Pricing European Call Option Using Binomial Tree Model

A detailed explanation of using a binomial tree model to price a European call option for a stock with two possible future prices. By constructing a riskless portfolio and utilizing the no-arbitrage assumption, the option price is determined based on different stock price outcomes, ensuring risk neutrality. The process involves creating a portfolio with a combination of shares and call options, resulting in an easily calculable option price.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Options, Futures and Other Derivatives By- Neha Arya For HRC, Eco Hons (Sem 6), FE

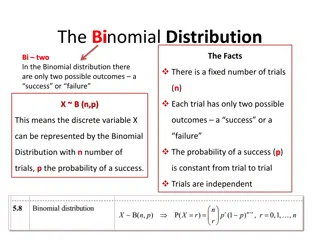

A binomial tree is one of the popular ways of pricing an options contract. This stock s price follows a random walk. The binomial tree represents the likely (with given probabilities) paths that the stock price may follow over the life of an option. model assumes that the underlying

A stock is currently priced at $20 In 3 months it will either be worth $22 or $18 Stock price= $20 Stock Price = $22 Stock Price = $18

We want to find the price of a European call option to buy the stock for $21 in 3 months. If the stock price turns out to be $22 at the end of 3 months, the value of the option will be $1 If the stock price at the end of 3 months is $18 the value of the option will be $0. The simple No Arbitrage opportunities exist assumption is used to price the option.

A 3-month call option on the stock has a strike price of $21. Stock price= $20 Option Price= ? Stock Price = $22 Option Price= $1 Stock Price = $18 Option Price= $0 Up move Down move

We create a portfolio of the stock and the option in a way that there is no uncertainty about the portfolio s value at the end of 3 months. Since there are 2 possible outcomes in this case, the number of shares can be so chosen that the final value of this portfolio is same in both cases. This makes the portfolio riskless. In absence of arbitrage opportunities, riskless portfolios must earn risk-free interest rate.

Using these facts, the price of the European call option can be easily found. Let the portfolio comprise of: long x shares + short 1 call option Portfolio value= $(22x 1) Up move Portfolio is riskless when $(22x-1) = $18x Down move Portfolio value= $(18x)

Or when x = 0.25 Hence, the riskless portfolio is: Long 0.25 shares + Short 1 call option The value of the portfolio in 3 months = $4.50 If the risk-free rate is 12% p.a, then the portfolio s value today must = 4.5*e (0.12*3/12) = $4.3670

The portfolio that is long 0.25 shares and short 1 option, is worth $4.367. The value of the shares= 0.25*20 = $5.00 Hence the value of the option today (in the absence of arbitrage opportunities) = 5 4.367= $0.633

Consider an option lasting for time T and the underlying stock price likely to go up Su or down Sd during the life of the option. S0 move Down move S0u fu Up S0d fd The current price of the option is f. S0u represents a move up from current stock price, with u>1.

While S0d represents a move down from current stock price, with d<1. The price of the option in either case is represented by fu and fd respectively. Value of the portfolio that is long x shares and short 1 option: S0u*x - fu Up move S0d*x - fd Down move

The portfolio is riskless when S0u*x -fu = S0d*x - fd or x = (fu fd)/(S0u - S0d) Value of the portfolio at time T = S0u*x -fu Value off the portfolio today is: S0x f = (S0u*x -fu)e-rT This gives, f = [pfu + (1-p) fd]e-rT where p = (erT- d)/ (u-d)

The p here can naturally be interpreted as probability of up and down movements. The value of the option is then its expected payoff discounted at the risk-free rate S0u fu S0 p S0d fd 1-p

When the probability of an up and down movements are p and (1-p), the expected stock price at time T is S0erT This shows that the stock price earns the risk-free rate. Binomial trees illustrate the general result that to value a derivative we can assume that the expected return on the underlying asset is the risk-free rate and discount at the risk- free rate. This is known as using risk-neutral valuation.

Say the current stock price is $20 and in each of the two time steps (each 3 month long) may go up by 10% or down by 10%. The risk-free rate is 12% p.a. We consider a 6-month option with a strike price of $21. The aim is to find the option price at the initial node of the tree.

Stock prices in a two-step tree: $24. 2 $2 2 $20 $19. 8 $1 8 By finding the option price at each node, like earlier, the option prices at the final nodes of the tree can be easily calculated. (*Refer to examples in the book) $16. 2