Understanding Taxes: An Overview of Taxation Principles and Collection in Ireland

This content covers the fundamental aspects of taxation, including its definition, purpose, principles (fairness, certainty, efficiency, convenience), and tax collection in Ireland by the Revenue Commissioners. It explores key concepts related to taxation and aims to enhance understanding of tax sys

2 views • 26 slides

Accounting and Taxation of Securities Organized by Belgaum Branch of ICAI

Explore the accounting treatment and taxation of securities in a seminar organized by the Belgaum branch of ICAI. Learn about various types of securities, their accounting principles, taxation rules, and important points through case studies and insightful discussions led by CA Kinjal Shah. Gain val

4 views • 74 slides

Driving Effectiveness with Direct Mail: Key Insights

Direct mail continues to be a powerful marketing tool, offering personalized, targeted, and impactful campaigns in today's digital world. WARC's research highlights the effectiveness of including direct mail in marketing strategies, driving revenue growth, brand building, and overall campaign succes

1 views • 15 slides

Stay Ahead in NRI Taxation in England with Bharat's Lower Tax Service

Stay ahead of the curve in NRI taxation in England with Bharat's Lower Tax Service. Our specialised solutions cater to the unique tax needs of Non-Resident Indians, ensuring compliance and maximising returns. With expert guidance and personalised strategies, navigate the complexities of cross-border

7 views • 3 slides

nritaxationbharat_blogspot_com_2024_05_nri_income_tax_return

Mastering NRI Taxation: Guidelines for Delhi Residents\" offers comprehensive insights into navigating the complexities of taxation for Non-Resident Indians (NRIs) residing in Delhi. This resource provides expert guidance on understanding tax laws, claiming exemptions, and optimizing deductions spec

3 views • 3 slides

Quick and Easy access to Cash with Direct Lender's Short Term Loans UK

Short Term Loans Direct Lenders | Short Term Loans UK Direct Lender | Short Term Loans UK\nOn the other hand, short term loans UK direct lender are available to you in a convenient way. The lender does not conduct a credit check. It is intended that these funds accept applications with any kind of c

1 views • 1 slides

Understanding the Purpose of Taxation: Financial, Social, Legal, and Ethical Perspectives

Taxation is a crucial method governments use to collect funds for public services. This chapter delves into the principles of a fair tax system, exploring how taxes should be related to income, predictable, cost-effective to collect, and convenient for taxpayers. It also discusses the redistribution

0 views • 19 slides

Understanding Direct and Reported Speech in English

Explore the differences between direct and reported speech, learn how to convert direct speech into reported speech, and understand when to use each form in writing. Direct speech uses the speaker's actual words in quotes, while reported speech conveys the gist of what was said without using exact w

2 views • 20 slides

Understanding Public Revenue and Taxation Fundamentals

Public revenue encompasses all income sources of the government, ranging from taxes to non-tax revenue. Taxes, the primary revenue source, are compulsory payments collected without direct benefits to taxpayers and play a crucial role in public finance and economic development. Non-tax revenue includ

0 views • 54 slides

Mastering Direct and Indirect Speech: A Comprehensive Guide

Explore the world of direct and indirect speech with this in-depth lesson on narration. Learn how to speak using both methods, transform sentences from direct to indirect, and discover the nuances of backshift of tenses and adverbs. Gain a better understanding of how grammatical changes occur betwee

2 views • 31 slides

Understanding Principles of Taxation

Principles of taxation, including concepts such as public revenue, sources of revenue, types of taxes (direct and indirect), and non-tax revenue, are essential for students of commerce to grasp. Taxation serves as a means for the government to collect revenue for the common good through compulsory c

0 views • 12 slides

Overview of Direct Taxation: Concepts and Entities Explained

Gain insights into the fundamental concepts of direct taxation explained by CA Varsha Lund, including information on previous year and assessment year, different types of entities for tax purposes such as individuals, Hindu Undivided Family (HUF), company, firm, and more.

0 views • 20 slides

Understanding Direct and Indirect Speech in English

Direct speech involves reporting exact words spoken, while indirect speech conveys the same message using different words. Learn about the rules for changing pronouns and key aspects of both direct and indirect speech. Master the art of transforming sentences from direct to indirect speech with ease

2 views • 15 slides

Exploring Taxation Acts and Their Impact on Revolutionary Sentiments

The provided content delves into historical taxation acts, including their specifics and potential implications on the onset of the American Revolution. It also draws parallels to modern-day examples of product taxation, prompting reflection on the fairness and consequences of such levies. The disco

4 views • 6 slides

Enhancing State Revenue Generation Through Effective Taxation Strategies

State governments rely on taxation to finance their expenditures, prioritizing revenue generation over borrowing. By engaging taxpayers in voluntary compliance, taxation strengthens government accountability and citizen participation in governance. Understanding the tax landscape, including federal,

0 views • 27 slides

Taxation Procedures and Authorities

Explore the principles and application of taxation laws, tax provisions, duties of tax authorities, and obligations during taxation procedures. Learn about the essential role of tax authorities in determining facts crucial for legitimate decision-making, benefiting taxpayers diligently, and conducti

0 views • 35 slides

Taxation Challenges in the Digital Economy

The increasing digitalization of the economy has raised significant tax challenges, with ongoing discussions among Revenue Authorities, Multinational Entities, and Advisory Bodies worldwide. This content delves into existing digital platforms, their role in the collection process, VAT taxation impli

0 views • 15 slides

Windfall Profit Taxation: Past, Present, and Future

The presentation discusses windfall profit taxation measures in Europe, specifically in Italy, comparing the old Robin Hood tax with new contributions. It explores the aims, issues, tax rates, and bases of windfall profit taxation, highlighting its redistributive purposes and challenges in constitut

1 views • 14 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

Understanding Direct and Indirect Objects in Grammar

Direct and indirect objects are essential components of sentences, helping clarify the action and recipients involved. Direct objects receive the action directly, answering the questions "Whom?" or "What?" Indirect objects indicate to whom or for whom the action is done, always appearing between the

0 views • 12 slides

Understanding Direct and Reported Speech Punctuation

Distinguishing between direct and reported speech is essential. Direct speech quotes the exact words using inverted commas, while reported speech summarizes without the same words, often in the past tense. In direct speech, present tense and inverted commas are used but not in reported speech.

1 views • 31 slides

Direct Routing with Teams: Opportunity or Threat?

Microsoft's shift in cloud architecture for voice services opens up new possibilities for enterprises and carriers with Teams Direct Routing. This allows seamless integration of PSTN services directly to the cloud, offering flexibility in maintaining existing contracts while transitioning to Teams a

0 views • 10 slides

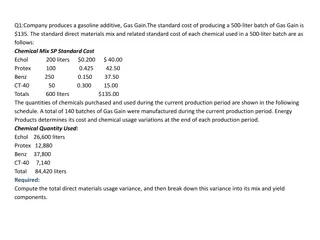

Costing and Variance Analysis in Manufacturing Processes

The content discusses various scenarios related to costing and variance analysis in manufacturing processes. It addresses topics such as direct materials usage variance, direct labor mix and yield variances, total direct labor efficiency variance, and standard costing system variances. The examples

0 views • 8 slides

Understanding Product Costs and Prices in Manufacturing

Product costs are expenses incurred to create a product for sale, including direct material, direct labor, and manufacturing overhead. Direct material refers to raw materials used for production, while direct labor includes wages for workers directly involved in manufacturing. Manufacturing overhead

2 views • 7 slides

Understanding Direct Objects and Direct Object Pronouns

Direct objects receive the direct action of the verb, and when they are people or domesticated animals, the personal "a" is used. Direct object pronouns replace the object to avoid repetition. Learn more about the personal "a", its usage, and how to identify direct objects in sentences.

0 views • 53 slides

Impact Analysis of New Corporate Taxation Regime Under Taxation Laws (Amendment) Ordinance, 2019

The new corporate taxation regime introduced through the Taxation Laws (Amendment) Ordinance, 2019 brings significant changes, including a lower tax rate for domestic companies. The regime allows companies to opt for a 22% tax rate, with implications on exemptions and deductions. Companies opting fo

0 views • 31 slides

Nevada Department of Taxation Guidelines for Repair and Reconditioning Services

Tax guidelines for repair and reconditioning services in Nevada provided by the Department of Taxation. Covers taxable repair labor, treatment of parts, repairmen as retailers or consumers, fabrication vs. refurbishing labor, painters, polishers, finishers, and replacement parts taxation.

0 views • 11 slides

Understanding Direct Object Pronouns in Spanish

Direct Object Pronouns in Spanish refer to the word in a sentence that receives the direct action of the verb. They can replace nouns and come before the verb. Learn how to use direct object pronouns with examples and understand their placement in different sentence structures.

0 views • 14 slides

Student Direct Deposit Setup Instructions

Follow these step-by-step instructions to set up direct deposit for your student accounting account. Start by accessing the Account Inquiry link under My Account, then navigate to the Account Services tab to enroll in Direct Deposit. Enter your Bank ID/Routing and Account number, agree to the terms,

0 views • 6 slides

Utilizing Direct Observation for Implementation Facilitation

This article discusses the importance of direct observation in guiding implementation facilitation processes. It emphasizes the value of formative evaluation to identify influences on implementation effectiveness. By thoroughly collecting data through mixed-methods direct observation, facilitators c

1 views • 29 slides

Mastering Direct Quotations in Writing

Direct quotations are essential in writing to convey the author's point effectively. This detailed guide covers the proper usage of direct quotations, including punctuation rules and formatting tips. Learn how to integrate direct quotes seamlessly into your writing to enhance clarity and credibility

0 views • 27 slides

Understanding Direct Objects and Direct Object Pronouns in English and French

Explore the concepts of direct objects and direct object pronouns in English and French languages. Learn how direct objects are used in sentences, the role of direct object pronouns in avoiding repetition, and the differences in sentence structure when using object pronouns in French. Discover commo

0 views • 24 slides

Understanding Taxation in Australia: Income Declaration and Assessment

Australian taxation laws require residents to declare worldwide income while non-residents are taxed on Australian-sourced income. The tax liability calculation involves taxable income, tax offsets, other liabilities such as Medicare levy, and PAYG credits. Assessable income includes various sources

0 views • 13 slides

Understanding Economic Porosity and Primitive Capital Accumulation in Mozambique

In this presentation by Carlos Nuno Castel-Branco, the concept of economic porosity and its consequences in Mozambique are examined. The discussion includes the historical rationale for economic porosity, magnitude of economic dynamics, taxation issues, investment patterns, capital flight, and publi

0 views • 36 slides

Overview of International Taxation in Italian Law

International taxation refers to rules governing tax laws in different countries, covering various aspects such as cross-border trade, investments, and taxation of individuals working abroad. Tax treaties play a crucial role in limiting the taxation power of treaty partners, with over 2,000 bilatera

0 views • 25 slides

Taxation Challenges for Cross-Border Teleworkers Post Covid-19

Challenges in international taxation arise for cross-border teleworkers post-Covid-19, especially regarding the taxation of income from employment under Article 15 of the OECD Model Tax Treaty. Issues such as physical presence, bilateral agreements during the pandemic, and future taxation scenarios

0 views • 7 slides

Understanding Taxation of Digital Goods and Tangible Personal Property in Alabama

Explore the taxation laws in Alabama regarding the digital delivery of tangible personal property and the classification of tangible personal property in sales tax cases. This content delves into specific court cases, definitions, and perspectives on the taxability of digital goods and software purc

0 views • 10 slides

Negative List Based Taxation of Services by S.B. Gabhawalla & Co.

This content delves into the conceptual framework of negative list based taxation of services, including the definition of service, elements such as service territory and value, and the framework dissecting the charge at 12%. It also explains what services are excluded from taxation and provides exa

0 views • 36 slides

Public Economics Course Summary - EHESS & Paris School of Economics

The Public Economics course at EHESS & Paris School of Economics offers an introduction to taxation history, government intervention theories, and policy incidence across developed and developing countries. The syllabus covers topics like welfare analysis, wealth taxation, and optimal taxation strat

0 views • 11 slides

The Case for Progressive Taxation: Ensuring Equality Through Fair Contributions

Progressive taxation involves higher tax rates for individuals with higher incomes or greater wealth, aiming to bridge economic and gender inequalities. This system can be achieved through well-designed tax scales, exemptions, and thresholds, ultimately contributing to fair distribution of contribut

0 views • 8 slides