Financial Analysis of Proposed Machine Acquisition

Riverview Company is evaluating the acquisition of a new production machine with a base price of $200,000. Calculations include net initial outlay, depreciation expense, annual cash flow, tax effects, terminal cash flow, and NPV at a cost of capital of 12%. The analysis considers operating costs, tax liabilities, salvage value, and NWC recapture to determine the financial feasibility of the investment over a 2-year period.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

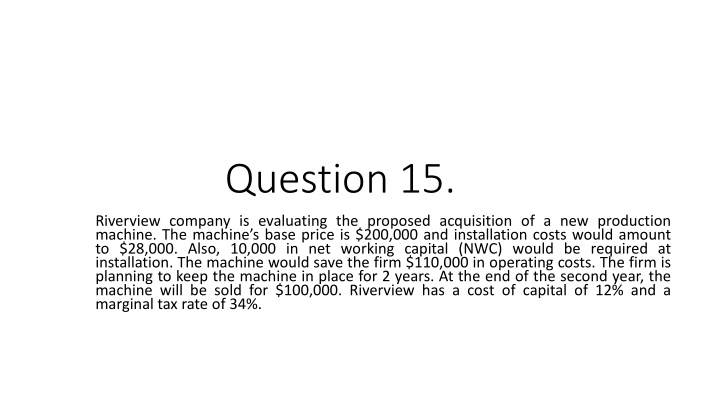

Question 15. Riverview company is evaluating the proposed acquisition of a new production machine. The machine s base price is $200,000 and installation costs would amount to $28,000. Also, 10,000 in net working capital (NWC) would be required at installation. The machine would save the firm $110,000 in operating costs. The firm is planning to keep the machine in place for 2 years. At the end of the second year, the machine will be sold for $100,000. Riverview has a cost of capital of 12% and a marginal tax rate of 34%.

Step 1A: Calculate net initial outlay Initial Outlay ($200,000) Installation costs (28,000) ______________________________________ Depreciable asset (228,000) NWC (10,000) _____________________________________ Net Initial Outlay ($238,000) Cash flow 0 = Cfj0

Step 1B: Calculate depreciation expense Depreciation expense= (Depreciable asset/class life) ???????????? ??????? =($228,000) = ($76,000) 3

Step 2: Calculate the annual cash flow Operating costs [SAVINGS+] 110,000 Depreciation expense (76,000) ____________________________________________ EBIT (Taxable income) 34,000 Tax liability (Taxable income*34%) (11,560) ____________________________________________ EAT (Operating cash flow) 22,440 Depreciation reversal (Add back depreciation) 76,000 ____________________________________________ ACF (Annual Cash Flow) $98,440 Cash flow 1 = Cfj1

Step 3A: Calculate the tax effect Salvage value (SV) $100,000 Book value (BV) (76,000) ____________________________________ Proceeds from sale [gain] 24,000 Tax rate (34%) x 0.34 ____________________________________ Tax liability (proceeds*34%) $(8,160)

Step 3B: Calculate the terminal cash flow Salvage value (SV) $ 100,000 Tax liability (8,160) NWC recapture __________________________________________ Cash flow 1 ___________________________________________ TCF (Terminal cash flow) 10,000 +98,440 $101,840 200,280 Cash flow 2 = Cfj2

Step 4: Calculate NPV Cfj0 = ($238,000) Cfj1 = $98,440 Cfj2 = $200,280 I/yr = 12% NPV = 9,555 We only have two cash flows because the company is planning to keep the machine only for 2 years, so we disregard the class life when calculating NPV