Guidelines for Direct Costs in H2020 Funding

Direct costs in Horizon 2020 funding must be accurately measured and attributed only to the specific action being funded. Costs must be directly linked to the implementation of the action and supported with sufficient evidence. It is crucial to avoid errors in other direct costs, ensure proper recor

0 views • 26 slides

Componentisation of Assets: Readiness and Overview for SCOPA June 2023

The readiness of departments and entities within the WCG on the componentisation of assets is discussed along with an overview. Componentisation involves breaking down significant parts of assets into individually identifiable parts with different useful lives. Advantages include accurate tracking o

0 views • 7 slides

Understanding Balance Sheets for Non-Trading Concerns

Balance sheets for non-trading concerns follow similar principles to those of trading concerns but may include specific items unique to nonprofit organizations. This article explains the format, preparation, and examples of balance sheets for non-trading concerns, along with additional information o

0 views • 6 slides

Financial Management in Proprietary Funds and Water Utility Fund Transactions

This content covers topics related to proprietary funds, specifically addressing closure and post-closure care costs of a landfill in Montgomery County and transactions in the Water Utility Fund of the Town of Weston. It includes calculations, trial balances, accrued expenses, billings, liabilities,

0 views • 57 slides

Understanding Compound Interest in Class VIII Mathematics

In this chapter, students will learn about simple interest and compound interest, memorize their formulas, derive compound interest formula from simple interest concept, calculate compound interest with different compounding frequencies, understand growth and depreciation concepts, and derive formul

1 views • 29 slides

Accounting Entries for Hire Purchase Transactions

Different hire purchase transactions are recorded in the books of both the hire vendor/seller and hire purchaser through various accounting methods like the Asset Accrual Method. This method involves gradual capitalization and recording installment payments towards the cash price of the asset. Depre

0 views • 11 slides

Understanding Automobile Depreciation in Financial Algebra

Explore linear automobile depreciation in advanced financial algebra, where cars lose value over time. Learn how to calculate depreciation equations, intercepts, slopes, and make future value predictions for cars. Discover the concept of linear depreciation and how it applies to car values using rea

0 views • 17 slides

Financial Analysis of Proposed Machine Acquisition

Riverview Company is evaluating the acquisition of a new production machine with a base price of $200,000. Calculations include net initial outlay, depreciation expense, annual cash flow, tax effects, terminal cash flow, and NPV at a cost of capital of 12%. The analysis considers operating costs, ta

0 views • 7 slides

Insights on Global Currencies: Roger Vicquer's Analysis

Helen Popper from Santa Clara University shared insightful commentary on Roger Vicquery's research paper "The Rise and Fall of Global Currencies over Two Centuries" at the Financial Globalization and De-Globalization Conference in May 2021. The discussion delved into control variables, orthogonaliza

0 views • 55 slides

Common Errors in Financial Statements and Legal Requirements Under Companies Act, 2013

Explore commonly found errors in financial statements and the legal requirements under the Companies Act, 2013, focusing on the correct presentation of company affairs, compliance with accounting standards, and proper disclosure of useful lives for depreciation on property, plant, and equipment. Und

0 views • 60 slides

Accounting Entries in Hire Purchase System for Credit Purchase with Interest Method

In the Credit Purchase with Interest Method of Hire Purchase System, assets acquired on hire purchase basis are treated as acquired on outright credit basis with interest. This method involves initial entries for recording the asset acquisition, down payments, interest on outstanding balance, instal

0 views • 10 slides

Understanding Hire Purchase System: Benefits, Parties Involved, and Agreement

Hire Purchase System is a buying system where the hirer purchases goods from the seller by making partial payments in installments. This system is ideal for goods with good resale value, allowing the vendor to repossess and resell the asset if needed. Parties involved include the hirer (buyer) and h

0 views • 7 slides

Factors Affecting the Amount of Depreciation in Asset Valuation

Depreciation in asset valuation depends on the cost, estimated useful life, and probable salvage value. The cost of an asset includes various expenses incurred to put it in working condition. Estimated net residual value is the expected sale value of the asset at the end of its useful life after ded

2 views • 5 slides

Alternative Depreciation Method for Modeling PPE Balance

In the context of modeling the balance of existed Property, Plant, and Equipment (PPE) for start-ups and fast-growing IT companies, the challenge lies in determining retirement rates with limited information. The approach involves making assumptions about starting retirement levels and growth rates,

4 views • 11 slides

Understanding Income Tax Issues in the Ratemaking Process

This content explores various aspects related to income tax issues in the ratemaking process, including Accumulated Deferred Income Taxes (ADIT), Net Operating Losses (NOLs), Tax Normalization, Repair Deductions, and more. It provides insights on how ADIT is calculated, the significance of NOLs, dif

0 views • 24 slides

Facilities & Administrative Costs and Recoveries Overview

Facilities & Administrative (F&A) costs are essential expenses in reconciling audited financial statements, with recoveries generated to reimburse the University for a portion of these costs. The negotiation process for F&A rates involves formal preparation and proposal every 3-4 years, aligning wit

0 views • 12 slides

Analyzing Telecom Network Cost in East Africa

This expert-level training workshop conducted in Arusha in 2013 delved into the country-by-country analysis of telecom network cost modeling in the East Africa region. The workshop covered topics such as regulatory frameworks, transparency, skills and resources, cost accounting, depreciation methods

0 views • 44 slides

Understanding Forward Looking Cost Base in Infrastructure Projects

Forward Looking Cost Base (FLCB) is a financial tool that helps in spreading lumpy capital expenditure over time to ensure revenue stability. It consists of key components like return of assets, return on assets, and operating expenditure. The model relies on actual expenditure, forecasts, and asset

0 views • 12 slides

Evolution of Accounting Practices in Social Housing Properties

Historic accounting practices for housing properties in the social housing sector underwent significant changes prior to and after the accounting period ending 1997/1998. Initially, all property assets were capitalized including major repair expenditure. However, a shift occurred leading to the remo

0 views • 44 slides

Understanding Foreign Exchange Markets and Risks

Financial managers need to grasp the operations of foreign exchange markets for global business success. These markets allow participants to trade currencies, raise capital, transfer risk, and speculate on currency values. Transactions expose businesses to foreign exchange risk, where fluctuations i

0 views • 40 slides

Repeated Percentage Change Challenges

Explore various scenarios involving repeated percentage changes such as sales, investments, savings, and value depreciation. Test your math skills with calculations, understanding multipliers, predicting outcomes, and debunking misconceptions. Challenge yourself with practical examples to master the

0 views • 8 slides

Overview of PATH Act of 2015: Depreciation and R&D Tax Credit

The PATH Act of 2015 focuses on depreciation and the R&D Tax Credit, extending approximately 50 taxpayer-favorable tax extenders. It includes enhancements such as 15-year improvement property rules, new bonus depreciation rules, and Section 179 expensing. The Act incorporates permanent provisions li

0 views • 23 slides

Monetary Policy Committee Statement for Q2 2024: Governor's Presentation

The Monetary Policy Committee maintained the Policy Rate at 13.5% in the second quarter of 2024 despite elevated inflation. Inflation rose to 14.6% driven by Kwacha depreciation and food & energy price hikes. The decision considered the impact of the drought and previous policy adjustments. Key area

0 views • 16 slides

Economic Resilience and Growth in the Philippines: A Success Story of Overcoming Financial Challenges

The Philippines faced economic turmoil with capital outflows, currency depreciation, and stock market crashes during crises, but rebounded with robust recovery and investment upgrades. Fiscal improvements, governance reforms, and investor confidence contributed to the country's emergence as a favore

1 views • 14 slides

Abellon Clean Energy Limited Comments on Draft CERC RE Tariff Regulations, 2024

Abellon Clean Energy Limited provides detailed comments on proposed regulations for waste-to-energy projects, suggesting revisions in capital cost, fuel cost, operational expenses, auxiliary consumption, interest on loan, and depreciation. The comments emphasize the need for real-time data, consider

0 views • 7 slides

Understanding Currency Derivatives and Exchange Rate Movements

Explore the history and significance of currency derivatives in global and Indian markets. Learn about currency appreciation, depreciation, and the impact on foreign exchange rates. Discover how to interpret changes in currency values and their implications for trading. Gain insights into the functi

0 views • 85 slides

Industrial All Risk Insurance Overview

Industrial All Risk (IAR) insurance provides comprehensive coverage for material damage, business interruption, and various perils such as fire, burglary, machinery breakdown, and more. The policy indemnifies against a range of risks including fire, theft, negligence, and excludes perils like war or

0 views • 8 slides

Understanding Exchange Rates: An Asset Approach

This chapter delves into the concept of exchange rates and the foreign exchange market from an asset approach perspective. It covers topics such as exchange rate quotations, domestic and foreign currencies, definitions of exchange rates, depreciation, appreciation, and examples illustrating these co

0 views • 28 slides

Understanding Income Tax Calculation and Salary Calculation

This educational content covers various aspects of income tax calculation, including taxable rates, personal allowances, and calculations for different salary levels. It explains how to determine weekly, monthly, and annual salaries and provides examples of income tax calculations for different inco

0 views • 23 slides

HANDY HINTS

Learn about the latest updates on rent increase regulations, including the freeze period due to Covid-19, notice requirements, and changes in asset depreciation limits. Stay informed to ensure compliance with current laws and maximized benefits for landlords.

0 views • 24 slides

Year-End Closing Procedures for Fiscal Year 2021

Conducting the fiscal year-end closing procedures for FY2021 involves tasks such as finishing all current year processing in the EIS system, ensuring items are properly added to EIS based on the receipt date, running reports to verify capitalization thresholds are met, and generating recommended rep

0 views • 17 slides

Mathematics Revision: Percentages, Investments, and Geometry

Practice solving percentage problems involving salary increases, depreciation, compound interest, and discounts. Explore concepts of congruence and similarity in triangles, as well as work with surface areas and volumes of cones.

0 views • 13 slides

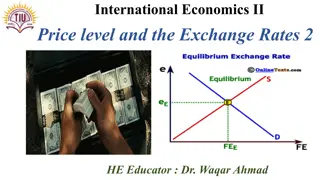

Understanding the Effects of Monetary Policy on Exchange Rates

Explore the interconnected relationship between money supply, interest rates, and exchange rates in international economics. Learn how changes in domestic and foreign money supplies impact currency depreciation, appreciation, and interest rate fluctuations. Gain insights into the long-run effects of

0 views • 26 slides

Benefits of Buying a Used Car in the UAE_ Saving Money and More

Purchasing a used vehicle in the UAE is a wise decision due to significant savings, slower depreciation, and lower insurance costs. In addition to financial benefits, buyers enjoy a wide selection of well-maintained vehicles, often with warranties or

3 views • 2 slides

Why Buying a Used Vehicle in the UAE is a Smart Choice Savings and Beyond

Purchasing a used vehicle in the UAE is a wise decision due to significant savings, slower depreciation, and lower insurance costs. In addition to financial benefits, buyers enjoy a wide selection of well-maintained vehicles, often with warranties or

0 views • 2 slides

Understanding Exchange Rates in International Economics

Exchange rates play a crucial role in translating prices between countries and impacting international trade. This chapter discusses how exchange rates are determined, their significance in global transactions, quoting methods, and the effects of currency appreciation and depreciation on relative pr

0 views • 39 slides