affordable housing, applicants are required to disclose if any family member disposed of assets for less than fair market value within two years of certification or recertification. This requirement, mandated by HUD, aims to prevent asset divestment for housing eligibility. Involuntary dispositio

0 views • 8 slides

Impact of New Minimum Wage and Semi-Monthly Pay on Charter Schools

Presentation by Kari Wallace at the CCSA Conference on how the progressive increase in California's minimum wage affects exempt/non-exempt classifications and the introduction of semi-monthly payrolls. The presentation discusses key details, including Delta Managed Solutions' experience, labor code

0 views • 33 slides

Understanding Research Paradigms in Qualitative Medical Research

Delve into the world of research paradigms in qualitative medical research with a focus on the key differences between objective and subjective research, the meaning of research paradigms, components of research paradigms, types of research paradigms, and how paradigms guide the selection of researc

0 views • 42 slides

Understanding Municipal Management Districts (MMDs) in Texas

Municipal Management Districts (MMDs) in Texas are special districts that are self-governed but require approval from the host municipality. They have the authority to provide infrastructure and approved service plans. MMDs can issue tax-exempt bonds, levy taxes, assessments, and impact fees, and pr

7 views • 21 slides

Taxation Process for Expert Witness Income at U.N.C.H.E.A.L.T.H.C.A.R.E.S.Y.S.T.E.M

Expert witness income at U.N.C.H.E.A.L.T.H.C.A.R.E.S.Y.S.T.E.M is subject to unrelated business income tax (UBIT) if the income is related to a provider testifying as an expert. The process involves calculating taxable income, determining tax rates, and reporting to the University's finance departme

0 views • 5 slides

Overview of TRAIN Revenue Regulations No. 13-2018 on Value-Added Tax

These regulations under the Tax Reform for Acceleration and Inclusion (TRAIN) Act (RA 10963) focus on Value-Added Tax provisions, amending Revenue Regulations No. 16-2005. They cover zero-rated sales, VAT-exempt transactions, claims for input tax, refund procedures, and more. Conditions for VAT appl

1 views • 54 slides

UNR WLTP: Regulations Update for Vehicle Type Approval

This document details the transposition of GTR15 (WLTP) and GTR19 (Evap) into UN Regulations, focusing on the scope, definitions, and application for approval of vehicle categories M1, M2, N1, and N2. It outlines requirements for emissions testing, carbon dioxide, fuel consumption, electric energy c

0 views • 38 slides

Guidelines for Selecting Research Project Topics in Environmental Health

Research is crucial for addressing environmental health issues. Choosing a good research topic is the first step towards effective research. This paper discusses the meaning, characteristics, types of research, and the research process to help in selecting appropriate research topics. Understanding

0 views • 15 slides

Guidelines for GPS IRB Application Process at Pepperdine University

The GPS IRB at Pepperdine University focuses on protecting the rights and welfare of human research subjects. Applications cover social, behavioral, and educational research, following federal regulations. IRB approval is required before starting any research activities, and different application ty

0 views • 12 slides

Understanding Exempt Research Categories and Requirements

Exploring the concept of exempt research in the context of the Common Rule and VA guidelines, this workshop series delves into the obligations and responsibilities of key entities involved in the initial review and approval process. It clarifies what it means to be exempt, outlines the categories of

0 views • 28 slides

Evolution of VA Research & Development Committee Responsibilities

The article discusses the changing roles of the VA Research & Development Committee in light of VHA Directive 1200.01. It covers the rationale behind revising committee responsibilities, strategies for exempt research functions, the importance of VA R&D Committee, and the major shift in responsibili

0 views • 16 slides

Executime Automated Time & Attendance Policy Overview

Executime is an automated system for capturing employee time, streamlining processes for salary exempt, non-exempt, and hourly employees. The policy highlights clock-in rules, time-off procedures, and steps for entering and approving time. Employees are required to adhere to the guidelines outlined

0 views • 8 slides

Understanding UW-Madison Salary and Activities Guidelines

This document covers the guidelines and policies related to salary, compensation, and activities for faculty members at UW-Madison. It explores topics such as institutional base salary, total UW effort components, exempt employee salaries, and overload policies. It emphasizes the importance of follo

0 views • 19 slides

Understanding Research Ethics at University of Alberta

Research at the University of Alberta involves disciplined inquiry aimed at extending knowledge, requiring approval from the Research Ethics Board for studies involving human participants. The process includes what research entails, what is not considered research, activities exempt from review, the

0 views • 21 slides

Guide to IRS Tax Exempt Status Application for Non-Profit Organizations

This comprehensive guide provides essential information on applying for tax-exempt status with the IRS for non-profit organizations. It covers the benefits, application procedures, responsibilities, and tools needed for a successful application process. From determining eligibility to understanding

0 views • 14 slides

South Carolina Public Service Authority Revenue Obligations Investor Presentation

This investor presentation provides details on South Carolina Public Service Authority Revenue Obligations for 2024, including Tax-Exempt Improvement Series A, Tax-Exempt Refunding Series B, and Taxable Improvement Series C. It emphasizes the preliminary nature of the information and the need for ca

0 views • 24 slides

Addressing Issues in Supported Housing: Exempt Accommodation Oversight Act of 2023

A comprehensive overview of the Supported Housing Regulatory Oversight Act of 2023 and the challenges faced in the exempt accommodation sector. The narrative delves into the need for increased regulations, concerns about exploitation, and the positive impact of recent pilot programs on improving res

0 views • 15 slides

Understanding IRB and IRBNet Processes at Lehman College

Explore the different types of IRB review processes, including exempt, expedited, and full/convened reviews. Learn about human subjects research, not human subjects research, and exempt categories. Discover the importance of obtaining informed consent and navigating IRBNet for research compliance at

0 views • 74 slides

Understanding Sales and Use Tax in Arizona

The University in Arizona is not tax-exempt and sales made to the University are subject to sales tax as per the Arizona Revised Statutes. This guide explains what is taxable under sales and use tax, the difference between sales tax and use tax, exceptions to tax rules, and reporting use tax on P-Ca

0 views • 13 slides

Exploring Research Design and Funding Priorities in Northern Ireland

Dive into the world of research at the upcoming Application and Research Design Workshop scheduled for Friday, 28th May 2021. Discover the strategic priorities driving impactful research initiatives, learn about current research projects, funding processes, and collaborations. Explore the rich histo

0 views • 37 slides

Understanding Human Subject Research and JIT Process at COMIRB

Explore the world of Human Subject Research and Just-In-Time (JIT) process as explained by Assistant Director Cat Sutherland at COMIRB. Learn about exempt categories, secondary research, grant approvals, and the intricate JIT process. Get insights into education research, surveys, behavioral interve

0 views • 7 slides