Stock Audit Service Providers in Hyderabad

KVR TAX Services is the best Stock Audit Consultant in Kukatpally, Gachibowli, Filmnagar, Kondapur, Lingampally, Hyderabad. Apply now for the new Stock Audit Process and Procedure

1 views • 3 slides

Stock Market Classes by Anish Singh Thakur

Booming Bulls Academy is a premier educational platform focusing on the Indian stock market. It provides Stock Market Classes that cater to both novice and experienced traders. Anish Singh Thakur, the driving force behind these classes, uses his extensive experience to teach effective trading strate

2 views • 9 slides

Online Stock Market Training From Basics to Advanced Strategies

The journey into stock market trading should begin with a solid foundation. Booming Bulls Academy\u2019s basic online stock market training courses are designed to introduce newcomers to the essential concepts such as types of stocks, market orders, and what influences stock prices. Understanding th

1 views • 9 slides

Escalate Your Trading with a Stock Market Course

Investing in the stock market is an effective way to build wealth and achieve financial independence. However, with proper expertise and training, navigating the complexities of the stock market may be more manageable. This is where a complete stock market course in India comes into play.\n

0 views • 9 slides

Unlock Your Stock Market Potential with Dipe Institute

Ready to navigate the dynamic world of the Delhi stock market, particularly the NSE? Dipe Institute, a leading Share Market Institute in Delhi and provider of share market education, offers a comprehensive curriculum designed to empower aspiring investors and traders.\n

1 views • 2 slides

SEBI's Role in Investor Protection and Stock Market Regulation

Securities and Exchange Board of India (SEBI) plays a crucial role in safeguarding investor interests and ensuring fair practices in the Indian stock market. By promoting transparency, enforcing regulations, and regulating market intermediaries, SEBI aims to maintain market integrity, protect invest

0 views • 23 slides

Overview of Financial Markets and Their Impact on the Economy

Financial markets encompass various segments like the bond market, stock market, and foreign exchange market, each playing a vital role in the economy. Bond markets facilitate borrowing for corporations and governments, while interest rates influence investments and savings. The stock market allows

0 views • 21 slides

Understanding Stock Market Data Visualization

Explore how stock data can be displayed through bar charts and candlestick charts, interpret stock market data to make informed decisions, and learn how to create visual representations of stock information using examples. Discover the significance of historical trading prices and volumes for invest

0 views • 15 slides

Understanding Stock Market Data Analysis

Explore the world of stock market data with a focus on daily trading progress, key terms, credible sources, and practical examples. Learn how to track stock trends and important statistics like net changes to make informed decisions. Dive into stock price differentials and percent increases to grasp

0 views • 14 slides

Understanding Stock Market Ticker Information and Trade Analysis

Explore the intricacies of stock market ticker information, learn how to determine the total value of a trade, and understand trade volumes. Discover key terms like Dow Jones Industrial Average, ticker symbols, and trade indicators through practical examples. Delve into the transmission of stock mar

0 views • 8 slides

Understanding How to Buy and Sell Shares in the Stock Exchange

This presentation provides educational insights on buying and selling shares in the stock market through the secondary market. It covers pre-trade preparation, the importance of due diligence, and steps to review and compare companies before investing. Emphasizing the need for research and analysis,

0 views • 79 slides

Understanding Stock Types and Evaluation

This content covers the basics of buying and selling stocks, evaluating different types of stocks, valuing stock prices, and understanding the benefits of owning stock. It discusses common stock, preferred stock, income stocks, growth stocks, and various stock investments. The information provided a

0 views • 49 slides

Valuation and Accounting for Unsold Stock in Consignment Transactions

Valuation and accounting for unsold stock in consignment transactions is crucial for determining true profit or loss. The cost of consigned goods plus proportionate expenses must be considered. Recurring and non-recurring expenses play a significant role in valuing closing stock. The value of unsold

1 views • 10 slides

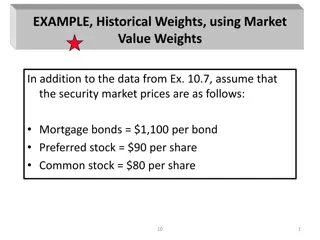

Historical Weights and Cost of Capital Analysis

The content discusses historical weights using market value weights for different securities like mortgage bonds, preferred stock, and common stock. It also delves into determining the overall cost of capital based on market value weights, including debt, preferred stock, common stock, and retained

0 views • 36 slides

Role of the Capital Market in Long-Term Development Financing

The presentation by John Robson Kamanga, CEO of Malawi Stock Exchange, delves into the role of capital markets in financing long-term development. Topics covered include defining capital markets, functions of stock exchanges, development finance, areas funded by development finance, the capital mark

0 views • 23 slides

Taxation for Stock Market Investors in India

The Indian stock market thrives on long-term investment strategies. But did you know that holding your investments for more than a year unlocks a treasure trove of tax benefits? This guide empowers you to leverage these advantages and make your stock

1 views • 5 slides

Understanding Stocks: Key Concepts and Market Dynamics

Explore the world of stocks with insights on different types of companies, initial public offerings (IPOs), stock exchanges, stock indexes, and factors influencing the market. Learn about publicly traded companies, IPOs, stock exchanges like NYSE and NASDAQ, stock indexes like Dow Jones and S&P 500,

0 views • 17 slides

Understanding Efficient Markets Hypothesis in Corporate Finance

Explore the concepts of efficient markets hypothesis (EMH) and adaptive markets hypothesis (AMH) in corporate finance. EMH posits that all information is instantly reflected in stock prices, while AMH suggests a gradual process based on the number of analysts. Learn about different forms of market e

0 views • 33 slides

Understanding Stock Market Indices and Their Importance

Stock market indices play a crucial role in measuring and analyzing the performance of various stocks within specific markets. They provide a snapshot of share price movements, help investors assess market performance, and serve as benchmarks for portfolio comparison. Different types of indices cate

1 views • 8 slides

Understanding Stock Valuation: Key Concepts and Approaches

Stock valuation is essential for investors to determine the intrinsic value of a stock compared to its market price. This process involves analyzing fundamental factors like revenue, dividends, and risk. Different models are used to calculate intrinsic value, guiding investment decisions based on wh

0 views • 13 slides

Understanding Common Stock Basics

Stocks represent ownership in a corporation, with common and preferred stock being the main types. Shareholders or equity owners have ownership rights, including voting at shareholders' meetings and receiving dividends. Common stock can have different classifications like Class A and Class B, each w

1 views • 50 slides

Using the BI Stock Screener for Targeted Industry Stock Analysis

Explore how to utilize the BetterInvesting Stock Screener for identifying great stocks in specific industries. The educational presentation by Gladys Henrikson for MicNova provides insights on effective stock screening methods adapted from Marion Michel's approach. Understand the disclaimer for educ

0 views • 15 slides

Development of Methodologically Robust Agricultural Capital Stock Statistics by FAO

In November 2015, the Food and Agriculture Organization of the United Nations (FAO) initiated a project to enhance Agricultural Capital Stock statistics, focusing on inclusive and efficient agricultural and food systems. The project involves developing methodologies for measuring capital stock and m

0 views • 38 slides

Stock Prices and Future Earnings: A Study on Accruals and Cash Flows

This study by Richard G. Sloan and Zhengying (Vivien) Fan explores whether stock prices fully reflect information in accruals and cash flows concerning future earnings. The research develops hypotheses, examines sample data, and conducts empirical analysis to assess the relationship between earnings

0 views • 19 slides

ICES Advice for 2015 Sea Bass Stock Structure Uncertain

Sea bass stock structure remains uncertain in IVbc, VIIa, and VIId-h with total landings advised to be below 1,155 t. The stock faces challenges such as slow growth, late maturation, and vulnerable spawning aggregations. Urgent management action is needed to reduce fishing mortality and prevent furt

0 views • 10 slides

Institutional Framework and Antitrust Law in the EU

The European Union's institutional framework is defined by the Treaties of Lisbon, European Union, and Functioning of European Union. These treaties establish the EU's objectives, governance principles, and delineate competences. Additionally, EU antitrust law principles are based on the Treaties of

0 views • 16 slides

Overview of Chinese Equity Markets: History and Regulation

Explore the evolution of Chinese stock markets from their beginnings in the centrally planned economy to the establishment of the Shanghai and Shenzhen stock exchanges in the 1990s. Learn about the regulatory framework, rights of stockholders, agency problems, and the role of the state in Chinese li

0 views • 19 slides

Uncovering the Influence of Media on Investor Sentiment in the Stock Market

This paper explores the interconnectedness between media content and investor sentiment in the stock market, focusing on the impact of media reports on daily market activity. It delves into the relationship between media pessimism and stock market returns, highlighting how different levels of sentim

0 views • 17 slides

Intensive Course on Stock Control and Inventory Management

This intensive course, led by Prof. Takao Ito, focuses on stock control and inventory management, exploring topics such as economic order quantity, two systems in stock control, and the supervision of supply and accessibility of items to maintain optimal stock levels. Participants will delve into de

0 views • 34 slides

Presidential Election of 1928: Hoover vs Smith and the Stock Market Boom

Herbert Hoover, successful engineer, won the 1928 presidential election against Alfred E. Smith. Hoover promoted prosperity and optimism, leading to a surge in stock prices. However, the stock market's rapid growth on margin trading eventually collapsed in 1929, causing the Great Depression.

0 views • 14 slides

Understanding Growth Companies and Stocks in Stock Valuation

When evaluating stocks for investment, it's essential to consider the difference between a good company and a good investment. While a great company may have strong performance, its stock may be overpriced compared to its intrinsic value, making it a poor investment choice. Growth companies and stoc

0 views • 39 slides

Improving Inventory Management Process for Freestock/Floor Stock

Addressing stock-outs in Freestock/Floor Stock inventory management using Six Sigma tools and methodologies. The project aims to reduce stock-outs by 25%, identify root causes, and optimize processes to enhance customer satisfaction and operational efficiency.

0 views • 12 slides

Financial Management: Valuation of Long-Term Securities and Stock

This content covers various aspects of financial management, including bond valuation, preferred stock valuation, common stock valuation, dividend valuation models, and dividend growth patterns. It discusses topics such as face value, coupon rates, types of bonds, semiannual compounding, and factors

0 views • 21 slides

Cross-Border Effects of a Major Tax Reform: Evidence from the European Stock Market

This study analyzes the impact of the Tax Cuts and Jobs Act (TCJA) on the European stock market, focusing on European firms with significant U.S. operations and those competing with U.S. firms. The research examines how the TCJA affects these firms directly and indirectly, exploring the potential im

0 views • 18 slides

Guide to Completing Stock Show Entries for AHS FFA Students

Detailed instructions on completing stock show entries for Arlington High School FFA students attending various major stock shows like Arlington Winter Classic, Ft. Worth Stock Show & Rodeo, and Rodeo Austin. Information includes required forms, entry order, show dates, animals to enter, and necessa

0 views • 11 slides

Understanding Stocks and the Stock Market: A Comprehensive Overview

Explore the intricacies of the stock market, including how it functions, the dynamics of investor interactions, differences between private and public companies, IPO processes, informed decision-making strategies for investors, and the significance of stock exchanges. Delve into the risks and benefi

0 views • 19 slides

Understanding BCG Matrix: Market Growth and Relative Market Share

BCG Matrix, developed by Bruce Henderson of the Boston Consulting Group, categorizes business units into Question Marks, Stars, Cash Cows, and Dogs based on market growth and relative market share. Market share and market growth are crucial factors in determining a company's position in the market.

0 views • 31 slides

Pricing European Call Option Using Binomial Tree Model

A detailed explanation of using a binomial tree model to price a European call option for a stock with two possible future prices. By constructing a riskless portfolio and utilizing the no-arbitrage assumption, the option price is determined based on different stock price outcomes, ensuring risk neu

0 views • 17 slides

Media Influence on Investor Sentiment and Stock Market Behavior

This literature review by Paul C. Tetlock explores the role of media in shaping investor sentiment and impacting stock market dynamics. The study delves into the correlation between media pessimism, market prices, trading volume, and volatility, providing insights into how media content affects mark

0 views • 40 slides

Understanding Fundamental Analysis in Stock Market Investing

Fundamental analysis blends economic, industry, and company evaluations to determine a stock's fair value and future potential. By considering macroeconomic factors like GDP, savings, inflation, interest rates, and budget impacts, investors can make informed decisions in the stock market.

0 views • 18 slides