Insights from Investment Experts: Navigating Market Volatility and Trends

Explore interviews with top investment professionals discussing strategies for capturing market volatility, navigating technology trends, evaluating U.S. equities, redefining the role of banks, seizing event-driven opportunities, transitioning to a carbon-free energy future, and adapting to the new

0 views • 7 slides

Understanding Investments: A Comprehensive Overview by Mr. Vinoth Kumar J, Assistant Professor

Mr. Vinoth Kumar J, an Assistant Professor at St. Joseph's College, dives into the world of investments, explaining the meaning, definition, and classification of investments. He covers financial products like equities, mutual funds, real estate, and more, providing insights into both financial and

0 views • 21 slides

Global Economic and Financial Market Update - June 2021

It is the end of the first half of 2021, marked by significant progress in the global vaccination campaign. While economic activities are showing signs of recovery, the oil market, equities, and fixed income markets have experienced notable movements. With inflation rates fluctuating and vaccine dis

0 views • 5 slides

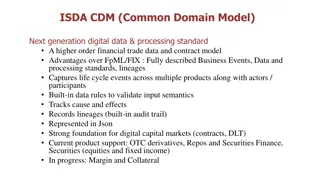

Next Generation Digital Data and Processing Standard in Financial Trade

ISDA CDM (Common Domain Model) presents a higher-order financial trade data and contract model with advantages over FpML/FIX. It offers fully described business events, data, and processing standards, capturing life cycle events across various products along with participants. The model includes bui

0 views • 4 slides

Insights on Investment Strategies and Trusts in Q1 2016

Delve into the world of investment with insights on market trends, risk assessment, ideal investments in equities and funds, and a focus on closed-end investment trusts in the UK. Explore expert opinions on long-term strategies, asset value discounts, governance principles, and more, all presented i

0 views • 36 slides

Equity Options Investment Challenge

You have $1,000,000 to invest in equities and equity options for one hour. Create a portfolio, email the halfway selection, and use the PORT function to track value changes. The participant with the highest earnings wins the challenge. Additional rules and guidelines ensure fair play and strategy. D

0 views • 16 slides

Implications of President's NSA Review Group - Conway-Walker Lecture

In the Conway-Walker Lecture at Cornell, the implications of the President's NSA Review Group were discussed, focusing on themes like declining half-life of secrets, multiple equities in one Internet, and the role of IT professionals. The lecture delved into the creation of the review group followin

0 views • 32 slides

Northamptonshire Pension Fund Investments Overview

The Northamptonshire Pension Fund Investments, managed by Richard Perry, follows regulations like the Local Government Pension Scheme Regulations. The fund structure includes investments in equities, bonds, diversified growth funds, private equity, and property. Investments are managed by profession

0 views • 10 slides

Understanding CRSP Data Services in WRDS

Exploring the basics of CRSP data services in WRDS, this content covers the popularity of CRSP, highlights of the data, types of CRSP data available, and how the data is structured. It delves into the stock market data for US equities, including historical identifiers and key information on prices,

0 views • 15 slides

Introduction to Security Types in Financial Markets

This chapter provides an overview of different types of securities traded in financial markets worldwide. It covers classifications of financial assets, including money market instruments, fixed-income securities, equities, futures, and options. The focus is on interest-bearing assets, such as Treas

0 views • 21 slides

Understanding Share Ownership and Dividend Yields in Equities

Owners of shares in companies receive dividend yields as part of their investment return, which are typically paid annually. Shareholders also benefit from perks like voting rights and trade discounts. However, there are risks involved, such as difficulties in selling shares at a reasonable price an

0 views • 7 slides

Understanding Equities Trading and Settlement Processes

The process of trading and settling securities involves three stages - trading, clearing, and settlement. Trading can occur on- or off-exchange and may be quote-driven or order-driven. On-exchange trading involves market makers providing liquidity, while off-exchange trading matches buyers and selle

0 views • 13 slides

Social Security Disability Claims Process Overview

The process of applying for Social Security Disability (SSD) benefits involves obtaining forms, submitting documentation, and potentially going through appeals if denied. Claimants can request reconsideration and hearings before an Administrative Law Judge (ALJ). The volume of claims each year is si

0 views • 12 slides